Geopolymer Market Report by Application (Cement and Concrete, Furnace and Reactor Insulators, Composites, Decorative Artifacts), End-Use Industry (Building Construction, Infrastructure, Industrial, Art and Decoration, and Others), and Region 2026-2034

Market Overview:

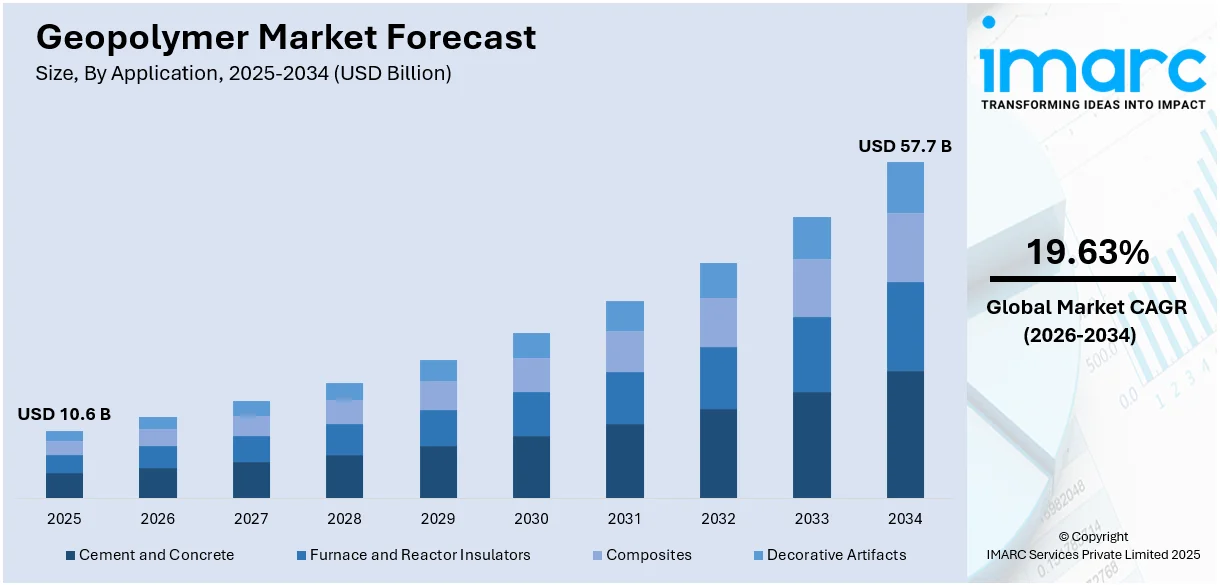

The global geopolymer market size reached USD 10.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 57.7 Billion by 2034, exhibiting a growth rate (CAGR) of 19.63% during 2026-2034. The growing focus on sustainable construction practices to reduce carbon footprint, rising awareness about environmental pollution, along with favorable government initiatives, and increasing demand for waste management solutions are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.6 Billion |

| Market Forecast in 2034 | USD 57.7 Billion |

| Market Growth Rate (2026-2034) |

19.63%

|

Geopolymer is a mineral-based material that is manufactured through a chemical process that comprises the reaction of aluminosilicate materials with an alkaline solution, commonly involving industrial by-products, such as fly ash or slag. It is widely available as pure inorganic and hybrid geopolymers. It exhibits enhanced mechanical properties, high resistance to fire and chemicals, and has a lower carbon footprint as compared to conventional cement. As it is an eco-friendly and sustainable choice for construction and infrastructure projects, the demand for geopolymers is rising across the globe.

To get more information on this market Request Sample

At present, the increasing demand for environmentally friendly and high tensile strength materials in the construction sector is influencing the market positively. Moreover, the rising utilization of geopolymers for repairing bridges, tunnels, and roads across the globe is strengthening the growth of the market. Apart from this, the growing demand for geopolymers, as they reduce energy consumption during production, is offering a favorable market outlook. Additionally, the rising utilization of these polymers in fire and heat-resistant coatings and adhesives is offering lucrative growth opportunities to industry investors. Besides this, the increasing need to reduce global warming is impelling the growth of the market. In addition to this, the rising demand for cost-effective alternatives to Portland cement as a binder in concrete is contributing to the growth of the market.

Geopolymer Market Trends/Drivers:

Rising focus on sustainable construction practices

The increasing focus on sustainable construction practices among individuals and builders across the globe is contributing to the growth of the market. Traditional cement production is a major contributor to carbon dioxide (CO2) emissions and resource depletion. Furthermore, there is a rise in awareness about the harmful impact of greenhouse gas (GHG) emissions in the environment. Apart from this, geopolymers, with their lower carbon footprint and reduced reliance on finite resources, align well with the sustainability goals. In line with this, governing agencies of various countries are encouraging the adoption of sustainable materials by reducing carbon footprint and supporting eco-friendly solutions, which is offering a favorable market outlook.

Increasing awareness about environmental pollution

The rising awareness about environmental pollution that causes various severe diseases among individuals is bolstering the growth of the market. In line with this, geopolymers offer a suitable and eco-friendly alternative to conventional cement that produces significantly fewer greenhouse gas (GHG) emissions. These polymers assist in minimizing resource consumption and improving waste management that aligns closely with the goals of pollution reduction and sustainable development. Apart from this, governing agencies and regulatory bodies of numerous countries are incentivizing the use of environmentally friendly materials by implementing stringent rules and policies to curb carbon emissions. Furthermore, this encourages construction companies to innovate geopolymer-based products and provide a more sustainable environment.

Growing demand for waste management solutions

The rising demand for these polymers in waste management systems, as they address environmental concerns and promote sustainable waste disposal solutions, is strengthening the growth of the market. These polymer-based materials encapsulate hazardous and toxic waste effectively, minimize leaching, and prevent soil and groundwater contamination. This makes them suitable for the creation of durable and stable waste containment structures, such as landfill liners and caps. In line with this, they can utilize industrial by-products like fly ash and slag that divert these materials from landfills. Furthermore, the rising utilization of these polymers, as they offer a practical and ecological solution for managing various types of waste and promoting a safer and cleaner environment for communities and ecosystems, is bolstering the growth of the market.

Geopolymer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global geopolymer market report, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on application and end-use industry.

Breakup by Application:

- Cement and Concrete

- Furnace and Reactor Insulators

- Composites

- Decorative Artifacts

Cement and concrete represent the largest market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes cement and concrete, furnace and reactor insulators, composites, and decorative artifacts. According to the report, cement and concrete represented the largest segment. Cement and concrete offer a sustainable alternative to traditional Portland cement. Geopolymer cement is produced by activating aluminosilicate materials with alkali solutions, forming a binder that can replace or supplement conventional cement in construction. Apart from this, it offers enhanced durability, reduced carbon emissions, and improved resistance to chemicals and corrosion. It also aligns with the increasing demand for eco-friendly building materials by addressing the environmental impacts of construction. In addition, various industries are focusing on sustainable practices to minimize the carbon footprint of the industry.

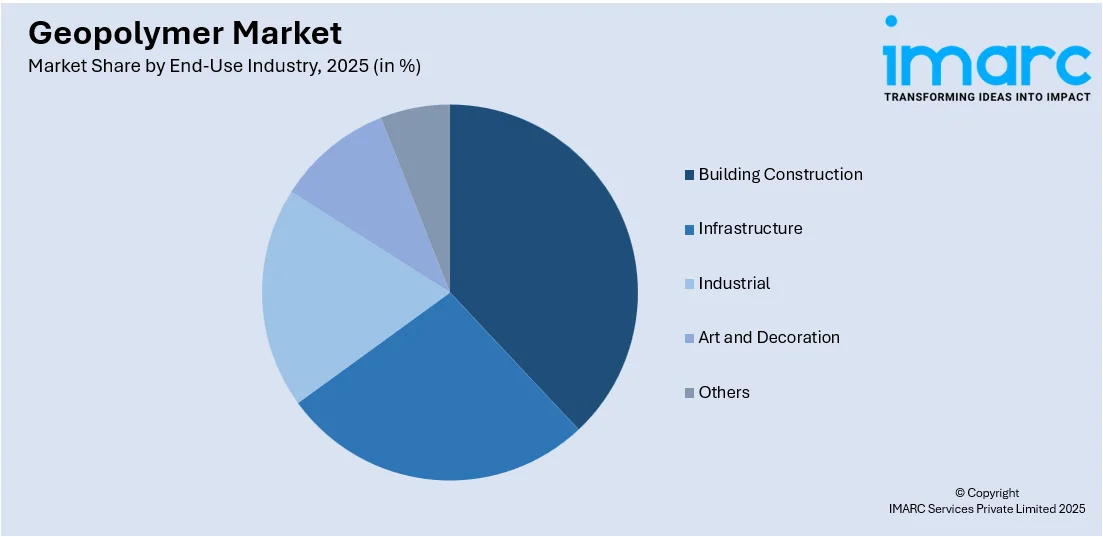

Breakup by End-Use Industry:

Access the comprehensive market breakdown Request Sample

- Building Construction

- Infrastructure

- Industrial

- Art and Decoration

- Others

Infrastructure accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes building construction, infrastructure, industrial, art and decoration, and others. According to the report, infrastructure represented the largest segment. The rising utilization of these polymers in infrastructure development projects due to their improved durability, decreased environmental impact, and versatility. In addition, they offer extended service life, as they are highly resistant to deterioration from factors like harsh weather conditions and chemical exposure. They are utilized in various infrastructure applications, such as roads, bridges, and tunnels. Furthermore, their lower carbon footprint aligns with sustainability goals and attracts public organizations to invest in resilient and environmentally conscious infrastructure.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Asia Pacific exhibits a clear dominance, accounting for the largest geopolymer market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, the Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share due to the growing number of power plants. In addition, the rising adoption of geopolymers to manufacture railroad sleepers is bolstering the growth of the market in the Asia Pacific region. Moreover, the increasing demand for these polymers in the concrete mix to reduce the amount of carbon dioxide (CO2) emissions in the region is supporting the growth of the market. Apart from this, the rising focus on eco-friendly practices is contributing to the growth of the market in the region.

Competitive Landscape:

Key players companies are investing in research and development (R&D) activities to develop new formulations, optimize production processes, and enhance the performance characteristics of geopolymer products. This includes exploring different raw materials, alkali activators, and curing techniques to tailor properties for specific applications. In line with this, they are diversifying their product offerings to cater to a broader range of industries and applications. This involves creating specialized blends for construction, infrastructure, aerospace, and other sectors and addressing their unique requirements. Apart from this, companies are forming collaborations with research institutions, universities, and other industry players to share knowledge, leverage expertise, and enhance technologies. Furthermore, manufacturers are ensuring their products adhere to international standards and regulations.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Imerys Group

- Milliken & Company Inc.

- PCI Augsburg GMBH

- Rocla

- Wagners

- Universal Enterprise

- Schlumberger Ltd

- Murray & Roberts Cementation Co. Ltd

- Banah UK Ltd

- Zeobond Pty Ltd

- Uretek

- BASF

- Corning Inc.

- Nu-Core

- Pyromeral Systems

- Airbus

Recent Developments:

- In March 2023, Schlumberger Ltd (SLB) introduced the EcoShield™ geopolymer cement-free system that minimizes the carbon dioxide (CO2) footprint as compared to conventional well cementing systems in the construction sector.

- In 2021, Wagners achieved a milestone with Hutchinson Builders by using Earth Friendly Concrete® for what is the biggest continuous slab pour for a geopolymer concrete.

Geopolymer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Cement and Concrete, Furnace and Reactor Insulators, Composites, Decorative Artifacts |

| End-Use Industries Covered | Building Construction, Infrastructure, Industrial, Art and Decoration, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Imerys Group, Milliken & Company Inc., PCI Augsburg GMBH, Rocla, Wagners, Universal Enterprise, Schlumberger Ltd, Murray & Roberts Cementation Co. Ltd, Banah UK Ltd, Zeobond Pty Ltd, Uretek, BASF, Corning Inc., Nu-Core, Pyromeral Systems and Airbus, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the geopolymer market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global geopolymer market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the geopolymer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global geopolymer market was valued at USD 10.6 Billion in 2025.

We expect the global geopolymer market to exhibit a CAGR of 19.63% during 2026-2034.

The rising demand for geopolymer to repair bridges, tunnels, roads, etc., owing to its advantageous properties, such as high strength, ultra-porosity, low drying shrinkage, low creep, acid resistance, etc., is primarily driving the global geopolymer market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of various end-use industries for geopolymer.

Based on the application, the global geopolymer market has been categorized into cement and concrete, furnace and reactor insulators, composites, and decorative artifacts. Currently, cement and concrete accounts for the majority of the global market share.

Based on the end-use industry, the global geopolymer market can be bifurcated into building construction, infrastructure, industrial, art and decoration, and others. Among these, the infrastructure sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into Asia-Pacific, Europe, North America, Middle East and Africa, and Latin America, where Asia-Pacific currently dominates the global market.

Some of the major players in the global geopolymer market include Imerys Group, Milliken & Company Inc., PCI Augsburg GMBH, Rocla, Wagners, Universal Enterprise, Schlumberger Ltd, Murray & Roberts Cementation Co. Ltd, Banah UK Ltd, Zeobond Pty Ltd, Uretek, BASF, Corning Inc., Nu-Core, Pyromeral Systems and Airbus.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)