Generic Injectables Market Report by Therapeutic Area (Oncology, Anaesthesia, Anti-infectives, Parenteral Nutrition, Cardiovascular), Container (Vials, Ampoules, Premix, Prefilled Syringes), Distribution Channel (Hospitals, Retail Pharmacy), and Region 2025-2033

Global Generic Injectables Market:

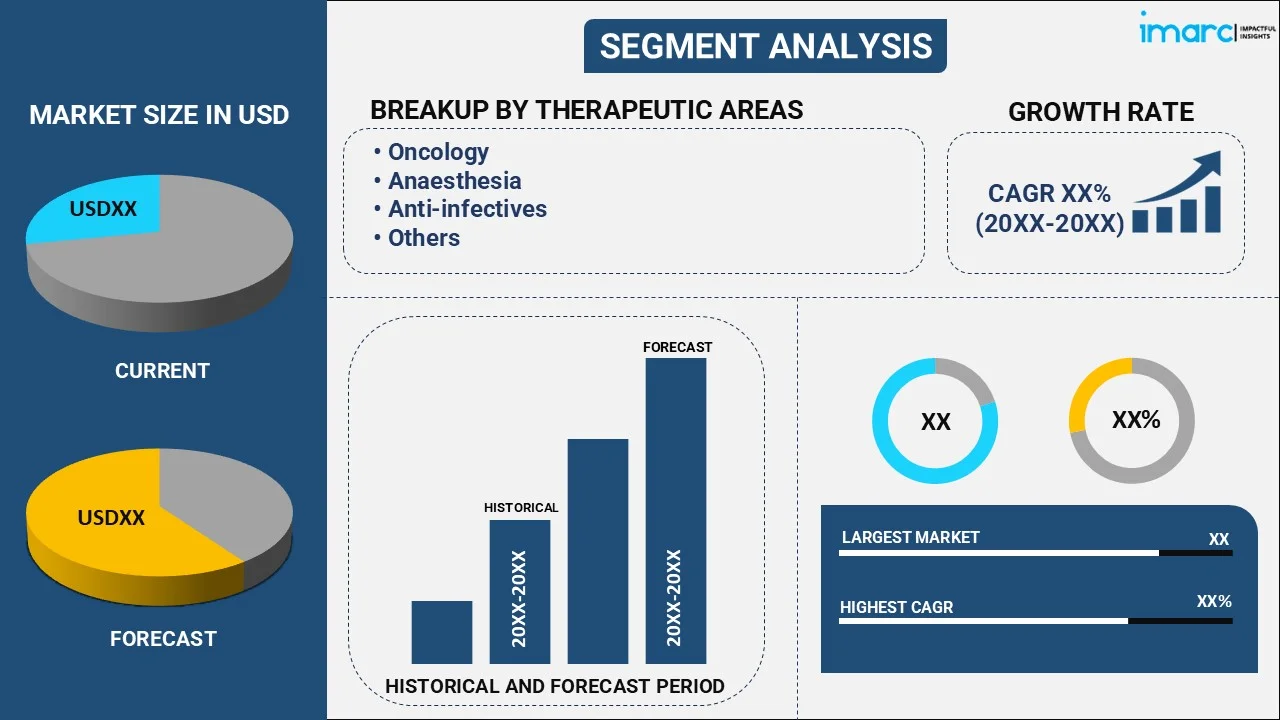

The global generic injectables market size reached USD 51.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 99.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.88% during 2025-2033. The growing patent expiration of branded drugs, along with the increasing regulatory support from government bodies, is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.0 Billion |

| Market Forecast in 2033 | USD 99.2 Billion |

| Market Growth Rate 2025-2033 | 6.88% |

Generic Injectables Market Analysis:

- Major Market Drivers: The increasing prevalence of chronic diseases is one of the key factors propelling the global market. Moreover, the expanding geriatric population, which requires more healthcare interventions, including injectables for several age-related ailments, is also acting as another significant growth-inducing factor.

- Key Market Trends: Continuous improvements in the supply chain, which have made the distribution of generic injectables more streamlined, are among the emerging trends bolstering the market. Apart from this, various technological advancements in drug formulation and delivery systems are further contributing to the global market.

- Competitive Landscape: Some of the prominent companies in the market include AstraZeneca plc, Baxter International, Inc., Fresenius SE & Co. KGaA, Hikma Pharmaceuticals plc, Lupin Ltd., Pfizer, Inc., Sandoz AG, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., and Viatris Inc., among many others.

- Geographical Trends: North America exhibits a clear dominance in the market, owing to the rising healthcare costs. Additionally, the escalating demand for cost-effective treatment options is also catalyzing the regional market.

- Challenges and Opportunities: One of the primary challenges hindering the market is stringent regulatory requirements. However, manufacturers are investing in advanced technologies and compliance processes to meet quality standards efficiently, which is expected to fuel the market in the coming years.

Generic Injectables Market Trends:

Rising Patent Expirations

The increasing expiration of patents for many blockbuster biologic drugs is stimulating the market. As these patents expire, opportunities arise for generic manufacturers to produce and market biosimilars and generic versions of these drugs. For example, in August 2023, Tanvex BioPharma USA Inc., one of the developers and manufacturers of biopharmaceuticals, introduced Tanvex CDMO to provide comprehensive biologic services, thereby offering its experience and expertise to the biopharmaceutical industry. Moreover, it assists early-stage companies in bringing mammalian and microbial-derived biologics from concept to commercialization. Similarly, in August 2023, CVS Health developed a new company that works directly with drug makers to produce and commercialize biosimilar drugs, the less expensive versions of expensive brand prescriptions derived from biotechnology. Additionally, the rising need for more affordable options for patients and healthcare systems is positively influencing the generic injectables market outlook. For instance, in January 2024, Accord BioPharma, Inc., the U.S. specialty division of Intas Pharmaceuticals Ltd. focused on the development of immunology, oncology, and critical care therapies, announced the acceptance of its Biologics License Application (BLA) by the U.S. Food and Drug Administration (FDA) for DMB-3115. It also proposed a biosimilar to STELARA, a blockbuster drug.

Growing Prevalence of Chronic Diseases

The rising incidences of cardiovascular diseases, diabetes, and cancer are bolstering the market. Consequently, there is an escalating demand for chronic disease management that generally requires generic injectables. For example, in June 2024, Teva Pharmaceuticals Inc., a U.S. affiliate of Teva Pharmaceutical Industries Ltd., developed an authorized generic injectable of Victoza to treat patients with type 2 diabetes. Moreover, the expanding geriatric population who needs long-term medication is also acting as another significant growth-inducing factor. For instance, in January 2024, Piramal Critical Care (PCC) introduced a new 10mg/10mL (1 mg/mL) concentration of zinc sulfate to expand its existing product line and overall generic injectables portfolio. Additionally, in January 2024, Milla Pharmaceuticals Inc. commercialized its Supplemental Abbreviated New Drug Application (sANDA) for a generic version of sodium acetate injection. It is also used as an additive for preparing specific intravenous fluid formulas when standard electrolyte or nutrient solutions cannot meet the needs of the patient. As per the generic injectables market statistics, these launches will continue to drive the market in the coming years.

Inflating Technological Advancements

Various advancements in drug formulation and delivery systems are propelling the global market. In line with this, innovations, such as auto-injectors, advanced manufacturing techniques, prefilled syringes, etc., are improving the efficacy, safety, and convenience of generic injectables, thereby contributing to the market. In February 2024, Lupin Ltd. launched the Ganirelix Acetate injection, a single-dose prefilled syringe approved by the U.S. FDA for women undergoing fertility treatments. The injection, a generic equivalent to Organon USA LLC, is adopted to inhibit premature Luteinizing Hormone surges. Furthermore, in April 2024, Baxter International introduced five novel generic injectables that feature ready-to-use formulations to help support patient safety. Apart from this, these advancements not only enhance patient compliance but also provide a competitive edge to manufacturers, which is one of the generic injectables market growth factors. For instance, in March 2024, Meitheal Pharmaceuticals, Inc. announced progress for its generic injectables portfolio, thereby underscoring its commitment to serve as a sustainable partner for generics development in the U.S.

Global Generic Injectables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the generic injectables market forecast at the global and regional levels for 2025-2033. Our report has categorized the market based on the therapeutic area, container, and distribution channel.

Breakup by Therapeutic Area:

- Oncology

- Anaesthesia

- Anti-infectives

- Parenteral Nutrition

- Cardiovascular

Oncology currently holds the majority of the total market share

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes oncology, anaesthesia, anti-infectives, parenteral nutrition, and cardiovascular. According to the report, oncology represented the largest market segmentation.

Oncology represents a significant segment in the market due to the high prevalence and the increasing incidence of cancer worldwide, which drives the demand for cost-effective treatment options. Cancer treatment often involves the use of expensive branded injectables, placing a substantial financial burden on healthcare systems and patients. The introduction of generic injectables in oncology provides a more affordable alternative without compromising efficacy, thereby making life-saving treatments accessible to a broader patient population. For example, in August 2023, Panacea Biotec launched the generic version of Abraxane, a Paclitaxel protein-bound particles of injectable suspension, that is indicated for the treatment of non-small cell lung cancer, metastatic breast cancer, and adenocarcinoma of the pancreas.

Breakup by Container:

- Vials

- Ampoules

- Premix

- Prefilled Syringes

Vials account for the largest generic injectables market share

The report has provided a detailed breakup and analysis of the market based on the container. This includes vials, ampoules, premix, and prefilled syringes. According to the report, vials represented the largest market segmentation.

Vials are a preferred packaging format for a wide range of injectable medications, including antibiotics, vaccines, and oncology drugs, because they offer a stable and secure means of storing and administering these drugs. The simplicity and efficiency of vial manufacturing also make them a cost-effective option for generic drug producers, allowing for competitive pricing in the market. They also provide flexibility in dosing and are compatible with various administration techniques, from direct injection to infusion. This versatility makes them suitable for use in hospitals, clinics, and home care settings. For instance, in February 2024, SCHOTT Pharma, one of the providers of pharmaceutical drug containment solutions and delivery systems, developed glass vials optimized for deep-cold storage of generic injectables.

Breakup by Distribution Channel:

- Hospitals

- Retail Pharmacy

Hospitals exhibit a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on distribution channel. This includes hospitals and retail pharmacy. According to the report, hospitals represented the largest market segmentation.

Hospitals rely heavily on injectable medications for their rapid onset of action and high bioavailability, making them essential for emergency care, anesthesia, oncology, and critical care. The growing emphasis on reducing healthcare costs has led hospitals to increasingly adopt generic injectables as a cost-effective alternative to branded drugs. This, in turn, is driving the segment's growth.

Breakup by Region:

- Europe

- North America

- Asia

- Latin America

- Middle East and Africa

North America holds a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest market share.

In the United States, for instance, the growing burden of conditions, such as diabetes, cancer, cardiovascular diseases, etc., has spurred the adoption of generic injectables to manage these ailments affordably, which is propelling the market in North America. According to the IMARC, the U.S. generic injectables market size reached US$ 19.9 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 44.6 Billion by 2032, exhibiting a growth rate (CAGR) of 9.1% during 2024-2032. Moreover, as per the generic injectables industry overview, robust regulatory support, with the FDA's initiatives like the Generic Drug User Fee Amendments (GDUFA), streamlining the approval process, will continue to bolster the regional market over the forecasted period. For instance, in January 2024, Accord BioPharma, Inc., the U.S. specialty division of Intas Pharmaceuticals Ltd., focused on the development of immunology, oncology, and critical care therapies, announced the acceptance of its Biologics License Application (BLA) by the U.S. Food and Drug Administration (FDA) for DMB-3115. It also proposed a biosimilar to STELARA, a blockbuster drug.

Competitive Landscape:

Leading generic injectables companies are consistently working to expand their range of generic injectable medications, including biosimilars, to cover a broader spectrum of therapeutic areas. Furthermore, they are investing in research and innovation to improve the formulation and stability of generic injectables, thereby enhancing their quality and market appeal. In addition, several key players are forming strategic partnerships with other industry stakeholders to enhance their capabilities, distribution networks, and product offerings. Besides this, companies are focusing on expanding their geographical reach through collaboration with local distributors or setting up manufacturing facilities. Additionally, they are working on optimizing their production processes to offer cost-effective solutions without compromising on quality. Moreover, major players are ensuring products meet rigorous regulatory requirements, especially in highly regulated markets.

The generic injectables market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- AstraZeneca plc

- Baxter International, Inc.

- Fresenius SE & Co. KGaA

- Hikma Pharmaceuticals plc

- Lupin Ltd.

- Pfizer, Inc.

- Sandoz AG

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Generic Injectables Market Recent Developments:

- June 2024: Teva Pharmaceuticals Inc., a U.S. affiliate of Teva Pharmaceutical Industries Ltd., developed an authorized generic injectable of Victoza to treat patients with type 2 diabetes.

- April 2024: Baxter International introduced five novel generic injectables that feature ready-to-use formulations to help support patient safety.

- February 2024: SCHOTT Pharma, one of the providers of pharmaceutical drug containment solutions and delivery systems, launched glass vials optimized for deep-cold storage of generic injectables.

Generic Injectables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Therapeutic Areas Covered | Oncology, Anaesthesia, Anti-infectives, Parenteral Nutrition, Cardiovascular |

| Containers Covered | Vials, Ampoules, Premix, Prefilled Syringes |

| Distribution Channels Covered | Hospitals, Retail Pharmacy |

| Regions Covered | Europe, North America, Asia, Latin America, Middle East and Africa |

| Companies Covered | AstraZeneca plc, Baxter International, Inc., Fresenius SE & Co. KGaA, Hikma Pharmaceuticals plc, Lupin Ltd., Pfizer, Inc., Sandoz AG, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Viatris Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the generic injectables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global generic injectables market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the generic injectables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global generic injectables market was valued at USD 51.0 Billion in 2024.

We expect the global generic injectables market to exhibit a CAGR of 6.88% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the easy availability of generic injectables via online pharmacies with free doorstep delivery to combat the risk of coronavirus infection.

The rising utilization of generic injectables in treating various cardiovascular disorders without affecting the efficacy of the treatment is primarily driving the global generic injectables market.

Based on the therapeutic area, the global generic injectables market can be segmented into oncology, anesthesia, anti-infectives, parenteral nutrition, and cardiovascular. Among these, the oncology segment holds the majority of the total market share.

Based on the distribution channel, the global generic injectables market has been segregated into hospitals and retail pharmacy. Currently, hospitals hold the largest market share.

On a regional level, the market can be classified into Europe, North America, Asia, Latin America, and the Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global generic injectables market include AstraZeneca plc, Baxter International, Inc., Fresenius SE & Co. KGaA, Hikma Pharmaceuticals plc, Lupin Ltd., Pfizer, Inc., Sandoz AG, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., and Viatris Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)