Germany Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

Germany Cement Market Overview:

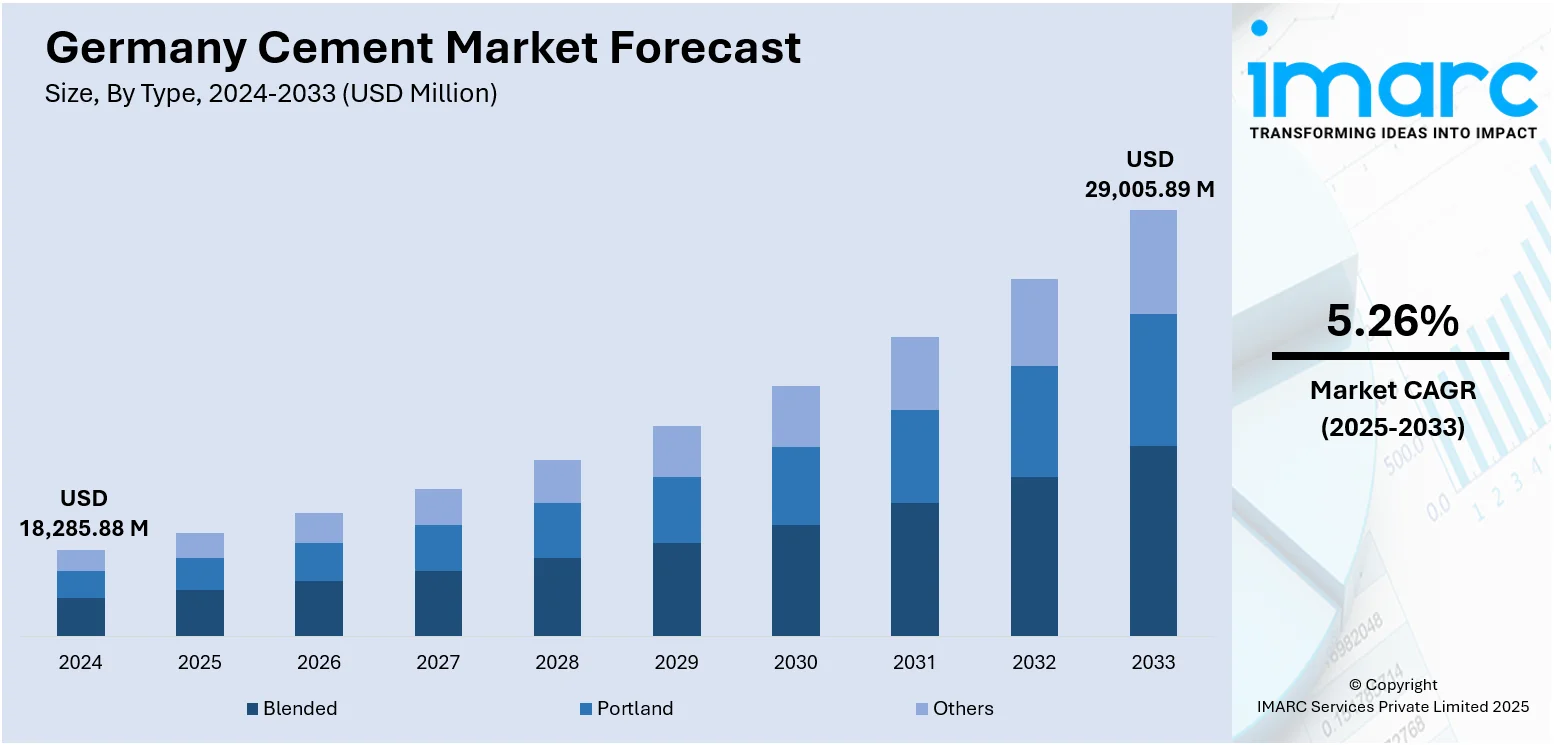

The Germany cement market size reached USD 18,285.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 29,005.89 Million by 2033, exhibiting a growth rate (CAGR) of 5.26% during 2025-2033. The market is driven by stringent energy-efficiency regulations promoting sustainable cement use in residential and commercial sectors. Infrastructure modernization, particularly in transport and logistics networks, requires engineered cement types with enhanced durability. Industrial renovations and the integration of green building standards are further augmenting the Germany cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18,285.88 Million |

| Market Forecast in 2033 | USD 29,005.89 Million |

| Market Growth Rate 2025-2033 | 5.26% |

Germany Cement Market Trends:

Energy-Efficient Construction Trends Driving Cement Demand

Germany’s commitment to energy-efficient building practices is significantly influencing the cement industry, particularly in urban residential and commercial developments. Regulations under the Gebäudeenergiegesetz (GEG) emphasize reduced carbon footprints and sustainable material sourcing, prompting the adoption of cement blends incorporating supplementary cementitious materials (SCMs) such as fly ash and slag. The construction of passive houses, retrofitting of older properties, and the introduction of net-zero energy buildings demand cement products that provide superior insulation compatibility, moisture resistance, and durability. Germany’s construction industry was valued at €425.7 billion in 2024, contributing 5.4% to the national GDP. In 2023, 32 million square meters of new floor space were built, including 5.48 million sqm of residential buildings. Construction material revenues reached €61.61 billion, while HVAC and sanitation turnover amounted to €61.3 billion in 2024.With urban densification projects expanding in metropolitan areas such as Berlin, Frankfurt, and Munich, high-performance cement variants are increasingly used for multi-functional spaces. Additionally, smart city frameworks focused on sustainable mobility hubs and mixed-use commercial centers require tailored concrete formulations suitable for energy-efficient design mandates. Cement producers have responded by investing in research and collaborating with regulatory bodies to develop product variants aligned with Germany’s Ecodesign Directive. Local production facilities are also modernizing kiln operations and integrating carbon capture techniques to align with Germany’s climate goals. This confluence of stringent environmental regulation and market-driven sustainability demands is reinforcing the role of cement in energy-optimized construction, directly supporting Germany cement market growth in a competitive European framework.

To get more information on this market, Request Sample

Growth in Industrial Renovation and Green Building Projects

Germany’s well-established industrial base, combined with the transition to greener manufacturing processes, is spurring demand for specialized cement products. Germany’s total construction investment stood at €486 billion in 2023, with residential construction making up 61% of this value. Employment in the sector reached 2.65 million, up 0.5% year-on-year. Upgrades to factories, warehouses, and production plants increasingly incorporate energy-efficient designs and sustainable construction standards under frameworks like DGNB (German Sustainable Building Council) certification. Cement is utilized for durable flooring, corrosion-resistant industrial platforms, and heavy-duty pavements in logistics hubs, particularly across the Rhineland, North Rhine-Westphalia, and Bavaria. Simultaneously, Germany’s renewable energy transition, known as Energiewende, involves constructing wind farms, solar facilities, and energy storage centers—all of which require large-scale cement usage in foundations, turbine bases, and ancillary facilities. Innovative cement formulations with lower embodied carbon are increasingly specified to align with corporate decarbonization targets. Moreover, green financing incentives tied to environmentally certified construction have accelerated the incorporation of blended cement products across industrial building schemes. Cement manufacturers are responding to demand for circular economy practices by enhancing recycling rates for demolition concrete and clinker substitutes. These developments highlight cement’s indispensable role in Germany’s industrial modernization and low-carbon construction, strengthening its contribution to long-term national sustainability goals.

Germany Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

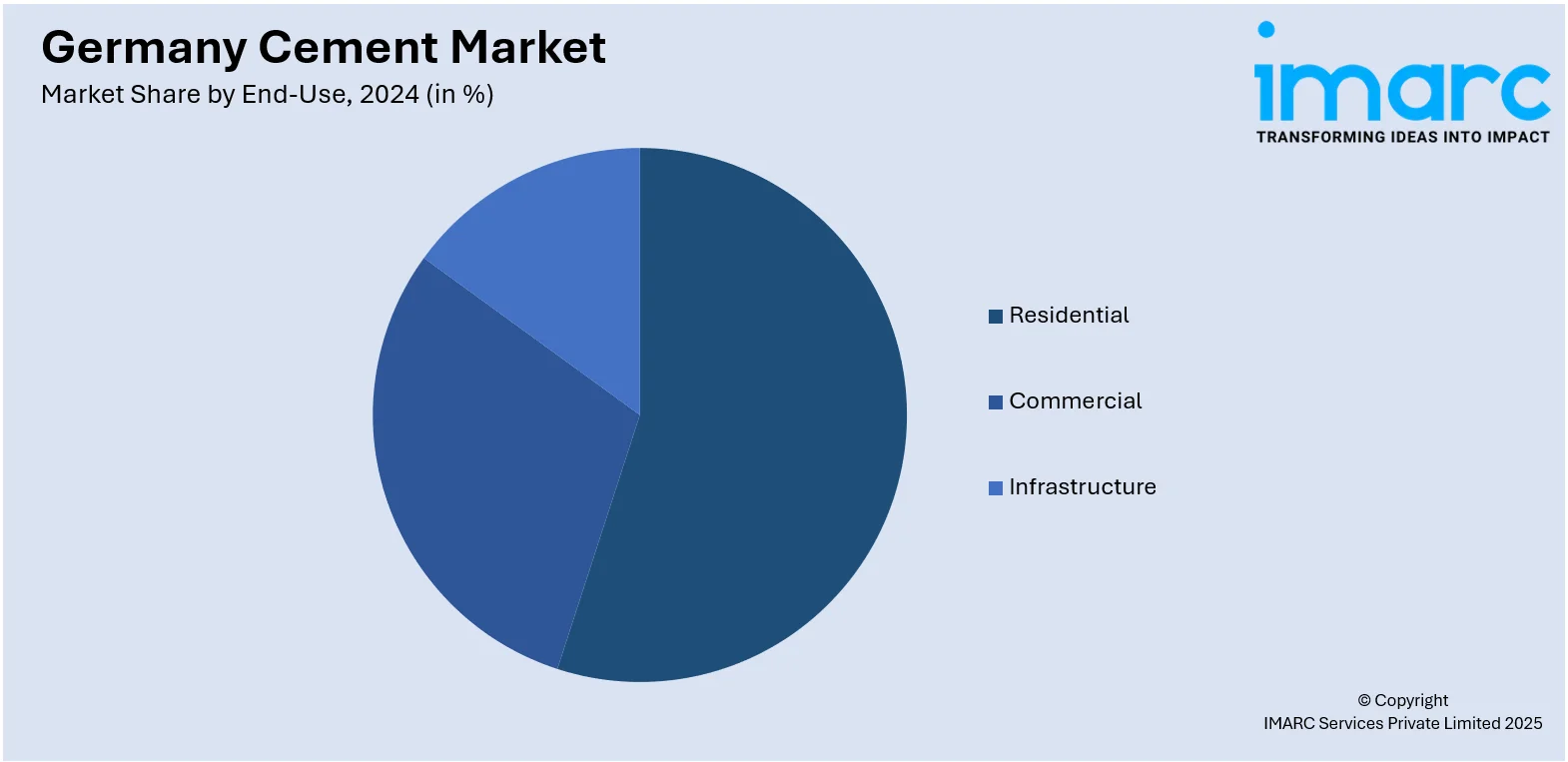

End-Use Insights:

- Residential

- Commercial

- Infrastructure

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes residential, commercial, and infrastructure.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all major regional markets. This includes Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Cement Market News:

- On December 4, 2024, Fluor Corporation secured a Front-end Engineering and Design (FEED) contract from Heidelberg Materials for integrating an industrial-scale carbon capture and storage (CCS) system at its Geseke cement production facility in Germany. The GeZero project aims to capture 700,000 tons of CO₂ annually, with construction scheduled to begin in 2026 and commissioning expected three years later. This initiative marks a significant step in decarbonizing Germany’s cement industry, directly impacting future sustainability goals and long-term cement market dynamics.

- On December 3, 2024, SPIE announced the installation of the world’s first industrial-scale Carbon Capture and Utilisation (CCU) facility at Heidelberg Materials’ Lengfurt cement plant in Germany. Designed by Linde Engineering, the facility will capture 70,000 tonnes of CO₂ annually for reuse in the chemical and food industries, leveraging its high purity. Supported by Germany’s Federal Ministry for Economic Affairs and Climate Action (BMWK), SPIE is managing major mechanical installations, including 5,500 metres of piping and 290 tonnes of steel, with operations expected to begin in 2025.

Germany Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany cement market on the basis of type?

- What is the breakup of the Germany cement market on the basis of end-use?

- What is the breakup of the Germany cement market on the basis of region?

- What are the various stages in the value chain of the Germany cement market?

- What are the key driving factors and challenges in the Germany cement market?

- What is the structure of the Germany cement market and who are the key players?

- What is the degree of competition in the Germany cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)