Germany Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Germany Meat Market Overview:

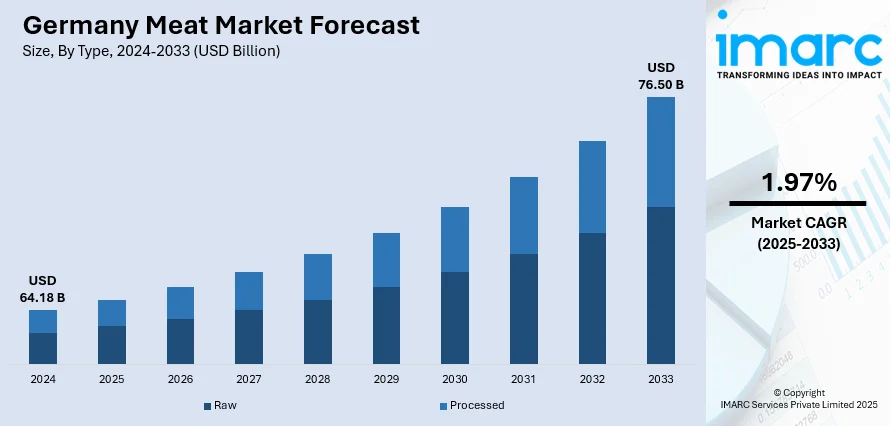

The Germany meat market size reached USD 64.18 Billion in 2024. The market is projected to reach USD 76.50 Billion by 2033, exhibiting a growth rate (CAGR) of 1.97% during 2025-2033. The market is underpinned by increased consumer demand for sustainable, ethically produced products that is fueling movement towards organic and local meat. Improvements in meat processing technology, logistics, and traceability are enhancing efficiency, transparency, and food safety. Combined, these trends are changing the conventional meat industry, forcing producers to innovate and evolve to meet changing consumer expectations and regulatory demands, thus strengthening the Germany meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 64.18 Billion |

| Market Forecast in 2033 | USD 76.50 Billion |

| Market Growth Rate (2025-2033) | 1.97% |

Germany Meat Market Trends:

Growing Demand for Sustainable and Ethical Products

Animal welfare and sustainability are increasingly becoming factors in German consumer behavior. Consumers are becoming more aware of the environmental footprint of meat production, such as greenhouse gases, land use, and water usage. Consequently, there is increased demand for ethically produced meat, e.g., organic, free-range, and locally produced meat. Producers and retailers are reacting with certified products with visible supply chains and animal welfare labels such as "Neuland" or "Bio-Siegel." Campaigns supported by the government and increased EU regulations have also further emphasized sustainability. Media coverage of climate change and animal rights continues to influence public opinion. Younger generations in particular are leading the way with their desire for values-driven products. This pressure is forcing manufacturers to adapt and innovate, which is transforming supply chains and marketing across the German meat sector.

To get more information on this market, Request Sample

Rising Popularity of Plant-Based Alternatives

The rapid rise of plant-based meat alternatives is a significant Germany meat market trend. The market is driven by health, environmental, and ethical concerns, many consumers—particularly younger demographics and urban dwellers—are reducing meat intake or switching to flexitarian, vegetarian, or vegan diets. Data shows that 37–41% of German households buy plant-based meat monthly, with 10% consuming it daily. Among 14–29-year-olds, 58% are routine buyers. Supermarkets and restaurants have expanded their offerings beyond traditional soy or tofu to include innovative meat substitutes made from peas, wheat, and cultivated ingredients. Major producers like Rügenwalder Mühle have significantly shifted toward plant-based lines. Startups and global food firms are also investing heavily in this growing category. As conventional meat demand plateaus, plant-based products are gaining market share, pushing traditional meat producers to adapt. This shift is redefining consumer expectations and reshaping the competitive dynamics of Germany’s protein market.

Technological Innovation in Meat Processing and Supply Chain

Germany’s meat market is undergoing a technological transformation, with 55% of processing plants adopting automation, 40% using robotics for carcass handling, and 47% implementing automated packaging systems. These innovations are enhancing efficiency, food safety, and labor conditions, especially after past controversies. Precision farming tools optimize livestock health, feed, and welfare, while cold chain logistics and smart packaging ensure freshness and reduce waste. Blockchain and Internet of Things (IoT) systems are improving traceability, letting consumers track meat from farm to fork. Digital platforms and growing e-commerce sales for meat and ready-to-eat (RTE) products reflect post-pandemic shifts in consumer behavior. These advancements support compliance with strict regulations and meet rising demand for transparency and sustainability. By integrating artificial intelligence (AI), robotics, and data-driven solutions across the value chain, Germany’s meat industry is aligning ethical responsibility with economic resilience, thus bolstering the Germany meat market growth.

Germany Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

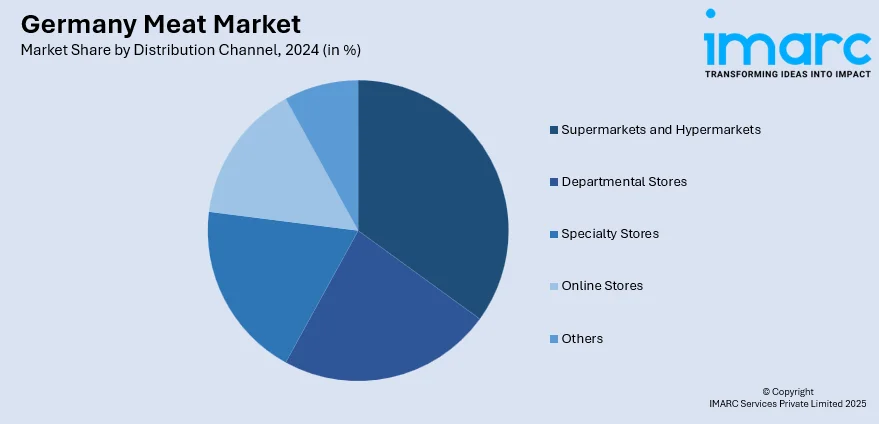

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Meat Market News:

- In April 2025, BASF and Werz launched a closed-loop, sustainable meat packaging solution for the Horeca sector in Germany. Using BASF’s Ultramid Ccycled polyamide and SÜDPACK’s recyclable high-barrier film, the packaging meets EU 2030 Packaging and Packaging Waste Regulation (PPWR) targets. Already in use at BASF sites, the solution integrates recycled materials into existing systems, showcasing chemical recycling as a viable path to circularity in food packaging for community catering and hospitality services.

- In June 2024, Redefine Meat launched its full chilled New Meat range in Germany via vegan online retailer Velivery, marking its retail debut in the country. Previously available only to foodservice and in select European markets, the range includes plant-based burgers, bratwurst, lamb kofta, and more. Following success in over 700 restaurants across the DACH region, the retail expansion meets growing consumer demand for premium, restaurant-quality plant-based meat alternatives at home.

- In April 2024, Germany’s meat consumption continues to decline, with 2023 showing a drop of 430g per person, mainly due to high prices and growing environmental awareness. FIRE&FOOD promotes a shift to quality over quantity, spotlighting affordable Sunday roasts made on classic kettle grills. The latest issue also introduces a “Garden” section and previews the FIRE&FOOD BBQ WEEK in Bayreuth, celebrating global grilling culture with events, masterclasses, and BBQ fan experiences.

Germany Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany meat market on the basis of type?

- What is the breakup of the Germany meat market on the basis of product?

- What is the breakup of the Germany meat market on the basis of distribution channel?

- What is the breakup of the Germany meat market on the basis of region?

- What are the various stages in the value chain of the Germany meat market?

- What are the key driving factors and challenges in the Germany meat market?

- What is the structure of the Germany meat market and who are the key players?

- What is the degree of competition in the Germany meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)