Germany Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

Germany Online Travel Market Overview:

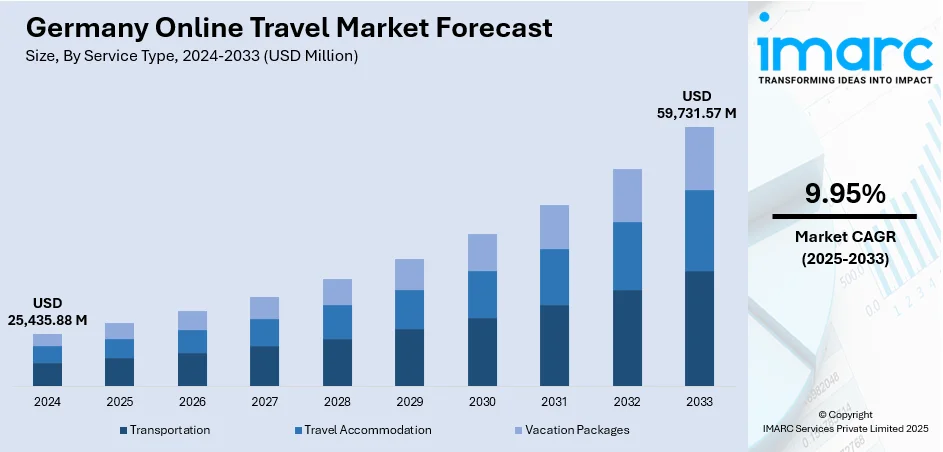

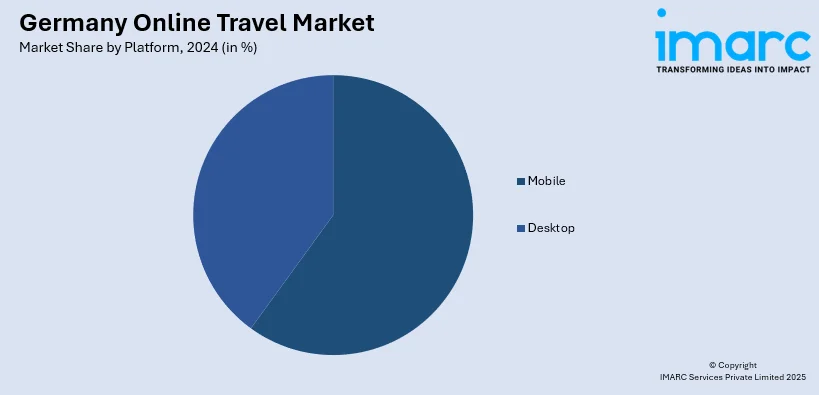

The Germany online travel market size reached USD 25,435.88 Million in 2024. The market is projected to reach USD 59,731.57 Million by 2033, exhibiting a growth rate (CAGR) of 9.95% during 2025-2033. The market is witnessing consistent growth based on increasing internet penetration, mobile applications, and the desire for customized travel experiences. Transportation, accommodation, and holiday packages are the leading services in the market, with platforms gravitating towards mobile and AI-driven interfaces. Bookings on the internet are gaining popularity among millennials and Gen Z, whereas the South and Western markets are witnessing robust performance. Strategic alliances and technological innovation keep influencing market trends, propelling the overall Germany online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25,435.88 Million |

| Market Forecast in 2033 | USD 59,731.57 Million |

| Market Growth Rate 2025-2033 | 9.95% |

Germany Online Travel Market Trends:

Surge in Multigenerational Domestic Travel Preferences

Domestic travel across Germany is increasingly shaped by multigenerational family trends. Families comprising parents, children, and grandparents are opting for regional destinations that balance accessibility and relaxation. Natural retreats such as coastal and lakeside locations are gaining popularity for their ease of access and multi-age appeal. Online booking platforms are responding by streamlining features like linked reservations, family-focused filters, and recommendations that suit varied age groups. Seamless digital itineraries tailored to group needs are enhancing planning efficiency, further encouraging staycations. In December 2024, Germany’s Federal Statistical Office reported 496.1 million overnight stays across all accommodation types, marking a 1.9% increase over the previous year and exceeding pre-pandemic levels—a rise largely driven by domestic guests, which accounted for 410.8 million stays (+1.1%). Travelers seek comfort and convenience, favoring short-haul trips that eliminate the complexities of international logistics. This growing focus on multigenerational travel signifies a notable shift in consumer behavior. It also reflects a deeper cultural preference for shared experiences within familiar settings, especially as digital tools make coordination across generations more manageable. This trend is reshaping Germany's tourism dynamic by prioritizing inclusive, easy-to-navigate travel experiences.

To get more information on this market, Request Sample

Rise of Customizable, Interest-Based Booking Interfaces

Travelers in Germany are increasingly drawn to booking platforms that offer highly personalized experiences aligned with their individual interests. From nature getaways and wellness retreats to cultural city breaks, users prefer portals that offer thematic filters and interest-based recommendations. Visual inspiration—through integrated maps, virtual tours, and social media-style galleries—is also playing a key role in trip planning. Instead of relying solely on destination popularity, users are curating travel based on lifestyle alignment and activity preferences. Additionally, platforms featuring flexible travel bundles and modular itinerary tools are gaining traction. These tools allow users to combine transport, lodging, and activities into customized packages that reflect their personal travel goals. This shift toward interest-driven travel planning underlines a broader digital maturity among German users, who expect tailored solutions and intuitive design. Enhanced user interfaces and experience-focused innovations are becoming key differentiators in a competitive online booking environment, contributing significantly to Germany Online Travel growth by aligning digital services with evolving user expectations.

Digital Convenience Fuels Regional Exploration

German travelers are embracing digital tools that facilitate regional tourism with unprecedented ease. From real-time route planning to mobile-based ticketing, the emphasis is on frictionless travel within national borders. Mobile apps now integrate weather updates, eco-friendly transit suggestions, and last-minute availability, empowering users to make decisions spontaneously. This responsiveness supports an emerging travel style rooted in flexibility and weekend exploration. As environmental awareness grows, digital travel platforms are promoting low-carbon regional options such as train journeys, bike-friendly routes, and eco-lodges. In 2024, the nationwide launch of the Deutschlandticket—a €49-per-month digital flat-rate pass for all regional and local public transport—marked a significant step toward affordable, app-integrated travel. By mid-year, over 11 million Germans had adopted the pass, reflecting a strong shift toward sustainable mobility and spontaneous domestic exploration. These Germany Online Travel trends reflect not only a post-pandemic preference for proximity but also a technological leap in how short-distance travel is planned and executed. The fusion of sustainability with real-time digital capability marks a turning point in Germany’s domestic tourism landscape, bringing efficiency, accessibility, and personalization to the forefront.

Germany Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Online Travel Market News:

- June 2024: FTI Group, a major German travel operator and one of Europe’s largest, has filed for insolvency. The decision follows financial difficulties despite efforts to secure a government-backed rescue deal earlier this year. Headquartered in Germany, the company cited ongoing challenges in the travel industry and liquidity issues as key factors behind the move. The insolvency filing marks a significant moment for Germany’s travel sector, impacting thousands of bookings and raising concerns across the European tourism landscape.

- October 2024: Germany’s National Tourist Board has introduced Emma, the country’s first AI-powered travel influencer. Based in Berlin, Emma appears as a friendly German local, available 24/7 in over 20 languages to offer travel suggestions and itinerary tips. Developed by GNTB and Startup Creator, she uses deep learning and large language models to share recommendations on social media and the official tourism website. While designed to complement not replace human influencers, reactions have been mixed, with some praising innovation and others questioning authenticity. Emma marks a major step in Germany’s digital tourism strategy

Germany Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany online travel market on the basis of service type?

- What is the breakup of the Germany online travel market on the basis of platform?

- What is the breakup of the Germany online travel market on the basis of the mode of booking?

- What is the breakup of the Germany online travel market on the basis of age group?

- What is the breakup of the Germany online travel market on the basis of the region?

- What are the various stages in the value chain of the Germany online travel market?

- What are the key driving factors and challenges in the Germany online travel market?

- What is the structure of the Germany online travel market and who are the key players?

- What is the degree of competition in the Germany online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)