Germany Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2025-2033

Germany Animal Health Market Overview:

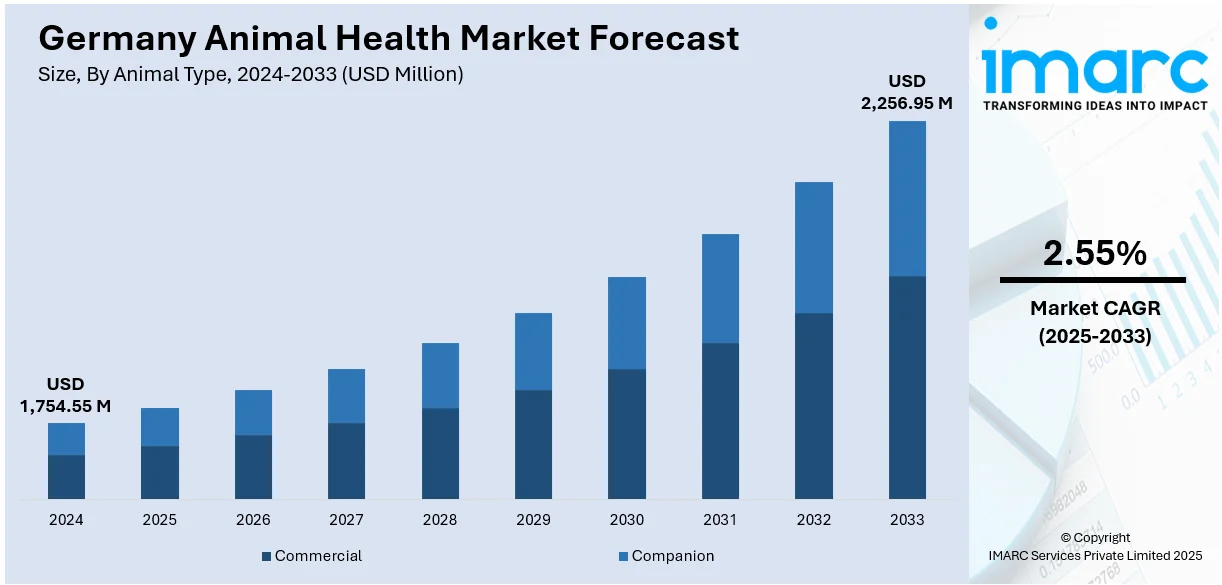

The Germany animal health market size reached USD 1,754.55 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,256.95 Million by 2033, exhibiting a growth rate (CAGR) of 2.55% during 2025-2033. At present, the need for animal-based food items, including meat, milk, and eggs, is constantly increasing in Germany. Moreover, the constant rise in awareness about animal welfare and health is supporting the market growth. Apart from this, the swift transformation of diagnostic equipment, treatment, and data-driven technologies is expanding the Germany animal health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,754.55 Million |

| Market Forecast in 2033 | USD 2,256.95 Million |

| Market Growth Rate 2025-2033 | 2.55% |

Germany Animal Health Market Trends:

Heightened need for animal-derived consumable products

The need for animal-based food items, including meat, milk, and eggs, is constantly increasing in Germany, which is largely responsible for the development of the animal health industry. People are paying greater attention to the quality, safety, and sustainability of food items, and as a result, there is a rise in the demand for healthier and disease-free animals. This is encouraging farmers and producers to implement superior veterinary care and preventive practices for ensuring high-quality production. As foodborne disease concerns, antibiotic resistance, and animal well-being are growing, the need for efficient vaccines, medicines, and diagnostic products is continuously on the rise. Industrialized livestock operations, coupled with the rising demand for organic and ethically produced animal foods, are facilitating the implementation of new animal health solutions for sustainability while answering changing demands. The market is also reacting to regulatory pressures that aim at ensuring the safety of animal foods. According to the Federal Agricultural Information Center (BZL), in 2024, the total meat consumption in Germany reached 4.44 million tons, reflecting an increase of 0.8 percent compared to the prior year.

To get more information on this market, Request Sample

Increasing concern about animal welfare and health

The constant rise in awareness about animal welfare and health is supporting the Germany animal health market growth. With the public increasingly becoming aware of the way animals are raised and treated, both individuals and farmers are demanding higher-quality animal health management. Increasing awareness is compelling improved veterinary treatment and care, as well as the uptake of sophisticated treatments, supplements, and diagnostic equipment to maintain animals' health in general. More veterinary clinics and animal husbandry farms are spending money on technologies and methods that track the health of animals and prevent diseases. With advancements concerning zoonotic disease threats, such as avian flu or bovine tuberculosis, putting more focus on disease prevention and control. This increased emphasis on animal well-being is facilitating the innovation and market creation of new products that enhance health outcomes for a range of animals, such as companion animals, livestock, and poultry.

Improvements in veterinary technology and innovation

Technological advancements and veterinary innovation are constantly strengthening the market growth. The swift transformation of diagnostic equipment, treatment, and data-driven technologies is considerably enhancing the productivity of animal care and disease prevention. Developing technologies like artificial intelligence (AI), machine learning (ML), and precision medicine are used for more accurate diagnosis and treatment of animal diseases. The use of wearable livestock devices is also making it possible to monitor animal health and behavior in real-time, minimizing the chances of disease outbreaks as well as enhancing overall productivity. In addition, advancements in biologics, including vaccines and monoclonal antibodies, are making treatment more targeted and effective. With animal health firms continuing to spend on research and development (R&D), the market is witnessing the launch of next-gen solutions that tackle existing as well as emerging challenges in animal care and continue to fuel long-term growth in the industry. In 2025, TeamVet Beteiligungs GmbH, a German veterinary buy-and-build platform concentrating on equine care while also catering to companion animals, has effectively refinanced its current liabilities and obtained extra acquisition facilities to bolster its remarkable buy-and-build strategy.

Germany Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

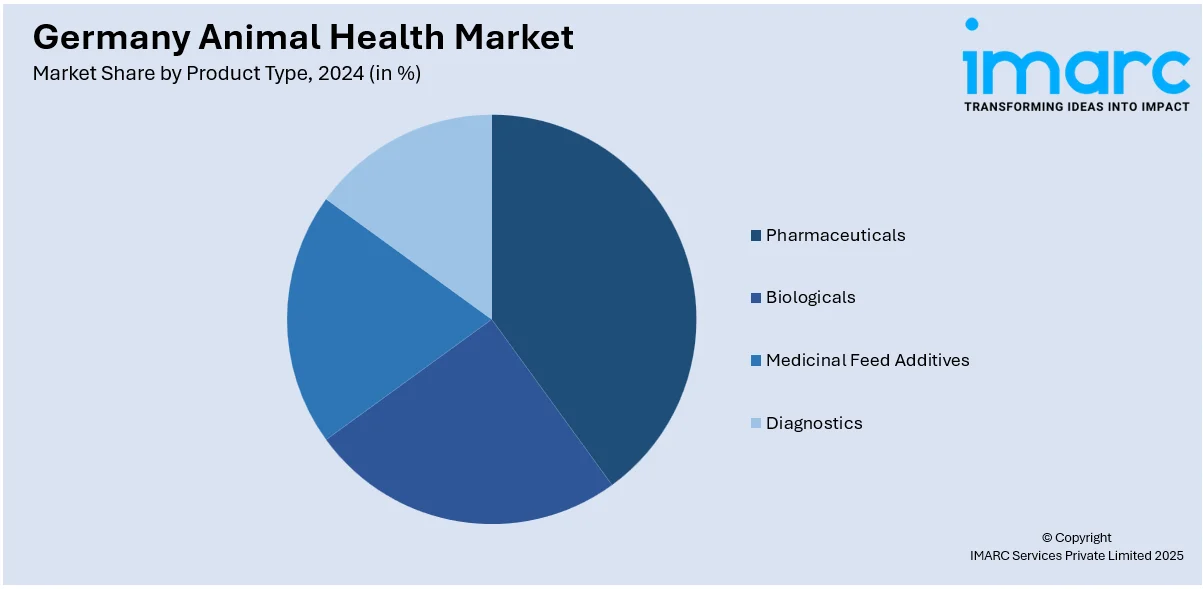

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany animal health market on the basis of animal type?

- What is the breakup of the Germany animal health market on the basis of product type?

- What is the breakup of the Germany animal health market on the basis of region?

- What are the various stages in the value chain of the Germany animal health market?

- What are the key driving factors and challenges in the Germany animal health market?

- What is the structure of the Germany animal health market and who are the key players?

- What is the degree of competition in the Germany animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)