Gluten-Free Products Market Size, Share, Trends and Forecast by Product Type, Source, Distribution Channel, and Region, 2025-2033

Gluten Free Products Market 2024, Size and Trends:

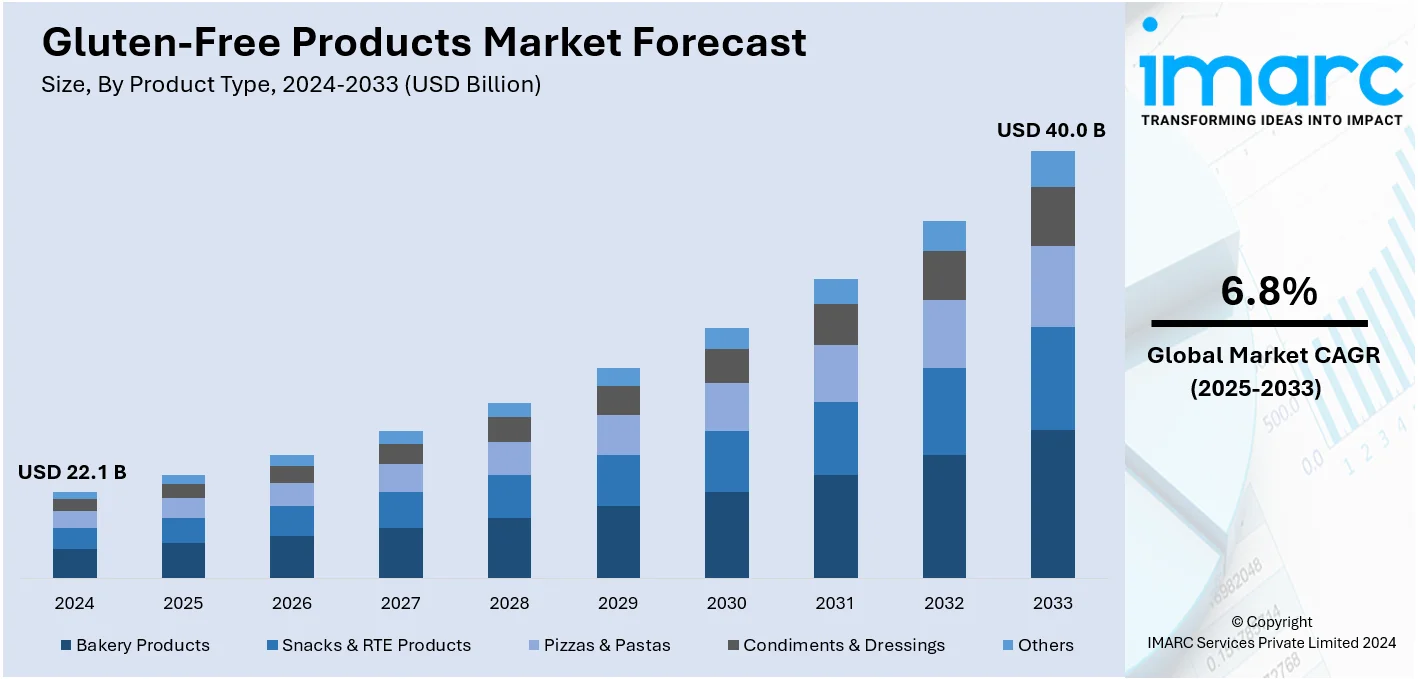

The global gluten free products market size was valued at USD 22.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40.0 Billion by 2033, exhibiting a CAGR of 6.8% from 2025-2033. North America currently dominates the market. The growth of the North American region is driven by high awareness of gluten-related disorders, increasing health-conscious consumers, innovative product launches, and strong retail and online distribution networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 22.1 Billion |

|

Market Forecast in 2033

|

USD 40.0 Billion |

| Market Growth Rate (2025-2033) | 6.8% |

The increasing demand for natural, minimally processed products aligns with the gluten-free trend. Many gluten-free products are marketed as clean-label items, free from artificial additives, appealing to consumers looking for healthier and more transparent food options. Additionally, the availability of gluten-free products is significantly improving, with conventional stores, specialty retailers, and online platforms ensuring that consumers can access these products easily. Supermarkets and mass merchandisers often dedicate sections to gluten-free items, while e-commerce platforms offer convenient delivery options and an extensive product range. Besides this, technological advancements in food processing are leading to the development of gluten-free products that closely replicate the taste, texture, and quality of traditional gluten-containing items. This is making gluten-free products more appealing to a wider audience, including those who do not have gluten-related health issues but seek healthier or alternative food choices.

The United States plays a crucial role in the market, driven by the increasing cases of celiac disease and gluten intolerance. Moreover, the growing awareness about the benefits of gluten-free diets and the potential harm of gluten for certain individuals is encouraging more consumers to adopt these products as part of healthier lifestyle choices, even if they do not have gluten intolerance. Furthermore, the introduction of innovative gluten-free products with improved recipes that mimic the taste and texture of conventional food, combined with certifications ensuring safety and quality, is bolstering the market growth. In 2024, Lancaster Colony Corp. launched its inaugural gluten-free frozen bread range under the New York Bakery label, which includes Garlic Texas Toast and Five Cheese Texas Toast. Crafted with a patent-pending dough formulation, these items provide the flavor and feel of traditional bread and are certified gluten-free.

Gluten Free Products Market Trends:

Increasing Healthy Snacking Options

The expanding working population with hectic lifestyles and busy schedules across countries is inflating the demand for meals and snacks that are convenient, ready-to-eat, and gluten-free. For instance, the ready-to-eat market in India is likely to grow about 45% over the next five years. Consequently, numerous companies are introducing gluten-free products that go beyond conventional bakery items, such as biscuits, pastries, pasta, cakes, etc. For example, gluten-free breakfast cereals are increasingly popular, and General Mills Inc. is producing almost 90% of its Cheerios line as gluten-free. Apart from this, Rage Coffee, a Delhi-based FMCG company, introduced three new snacks, namely caffeine almond bars, coffee peanut bars, and chocolate oats cookies. These products are prepared with natural premium ingredients and are gluten-free. Moreover, they do not contain colors or preservatives, thereby making them ideal for healthy snacking. Besides this, Wild Drum, an Indian brand, further developed gluten-free hard-seltzers, a clear carbonated alcoholic beverage infused with natural fruit flavorings. All these healthy snacking and drinking options are extensively utilized by consumers across the globe, which, in turn, is anticipated to propel the gluten-free products market over the forecasted period.

Rising Brand Offerings

The wide presence of multinational companies across the globe that are focusing on manufacturing gluten-free food items to expand their product portfolio by entering into strategic partnerships and collaborations, thereby fueling the gluten-free products market revenue. For example, Rudi’s introduced 15 of its organic and gluten-free products with a new fermentation process and new packaging that included bread. Furthermore, Feel Good Foods, a gluten-free frozen appetizers and snack brand, launched a gluten-free square pan pizza. Besides this, in January 2023, Dr. Schar USA Inc., a division of Dr. Schar AG located in Burgstall, Italy, revealed plans to increase its manufacturing capabilities in the US and diversify its offerings into new categories. It was carried out to broaden its gluten-free product range and enhance its market visibility in North America.

Launch of Favorable Policies

One key recent opportunity in the gluten-free products market is that government bodies worldwide are introducing favorable policies to promote the adoption of gluten-free products at affordable prices. For example, in April 2022, the Agricultural & Processed Food Products Export Development Authority (APEDA) launched numerous millet products at the AAHAR food fair at affordable prices, ranging from Rs. 5 to Rs. 15 for individuals of all ages. All the millet items, including ragi peanut butter, jowar peanut butter, khichadi, cream biscuits, salt biscuits, milk biscuits, millet malts, etc., introduced by APEDA were gluten-free and patented. In addition to this, various organizations are also providing certificates to encourage brands to use clean labeling, which helps in gaining consumer attention. For instance, the Association of European Coeliac Societies (AOECS) operates and owns a gluten-free certification program that is recognized internationally by its Crossed Grain Symbol, which is a registered trademark. Furthermore, brand owners can use this symbol in their pre-packaged food products by meeting the Grossed Grain Symbol’s licensing rules and the AOECS Standard for gluten-free foods. As such, SGS has partnered with AOECS to offer food retailers and manufacturers a cost-effective and robust route to gluten-free food certification. These initiatives by various associations will continue to fuel the gluten-free products market over the forecasted period.

Market Dynamics

Drivers: Increasing Diagnosis of Celiac Disease and Food Allergies

Celiac disease is affecting more people worldwide, with about 1% of the global population diagnosed, according to a 2022 report in Nature Reviews Gastroenterology & Hepatology. People with this condition must follow a strict gluten-free diet, which helps drive the demand for gluten-free products. A report from The American College of Gastroenterology also emphasized the increasing incidence of celiac disease, particularly among women and children. This trend, along with an increase in individuals self-diagnosing as gluten-sensitive or adopting gluten-free diets for health reasons, is also contributing to market growth. Overall, more awareness of celiac disease, rising numbers of gluten-related disorders, and increasing health consciousness are pushing up sales of gluten-free products, leading to more availability and variety in the market.

Restraints: Higher Costs of Gluten-Free Products

Gluten-free foods tend to be more expensive than regular gluten-containing products. For example, research from the University of Massachusetts Amherst in March 2024 showed that gluten-free foods can be up to 87% more expensive, especially items like bread. A study from Dalhousie University also found that gluten-free goods cost, on average, 242% more than their gluten-containing counterparts. This price difference makes it harder for consumers to stick to a strict gluten-free diet.

Opportunities: Use of Microencapsulation Technology to Extend Shelf Life

One significant opportunity in the gluten-free products market is the application of microencapsulation technology. This involves coating sensitive ingredients like gluten-free flour to protect them from factors like oxidation, moisture, and flavor loss. The result is a longer shelf life for gluten-free products, which reduces waste and improves distribution. This also reduces the need for artificial preservatives, meeting the rising demand for clean-label products. This innovation can make gluten-free items more widely available and appealing, helping manufacturers stay competitive in a growing market.

Challenges: Difficulty in Product Formulation

Manufacturers face challenges in creating gluten-free products because gluten plays a crucial role in giving texture, structure, and elasticity to baked goods. Replacing gluten with other ingredients like xanthan gum, guar gum, or psyllium husk is tricky and expensive. Gluten-free products often end up being dense, crumbly, or lacking in flavor. Additionally, maintaining consistent quality is tough since gluten-free flours behave differently from regular flours. There’s also the issue of cross-contamination, which requires strict controls in production facilities. All of these factors make gluten-free products harder and more expensive to produce, limiting the variety and appeal of gluten-free options in the market.

Gluten Free Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gluten free products market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, source, and distribution channel.

Analysis by Product Type:

- Bakery Products

- Breads, Rolls, Buns, and Cakes

- Cookies, Crackers, Wafers, and Biscuits

- Baking Mixes & Flours

- Snacks & RTE Products

- Pizzas & Pastas

- Condiments & Dressings

- Others

Bakery products (breads, rolls, buns, and cakes, cookies, crackers, wafers, and biscuits, baking mixes & flours) dominate the market because of their widespread appeal and staple nature in daily diets. As consumers increasingly seek gluten-free alternatives, manufacturers are focusing on improving the quality, taste, and texture of these products to match or exceed traditional options. Bread and rolls are particularly popular, serving as everyday essentials, while cakes, cookies, and biscuits cater to indulgent treats and desserts. Crackers and wafers offer convenient snacking options, appealing to on-the-go consumers. Baking mixes and flours empower individuals to create homemade gluten-free goods, expanding their culinary choices. Retailers support this segment through dedicated bakery sections and gluten-free aisles, making products easily accessible. Rising health awareness, innovative formulations using alternative grains like rice, almond, and quinoa flours, and the growing interest in premium, artisan baked goods further reinforce the dominance of bakery products in the market.

Analysis by Source:

- Animal Source

- Dairy

- Meat

- Plant Source

- Rice and Corn

- Oilseeds and Pulses

- Others

Plant source (rice and corn, oilseeds and pulses, and others) represents the largest segment due to its broad accessibility, cost-effectiveness, and adaptability in gluten-free product formulations. Ingredients such as rice and corn are staple in numerous regions and act as main foundations for gluten-free flours, snacks, and baked products. Oilseeds and pulses, like lentils and chickpeas, offer significant nutritional benefits, featuring protein and fiber, which makes them perfect for health-conscious consumers. Its capacity to cater to various dietary preferences, such as vegan and allergen-free options, further boosts its attractiveness. The rising trend of plant-based diets, combined with consumer interest in clean-label and natural ingredients, is boosting the popularity of gluten-free products derived from plants. Furthermore, continuous advancements in processing and formulation methods guarantee that these components provide enhanced flavor and texture, broadening their uses across different product types.

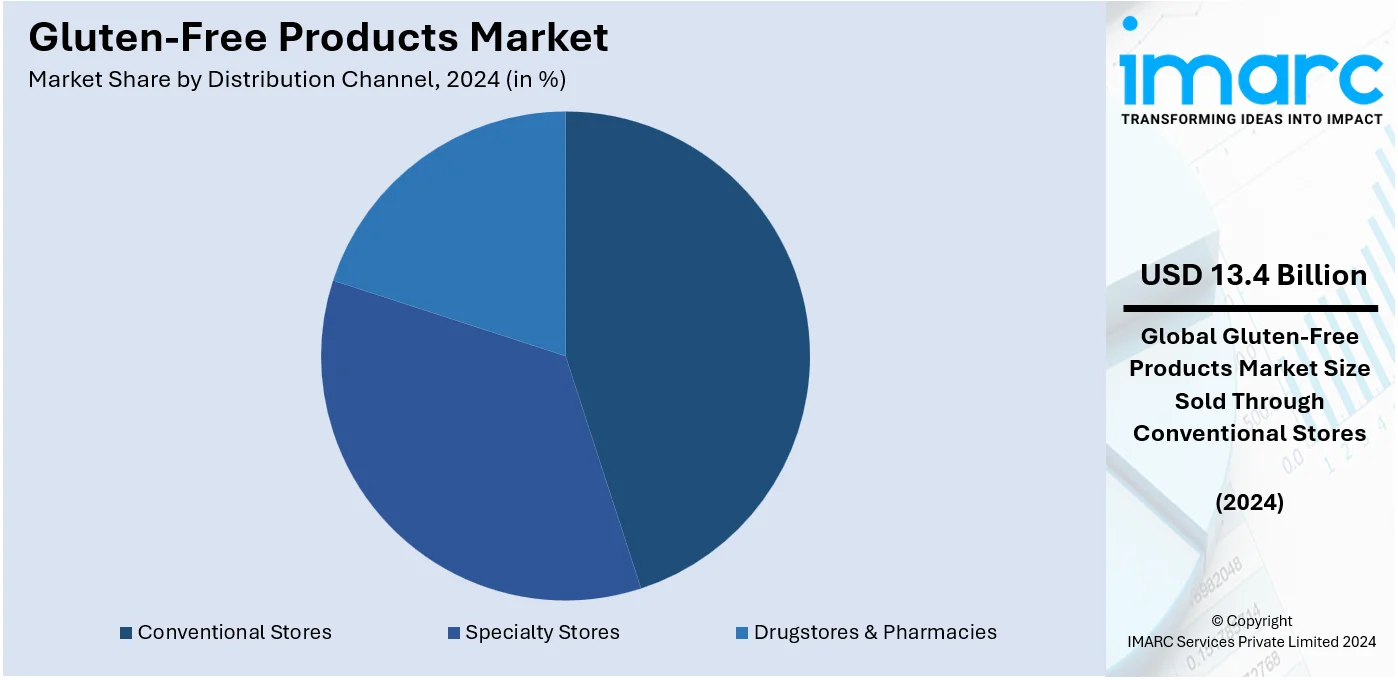

Analysis by Distribution Channel:

- Conventional Stores

- Grocery Stores

- Mass Merchandisers

- Warehouse Clubs

- Online Retailers

- Specialty Stores

- Bakery Stores

- Confectionery Stores

- Gourmet Stores

- Drugstores & Pharmacies

Conventional stores (grocery stores, mass merchandisers, warehouse clubs, and online retailers) hold the biggest market share because of their accessibility, convenience, and capability to serve a wide user demographic. These venues offer a broad selection of gluten-free choices, ranging from snacks to meal necessities, facilitating the inclusion of these products in consumers' diets. Supermarkets and large retailers provide the benefit of instant product access, competitive prices, and regular promotional deals, drawing in a steady flow of shoppers. Warehouse clubs serve budget-minded wholesale shoppers looking for savings in larger amounts. In addition, e-commerce platforms offer a vast array of products and customized shopping experiences via suggestions, ratings, and personalized discounts, attracting tech-oriented, convenience-seeking buyers. Retailers are investing in specific gluten-free areas, transparent labeling, and education initiatives to inform consumers about their products. Seasonal promotions and exclusive product launches further boost sales, solidifying the dominance of conventional stores in the market.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America leads the market for various reasons, such as a significant occurrence of celiac disease and gluten sensitivity, resulting in heightened consumer demand. Awareness initiatives and education concerning gluten-related conditions are additionally impacting buying habits, leading numerous consumers to embrace gluten-free diets as a health-driven option. The area benefits from strong retail networks, comprising supermarkets, specialty shops, and online platforms, which guarantee the broad availability of gluten-free items. Advancements in food processing and the launch of high-quality, attractive products are additionally driving market expansion. The involvement of major industry stakeholders consistently launching attractive, high-quality products is providing a positive market perspective in the area. In 2024, Thabico Foods North America Inc introduced "Bestropics" 100% Pure Mango Juice, a nutritious drink choice. This plant-based, gluten-free juice has no added sugars, preservatives, artificial colors, or flavors.

Key Regional Takeaways:

United States Gluten Free Products Market Analysis

The rising popularity of gluten-free items in the United States is linked to a heightened emphasis on health and well-being. For example, as 50% of Americans make efforts to eat better and 62% place importance on health in their food selections, there is a notable change toward more conscious eating practices. This trend, sped up by the COVID-19 pandemic, increases the need for Gluten-Free products as shoppers look for healthier options. More than 70% of people currently prioritize their physical well-being, which is further propelling this change in diet. With an increasing number of consumers focusing on healthier living, there is a growing need for gluten-free options. This trend is further reinforced by the increasing awareness of gluten-related conditions and the view of gluten-free products as a healthier option. As research continues to emphasize the possible advantages of a gluten-free diet, especially for those with sensitivities, the need for gluten-free items, such as bread, pasta, and snacks, keeps increasing. The presence of numerous gluten-free alternatives in common grocery stores and eateries has simplified the process for individuals to include these items in their everyday meals. Moreover, the health-aware consumer demographic looks for choices that accommodate dietary limitations while preserving flavor and quality, consequently fostering the broad acceptance and use of gluten-free products.

Europe Gluten Free Products Market Analysis

The rising occurrence of celiac disease greatly impacts the uptake of gluten-free products in Europe. For example, celiac disease impacts more than 5 Million individuals in the EU, leading to heightened demand for gluten-free items as the sole remedy for this issue. This increasing occurrence is enhancing the gluten-free product market throughout the region. As knowledge of the autoimmune condition expands, an increasing number of individuals are being diagnosed, resulting in a higher demand for gluten-free food items. Celiac disease is a condition in which the ingestion of gluten causes an immune reaction that harms the intestines, necessitating that individuals eliminate gluten entirely from their diet. As a result, the increasing number of diagnoses has amplified the need for gluten-free foods, leading producers to create a wider variety of accessible choices. Furthermore, the growing awareness of gluten sensitivity has played a role in changing consumer preferences, as those without celiac disease also desire gluten-free options for better health. This increasing demand has led to a burgeoning market for gluten-free items, such as specialized baked goods and convenient meal options.

Asia Pacific Gluten Free Products Market Analysis

In the Asia-Pacific area, the rising popularity of gluten-free products is fueled by the expanding influence of e-commerce platforms. Reports indicate that in 2023, around 300 million consumers in India made online purchases, fueling the expansion of e-commerce. This increase advantages gluten-free items, providing broader access and ease for health-aware customers. E-commerce sites are simplifying access for consumers to a diverse array of gluten-free products that might not be found in nearby physical stores. Due to the ease of home delivery and the option to compare prices, an increasing number of shoppers are using online platforms to buy gluten-free food products. This trend is especially significant in city environments where fast-paced lives lead to online shopping being the favored option. The growing online retail sector in this area is enhancing the accessibility of gluten-free items while simultaneously raising awareness via digital marketing, social media, and online groups dedicated to healthy eating and lifestyle options.

Latin America Gluten Free Products Market Analysis

In Latin America, increasing disposable income is fueling the rising demand for gluten-free products. For example, total disposable income in Latin America is expected to rise by almost 60% in real terms between 2021 and 2040, fueled by technological progress and a transition to sectors with higher value addition. This economic development offers considerable chances for the growth of the gluten-free product market. As a greater number of people in the area see enhancements in their financial situation, they are increasingly inclined to purchase high-quality products, such as gluten-free alternatives. This rise in buying power enables consumers to focus on health and dietary choices, such as the need for gluten-free products. With the growth of the middle class, consumers are increasingly open to trying dietary options that promote a healthier way of living. This has resulted in an increase in the accessibility and use of gluten-free products in different food categories, ranging from snacks to baked goods, as they become more reachable for a wider audience.

Middle East and Africa Gluten Free Products Market Analysis

In the Middle East and Africa, the increasing interest in gluten-free baked goods is associated with the surge in tourism, resulting in a stronger focus on accommodating the dietary needs of global travelers. For example, international tourist expenditure in the UAE rose almost 40% in 2023, exceeding AED 175BN, which is a 12% rise from 2019 figures, showcasing the nation's robust worldwide tourism appeal. This increase highlights the UAE's ongoing significance as a top global hub. With the tourism industry thriving in popular locations, there is a growing demand for food options that cater to various dietary needs, such as gluten-free diets. Hotels, restaurants, and cafes are adapting by adding gluten-free baked goods to their menus to cater to the increasing number of travelers looking for these choices. This change has not only addressed the needs of travelers but has also impacted local buyers, resulting in increased acceptance and consumption of gluten-free products in the area.

Competitive Landscape:

Major participants in the market are concentrating on innovation, broadening product ranges, and improving production capabilities to satisfy the increasing consumer demand. They are funding research efforts to enhance the flavor, consistency, and nutritional quality of gluten-free products. Businesses are aiming at niche markets by creating tailored products for specific dietary requirements, like vegan or allergen-free alternatives. Marketing tactics highlight openness and certifications to foster consumer confidence. Furthermore, strategic alliances, partnerships, and acquisitions are being sought to enhance market presence and obtain new distribution avenues. In September 2024, Bay State Milling has broadened its operations by purchasing Montana Gluten Free, strengthening its position as one of the largest family-operated milling firms in the US. The facility focuses on SowNaked® Mindfully Farmed Oats, a distinct non-GMO type that is gluten-free and contains 40% more protein compared to traditional oats. These oats are prepared following strict gluten-free guidelines, guaranteeing that gluten levels are much lower than FDA standards.

The report provides a comprehensive analysis of the competitive landscape in the gluten free products market with detailed profiles of all major companies, including:

- Kraft Heinz Company

- Hain Celestial Group

- Boulder Brands

- General Mills

- Pinnacle Foods

- Kellogg's

- Hero Group

- Freedom Nutritional Products

- Warburtons

- Barilla Group

- Glutamel

- Raisio Group

- Dr. Schär Company

- Domino's Pizza Enterprises

- Alara Wholefoods Ltd

- Genius Foods

- Enjoy Life Foods

- Silly Yak Foods

Latest News and Developments:

- October 2024: PepsiCo announced that it plans to purchase Siete Foods for USD 1.2 Billion. With this acquisition, PepsiCo is looking to expand its portfolio with the authentic Mexican American food offerings of Siete Foods, including grain-free tortillas, salsas, and snacks. The company was established in 2014, and the company's focus is heritage-inspired foods catering to diverse needs and preferences. Its products are distributed widely across the US.

- September 2024: Once Again Nut Butter has released a new line of gluten-free graham crackers in cinnamon, honey, and chocolate flavors. These snacks are organic and gluten-free, and the cinnamon and dark chocolate flavors are also vegan. Handcrafted in small batches, they use organic sorghum, oat, and cassava flours and are enhanced with natural ingredients such as organic cinnamon and non-GMO honey.

- May 2024: Mondelēz International introduced its first gluten-free Chips Ahoy! Cookie in May. The company is targeting roughly 25% of Americans who are gluten-free in diet with this move. This is a time in which the company entered the gluten-free market with Oreo Gluten Free cookies.

Gluten Free Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Sources Covered |

|

| Distribution Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Kraft Heinz Company, Hain Celestial Group, Boulder Brands, General Mills, Pinnacle Foods, Kellogg's, Hero Group, Freedom Nutritional Products, Warburtons, Barilla Group, Glutamel, Raisio Group, Dr. Schär Company, Domino's Pizza Enterprises, Alara Wholefoods Ltd, Genius Foods, Enjoy Life Foods, Silly Yak Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gluten free products market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global gluten free products market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gluten free products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global gluten free products market was valued at USD 22.1 Billion in 2024.

The market is estimated to reach USD 40.0 Billion by 2033, exhibiting a CAGR of 6.8% from 2025-2033.

The global gluten free products market is driven by increasing health awareness, rising cases of celiac disease and gluten intolerance, and a growing preference for healthier lifestyle choices. Demand is further fueled by innovations in food processing, expanded product availability, and targeted marketing.

Bakery product accounted for the largest market share based on product type due to their widespread appeal and staple nature in daily diets.

North America currently dominates the global market. The growth of the North American region is driven by high awareness of gluten-related disorders, increasing health-conscious consumers, innovative product launches, and strong retail and online distribution networks.

Some of the major players in the global gluten free products market include Kraft Heinz Company, Hain Celestial Group, Boulder Brands, General Mills, Pinnacle Foods, Kellogg's, Hero Group, Freedom Nutritional Products, Warburtons, Barilla Group, Glutamel, Raisio Group, Dr. Schär Company, Domino's Pizza Enterprises, Alara Wholefoods Ltd, Genius Foods, Enjoy Life Foods, Silly Yak Foods, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)