GCC Water Heater Market Report by Product Type (Storage Covering Water Heater, Solar Water Heater, Instant Water Heater), End Use (Residential, Commercial, Industrial), and Region 2025-2033

Market Overview:

The GCC water heater market size reached USD 1,006.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,773.0 Million by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The rising demand for energy-efficient appliances, rapid urbanization and infrastructure development, and shift toward sustainable technologies are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,006.0 Million |

| Market Forecast in 2033 | USD 1,773.0 Million |

| Market Growth Rate 2025-2033 | 6.18% |

A water heater is a household appliance designed to heat water for domestic use, catering to activities like bathing, cleaning, and cooking. Operating on electricity, gas, or other energy sources, water heaters typically consist of a tank or heating element that heats and stores water at a predetermined temperature. When a hot water tap is opened, the preheated water is supplied for immediate use. Water heaters usually come in various types, including tankless (on-demand), storage tank, and heat pump variants, each offering different benefits in terms of energy efficiency, capacity, and continuous hot water supply.

The extreme climate conditions of the GCC region characterized by high ambient temperatures and occasional cold spells that necessitate reliable access to hot water for various domestic and commercial purposes represents the primary factor driving the market growth. Moreover, rapid urbanization and infrastructure development across various GCC countries has augmented the demand for water heaters, fueled by the need to provide modern amenities in residential and commercial buildings. Additionally, the inflating household incomes and changing consumer lifestyles that elevated expectations for improved comfort and convenience has accelerated the adoption of advanced water heating solutions. Apart from this, the rising consumer preference for eco-friendly water heaters that reduce energy consumption and carbon emissions due to increasing awareness of energy efficiency and sustainability has catalyzed the market growth. Besides this, several favorable government initiatives across the region promoting energy-efficient appliances and the integration of renewable energy sources are propelling the market growth. Furthermore, the influx of expatriate populations and the rapid expansion of the tourism sector have escalated the need for water heaters in residential complexes and hotels, thereby contributing to market growth.

GCC Water Heater Market Trends/Drivers:

Extreme Climatic Conditions and Energy Consumption

The extreme climatic conditions prevalent in the GCC region, characterized by scorching temperatures and occasional cold spells, stimulate the demand for water heaters. Reliable access to hot water for bathing, cleaning, and cooking is essential for maintaining comfort and hygiene. As a result, there is a rise in demand for water heaters across residential, commercial, and hospitality sectors. Moreover, energy efficiency is a key concern in the GCC region owing to high energy consumption for water heating. This further encourages consumers and businesses to invest in energy-efficient water heaters, promoting both cost savings and reduced environmental impact. As energy prices rise and awareness of sustainability grows, the demand for energy-efficient water heaters continues to increase, propelling market growth.

Rapid Urbanization and Infrastructure Development

The ongoing construction of residential complexes, commercial buildings, and hospitality establishments in the GCC region necessitates the installation of water heaters to provide modern amenities. As urban populations grow and consumer lifestyles evolve, the demand for water heaters as essential components of urban living escalates. Furthermore, increasing disposable incomes and rising consumer expectations for comfortable living standards contribute to the heightened demand for advanced and feature-rich water heating solutions. The expanding urban landscape across numerous GCC countries creates a sustained need for water heaters, positioning them as integral to the region's development and urbanization efforts.

GCC Water Heater Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC water heater market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on product type and end use.

Breakup by Product Type:

- Storage Covering Water Heater

- Solar Water Heater

- Instant Water Heater

Storage covering water heater represents the most popular product type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes storage covering water heater, solar water heater, and instant water heater. According to the report, storage covering water heater represented the largest segment.

Storage covering water heaters offer enhanced insulation, preventing heat loss and maintaining water temperature, thus reducing energy consumption. Moreover, these covers provide additional safety by shielding the heating element and controls from external elements. The convenience of easily accessible storage for household items often accompanies these designs, adding value for consumers. As the extreme climate conditions in the region necessitate protection for water heaters from the harsh environment, including high temperatures and dust, storage covering water heaters are witnessing increased adoption.

Additionally, the integration of aesthetic designs and durable materials ensures that storage covering water heaters seamlessly blend into modern interiors while withstanding the challenging climate. As consumers seek efficient solutions that align with comfort, energy savings, and aesthetics, the escalating adoption of storage covering water heaters becomes a major driver of the GCC water heater industry, meeting both practical and lifestyle preferences.

Breakup by End Use:

- Residential

- Commercial

- Industrial

Residential accounts for the majority of the market share

A detailed breakup and analysis of the market based on the end use has also been provided in the report. This includes residential, commercial, and industrial. According to the report, residential accounted for the largest market share.

The main factors that are driving the growth of the residential segment is the growing urban population, coupled with the increasing number of households, which drives the demand for water heaters as essential appliances for daily living. The region's extreme climatic conditions, ranging from scorching summers to occasional cold spells, underscore the necessity for reliable access to hot water for bathing, cleaning, and cooking purposes.

Additionally, the rising disposable incomes and changing consumer lifestyles in the GCC countries elevate expectations for higher convenience and comfort, accelerating the adoption of advanced and efficient water heating solutions. As consumers seek innovative products that optimize energy consumption, incorporate smart features, and align with modern home aesthetics, the residential segment emerges as a crucial driver, propelling the growth of the GCC water heater market in response to evolving consumer demands.

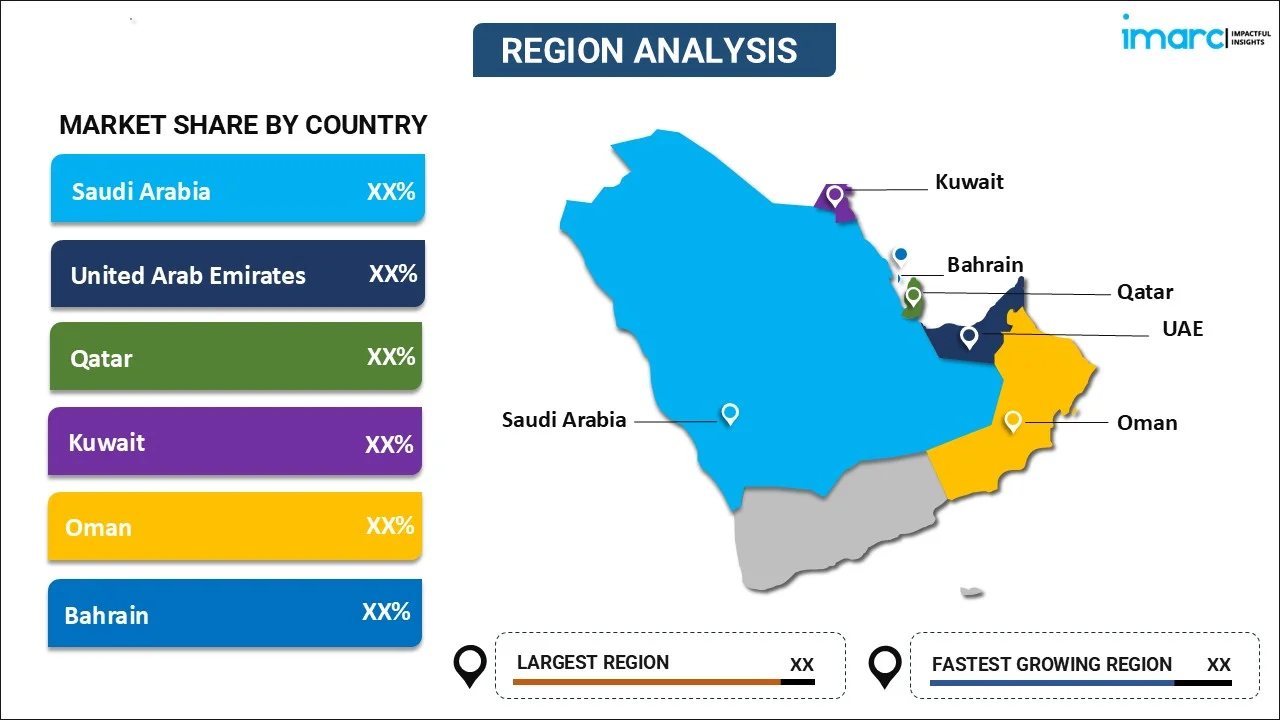

Breakup by Region:

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia exhibits a clear dominance in the market

A detailed breakup and analysis of the GCC water heater market has been provided based on region. This includes Saudi Arabia, the UAE, Quatar, Oman, Kuwait, and Bahrain. According to the report, Saudi Arabia accounted for the largest market share.

Saudi Arabia held the biggest share in the market due to rapid urbanization and extensive infrastructure development in the residential, commercial, and hospitality sectors across the country. As the population grows and urban landscapes expand, the need for reliable hot water supply for various domestic and commercial activities becomes paramount.

Moreover, Saudi Arabia's extreme climate conditions, characterized by high temperatures, further highlight the significance of efficient water heaters. The nation's rising disposable incomes, coupled with an increasing awareness of energy-efficient appliances, also promote the adoption of advanced water heating solutions. The country's commitment to sustainability and renewable energy further catalyzes the demand for solar-powered water heaters. As Saudi Arabia aims to balance economic progress and quality of life improvements, the GCC water heater market receives strong impetus from these multifaceted factors driven by the nation's development, climatic considerations, and energy-conscious initiatives.

Competitive Landscape:

Key players in the market are introducing innovative solutions to meet evolving consumer needs. They are integrating AI-driven algorithms to predict and optimize water heating cycles for maximum efficiency and comfort. Smart water heaters equipped with mobile apps enable remote control, scheduling, and energy tracking. Hybrid models featuring heat pump technology extract ambient heat, reducing energy consumption while maintaining high performance. Furthermore, the incorporation of self-cleaning mechanisms and anti-corrosion technologies by leading players that enhances longevity and reduces maintenance requirements. In response to the region's focus on sustainability, solar-powered water heaters with efficient collectors are gaining prominence. These innovations by key players in the GCC water heater market reflect a commitment to energy efficiency, user convenience, and eco-friendliness, catering to the demands of a dynamic and forward-thinking consumer base.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players included:

- Ariston Thermo SPA

- Orbital Horizon

- Saudi Ceramics Est.

- Al Huraiz Est.

GCC Water Heater Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, GW th |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Storage Covering Water Heater, Solar Water Heater, Instant Water Heater |

| End Uses Covered | Residential, Commercial, Industrial |

| Countries Covered | Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain |

| Companies Covered | Ariston Thermo SPA, Orbital Horizon, Saudi Ceramics Est., Al Huraiz Est., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC water heater market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC water heater market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC water heater industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC water heater market was valued at USD 1,006.0 Million in 2024.

We expect the GCC water heater market to exhibit a CAGR of 6.18% during 2025-2033.

The rising demand for tank-less water heaters in restaurants, hospitals, hotels, etc., as they save space and consume less energy than their conventional counterparts, is primarily driving the GCC water heater market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous manufacturing units for water heaters.

Based on the product type, the GCC water heater market has been segregated into storage covering water heater, solar water heater, and instant water heater. Among these, storage covering water heater currently holds the majority of the total market share.

Based on the end use, the GCC water heater market can be bifurcated into residential, commercial, and industrial. Currently, the residential sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain, where Saudi Arabia currently dominates the GCC water heater market.

Some of the major players in the GCC water heater market include Ariston Thermo SPA, Orbital Horizon, Saudi Ceramics Est., and Al Huraiz Est.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)