Germany Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

Germany Steel Market Overview:

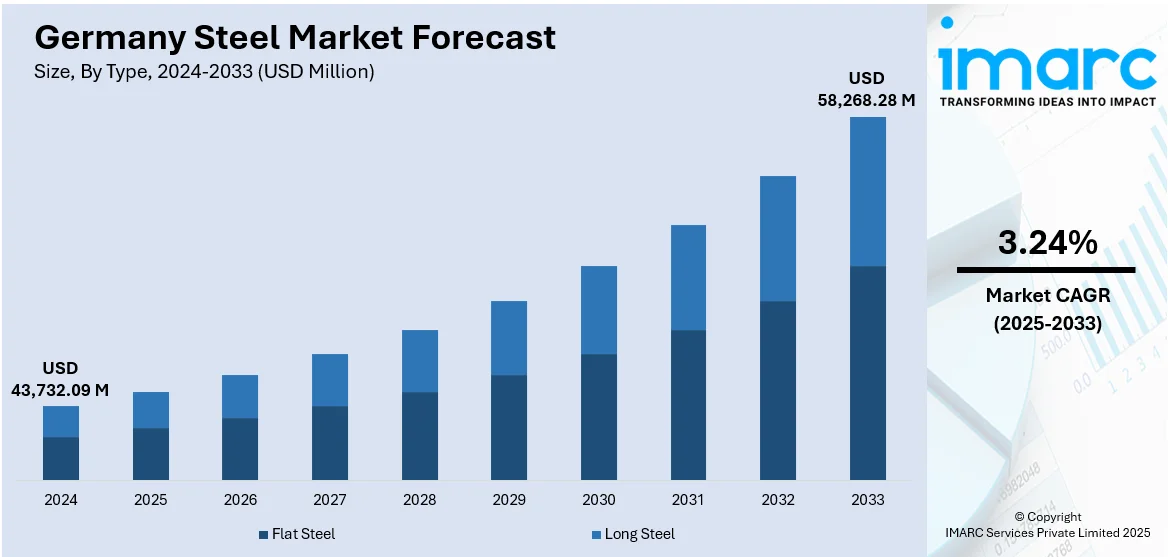

The Germany steel market size reached USD 43,732.09 Million in 2024. The market is projected to reach USD 58,268.28 Million by 2033, exhibiting a growth rate (CAGR) of 3.24% during 2025-2033. The demand is being driven by a big push towards decarbonization and green steel production that is supported by EU climate policies and growing demand for environmentally friendly materials. Firms are embracing technological innovations such as hydrogen-based direct reduction and electric arc furnaces to reduce carbon emissions. The market is also moving towards a circular economy with greater utilization of recycled scrap metal to minimize reliance on raw material and energy and thereby reinforcing the Germany steel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 43,732.09 Million |

| Market Forecast in 2033 | USD 58,268.28 Million |

| Market Growth Rate 2025-2033 | 3.24% |

Germany Steel Market Trends:

Green Steel and Decarbonization Push

Germany’s steel industry is rapidly shifting toward green and low-carbon production, backed by €7 billion in public funding to drive decarbonization. Companies are heavily investing in hydrogen-based steelmaking and energy-efficient technologies to reduce CO₂ emissions, meeting EU climate goals and rising customer demand for sustainable materials. Despite this push, the sector faces hurdles such as high electricity prices, renewable energy supply uncertainty, and slow hydrogen infrastructure development. Still, companies remain committed to green transformation to stay globally competitive and compliant with stricter regulations. Feralpi’s recent €220 million emission-free rolling mill in Riesa exemplifies this green push. On the other hand, the financial and logistical difficulties of this shift are demonstrated by ArcelorMittal's decision to abandon its German green steel plan because of exorbitant costs, which reflects the larger obstacles the sector must surmount in order to successfully decarbonize.

To get more information on this market, Request Sample

Increased Use of Scrap and Circular Economy Practices

One of the most important Germany steel market trends is increasing dependence on scrap and circular economy concepts. Steel producers are building more electric arc furnace (EAF) capacity, which employs recycled steel scrap rather than raw iron ore, lowering CO₂ emissions and energy use. Feralpi Stahl, for instance, derives scrap from Germany, Poland, and the Czech Republic and inspects its purity to ensure high quality. The transition is in line with EU environmental objectives and contributes to lowered reliance on raw material imports such as coking coal or iron ore. Customers also prefer merchandise produced from recycled steel due to environmental considerations. Supply issues such as scrap availability and inconsistency in quality face the industry. Investment in recycling infrastructure, scrap sorting, and logistics is therefore on the increase. Circular economy strategies will be the order of the day in Germany's steel-making model for the next decade.

Digitalization and Smart Manufacturing

An emerging driver for Germany's steel sector is embracing digitalization and intelligent manufacturing technologies. Companies are increasingly adopting advanced data analytics, automation, and AI-based systems to streamline production processes, minimize waste, and enhance energy efficiency. Intelligent sensors, IoT devices, and predictive maintenance software assist in tracking equipment in real-time, reducing downtime and optimizing output quality. Digital twin technology enables simulation of steel production conditions to optimize process control and resource utilization. This change accommodates not only cost cutting but also sustainability agendas through reduced energy use and emissions. With stiffening global competition, digital innovation positions German steelmakers advantageously in terms of flexibility, customization, and supply chain integration. Digitalization further alleviates staff shortages through automation of labor-intensive operations. Government programs, such as "Industrie 4.0" initiatives, also stimulate digital improvements, so technology becomes an essential driver for future competitiveness and resilience thereby boosting the Germany steel market growth.

Germany Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel, and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

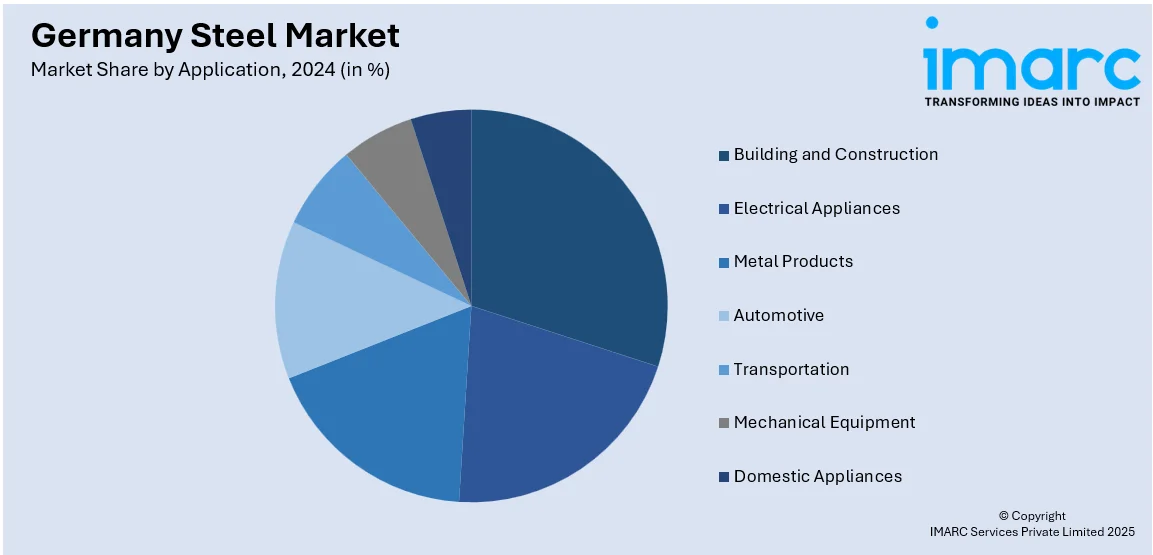

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Steel Market News:

- In June 2025, ArcelorMittal, the world's second-largest steelmaker, scrapped its plans to switch two German plants to carbon-neutral production, citing high energy costs. Additionally, the business turned down government subsidies totaling €1.3 billion ($1.5 billion). Germany's aspirations for green hydrogen are called into question by this setback, particularly in light of the loss of Russian gas supply. Meanwhile, rivals Thyssenkrupp and Salzgitter continue their green steel projects. The German ministry expressed regret over ArcelorMittal's decision.

- In May 2025, Feralpi Stahl opened a €220 million energy-efficient steel rolling mill in Riesa, Saxony, one of Germany’s largest recent green metallurgy investments. The plant uses direct rolling technology, cutting energy use and emissions by feeding steel billets directly from electric arc furnaces powered by renewable energy. Despite innovation efforts, Feralpi warns high electricity costs remain a challenge and urges the government to lower tariffs and extend support for energy-intensive industries.

Germany Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany steel market on the basis of type?

- What is the breakup of the Germany steel market on the basis of product?

- What is the breakup of the Germany steel market on the basis of application?

- What is the breakup of the Germany steel market on the basis of region?

- What are the various stages in the value chain of the Germany steel market?

- What are the key driving factors and challenges in the Germany steel market?

- What is the structure of the Germany steel market and who are the key players?

- What is the degree of competition in the Germany steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)