Germany Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2025-2033

Germany Business Process Management Market Overview:

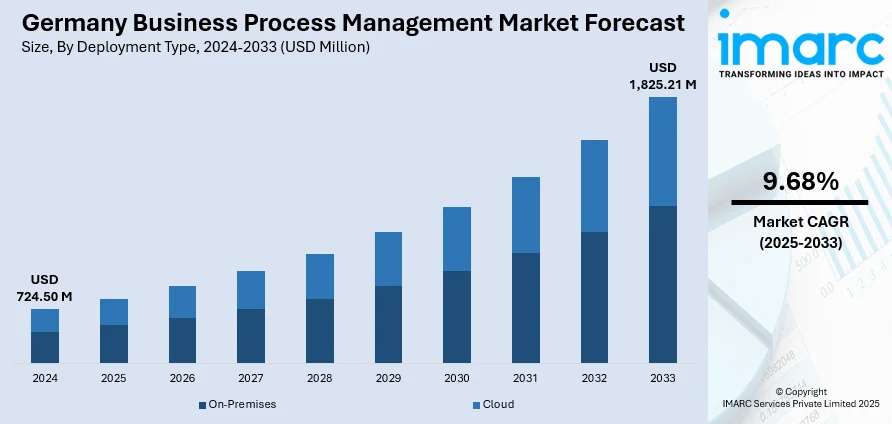

The Germany business process management market size reached USD 724.50 Million in 2024. Looking forward, the market is expected to reach USD 1,825.21 Million by 2033, exhibiting a growth rate (CAGR) of 9.68% during 2025-2033. The market is led by the nation's intensive emphasis on industrial effectiveness, digitalization, and compliance. Integration of BPM with Industry 4.0 technologies within industries such as manufacturing and automotive increases operational responsiveness and supply chain clarity. Strict regulatory environments regarding data privacy and sustainability are also forcing organizations to incorporate BPM tools, which further drives the growth and competitiveness of the Germany business process management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 724.50 Million |

| Market Forecast in 2033 | USD 1,825.21 Million |

| Market Growth Rate 2025-2033 | 9.68% |

Germany Business Process Management Market Trends:

Industry 4.0 Integration and Manufacturing Excellence

Germany's business process management (BPM) market is developing in the overall backdrop of Industry 4.0, where the focus is placed on smart factories, automation, and connected systems. German manufacturers—particularly the famous Mittelstand companies in the automotive, machinery, and electrical equipment industries—are using BPM to coordinate intricate supply chains, bring IoT-enabled machines into the fold, and maintain operational flexibility. With the focus on highly customized, flexible products, German companies are embracing dynamic BPM solutions that enable process owners to make real-time changes in workflows. They're incorporating BPM with robotics and sensor data to provide predictive maintenance, optimized production scheduling, and quality control. The outcome is an ecosystem in which BPM is more than administrative software but a core infrastructure for Germany's culture of precision manufacturing, driving scalability and resilience globally.

AI-Augmented Workflow and Cloud Transformation

One of the prominent regional trends is the embracing of artificial intelligence and cloud platforms as part of BPM services. German companies—ranging from the pharmaceutical sector to logistics—are at the forefront of AI-powered process analysis, which identifies bottlenecks, foresees failure, and streamlines resource usage without hindering current operations. At the same time, the shift towards cloud-based BPM is gaining momentum, allowing companies to use flexible, scalable systems with minimal initial infrastructure expense. This is especially suitable for small and mid-sized organizations that need not have specialized IT personnel. Taking advantage of centralized process modeling and cloud-based analytics also facilitates remote collaboration among remote workforces and quicker response to market movements. With Germany facing regulatory overcomplication and shortages in digital transformation talent, AI-bolstered BPM on the cloud presents a solution to sustaining efficiency and compliance across industries, which further propels the Germany business process management market growth.

To get more information on this market, Request Sample

Regulatory Compliance, Sustainability, and Organizational Culture

Germany's compliance environment—spanning data privacy, environmental reporting, and industry regulations—has driven the uptake of BPM systems that infuse compliance and auditability into everyday operations. Organizations are incorporating transparent workflows and electronic audit trails to meet rigorous requirements under GDPR and industry-specific rules. Concurrently, sustainability and ESG objectives have boosted the demand for BPM solutions that track resource usage, waste minimization, and energy efficiency within business processes. Germany's focus on long-term planning and nature conservation is well-suited to BPM's ability to optimize processes and improve them continuously. In addition, BPM is being democratized by low-code/no-code platforms, which allow for design and streamlining of workflows by non-IT employees. This complements Germany's conservative and formal organizational culture by mitigating over-reliance on centralized IT and promoting wider participation in process innovation.

Germany Business Process Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment type, component, business function, organization size, and vertical.

Deployment Type Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud.

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

The report has provided a detailed breakup and analysis of the market based on the component. This includes IT solution (process improvement, automation, content and document management, integration, and monitoring and optimization) and IT service (system integration, consulting, and training and education).

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

The report has provided a detailed breakup and analysis of the market based on the business function. This includes human resource, accounting and finance, sales and marketing, manufacturing, supply chain management, operation and support, and others.

Organization Size Insights:

- SMEs

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes SMEs and large enterprises.

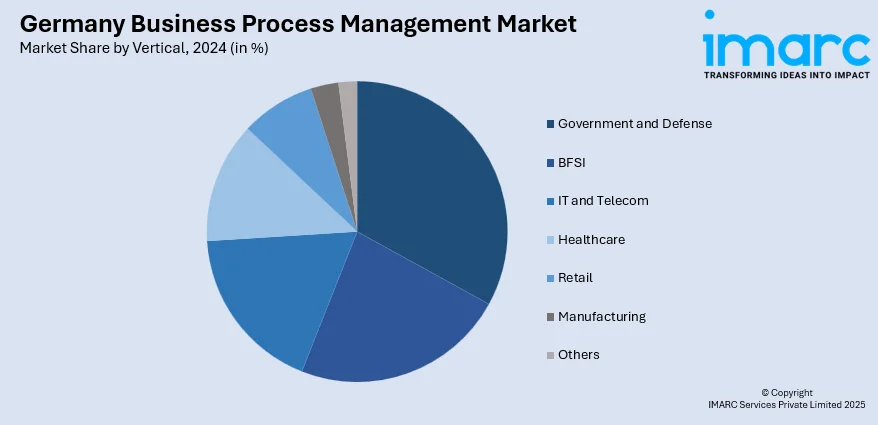

Vertical Insights:

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Business Process Management Market News:

- In November 2023, the acquisition of Symbioworld GmbH, a state-of-the-art supplier of AI-based Business Process Management (BPM) software, was announced by Celonis, the global leader in process mining. Today, the firms also announced the updated Process Cockpit, which integrates Symbio-gathered data with real-time process insights into a unified interface. By combining crucial process KPIs and insights with customers' models and rules, this enables all users within an organization to execute processes in a compliant and intelligent manner.

Germany Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-Premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany business process management market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany business process management market on the basis of deployment type?

- What is the breakup of the Germany business process management market on the basis of component?

- What is the breakup of the Germany business process management market on the basis of business function?

- What is the breakup of the Germany business process management market on the basis of organization size?

- What is the breakup of the Germany business process management market on the basis of vertical?

- What is the breakup of the Germany business process management market on the basis of region?

- What are the various stages in the value chain of the Germany business process management market?

- What are the key driving factors and challenges in the Germany business process management market?

- What is the structure of the Germany business process management market and who are the key players?

- What is the degree of competition in the Germany business process management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany business process management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany business process management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany business process management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)