GCC Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2026-2034

GCC Used Car Market Size and Share:

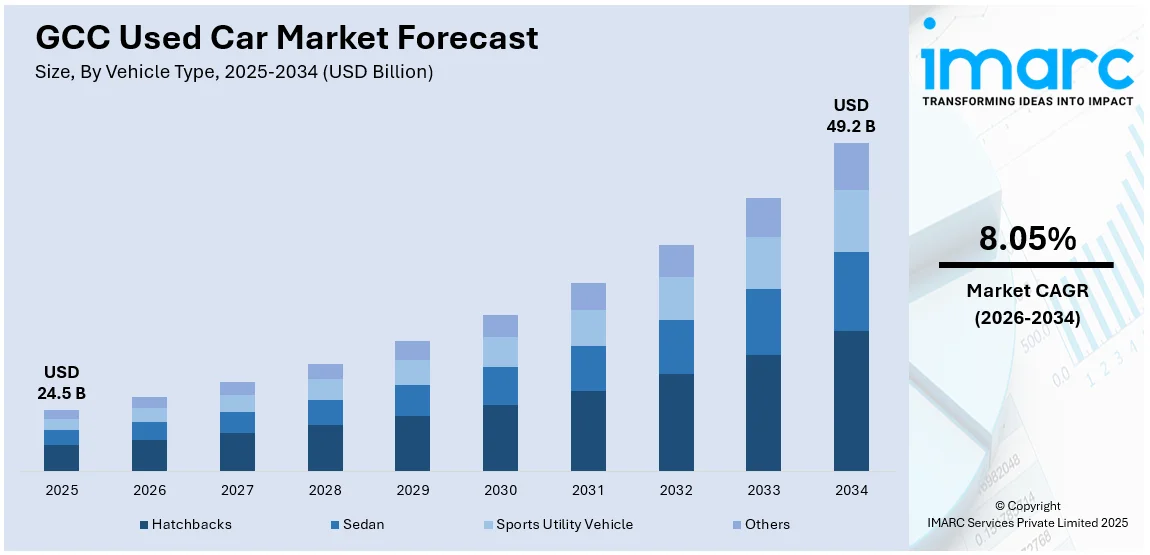

The GCC used car market size was valued at USD 24.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 49.2 Billion by 2034, exhibiting a CAGR of 8.05% from 2026-2034. The market is experiencing robust growth driven by the rising consumer demand for affordable vehicle options, expanding financing solutions, increasing availability of high-quality pre-owned vehicles, the rise of digital automotive marketplaces, and the region's rapid urbanization and economic diversification efforts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 24.5 Billion |

| Market Forecast in 2034 | USD 49.2 Billion |

| Market Growth Rate (2026-2034) | 8.05% |

The market in GCC is majorly driven by shifting consumer attitudes towards sustainability and the growing appeal of refurbished vehicles. The integration of advanced technology and data analytics is revolutionizing the GCC used car market. Companies leveraging these innovations streamline operations, significantly reducing costs and improving efficiency in vehicle reconditioning and distribution. For instance, On January 26, 2024, Latin American auto-tech company Kavak announced its transformative impact on the UAE's used car market since its 2022 entry. By integrating technology and data, Kavak has doubled its regional volume and reduced per-car costs fourfold. Its Dubai Festival Plaza hub reconditions over 1,500 vehicles monthly, offering a seamless omnichannel experience with comprehensive services from sales to financing.

To get more information on this market Request Sample

The market is further driven by the continual development of trade-in programs that offer attractive deals for customers who look for upgrading their vehicles. These programs add value to sellers but also create a healthy market cycle through the increase in supply of well-maintained used vehicles. Furthermore, the increasing presence of Chinese automobile manufacturers in the GCC markets is reshaping the competitive landscape of the used car segment. Offering vehicles with innovative designs and advanced features at competitive prices, these manufacturers attract a wide range of cost-conscious consumers. On May 12, 2024, Chinese automobile manufacturers have significantly increased their presence in Gulf cooperation council (GCC) markets, capturing approximately 12% of new vehicle sales, a substantial rise from less than 1% in 2017. This growth is attributed to competitive pricing and innovative designs, appealing to consumers in countries like the United Arab Emirates and Saudi Arabia.

GCC Used Car Market Trends:

Rising Demand for Electric Vehicles (EVs)

The growing preference for electric and hybrid vehicles is driving a significant transformation in the GCC used car market. For instance, according to Auto Data Middle East report, GCC used car market saw a 250% increase in electric and hybrid vehicle registrations from 2019 to 2023. The report indicates that 79% of UAE consumers and 72% in Saudi Arabia are considering electric vehicles for their next purchase. Increasing awareness of sustainability, coupled with government incentives and investments in EV infrastructure, is encouraging consumers to switch to eco-friendly alternatives. The appeal of reduced running costs and advancing battery technology further enhances the desirability of electric models.

Ongoing Digital Integration

The increasing integration of digital platforms with automotive dealerships is driving growth in the used car market. On July 18, 2024, Approved Automotive, a Dubai-based dealership specializing in premium luxury used cars, announced a partnership with DubiCars, the UAE's leading online automotive marketplace. This collaboration aims to enhance Approved Automotive's brand visibility and connect with a broader audience of car purchasers in the UAE and across the GCC. Partnerships with online marketplaces offer seamless access to a wider audience, hence increasing visibility and consumer engagement. Online platforms, with comprehensive information about the vehicles and virtual purchasing options, attract tech-savvy buyers. Additionally, premium and luxury used cars also cater to diverse consumer preferences, which increases market appeal.

Expanding Financing Options

Flexible financing and leasing options are driving the GCC market. Banks and other financial institutions are offering customized loans for used vehicles, featuring competitive interest rates and long repayment periods. This makes car ownership by used cars affordable to a wider population, especially first-time buyers, and cost-conscious consumers. The rise of online platforms increases this trend by offering financing calculators, instant loan approvals, and easier processes, which encourages purchasing. These developments cater to the growing demand, enabling smoother transactions and reducing financial barriers. With accessible financing becoming an integral part of the market, both buyers and sellers are able to benefit from increased participation and convenience. This trend significantly supports the used car sector, meeting diverse consumer needs while fostering overall market growth.

GCC Used Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC used car market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on vehicle type, vendor type, fuel type, and sales channel.

Analysis by Vehicle Type:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Hatchbacks are an integral part of the GCC market as they appeal to urban consumers looking for practicality and affordability. Their compact size is ideal for crowded city streets and easy parking in minimal spaces. Moreover, hatchbacks provide versatility with foldable rear seats, which maximizes cargo capacity.

Sedans are favored due to their comfort, style, and balanced performance. Families and professionals prefer sedans for spacious interiors, smooth rides, and superior safety features. With their reputation for reliability and durability, sedans continue to draw in a large proportion of the used car buying crowd.

Sports utility vehicles are the most preferred in GCC used car markets, attributed to their usability in all kinds of diverse terrains and family-oriented cultures. Individuals know SUVs as strong builds, spacious interior, and off-road use. A lot of demand for pre-owned SUVs reflects their status as a preference for families and outdoor goers.

Analysis by Vendor Type:

- Organized

- Unorganized

The organized sector shapes the GCC used car market by providing reliability, transparency, and quality assurance. Certified dealerships and online platforms provide thoroughly inspected and certified vehicles, often accompanied by warranties, appealing to risk-averse consumers. Players also establish well-machinery purchasing processes, starting from financing options and after-sales service facilities, which increase the confidence of buyers and enhance professionalism within the used car market.

The unorganized sector accounts for a significant share of the GCC used car market, catering to budget-conscious consumers, and offering a wide range of vehicle options. Private sellers and small dealerships dominate this space, often selling vehicles at lower prices than organized players. The unorganized sector is flourishing despite the lack of warranties and quality assurances due to its flexibility in pricing and negotiation, making it an integral part of the market's accessibility and dynamism.

Analysis by Fuel Type:

- Gasoline

- Diesel

- Others

Gasoline-based vehicles remain the most prevalent in the GCC market. They are largely available, and most buyers are accustomed to their smoother performance and lower upfront costs, together with better refueling infrastructure that makes them ideal for use in cities and suburbs. Gasoline cars are often associated with less noise pollution and cleaner emissions than diesel.

Diesel vehicles have great importance in the GCC used car market for consumers requiring strong performance and fuel efficiency for long-distance travel. The vehicle is very popular due to its durability and high torque output, making it suitable for commercial applications and heavy-duty usage. With advancements in diesel engine technology reducing emissions, diesel-powered vehicles remain a practical choice for buyers prioritizing reliability and operational cost savings.

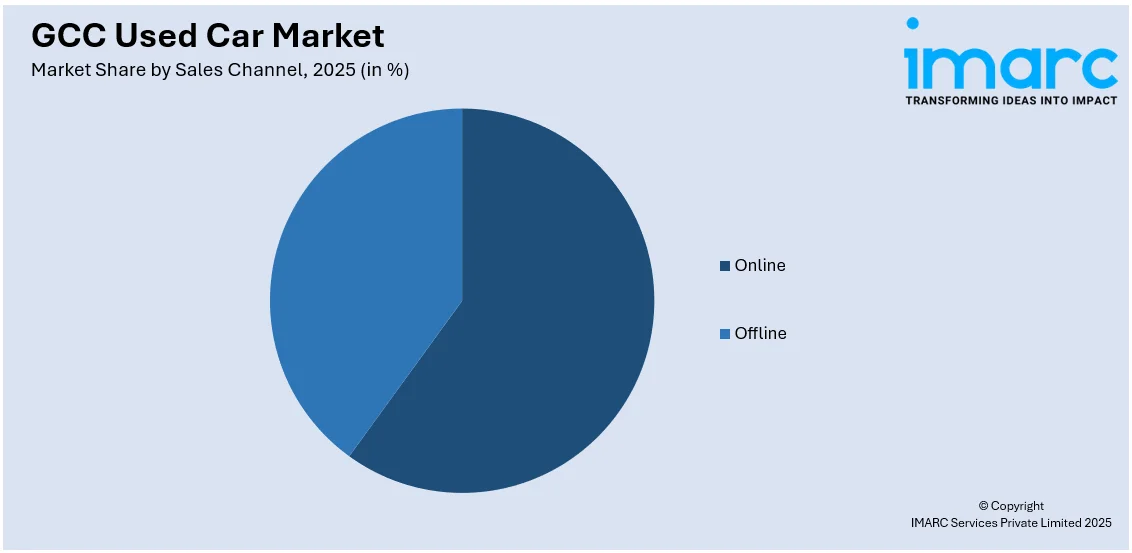

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Online platforms play a great role in the market, providing buyers and sellers with the most convenient and transparent transactions. Digital marketplaces help users to compare vehicle prices, features, and conditions seamlessly. Virtual inspections, financing calculators, and secure payment gateways further enhance the confidence of buyers and streamline the transactions. These platforms appeal to the tech-savvy consumer, ensuring a hassle-free car-buying experience while contributing to the growth of the digital automotive ecosystem in this region.

Offline dealerships are an essential part of the GCC used car market. Physical showrooms give customers the opportunity to physically inspect the vehicle, take a test drive, and get direct contact with the salesperson. This hands-on approach fosters trust and confidence, especially for high-value purchases. Offline presence also facilitates after-sales services, so it is an integral part of the automotive retail strategy in the region.

Regional Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

As the largest automotive market in the GCC, Saudi Arabia is playing a crucial role in the used car segment. Its high population and extensive urbanization have been driving consistent demand for affordable and reliable vehicles. The preference for SUVs and sedans, along with government initiatives to improve automotive trade, has propelled the market growth. The growing expatriate population further contributes to the vibrant used car ecosystem in the market.

The UAE is the leading player in the GCC used car market, due to its varied population and growing automobile trade. Dubai and Abu Dhabi, economic centers, also attract consumers wanting premium pre-owned vehicles, such as luxury brands. Online trading platforms and trade-in schemes increase market access, and growing interest in electric and hybrid vehicles further demonstrates the role of the UAE in defining regional trends.

Qatar's affluent population and demand for high-end vehicles make it a unique contributor to the GCC used car market. Luxury pre-owned vehicles dominate consumer preferences, driven by the country's economic prosperity. The increasing adoption of digital automotive marketplaces simplifies transactions, fostering growth in the sector. Additionally, Qatar’s hosting of global events like the FIFA World Cup which resulted in the massive growth of short-term car ownership, propelling the supply of quality used cars.

Bahrain’s compact market is marked by its focus on affordability and convenience. The used car sector is expanding due to the increasing preference for reliable, cost-effective vehicles among both locals and expatriates. Government initiatives to streamline automotive trade and the presence of refurbished used vehicles support market stability. Bahrain’s proximity to larger GCC nations also facilitates cross-border automotive transactions, enriching its used car landscape.

The demand for premium and luxury cars has been strong in the used car market of Kuwait. The country's wealthy consumer base frequently trades in their vehicles, which creates a constant flow of high-quality pre-owned vehicles. Financing and trade-in programs have become popular, which increases access to used cars for more consumers. The country's focus on sustainability is also growing demand for hybrid and electric vehicles in the pre-owned segment.

Oman's used car market is influenced by its demand for practical, durable vehicles suitable for varied terrains. Pickup trucks and SUVs are in great demand as they suit the country's geography. The market also benefits from the increase in internet penetration, allowing online sales platforms to reach remote areas. Moreover, the affordability of used cars compared to new models suits Oman's cost-conscious consumers, which strengthens its market presence.

Competitive Landscape:

The key players in the GCC market have been adopting multi-dimensional strategies to strengthen their market position and cater to the ever-changing needs of consumers. Expanding vehicle inventories offer a wide range of makes and models to cater to different customer preferences. Collaborative agreements, mergers, and acquisitions are pursued for strengthening market positioning and enhancing operational capabilities. Advances in technologies such as artificial intelligence and data analytics are thereby optimizing inventory management and customer experiences. A focus on certified pre-owned programs helps improve the quality of vehicles, instilling trust among consumers. Important players are investing in broad after-sales services, maintenance, and warranty packages for customers to improve their experience and loyalty.

The report provides a comprehensive analysis of the competitive landscape in the GCC used car market with detailed profiles of all major companies, including:

- Arabian Auto Agency

- YallaMotors

- AlNabooda Automobiles

- AlTayer Motors

- Alfuttaim Group

- CARS24

- OpenSooq

- Dubizzle

Latest News and Developments:

- On April 23, 2024, Al-Futtaim Automotive reported a 40% month-on-month increase in car purchase inquiries following severe UAE floods that damaged approximately 10,000 vehicles. This rise is particularly notable in the used car market, with heightened interest in SUVs and large 4x4 models such as Toyota's Land Cruiser, FJ, Prado, and Jeep Wranglers.

GCC Used Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Companies Covered | Arabian Auto Agency, YallaMotors, AlNabooda Automobiles, AlTayer Motors, Alfuttaim Group, CARS24, OpenSooq, Dubizzle |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC used car market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC used car market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC used car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A used car, also known as a pre-owned vehicle, is a previously owned automobile that is resold by its original owner or dealership. Applications include personal transportation, trade-in upgrades, and cost-efficient alternatives for first-time or budget-conscious buyers. Used cars are also sought for their affordability and immediate availability.

The GCC used car market was valued at USD 24.5 Billion in 2025.

IMARC estimates the GCC used car market to exhibit a CAGR of 8.05% during 2026-2034.

The GCC used car market is driven by rising consumer demand for affordable options, increasing adoption of digital automotive platforms, flexible financing solutions, and a shift toward sustainability, with refurbished and electric vehicles gaining popularity. Urbanization and economic diversification further amplify the demand across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)