Germany Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

Germany Real Estate Market Overview:

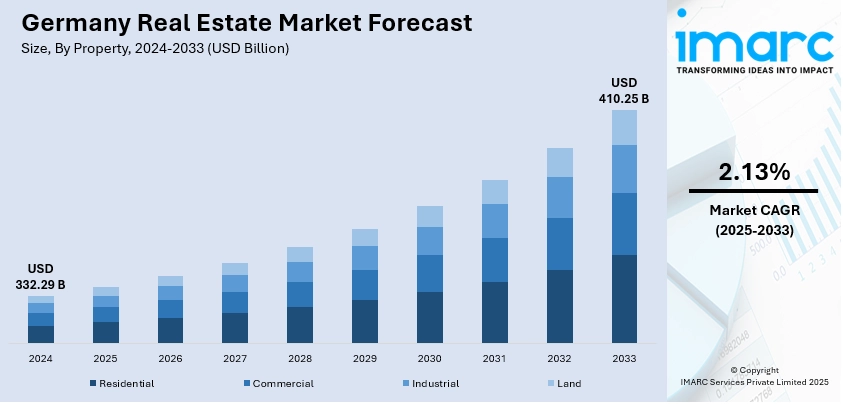

The Germany real estate Market size reached USD 332.29 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 410.25 Billion by 2033, exhibiting a growth rate (CAGR) of 2.13% during 2025-2033. The market is driven by strong urbanization in cities like Berlin and Munich, leading to high housing demand amid limited supply. Foreign investors view the market as a safe, stable destination, increasing capital flows into residential, office, and logistics assets. Additionally, government policies such as rent controls, strict tenant protections, and energy efficiency mandates shape market dynamics by constraining supply growth while promoting sustainable development. These factors collectively sustain high property values and consistent investment interest across asset classes further resulting in the rise in Germany real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 332.29 Billion |

| Market Forecast in 2033 | USD 410.25 Billion |

| Market Growth Rate 2025-2033 | 2.13% |

Germany Real Estate Market Trends:

Urbanization and Population Growth in Major Cities

Urbanization is an important Germany real estate market trend, particularly in urban centers such as Berlin, Munich, Hamburg, and Frankfurt. A consistent flow of both local and foreign migrants—drawn by education, employment, and lifestyle prospects—has fueled demand for housing in cities. This has led to shortages, particularly in affordable housing segments. Despite government measures such as rent control laws (e.g., Mietpreisbremse), the demand-supply mismatch continues. Urban regeneration schemes and the growth of public transport infrastructure further encourage demand in city centers and outer suburban areas. Furthermore, the rise of work-from-home and hybrid work styles has expanded demand to well-linked secondary cities and commuter corridors. These forces maintain high property values and rents in central markets, as well as stimulate investment in residential construction and mixed-use properties, keeping the urban property market competitive and resilient even during economic downturns.

To get more information on this market, Request Sample

Regulatory Environment and Government Policies

The German government plays a decisive role in shaping its real estate market through stringent regulations and housing policies. Rent controls like the Mietpreisbremse, strong tenant protection laws, and strict energy efficiency mandates under the Building Energy Act (GEG) significantly influence supply, development, and profitability. The GEG requires new buildings to reduce primary energy demand to 75% of reference levels, with a target of 55% by 2023, and further tightening expected, pushing developers to invest in costly energy-efficient solutions. Moreover, mandatory ESG (Environmental, Social, Governance) standards compel property owners to modernize aging building stock to meet carbon neutrality goals by 2045. These measures unlock subsidies and green financing but also raise construction costs. Combined with complex permitting processes and planning restrictions, these policies limit new supply, maintaining high demand and prices, while ensuring long-term market stability and sustainability thereby supporting the Germany real estate market growth.

Foreign Investment and Institutional Capital Flows

Foreign capital plays a significant role in Germany’s property sector, particularly in commercial real estate (offices, logistics, and retail). The country is regarded as a “safe haven” for investors due to its political stability, strong legal system, and central location in Europe. Institutional investors from the US, Asia, and neighboring EU countries continuously allocate capital into German real estate, attracted by moderate but stable returns. This foreign appetite has contributed to the escalation of asset prices, especially in prime city locations. Additionally, the expansion of Real Estate Investment Trusts (REITs) and sovereign wealth funds into the German market intensifies competition. Investment is also growing in logistics hubs due to the e-commerce boom, and in green-certified properties, reflecting global sustainability mandates. These capital flows domestic economic fluctuations, maintaining liquidity and pushing up valuations across asset classes.

Germany Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

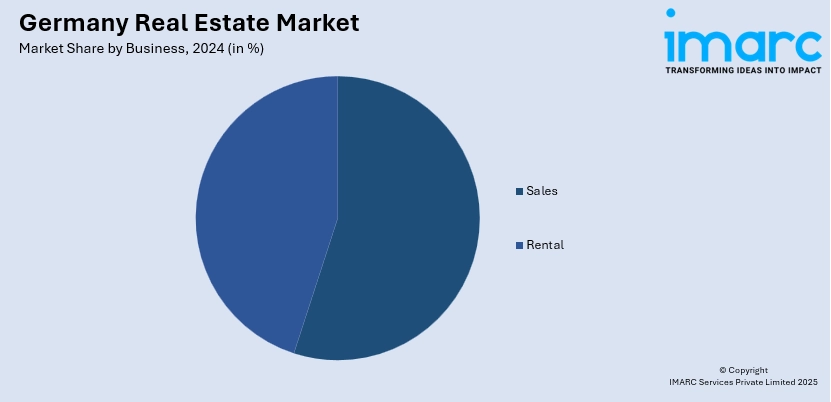

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Real Estate Market News:

- In April 2025, Hauck Aufhäuser Lampe Privatbank launched HAL Data Center Development (HAL DCD), a new platform focused on developing 10MW+ data centers across Germany. The firm will handle acquisition, planning, financing, construction, and leasing, aiming to attract international investors to Germany’s growing digital infrastructure market. Led by Peter Pohlschröder, HAL DCD will leverage in-house expertise to deliver turnkey data centers, meeting rising demand for capacity from global operators and investors.

- In March 2025, PGIM Real Estate launched OmniLiv, a residential platform focused on developing and redeveloping micro-living and student housing in Germany's top cities, including Berlin, Munich, and Frankfurt. Targeting rising demand from students and young professionals in urban centers, OmniLiv will offer affordable, flexible living solutions. Led by industry expert Rainer Nonnengaesser, the platform aims to address chronic undersupply in the market and deliver strong rental growth and returns for investors.

- In September 2024, KINGSTONE Real Estate launched an open-ended institutional fund targeting affordable, energy-efficient housing in Germany, with a planned volume of €500 million. At least 60% will go into subsidised housing, alongside senior living and social infrastructure. Focused on metro regions, the fund meets ESG standards under Article 8 of SFDR. Backed by institutional investors, it promises stable, long-term returns while addressing Germany’s pressing affordable housing shortage. Initial acquisitions are under negotiation.

Germany Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany real estate market on the basis of property?

- What is the breakup of the Germany real estate market on the basis of business?

- What is the breakup of the Germany real estate market on the basis of mode?

- What is the breakup of the Germany real estate market on the basis of region?

- What are the various stages in the value chain of the Germany real estate market?

- What are the key driving factors and challenges in the Germany real estate market?

- What is the structure of the Germany real estate market and who are the key players?

- What is the degree of competition in the Germany real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)