Germany Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking Mode, and Region, 2025-2033

Germany Glamping Market Overview:

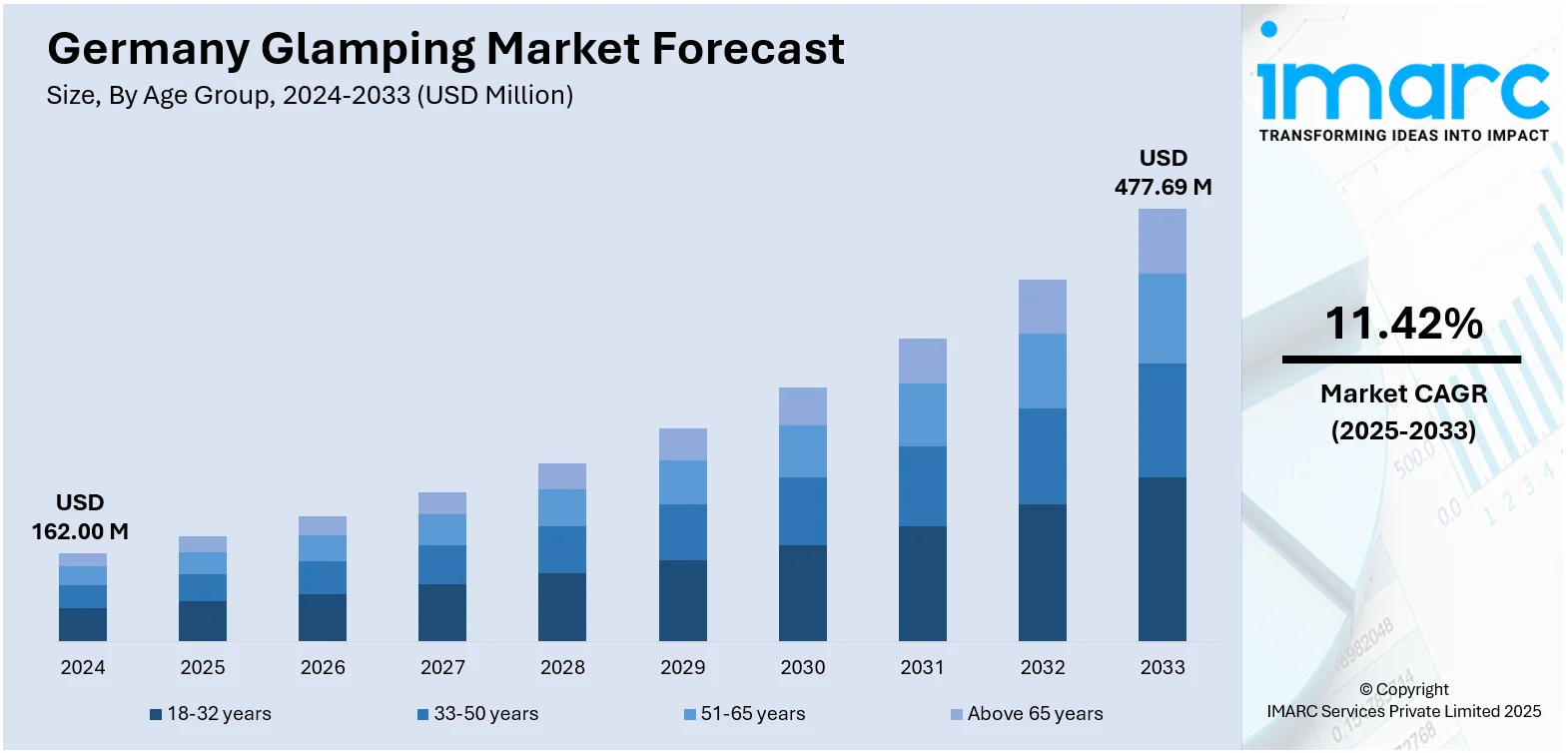

The Germany glamping market size reached USD 162.00 Million in 2024. The market is projected to reach USD 477.69 Million by 2033, exhibiting a growth rate (CAGR) of 11.42% during 2025-2033. The market is fueled by consumers increasingly seeking sustainable and experiential travel choices that blend comfort with exposure to nature. Further, the increased focus on eco-tourism among the younger generations, such as millennials and Gen Z travelers, has resulted in more investment in outdoor luxury accommodations. Also, rural tourism and green infrastructure initiatives of the government are incentivizing private players to increase their glamping provision, which is also augmenting the Germany glamping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 162.00 Million |

| Market Forecast in 2033 | USD 477.69 Million |

| Market Growth Rate 2025-2033 | 11.42% |

Germany Glamping Market Trends:

Increasing Demand for Nature-Based Luxury Tourism

A prominent trend in the market is the increasing consumer move towards nature-based luxury tourism. As city life becomes increasingly fast and digitally heavy, a significant group of tourists is looking for immersive natural getaways with comfort. Glamping, a combination of camping with luxury amenities, serves that purpose well. Germany also saw the development of beautiful landscapes like the Bavarian Alps, the Black Forest, and lake districts as major locations for these getaways. Furthermore, the desire for shorter and domestic vacations, particularly post-pandemic, further drives this trend. Moreover, the German tourist is very appreciative of privacy, health, and authenticity, and so the demand for isolated retreats with hot tubs, private decks, saunas, and gourmet cuisine has picked up pace. This trend towards unique, customized experiences continues to shape the evolution of glamping accommodations, steering them away from standardization and toward tailored, high-quality offerings.

To get more information on this market, Request Sample

Expansion of Wellness-Oriented Glamping Experiences

Wellness tourism is increasingly intersecting with the glamping segment in Germany, giving rise to holistic retreat-style offerings. An industry study that examined the need for mental health services revealed approximately 16–18% of respondents reported a perceived need for mental healthcare in the past 12 months. This rising awareness of mental well-being has directly influenced consumer preferences, with a growing number of travelers seeking restorative escapes that support emotional balance and stress reduction. Glamping sites are now incorporating elements like yoga decks, meditation gardens, herbal treatments, and spa facilities into their offerings. In addition, accommodations often include wellness-inspired interiors, such as natural materials, calming color schemes, and open-air layouts that foster a sense of connection with the surroundings. Besides, operators are emphasizing nutritional wellness by offering organic, locally sourced food and plant-based dining options. Moreover, the demand for digital detox experiences has led to packages that encourage screen-free stays, guided mindfulness sessions, and nature-based therapies like forest bathing. These wellness-focused glamping experiences appeal particularly to solo travelers, couples, and corporate groups seeking restorative escapes. This, in turn, is contributing to the Germany glamping market growth.

Seasonal Diversification and Year-round Operation

Traditionally associated with warm-weather travel, glamping in Germany is now evolving into a year-round offering driven by innovations in seasonal adaptability. Operators are investing in insulated structures, underfloor heating, thermal glazing, and wood-burning stoves to create all-season accommodations capable of withstanding the country's varied climate. As a result, glamping sites in colder regions, such as the Harz mountains or the Eifel, can now cater to winter tourism, including snowshoeing, stargazing, and cozy indoor experiences. Furthermore, the expansion into off-peak seasons also supports revenue diversification and improves site utilization throughout the year. To attract guests beyond summer, operators are designing themed experiences aligned with seasonal trends, such as autumn foliage escapes, winter wellness retreats, or springtime floral excursions. This strategic extension not only appeals to domestic travelers seeking frequent getaways but also aligns with changing travel behaviors, wherein consumers value flexibility and spontaneity. The ability to offer climate-adapted glamping experiences is increasingly becoming a competitive differentiator in Germany's maturing market landscape.

Germany Glamping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on age group, accommodation type, and booking mode.

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 18-32 years, 33-50 years, 51-65 years, and above 65 years.

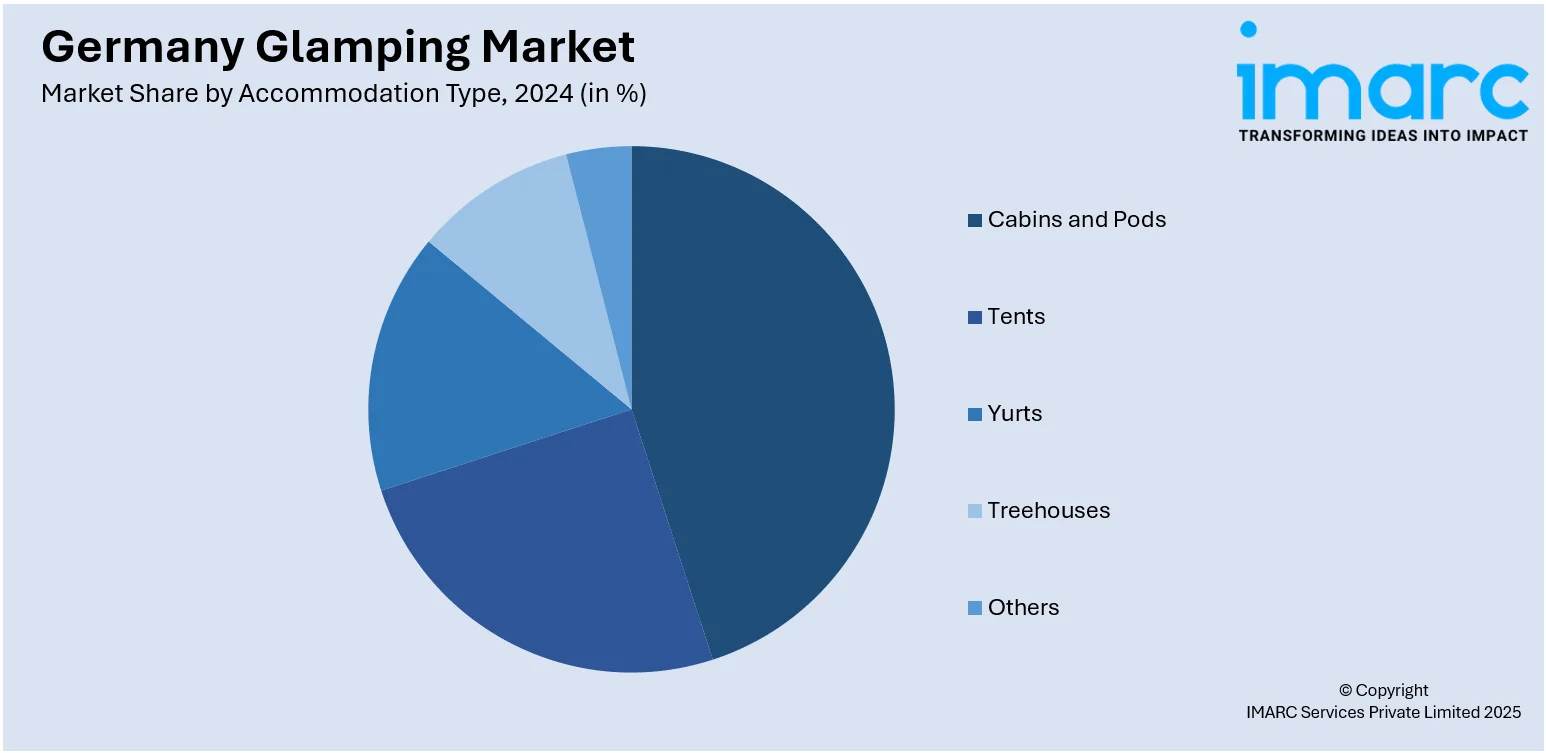

Accommodation Type Insights:

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

A detailed breakup and analysis of the market based on the accommodation type have also been provided in the report. This includes cabins and pods, tents, yurts, treehouses, and others.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

The report has provided a detailed breakup and analysis of the market based on the booking mode. This includes direct booking, travel agents, and online travel agencies.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany glamping market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany glamping market on the basis of age group?

- What is the breakup of the Germany glamping market on the basis of accommodation type?

- What is the breakup of the Germany glamping market on the basis of booking mode?

- What is the breakup of the Germany glamping market on the basis of region?

- What are the various stages in the value chain of the Germany glamping market?

- What are the key driving factors and challenges in the Germany glamping market?

- What is the structure of the Germany glamping market and who are the key players?

- What is the degree of competition in the Germany glamping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany glamping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany glamping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)