Germany ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Germany ATM Market Overview:

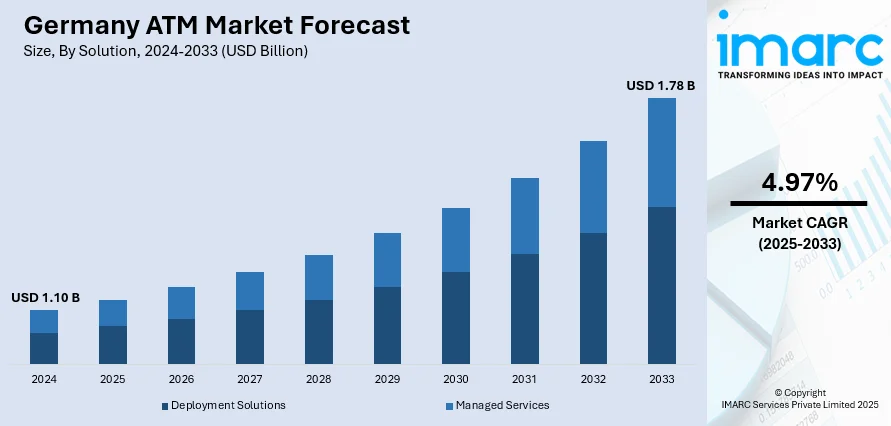

The Germany ATM market size reached USD 1.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.78 Billion by 2033, exhibiting a growth rate (CAGR) of 4.97% during 2025-2033. The market is driven by the move toward electronic payments, which is causing financial institutions to redesign their ATMs. Germany's vast interbank networks, including Cash Group, CashPool, and Bankcard-Servicenetz, provide broad access to ATMs nationwide, while allowing users to access ATMs of other banks without charge, is also improving the convenience of ATMs. Implementation of sophisticated technologies, such as contactless payments and biometrics, for authentication is enhancing the security and effectiveness of ATM transaction,s which further influences the dynamics of the Germany ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.10 Billion |

| Market Forecast in 2033 | USD 1.78 Billion |

| Market Growth Rate 2025-2033 | 4.97% |

Germany ATM Market Trends:

White-Label and Brown-Label ATM Expansion

White-label and brown-label ATMs are steadily taking over the leading position in the German ATM scene. White-label machines are installed by independent deployers and are not linked to any banking institution. They issue cash and perform balance checks. Such ATMs are found in unorthodox locations such as shopping centers, convenience stores, and gasoline stations, thereby giving more points of banking to the customers. In contrast, brown-label ATMs are owned by the banks but are hosted by third parties so that the banks may outsource the running and upkeep of their ATM networks. This thereby allows the banks to cut down on operational expenses while maintaining a wide ATM presence. These altogether display the trend in Germany toward more flexible and viable solutions for ATM deployment.

To get more information on this market, Request Sample

Integration of Cryptocurrency ATMs

Germany is experiencing a significant trend in the integration of cryptocurrency ATMs, demonstrating the nation's forward-thinking approach to digital currencies. These ATMs permit customers to purchase and sell cryptocurrencies like Bitcoin and Ethereum with cash or debit cards, offering a gateway to the world of digital money. Berlin, Frankfurt, and Munich observed a surge in the quantity of crypto ATMs as more people demand cryptocurrency services. Integration of such ATMs is made possible by regulatory environments that foster innovation while also guaranteeing consumer protection. Secondly, technological advancements have provided for the emergence of multi-currency ATMs as well as advanced security measures, driving the use of crypto ATMs in Germany further. The development contributes to Germany's leadership in the European crypto ATM industry, closing the gap between digital currencies and conventional banking, and further fueling the Germany ATM market growth.

Adoption of Advanced ATM Technologies

The German ATM sector is undergoing a transition towards embracing cutting-edge technologies to improve users' experience and operational effectiveness. Some of the popular features include contactless cash withdrawal, biometric verification, and enhanced security features, which are increasingly found on ATMs in Germany. The trends are fueled by customers' appetite for quick, secure, and convenient banking services. In addition, the regulatory framework in Germany supports the modernization of ATM infrastructure to keep pace with digital banking trends. Nevertheless, the high cost of maintaining and upgrading ATM systems is a challenge for financial institutions. Notwithstanding this, the drive towards technological upgrade in the ATM industry is likely to persist, as banks seek to respond to changing customer needs and remain competitive in the digital economy.

Germany ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size has also been provided in the report. This includes 15” and below and above 15”.

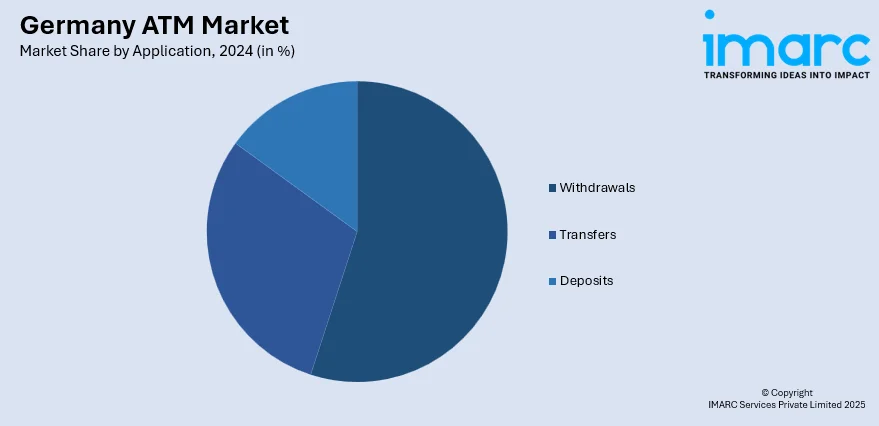

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

The report has provided a detailed breakup and analysis of the market based on the ATM type. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany ATM market on the basis of solution?

- What is the breakup of the Germany ATM market on the basis of screen size?

- What is the breakup of the Germany ATM market on the basis of application?

- What is the breakup of the Germany ATM market on the basis of ATM type?

- What is the breakup of the Germany ATM market on the basis of region?

- What are the various stages in the value chain of the Germany ATM market?

- What are the key driving factors and challenges in the Germany ATM market?

- What is the structure of the Germany ATM market and who are the key players?

- What is the degree of competition in the Germany ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)