Germany Aluminium Cans Market Size, Share, Trends and Forecast by Application, and Region, 2025-2033

Germany Aluminium Cans Market Overview:

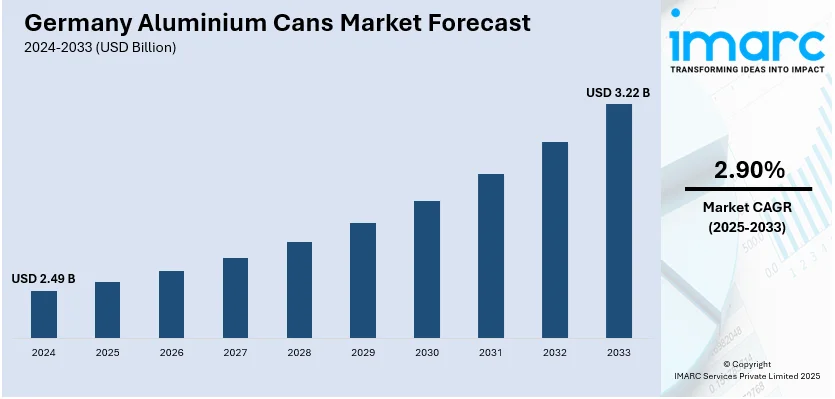

The Germany aluminium cans market size reached USD 2.49 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.22 Billion by 2033, exhibiting a growth rate (CAGR) of 2.90% during 2025-2033. The rising consumer demand for sustainable packaging, increasing preferences for lightweight and recyclable materials, the expansion of the beverage industry, government regulations promoting eco-friendly solutions, and ongoing innovations in can design and technology to enhance product shelf life are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.49 Billion |

| Market Forecast in 2033 | USD 3.22 Billion |

| Market Growth Rate 2025-2033 | 2.90% |

Germany Aluminium Cans Market Trends:

Sustainability and environmental concerns:

The highest growth trend within the German market for aluminum cans is the trend towards sustainability. As consumers realize that they can do their bit to save the planet, the preference is clearly in favor of recyclable packing materials with lesser carbon footprints. For instance, Aryum's J. Company embossed cans and Trivium's eco-friendly insect repellent packaging took the top awards in the 2024 World Aluminium Aerosol Can Awards in August 2024. Adidas's environmentally friendly deodorant packaging and Nussbaum's innovative aerosol cans were also recognized as design and sustainability leaders. Moreover, aluminum cans stand out specifically because they can be recycled indefinitely without any change in quality and thus are great packaging options to consider for greener packaging. This becomes a perfect fit with Germany's strong recycling infrastructure and policy. The German government's determination to minimize plastic waste and encourage circular economy practices further increases the attractiveness of aluminum cans. Additionally, brands are turning towards aluminum packaging more and more to appeal to consumers who are concerned about sustainability, and positioning themselves as environmentally conscious alternatives, which is further building the market growth.

Growth of the beverage industry:

The growing German beverage sector is another key driver of the market for aluminum cans. The growing need for ready-to-drink (RTD) drinks, such as carbonated soft drinks, energy drinks, and alcoholic drinks has made aluminum cans the go-to packaging option. Their light weight and mobility make them well-suited for consumption on the move, a popularity they command highly among the youth. Also contributing to the market demand is the ease of use of aluminum cans, which usually have easy-open tops, making the consumer experience easier. This is further complemented by the rise in the craft beer segment, where most breweries are opting for aluminum cans to package their products, taking advantage of the trend of creative and visually pleasing packaging designs that entice consumers, propelling the market demand.

Technological innovations in manufacturing:

Advancements in manufacturing processes of aluminum cans are also driving the market growth. As there is a heightened emphasis on reducing the weight of the product to save transport and manufacturing costs, the manufacturers are thinning down aluminum without sacrificing strength. Moreover, huge developments in printing and labeling technology allow brands to produce more vibrant and attractive designs, leading to better shelf presence and consumer draw. Automation and digitalization within the manufacturing process are enhancing efficiency, enabling quicker production cycles and shorter lead times. Additionally, these technological advances in the packaging industry are highly rendering them with feasible choice for manufacturers and brands looking to improve their sustainability profiles while satisfying consumer requirements for quality and convenience, thus enabling market growth.

Germany Aluminium Cans Market Segmentation:

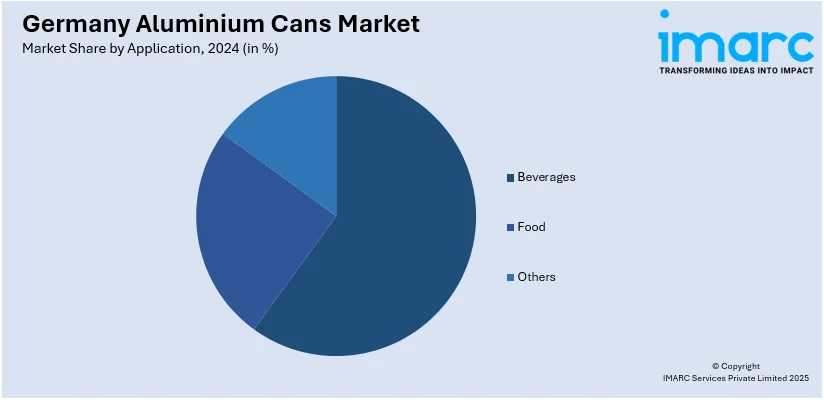

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application.

Application Insights:

- Beverages

- Food

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes beverages, food, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western, Southern, Eastern, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Aluminium Cans Market News:

- In November 2023, AkzoNobel introduced its bisphenol-free Accelstyle™ coatings on aluminum beverage cans, furthering the industry transition to safer, more sustainable packaging. The business is investing €32 million in a new plant that will become operational by mid-2025 to satisfy increased demand for metal packaging solutions with an eco-efficient approach.

- In September 2024, KHS Group presented the latest filling technology, inspection technology, and environmentally friendly packaging solutions at BrauBeviale 2024. The showpiece was the Innofill Can C filler, with a capacity of up to 60,000 cans per hour, which is suitable for highly efficient integration with KHS's process technology and advanced inspection technology.

Germany Aluminium Cans Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Beverages, Food, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany aluminium cans market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany aluminium cans market on the basis of application?

- What is the breakup of the Germany aluminium cans market on the basis of region?

- What are the various stages in the value chain of the Germany aluminium cans market?

- What are the key driving factors and challenges in the Germany aluminium cans?

- What is the structure of the Germany aluminium cans market and who are the key players?

- What is the degree of competition in the Germany aluminium cans market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany aluminium cans market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany aluminium cans market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany aluminium cans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)