Health Insurance Market Size, Share, Trends and Forecast by Provider, Type, Plan Type, Demographics, Provider Type, and Region, 2026-2034

Health Insurance Market Size and Share:

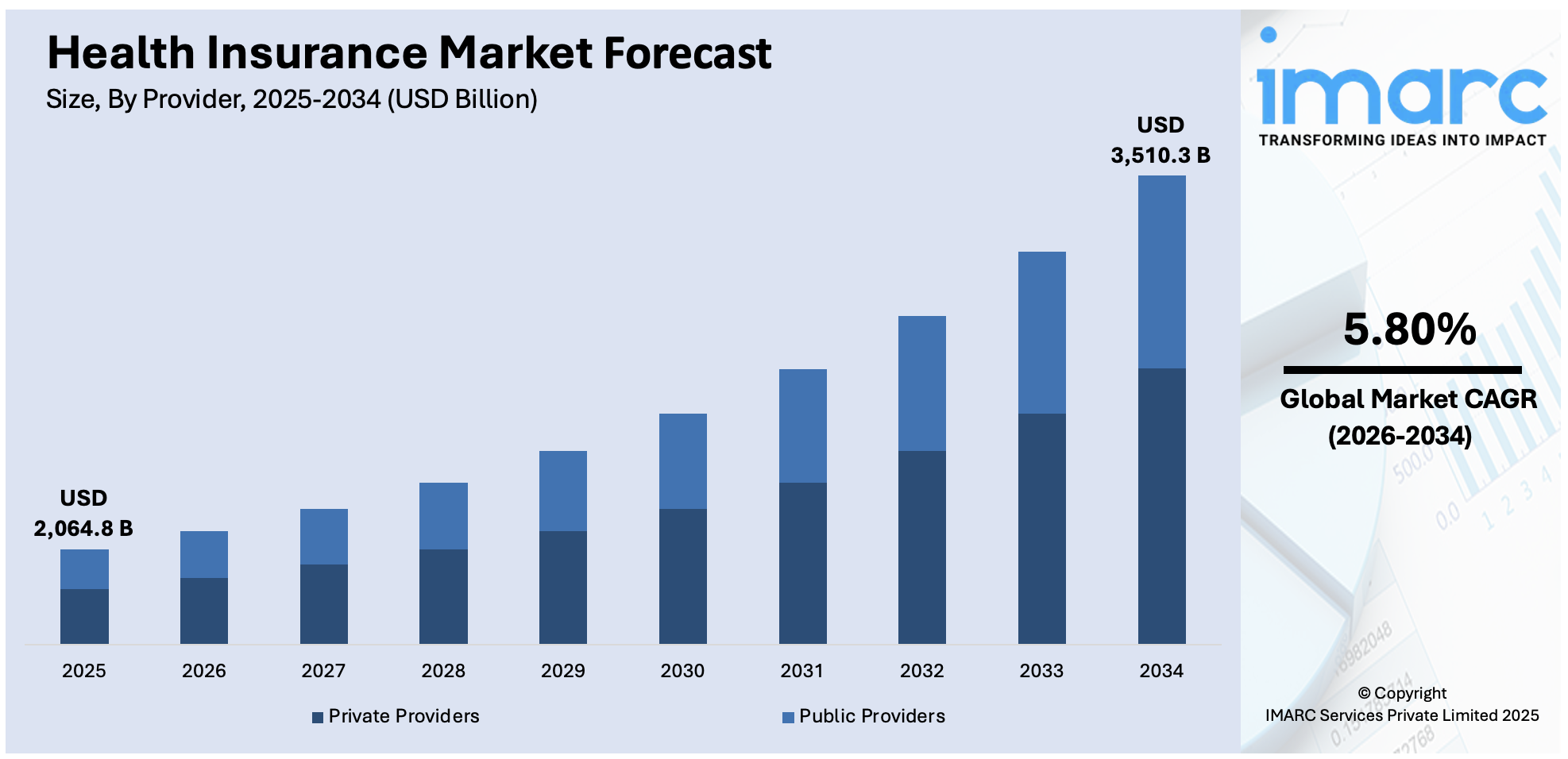

The global health insurance market size was valued at USD 2,064.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3,510.3 Billion by 2034, exhibiting a CAGR of 5.80% during 2026-2034. North America currently dominates the market, holding a significant market share of over 65.4% in 2025. The rising prevalence of chronic diseases and viral infections, growing geriatric population which is more prone to complicated medical conditions, and increasing number of surgical procedures are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,064.8 Billion |

| Market Forecast in 2034 | USD 3,510.3 Billion |

| Market Growth Rate (2026-2034) | 5.80% |

The health insurance sector is now undergoing tremendous change, fueled by the growing use of technology in health insurance services. Insurers are embracing digital platforms, mobile apps, and telemedicine services to make their services more accessible and convenient for policyholders. These advances in technology enable remote consultations, automate claims processing, and offer real-time health monitoring, thus enhancing overall customer experience. Another notable trend is the increasing focus on preventive care and wellness programs. Health insurers are increasingly providing incentives for policyholders to pursue healthy lifestyles, including regular exercise and periodic health screenings. These efforts are intended to lower the cost of long-term healthcare by treating health conditions before they become too costly to treat. In addition, the market is witnessing more personalized and flexible insurance products. Customers are looking for policies that are tailored to their unique health requirements and desires, which is forcing the insurers to provide customize coverage products. This is fueled by advances in data analytics that enable the insurers to analyze individual health profiles and offer customized products accordingly.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by its accelerated uptake of various technologies, policy innovations, and consumer-led healthcare solutions. Unlike most other nations with more integrated systems, the US has a complex combination of private and public insurance, providing a rich ground for innovation and competition. Tech companies and startups are both moving into the health insurance market, using data analytics, artificial intelligence, and telehealth to create more personalized and affordable insurance products. The move toward value-based care is redefining insurance models, prioritizing patient outcomes over volume of services. And regulatory shifts like those under the Affordable Care Act and ongoing discussions regarding Medicare expansion keep testing traditional insurance models. Consumer expectations for transparency, affordability, and convenience are also compelling insurers to reorganize their service delivery models.

Health Insurance Market Trends:

Rising prevalence of chronic diseases and viral infections

Presently, with the increase in chronic diseases and viral infections, more individuals and families recognize the importance of having health insurance coverage. According to the National Institutes of Health (NIH), the global burden of chronic disease is predicted to reach USD 47 Trillion globally by 2030. This has led to a surge in the demand for health insurance policies as people seek financial protection against high medical expenses. Moreover, insurers are introducing specialized insurance plans that cater to the specific needs of individuals with chronic conditions or those at higher risk of contracting viral infections. These plans offer enhanced coverage for related treatments and medications thus propelling the market. Besides, governments and regulatory bodies are closely monitoring the impact of chronic diseases and viral infections on the health insurance sector. New regulations and mandates are being introduced to ensure that insurers provide adequate coverage and support for affected individuals which is accelerating the health insurance market growth.

Growing geriatric population across the globe

As individuals age, they typically require more healthcare services and treatments. This increased demand for healthcare services drives a higher demand for health insurance coverage among the elderly. As per the Office for National Statistics (ONS), in 2024, individuals aged 60 years and above accounted for 12% of the global population, equating to 1.2 Billion people. This number is projected to double by 2050, reaching 2.1 Billion and making up 26% of the population of the world. Besides, older individuals often face higher healthcare costs due to age-related health conditions and the need for more frequent medical interventions. Moreover, the unique healthcare needs of the elderly population have given rise to specialized insurance products tailored to their requirements. Medicare, for instance, is a government program in the United States that provides health coverage specifically for individuals aged 65 and older. Additionally, insurers are developing innovative insurance products and services to cater to the elderly population. These include long-term care insurance, which covers the costs of nursing home care or in-home care, and policies that provide coverage for chronic conditions and prescription medications.

Increasing number of surgical procedures

Surgeries are often among the most expensive medical treatments. Health insurance companies need to account for these rising costs when setting premiums for their policyholders. Moreover, with health insurance, individuals can access a broader network of healthcare providers, including specialists who perform surgical procedures. This access to quality healthcare is essential when surgical interventions are required, which is accelerating the product adoption rate. Besides, health insurance plans often include coverage for preventive measures and diagnostic tests. This can lead to early detection and intervention, potentially reducing the need for more extensive surgeries in the future. Additionally, many surgical procedures are related to chronic health conditions, such as heart disease, diabetes, and obesity. As the prevalence of these conditions increases, so does the need for surgeries, making health insurance a vital resource for managing these long-term health issues. For instance, according to the International Diabetes Federation (IDF), in 2021, 537 Million individuals between the ages of 20-79 years suffered from diabetes. This number is projected to increase to 643 Million by 2030 and 783 Million by 2045. This is influencing the health insurance market outlook.

Health Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global health insurance market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on provider, type, plan type, demographics, and provider type.

Analysis by Provider:

- Private Providers

- Public Providers

Private providers stand as the largest component in 2025, holding around 51.7% of the market. Private health insurance providers often offer a wide range of insurance products tailored to different customer needs. These offerings include individual plans, family plans, group plans for employers, and specialized coverage options. This diversity allows them to cater to a broader customer base. Besides, private insurers are known for their ability to innovate and customize insurance plans. They can adapt quickly to changing market demands and introduce new features, such as telemedicine services, wellness programs, and personalized health management tools. Moreover, private insurers often have extensive networks of healthcare providers, including hospitals, clinics, and specialists. These networks provide policyholders with a wide choice of healthcare providers and facilities, enhancing the attractiveness of their insurance plans.

Analysis by Type:

- Life-Time Coverage

- Term Insurance

Life-time coverage leads the market with around 53.5% of market share in 2025. Lifetime coverage provides policyholders with long-term security and peace of mind. It assures them that their health insurance needs will be met throughout their lifetime, regardless of changing health conditions or age-related issues. Besides, in many cases, lifetime coverage comes with stable premium rates due to which policyholders can lock in a relatively consistent premium amount, making it easier to budget for healthcare expenses over the long term. Moreover, lifetime coverage often offers comprehensive benefits, including coverage for major medical expenses, hospitalization, surgeries, and even preventive care. This makes it a comprehensive solution for policyholders' healthcare needs.

Analysis by Plan Type:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

Medical insurance leads the market with around 51.8% of market share in 2025. Medical insurance provides coverage for a wide range of healthcare services, including doctor visits, hospital stays, surgeries, prescription drugs, and preventive care. This comprehensive coverage addresses the most fundamental healthcare needs of individuals and families. Besides, healthcare costs can be substantial, and unexpected medical expenses can lead to financial hardship. Medical insurance offers a safety net by covering a significant portion of these costs, reducing the financial burden on policyholders. Moreover, medical insurance plans often include coverage for preventive services like vaccinations, screenings, and wellness check-ups. This encourages individuals to prioritize preventive care, which can lead to early detection and treatment of health issues.

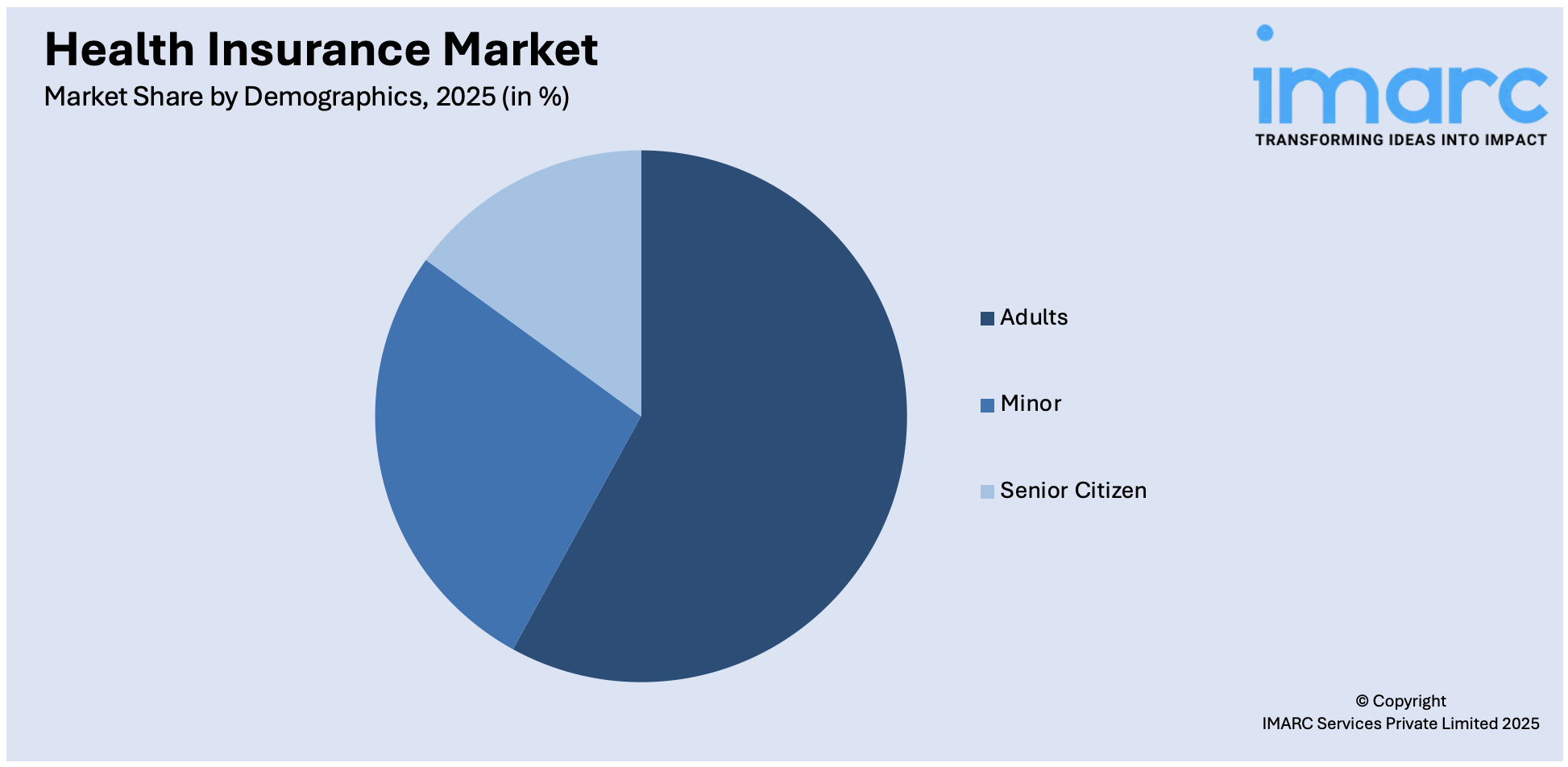

Analysis by Demographics:

Access the comprehensive market breakdown Request Sample

- Minor

- Adults

- Senior Citizen

Adults lead the market with around 57.5% of market share in 2025. Several adults obtain health insurance through their employers. Since the majority of adults are part of the workforce, they have access to employer-sponsored health insurance plans. This contributes significantly to the market share held by adults. Moreover, adults often secure health insurance policies that cover their entire families, including children and sometimes elderly parents. This means that one adult's health insurance policy can account for coverage for multiple individuals, further increasing their market share. In addition, insurance companies offer a range of health insurance products tailored to adults, such as individual policies, family plans, and plans with specific benefits for adults, like maternity coverage or preventive care.

Analysis by Provider Type:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

Preferred Provider Organizations (PPOs) lead the market with around 60.9% of market share in 2025. PPOs offer policyholders a significant degree of flexibility when it comes to choosing healthcare providers. Unlike Health Maintenance Organizations (HMOs), which often require members to select a primary care physician and obtain referrals for specialist care, PPOs allow individuals to see any healthcare provider, specialist, or hospital of their choice. This flexibility is highly valued by consumers who want control over their healthcare decisions. Besides, PPOs typically provide coverage for both in-network and out-of-network healthcare services. While staying in-network usually results in lower out-of-pocket costs, the option to seek care outside the network is important for individuals who may need specialized or out-of-area services. This flexibility can be especially beneficial in emergencies or when seeking care from specific specialists.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest healthcare insurance market share of over 65.4%. North America, particularly the United States and Canada, has a large and affluent population. This creates a substantial customer base for health insurance providers. The ability to serve millions of customers across diverse demographic groups contributes to the market's size and influence. Besides, the healthcare systems in the United States and Canada are relatively complex, with a mix of public and private providers. This complexity has led to a robust health insurance market where individuals and employers often purchase private health insurance to supplement government-sponsored healthcare programs like Medicare and Medicaid in the U.S. Additionally, healthcare costs in North America are among the highest in the world. This includes expenses related to medical treatments, prescription drugs, hospital stays, and specialized care. Due to these high costs, individuals and businesses seek health insurance coverage to mitigate the financial burden of healthcare expenses.

Key Regional Takeaways:

United States Health Insurance Market Analysis

In 2024, the United States accounted for over 91.10% of the health insurance market in North America. The United States health insurance market is primarily driven by economic conditions and government policies. The growing prevalence of chronic diseases, such as diabetes and heart conditions, is also contributing to the higher healthcare demand, impacting insurance models, driving up costs, and putting pressure on insurers to adjust their plans. Heart disease is the leading cause of death, with various risk factors contributing to its increase, based on information presented in the 2025 Heart Disease and Stroke Statistics: A Report of U.S. and Global Data From the American Heart Association. Economic factors, including income inequality and unemployment rates, also influence the affordability and accessibility of health insurance, with more individuals relying on government programs such as Medicaid and Medicare. In addition to this, government policies, particularly the Affordable Care Act (ACA), have significantly shaped the market by expanding coverage options and introducing regulations to curb discrimination. Other than this, consumer preferences for personalized and value-based care are prompting insurers to offer more flexible, comprehensive plans. These dynamics, combined with rising healthcare costs, continually reshape the landscape of the health insurance market in the United States, making it complex and highly responsive to social, political, and economic changes.

Asia Pacific Health Insurance Market Analysis

The Asia Pacific health insurance market is expanding due to rapid economic growth and growing healthcare awareness. As countries in the region experience economic expansion, disposable incomes are rising and leading to greater demand for private health insurance as individuals seek better healthcare options. Moreover, the increasing geriatric population in the region also creates a higher need for medical services, driving the demand for insurance products that cater to older demographics. As per the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), in 2022, there were 672 Million individuals aged 60 years and above in the Asia Pacific region, accounting for 61% of the total geriatric population globally. This number is expected to rise to 1.3 Billion by 2050, accounting for 63% of the global total and 26% of the total population in Asia Pacific. Additionally, the growing middle class is increasingly investing in health insurance for preventive care and protection against rising medical costs, further supporting industry expansion.

Europe Health Insurance Market Analysis

The health insurance market in Europe is growing, fueled by demographic trends, regulatory frameworks, and technological innovations. One of the most significant drivers is the increasing geriatric population in the region, which places increased demand on healthcare services and insurance products as older individuals require more medical care. According to reports, in 2024, individuals aged 65 years and above accounted for approximately 21.6% of the total population of the European Union, recording a growth of 0.3% in comparison to 2023. Additionally, the regulatory environment is significantly impacting the market, with the European Union setting guidelines and national governments shaping insurance policies, often ensuring universal healthcare access while encouraging private coverage for supplemental services. Moreover, technological advancements, such as telemedicine, electronic health records, and AI-driven health services, are revolutionizing the healthcare landscape, providing insurers with new ways to reduce costs and enhance care delivery. Furthermore, the increasing presence of international and tech-driven health insurance providers is reshaping the competitive landscape, propelling established companies to adapt to new business models. The expansion of cross-border healthcare services within the European Union has also led to greater integration of healthcare systems, prompting insurers to offer policies that provide international coverage and flexibility.

Latin America Health Insurance Market Analysis

The health insurance market in Latin America is significantly influenced by economic growth, increasing healthcare awareness, and rising demand for better healthcare services. Urbanization and changing lifestyles have also contributed to health risks that make insurance more appealing. As per industry estimates, 88.1% of the population in Latin America lived in urban areas in 2024, equating to 383,659,794 individuals. In addition to this, governments in several countries are also expanding healthcare access and introducing regulations to encourage private insurance uptake. For instance, 9.47% of the GDP of Brazil is spent on healthcare, equating to USD 161 Billion, as per the International Trade Administration (ITA). The shift toward private healthcare in some countries is further propelling the healthcare insurance demand across the region.

Middle East and Africa Health Insurance Market Analysis

The Middle East and Africa health insurance market is being increasingly propelled by rapid population growth and rising healthcare costs. As the region’s population expands, there is a greater demand for accessible and efficient healthcare services, driving the uptake of health insurance. For instance, the population of Africa was calculated to be growing at a yearly rate of 2.32% in 2024, according to recent industry reports. Additionally, the increasing prevalence of lifestyle-related diseases, such as diabetes and cardiovascular conditions, has heightened the need for health coverage. According to the International Diabetes Federation (IDF), in 2021, 73 Million individuals suffered from diabetes in the Middle East and North Africa (MENA) region. This number is expected to reach 95 Million by 2030 and 136 Million by 2045. Besides this, the growing expatriate population in the Middle East also contributes to the demand for private health insurance.

Competitive Landscape:

Major players in the health insurance industry are making strategic and innovative moves to spur growth, improve the customer experience, and keep pace with changing healthcare needs. Insurers are putting greater emphasis on digital transformation to automate operations, enhance claims management, and provide friendlier services through mobile applications and websites. These technologies enable members to control their policies, access telehealth, and get real-time information, making healthcare more transparent and accessible. Data analytics and artificial intelligence are also being emphasized by companies to tailor insurance products, better measure risk, and provide targeted wellness programs. Preventive care is increasingly becoming a priority, with insurers offering incentives for healthy living, including fitness monitoring and wellness rewards. Apart from this, mental health care and integrated care models are being developed to respond to a more complete perspective of health. Collaborations with technology companies, healthcare organizations, and pharmacies are becoming increasingly popular to enable insurers to provide complete care solutions. Policy innovation, including flexible and customizable plans, is also on the rise to respond to various consumer needs. Through these multi-faceted initiatives, large health insurers are ensuring competition while also adding to a more streamlined, consumer-focused health system that can meet contemporary expectations and medical needs.

The report provides a comprehensive analysis of the competitive landscape in the health insurance market with detailed profiles of all major companies, including:

- Aetna Inc

- AIA Group Limited

- Allianz Care

- Aviva India

- AXA Global Healthcare

- Centene Corporation

- Cigna Healthcare

- CVS Health

- International Medical Group, Inc.

- National Insurance Company Limited

- Ping An Insurance (Group) Company of China, Ltd

- United HealthCare Services, Inc.

- Zurich Kotak General Insurance

Latest News and Developments:

- March 2025: Claremont Insurance Services entered into a partnership with Health Net, a renowned provider of health insurance solutions based in California. With this collaboration, Claremont will be able to offer Health Net's extensive range of health insurance plans to small business brokers, along with increased access to premium, cost-effective insurance options.

- March 2025: Toothlens, a leading provider of digital dental health insurance services, established a partnership with Allied Insurance Company, Vizza Broking Services, and Star Health in order to introduce the first cashless Dental OPD insurance service in India. This launch brings dental care under the umbrella of conventional health insurance for the very first time, providing comprehensive access to advanced dental care services.

- March 2025: Integrity Marketing Group LLC, a renowned provider of life and health insurance solutions, entered into a partnership with The Modern Insurance Store to revolutionize health and wealth planning solutions for senior citizens. Through this collaboration, Medicare-focused agencies will be able to better connect with tech-savvy senior citizens by leveraging Integrity's sophisticated advertising strategies and technological platform for holistic health insurance solutions.

- January 2025: Care Health Insurance launched Ultimate Care, a novel health insurance program developed to revolutionize the industry. The program provides comprehensive health coverage, along with various additional benefits such as the MoneyBack feature, which offers incentives to users for staying up-to-date with their health.

- May 2024: Emoha, the leading provider of healthcare services for senior citizens in India, established a partnership with Aditya Birla Health Insurance Co. Limited (ABHICL), Aditya Birla Capital's health insurance subsidiary. Through this partnership, ABHICL will be able to provide customized elder care options to its corporate customers and mediclaim policyholders, expanding the reach of Emoha's all-inclusive services throughout the country.

Health Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOS), Point of Service (POS), Health Maintenance Organizations (HMOS), Exclusive Provider Organizations (EPOS) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aetna Inc, AIA Group Limited, Allianz Care, Aviva India, AXA Global Healthcare, Centene Corporation, Cigna Healthcare, CVS Health, International Medical Group, Inc., National Insurance Company Limited, Ping An Insurance (Group) Company of China, Ltd, United HealthCare Services, Inc., Zurich Kotak General Insurance, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the health insurance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global health insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the health insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The health insurance market was valued at USD 2,064.8 Billion in 2025.

The health insurance market is projected to exhibit a CAGR of 5.80% during 2026-2034, reaching a value of USD 3,510.3 Billion by 2034.

Health insurance market drivers include rising healthcare costs, growing awareness of health and wellness, aging populations, and increased prevalence of chronic diseases. Technological advancements, policy reforms, and demand for personalized, digital, and accessible coverage also fuel growth. Employers and governments are expanding coverage, further accelerating market development and innovation.

North America currently dominates the health insurance market, driven by high healthcare costs, aging demographics, and a strong focus on chronic disease management. Technological innovation, regulatory reforms, and employer-sponsored plans support market growth. Rising demand for telehealth, personalized coverage, and improved access to care also contribute to sustained market expansion.

Some of the major players in the health insurance market include Aetna Inc, AIA Group Limited, Allianz Care, Aviva India, AXA Global Healthcare, Centene Corporation, Cigna Healthcare, CVS Health, International Medical Group, Inc., National Insurance Company Limited, Ping An Insurance (Group) Company of China, Ltd, United HealthCare Services, Inc., Zurich Kotak General Insurance, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)