Global Gluten-Free Products Market Expected to Reach USD 40.0 Billion by 2033 - IMARC Group

Global Gluten-Free Products Market Statistics, Outlook and Regional Analysis 2025-2033

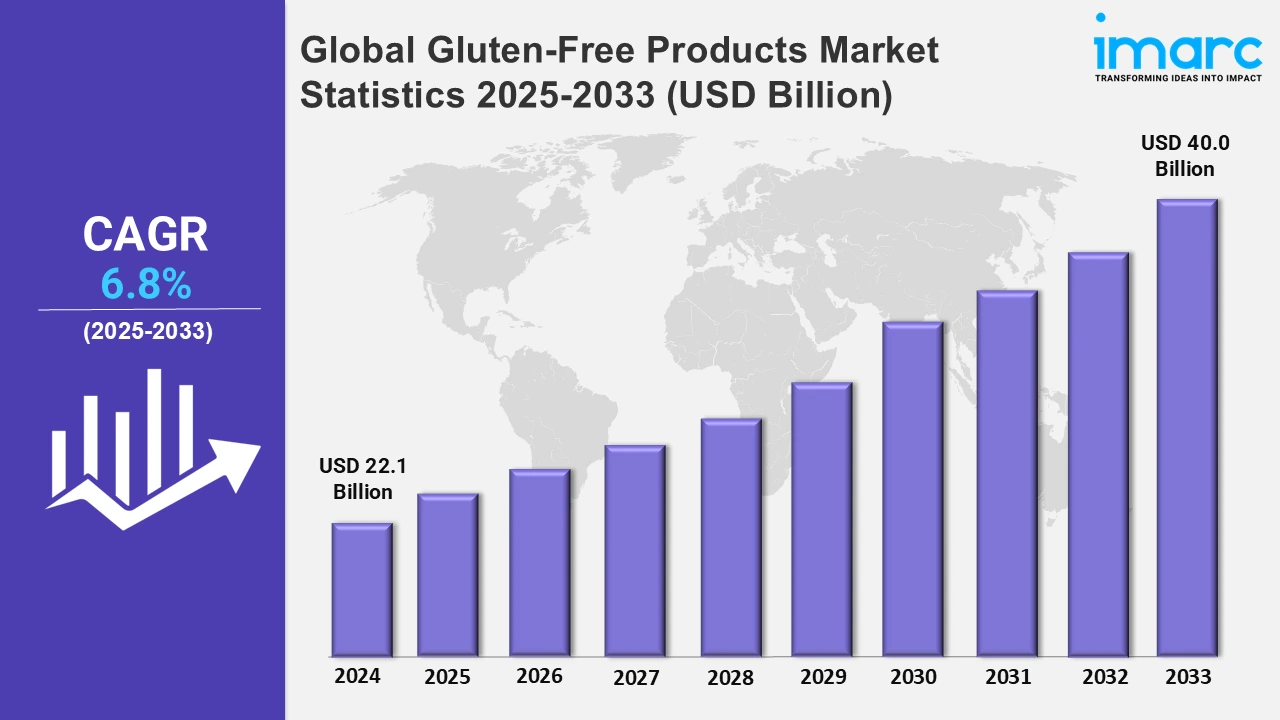

The global gluten-free products market size was valued at USD 22.1 Billion in 2024, and it is expected to reach USD 40.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.8% from 2025 to 2033.

To get more information on this market, Request Sample

The growing prevalence of gluten intolerance and celiac disease is a significant driver of the gluten-free products market. Increasing awareness among consumers about the adverse health effects of gluten consumption is leading to a rise in demand for gluten-free options. Additionally, a rise in the number of individuals adopting gluten-free diets as part of a healthier lifestyle, even without medical necessity, is expanding the market’s consumer base. This trend is fueled by advancements in diagnostic techniques, enabling better detection of gluten sensitivities, and extensive health campaigns highlighting gluten-free benefits. Furthermore, manufacturers are responding with innovative product offerings, improved taste, and enhanced nutritional value, which further encourage consumer adoption of gluten-free alternatives. On 29th October 2024, Feel Good Foods introduced gluten-free frozen chicken soup dumplings, made with a rice flour blend wrapper and filled with chicken, broth, scallions, and ginger. Ready in three minutes, the dumplings come in a microwaveable steamer tray and are available nationwide at Whole Foods, Sprouts Farmers Market, and Ahold Delhaize. Founder Vanessa Phillips highlights their commitment to providing simple, delicious gluten-free options.

In addition, the growing retail availability and marketing of gluten-free products is significantly supporting the market. On 14th November 2024, Antonina’s Gluten-Free Bakery launched an online store, offering cases and half-cases of its popular gluten-free muffins, cupcakes, and new Double Chocolate brownies. Products ship on dry ice to ensure quality and arrive within 1-3 days. The bakery, certified by GFCO, is also expanding its retail presence and will soon be available on Walmart.com, Amazon.com, and Kroger.com. Supermarkets, health food stores, and e-commerce platforms are increasingly dedicating shelf space and promotions to these products, making them more accessible to consumers. Similarly, the rise in disposable income, particularly in developing regions, enables greater spending on specialized dietary products, including gluten-free options. Apart from this, social media and digital platforms also play a key role, with influencers and brands promoting gluten-free lifestyles and recipes, thereby influencing purchasing decisions. As consumer preferences shift toward transparency, many brands emphasize clean-label practices, leveraging the "gluten-free" claim as part of their branding strategy to attract health-conscious buyers.

Global Gluten-Free Products Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, North America accounted for the largest market share on account of high consumer awareness, strong adoption of gluten-free diets, and widespread availability through diverse retail channels. Regulatory support and continuous product innovation further bolster the region's dominance.

North America Gluten-Free Products Market Trends:

North America accounts for the largest share of gluten-free products on account of high consumer awareness and massive adoption of gluten-free diets. The region encompasses a significant prevalence of gluten-related disorders, including celiac disease and gluten intolerance, driving demand for gluten-free options across the food and beverage categories. In addition, changing preferences toward healthy lifestyles are triggering increased demand for gluten-free products among consumers without gluten-related medical conditions. The presence of established industry players, coupled with continuous product innovation, ensures a diverse range of options for consumers. On 21st May 2024, Nestlé announced the launch of Vital Pursuit, a new food line tailored for weight-management medication users and health-conscious consumers. Featuring affordable high-protein, fiber-rich frozen meals such as protein pasta, whole grain bowls, sandwich melts, and pizzas, the brand includes gluten-free and air fryer-ready options. Nestlé aims to provide accessible, nutrient-packed foods supporting diverse health journeys. Besides this, retail channels, including supermarkets, specialty stores, and e-commerce platforms, further enhance accessibility. Regulatory support and clear labeling practices have also played a crucial role in cementing North America as the largest market segment.

Europe Gluten-Free Products Market Trends:

Europe has a substantial share in the gluten-free products market due to increasing health awareness among consumers and the rising diagnosis of gluten-related disorders. Germany, Italy, and the UK are the largest demand countries due to a growing demand for clean-label and allergen-free foods. Strict regulatory standards also ensure the quality of products and transparency. The region’s expanding vegan and organic food markets further enhance gluten-free product consumption among health-conscious consumers.

Asia Pacific Gluten-Free Products Market Trends:

The Asia Pacific gluten-free products market is growing rapidly, fueled by increasing health awareness and rising disposable incomes. Countries such as China, Japan, and India are gaining demand as consumers seek gluten-free diets for a healthier lifestyle. The increased adoption of e-commerce and innovative products customized to local tastes also support market growth. Urbanization and a shift toward healthier lifestyles further support the market's growth in this region.

Latin America Gluten-Free Products Market Trends:

Latin America's gluten-free products market is growing steadily, motivated by expanding awareness of health issues of gluten and increasing dietary demand for natural and clean-label products. Key markets Brazil, Mexico, and Argentina receive significant benefits from the adoption of gluten-free alternatives. Improved distribution networks and growing interest in healthier diets contribute to regional growth. Moreover, government initiatives promoting food safety and quality standards further encourage the adoption of gluten-free products.

Middle East and Africa Gluten-Free Products Market Trends:

The Middle East and Africa are the new emerging markets for gluten-free food products, which are supplemented by growing health-consciousness and urbanization. Additionally, countries such as UAE, Saudi Arabia, and South Africa have also demanded such food. Limited awareness had been an issue, however easy accessibility through retail as well as online channels has proved to be a savior. Increasing disposable incomes and the ever-increasing numbers of expatriates is a vital element in building the market.

Top Companies Leading in the Gluten-Free Products Industry

Some of the leading gluten-free products market companies include Kraft Heinz Company, Hain Celestial Group, Boulder Brands, General Mills, Pinnacle Foods, Kellogg's, Hero Group, Freedom Nutritional Products, Warburtons, Barilla Group, Glutamel, Raisio Group, Dr. Schär Company, Domino's Pizza Enterprises, Alara Wholefoods Ltd, Genius Foods, Enjoy Life Foods, and Silly Yak Foods, among others. On 29th March 2024, Dr. Schär launched its gluten-free Marble Cake, a shelf-stable treat combining a light, airy texture with rich cocoa swirls. Made from premium ingredients such as farm-fresh eggs and fine cocoa, the cake is ready to eat and perfect for any occasion. Priced at USD 5.99, it is available at supermarkets, specialty stores, and online, offering an indulgent gluten-free option for all.

Global Gluten-Free Products Market Segmentation Coverage

- On the basis of the product type, the market has been categorized into bakery products (breads, rolls, buns, and cakes, cookies, crackers, wafers, and biscuits, baking mixes & flours), snacks & RTE products, pizzas & pastas, condiments & dressings and others, wherein bakery products represent the leading segment. This can be supported by the high consumer demand for alternatives to traditional bread, pastries, and cakes. These products serve those with gluten intolerance and health-conscious consumers. The innovation of gluten-free products continues, such as taste and texture improvements, enhancing consumer acceptance. Gluten-free bakery products are available in supermarkets, specialty stores, and online sites, hence their wide accessibility. Bakery items are the largest part of the gluten-free industry due to their variety and staple nature.

- Based on the source, the market is classified into animal source (dairy and meat) and plant source (rice and corn, oilseeds and pulses, and others), amongst which plant source dominates the market. This can be attributed to their natural, sustainable, and health-oriented appeal. Due to their gluten-free qualities and nutritional advantages, ingredients such as rice, corn, quinoa, and legumes are frequently employed. Demand is also supported by the rising acceptance of plant-based diets as individuals seek less processed and allergy-free choices. Versatility in application across bakeries, snacks, and beverages makes plant sources highly preferred. Their cost-effectiveness and wide availability contribute to their position as the largest segment.

- On the basis of the distribution channel, the market has been divided into conventional stores (grocery stores, mass merchandisers, warehouse clubs, and online retailers), specialty stores (bakery stores, confectionery stores, and gourmet stores), and drugstores & pharmacies. Among these, conventional stores account for the majority of the market share. Supermarkets, hypermarkets, and other traditional retail establishments dominate the market for gluten-free items as the main distribution channel. Their huge customer base is drawn to them by their ease, variety of products, and reach. These stores provide easy access to gluten-free options, often featuring dedicated aisles or sections. Competitive pricing and promotional activities further drive customer preference. Additionally, the trust and familiarity associated with traditional retail outlets make them a favored choice for purchasing gluten-free products, solidifying their market dominance.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 22.1 Billion |

| Market Forecast in 2033 | USD 40.0 Billion |

| Market Growth Rate 2025-2033 | 6.8% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Sources Covered |

|

| Distribution Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Kraft Heinz Company, Hain Celestial Group, Boulder Brands, General Mills, Pinnacle Foods, Kellogg's, Hero Group, Freedom Nutritional Products, Warburtons, Barilla Group, Glutamel, Raisio Group, Dr. Schär Company, Domino's Pizza Enterprises, Alara Wholefoods Ltd, Genius Foods, Enjoy Life Foods, Silly Yak Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)