Germany IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Region, 2025-2033

Germany IT Training Market Overview:

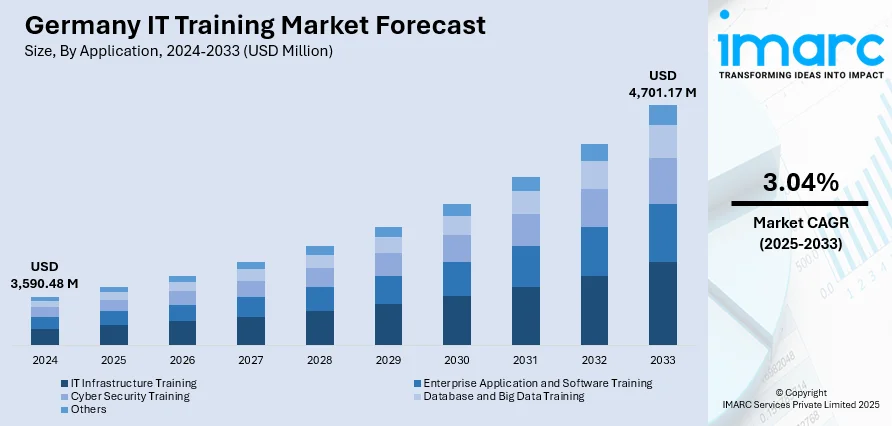

The Germany IT training market size reached USD 3,590.48 Million in 2024. The market is projected to reach USD 4,701.17 Million by 2033, exhibiting a growth rate (CAGR) of 3.04% during 2025-2033. The market is driven by growing demand for upskilling in areas like cloud computing, cybersecurity, and software development. In addition to this, government initiatives promoting digital literacy and the integration of IT training in corporate are also contributing to market expansion. Apart from this, the presence of a strong industrial base and rising adoption of advanced technologies across sectors continue to fuel the need for structured IT training, which is further augmenting the Germany IT training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,590.48 Million |

| Market Forecast in 2033 | USD 4,701.17 Million |

| Market Growth Rate 2025-2033 | 3.04% |

Germany IT Training Market Trends:

Focus on Cybersecurity and Regulatory Compliance Training

With the rising frequency of cyberattacks and stricter enforcement of data protection laws like the EU's General Data Protection Regulation (GDPR), cybersecurity has become a critical area in the market. For instance, between mid-2023 and mid-2024, cybersecurity threats escalated significantly, with an average of 309,000 new malware variants detected each day—a 26% rise compared to the prior year. This surge in threat complexity and frequency has intensified the urgency among German enterprises to enhance their cybersecurity preparedness. As a result, demand for specialized IT training programs focused on malware analysis, incident response, and secure infrastructure has grown substantially. Moreover, companies are investing in programs that not only cover technical threat mitigation but also address regulatory compliance, data governance, and incident response. Cybersecurity training is now a requirement across industries such as finance, healthcare, and logistics, where data sensitivity is high and regulatory scrutiny is increasing. Training offerings have expanded to include modules on secure coding practices, risk assessment, ethical hacking, and zero-trust architecture. Many organizations are mandating periodic refresher courses for all employees, not just IT staff, to reduce human error vulnerabilities. Apart from this, the demand for certified training is growing, driven by both internal risk management needs and client expectations. In Germany's Mittelstand (SMEs), managed training services are also sought to ensure compliance without building large in-house teams, further contributing to Germany IT training market growth in this segment.

To get more information on this market, Request Sample

Expansion of Remote and Hybrid Learning Models

Remote and hybrid training formats have become an established norm in the market, largely shaped by evolving work environments and improved digital infrastructure. With internet penetration reaching 93.3% of the overall population at the beginning of 2024, the foundational conditions for scalable online training are firmly in place. This widespread connectivity enables enterprises to adopt flexible, location-independent platforms that support both self-paced learning and live instruction. Furthermore, enterprises now prioritize flexible, location-independent learning platforms that support self-paced as well as instructor-led modules. This shift has allowed organizations to extend training access to employees across regions without the need for centralized physical sessions. Along with this, cloud-based LMS platforms such as Moodle, TalentLMS, and SAP Litmos are seeing increased implementation among German firms. These systems offer scalability and integration with enterprise HR tools, making it easier to track progress and measure outcomes. The hybrid model also allows for in-person workshops or mentoring sessions to complement online coursework when needed. This blended approach supports both foundational and advanced training without compromising continuity. Remote learning is also used by training providers to reach freelance IT professionals and small businesses, expanding the market beyond corporate clientele.

Germany IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, data and big data training, and others.

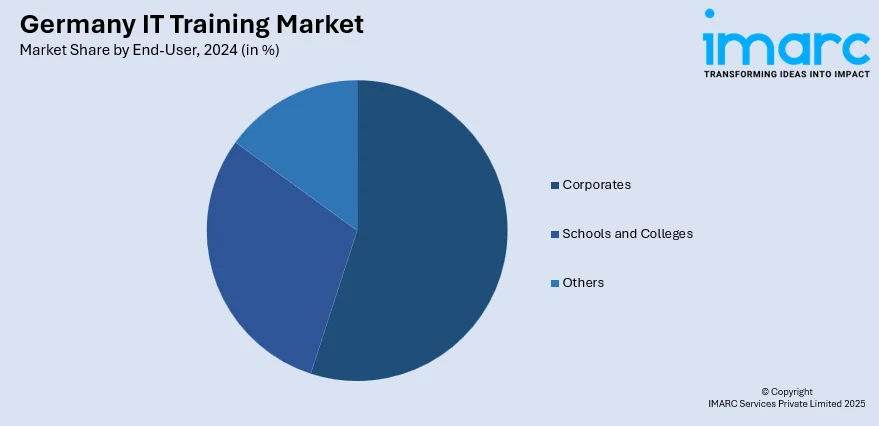

End-User Insights:

- Corporates

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes corporate, schools and colleges, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany IT Training Market News:

- On May 9, 2025, the German Embassy in Pakistan partnered with SAP to launch a targeted training program aimed at equipping young Pakistani professionals with in-demand skills to qualify for employment opportunities in Germany and other European countries. Under the initiative, SAP will provide technical training through its platform, offering free SAP certification in Pakistan, while the embassy will collate information on job openings in Europe to support placement.

Germany IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporates, Schools and Colleges, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany IT training market on the basis of application?

- What is the breakup of the Germany IT training market on the basis of end-user?

- What is the breakup of the Germany IT training market on the basis of region?

- What are the various stages in the value chain of the Germany IT training market?

- What are the key driving factors and challenges in the Germany IT training market?

- What is the structure of the Germany IT training market and who are the key players?

- What is the degree of competition in the Germany IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)