Healthcare Big Data Analytics Market Size, Share, Trends, and Forecast by Component, Analytics Type, Delivery Model, Application, End-User, and Region, 2025-2033

Healthcare Big Data Analytics Market Size and Share:

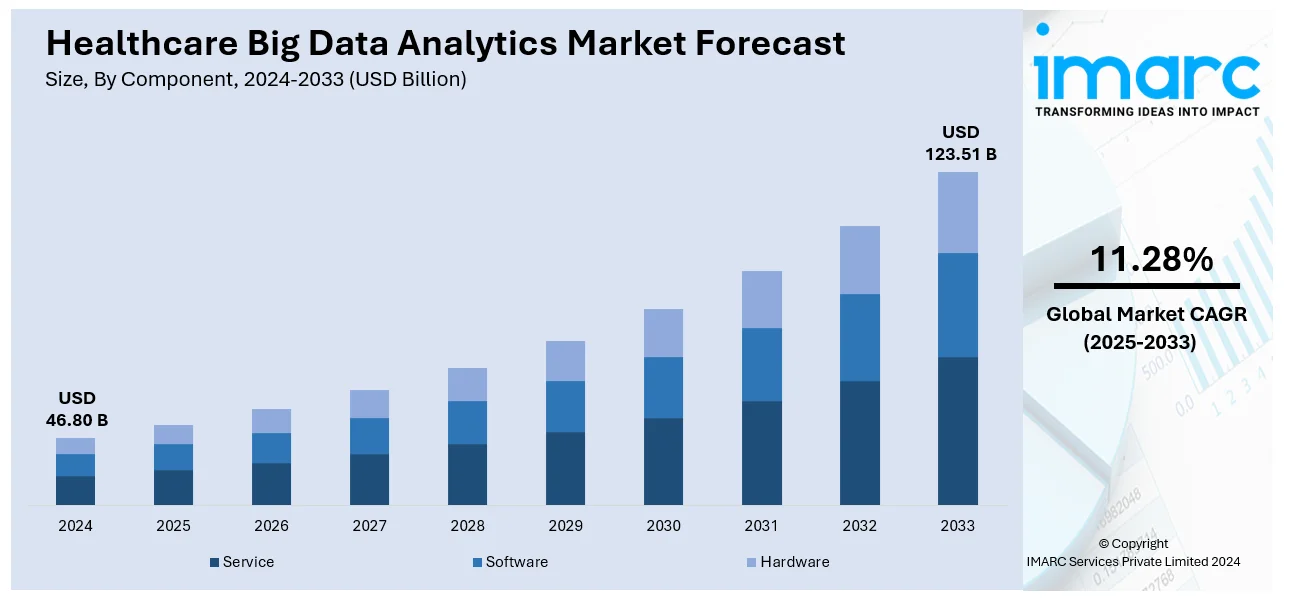

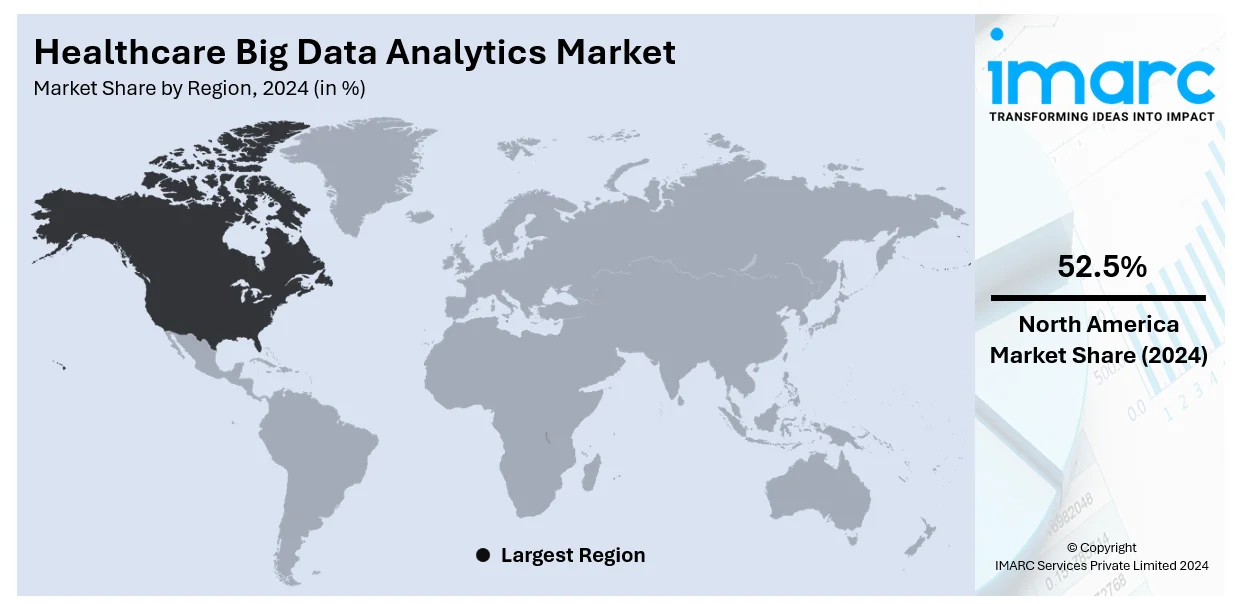

The global healthcare big data analytics market size was valued at USD 46.80 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 123.51 Billion by 2033, exhibiting a CAGR of 11.28% from 2025-2033. North America currently dominates the market, holding a market share of over 52.5% in 2024. The growth of the North American region is driven by the widespread adoption of advanced healthcare technologies, increasing investments in big data solutions, and supportive government initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 46.80 Billion |

|

Market Forecast in 2033

|

USD 123.51 Billion |

| Market Growth Rate 2025-2033 | 11.28% |

The widespread adoption of electronic health records (EHRs), medical imaging technologies, wearable devices, and telemedicine platforms is resulting in an increased volume of healthcare data. This data, coming from diverse sources, requires sophisticated analytics tools for processing and interpretation. Additionally, the integration of artificial intelligence (AI), machine learning (ML), natural language processing (NLP), and cloud computing into analytics platforms is significantly enhancing the efficiency and accuracy of data processing. These advancements make it possible to uncover insights that improve decision-making, patient care, and operational workflows. Furthermore, the shift toward precision medicine, which focuses on tailoring treatments to individual patient profiles, is heavily reliant on big data analytics. By analyzing genetic information, clinical histories, and other patient-specific factors, healthcare providers can develop customized treatment plans.

To get more information on this market, Request Sample

The United States plays a crucial role in the market, driven by the presence of leading healthcare organizations, research institutions, and technology companies, which fosters collaboration and innovation in big data analytics. Additionally, significant investments in emerging technologies and startups focused on predictive and risk management analytics is bolstering the market growth. These initiatives aim to address challenges such as operational inefficiencies, cybersecurity threats, and evolving regulatory landscapes. Strategic collaborations and funding are driving the development of advanced platforms to improve decision-making and overall healthcare system resilience. In 2024, Banner Health spearheaded a $10 million Series A funding round for 1m, a startup focused on risk management that employs analytics to forecast financial and operational risks for healthcare systems. Cleveland Clinic, Stanford Health Care, St. Charles Health System, and Carle Foundation were also involved. The platform supports strategic decision-making by evaluating risks such as cybersecurity, policy shifts, and competition.

Healthcare Big Data Analytics Market Trends:

Increasing data volume

The healthcare industry is experiencing a notable increase in data generation. This encompasses electronic health records (EHRs), medical imaging, and genomic information. Reports indicate that by 2021, 96% of hospitals in the US and 78% of physicians in the US had implemented EHR. In Europe, 96% of General Practitioners (GPs) make use of EHR. The use of wearable devices is rising, which also produces significant quantities of data. In addition to this, conventional approaches to data analysis are inadequate. Moreover, healthcare institutions are acknowledging the importance of leveraging big data analytics to better patient care, boost operational efficiency, and make well-informed decisions. Furthermore, sophisticated analytical tools and methods can swiftly process and analyze extensive datasets, drawing out valuable insights relevant to clinical decisions, recognizing trends, and improving resource distribution. Besides this, predictive analytics can assist hospitals in anticipating patient admissions, facilitating better staff scheduling and resource allocation.

Integration of advanced technologies

Integration of advanced technologies, such as machine learning (ML), artificial intelligence (AI), blockchain, natural language processing (NLP), robotics and telemedicine, and cloud computing, to streamline healthcare operations is impelling the market growth. According to McKinsey, AI in health care will unlock a $150 billion opportunity in cost reduction and operational improvement while delivering new strategic insights that will yield significant pay-offs for payers from the automated efficiency gains. This will also enable the ML algorithm to identify certain patterns within medical data that might be very hard for humans to find. Moreover, virtual assistants and AI chatbots have improved patient engagement and offer tailored health suggestions. Furthermore, AI-powered image analysis can detect anomalies in medical images with very high accuracy, helping the radiologist diagnose conditions like cancer or fractures. NLP algorithms help in obtaining information from structured and unstructured healthcare data, that include clinical notes, medical literature, and narratives from the patient. Through this, narrative data will be allowed into analytics using the possibility of automated textual data processing.

Growing focus on enhanced patient outcomes

The focus on improving patient care and outcomes is stimulating the market growth. In line with this, there is an increase in the demand for value-based care, as it focuses on achieving improved patient outcomes while controlling costs. Moreover, healthcare organizations are reimbursing as per the quality of care offered, rather than the volume of services provided. Besides this, big data analytics allows healthcare organizations to track patient outcomes, monitor adherence to treatment plans, and identify interventions that improve quality and reduce costs. For example, implementing big data analytics in healthcare is expected to reduce annual expenses for organizations by more than 25% in the near future. It also helps in population health management by segmenting patient populations and tailoring interventions to specific groups. Furthermore, healthcare big data analytics facilitates healthcare providers in making informed decisions as per a wealth of patient data. These analytics help in analyzing historical patient data, offering treatment efficacy and supporting providers in identifying the effective treatments and interventions.

Healthcare Big Data Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global healthcare big data analytics market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on component, analytics type, delivery model, application, and end-user.

Analysis by Component:

- Service

- Software

- Electronic Health Record Software

- Practice Management Software

- Workforce Management Software

- Hardware

- Data Storage

- Routers

- Firewalls

- Virtual Private Networks

- E-Mail Servers

- Others

Service stands as the largest component in 2024, holding 52.3% of the market share. Service exhibits a clear dominance in the market attributed to the essential role it plays in ensuring the successful implementation, integration, and management of analytics solutions. Service includes consulting, maintenance, support, and training, which are critical for healthcare organizations to effectively utilize analytics tools and optimize their performance. These services address the complexities of integrating big data systems with existing healthcare infrastructures, ensuring smooth interoperability and compliance with regulatory standards. Consulting service helps organizations identify specific analytics needs and develop tailored strategies, while ongoing support and maintenance ensure systems remain updated and secure. Training programs empower healthcare professionals to leverage analytics effectively, enhancing decision-making and operational efficiency. Managed service provides continuous monitoring and optimization, enabling healthcare providers to focus on patient care while ensuring robust analytics performance.

Analysis by Analytics Type:

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Cognitive Analytics

Descriptive analytics is the largest segment, accounting 35.1% of the market share in 2024. Descriptive analytics accounts for the majority of the market share as it forms the foundation for understanding historical data and identifying trends within healthcare systems. By summarizing large datasets into actionable insights, descriptive analytics enables healthcare providers to monitor performance, track patient outcomes, and evaluate the effectiveness of clinical and operational strategies. This type of analytics is widely used to analyze patient demographics, disease prevalence, and treatment success rates, supporting informed decision-making across organizations. It also aids in resource allocation by identifying areas of inefficiency, such as unnecessary procedures or underutilized equipment. Descriptive analytics plays a crucial role in regulatory compliance, helping organizations generate accurate reports and maintain transparency. With advancements in visualization tools, descriptive analytics allows healthcare stakeholders to interpret data more effectively through intuitive dashboards and graphical representations. Its ability to provide clear, comprehensive overviews makes descriptive analytics a critical component for improving operational efficiency and enhancing patient care.

Analysis by Delivery Model:

- On-Premise Delivery Model

- On-Demand Delivery Model

On-demand delivery model leads the market, holding a 54.8% share in 2024. The on-demand delivery model is the largest segment, driven by its flexibility, scalability, and cost-effectiveness. This cloud-based approach allows healthcare organizations to access analytics tools and services without the need for significant upfront investments in hardware or infrastructure. The model's scalability ensures that organizations can adjust resources based on demand, making it ideal for dynamic healthcare environments. On-demand analytics also facilitates seamless integration across multiple departments and locations, enabling real-time data access and collaborative decision-making. Additionally, the on-demand model supports rapid deployment of updates and new features, ensuring organizations stay at the forefront of technological advancements. With increasing volumes of healthcare data generated from diverse sources, the ability to store, process, and analyze information efficiently in the cloud further strengthens the appeal of the on-demand delivery model.

Analysis by Application:

- Financial Analytics

- Clinical Analytics

- Operational Analytics

- Others

In 2024, clinical analytics held the biggest market share, attaining 47.5%. Clinical analytics exhibits a clear dominance in the marker due to its essential function in enhancing patient care and optimizing clinical workflows. Through the examination of extensive patient information from EHRs, laboratory findings, and imaging technologies, clinical analytics facilitates precise diagnoses, tailored treatment strategies, and improved oversight of chronic illnesses. These instruments assist healthcare professionals in forecasting patient results, recognizing risks, and executing preventive care strategies, which minimizes complications and decreases hospital readmissions. Real-time analytics improves decision-making in crucial scenarios, like emergency services, by delivering immediate actionable insights. Clinical analytics aids population health management by recognizing trends and patterns, enabling targeted interventions for particular patient groups. As the focus on evidence-based care increases, clinical analytics aids in creating treatment protocols and monitoring their effectiveness.

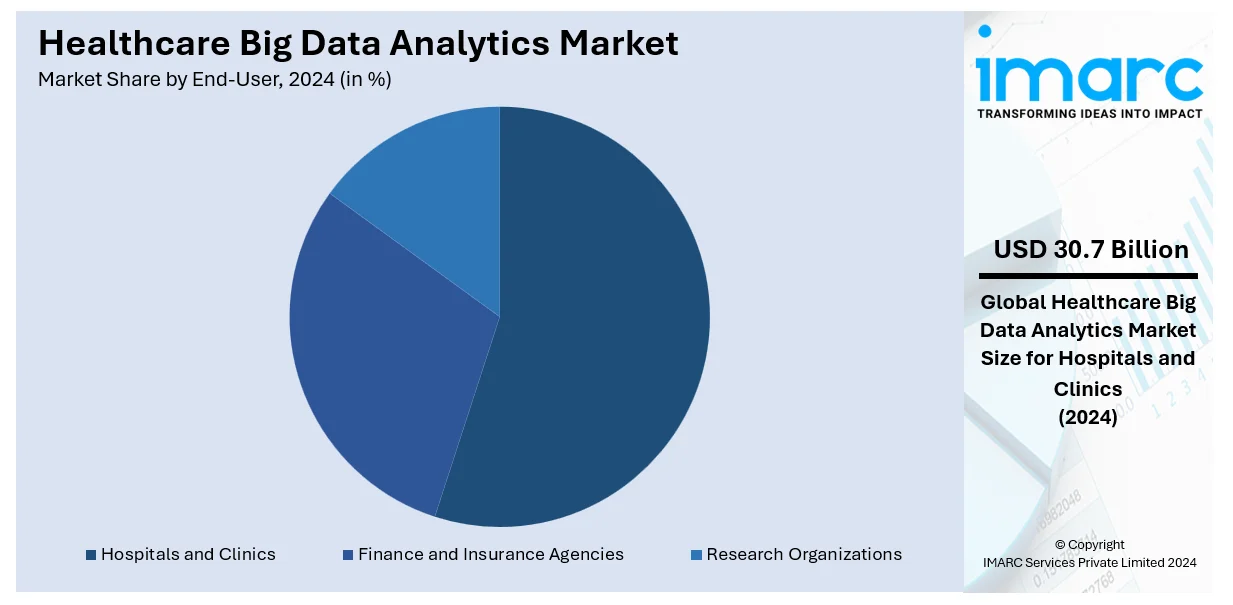

Analysis by End-User:

- Hospitals and Clinics

- Finance and Insurance Agencies

- Research Organizations

Hospitals and clinics represent the largest segment, accounting 65.7% of market share in 2024. Hospitals and clinics are the leading segment because of their need to improve operational efficiency, patient outcomes, and resource management. These organizations generate vast amounts of data from EHRs, imaging systems, and patient monitoring devices, creating opportunities to leverage analytics for decision-making. Big data tools enable hospitals to optimize resource allocation, predict patient admissions, and reduce wait times by analyzing trends and demand patterns. Moreover, analytics aid in customized treatment strategies by recognizing individual patient factors and improving diagnostic precision. Hospitals utilize predictive analytics to avert complications and enhance outcomes, especially for chronic illnesses and intensive care. The incorporation of analytics into clinical workflows improves real-time decision-making, enabling quicker and more efficient responses to patient requirements. Through examining data from different departments, hospitals recognize inefficiencies, optimize processes, and cut costs while ensuring care quality.

Analysis by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share, reaching 52.5%. North America leads the market, driven by advanced technological infrastructure and early adoption of innovative solutions. The region benefits from a robust ecosystem of healthcare providers, research institutions, and analytics companies actively collaborating to harness data for improved decision-making and patient outcomes. Significant government support for health IT initiatives and policies promoting interoperability and data sharing further strengthens the market. Strategic investments in AI and ML by organizations across the healthcare landscape fuel the development of sophisticated analytics platforms. Additionally, advancements in EHRs and telemedicine are creating vast amounts of data, which analytics tools process to improve operational efficiency and patient care quality. In November 2024, AOAExcel, a subsidiary of the American Optometric Association, has endorsed Barti EHR, marking its first-ever endorsement of an eye care Electronic Health Records system. This San Francisco-based software offers cutting-edge solutions tailored for optometrists. AOAExcel has also made a financial investment in Barti Software. This collaboration highlights a significant advancement in EHR solutions for the eye care industry.

Key Regional Takeaways:

United States Healthcare Big Data Analytics Market Analysis

In North America, the United States accounted for 83.00% of the total market share. The advancement of data-driven technologies has revolutionized healthcare, fostering the adoption of big data analytics. Improved infrastructure enables seamless integration of large-scale data sets from electronic health records, medical imaging, and wearable devices. According to reports, healthcare spending in the United States increased by 7.5% in 2023, reaching USD 4.9 Trillion, or USD 14,570 per person, representing 17.6% of GDP. This increasing investment in health care infrastructure supports the integration of big data analytics for the betterment of patient care, operational efficiency, and cost management in the healthcare industry. This supports effective diagnosis, predictive analytics, and personalized treatment plans. Improved connectivity and advanced storage capabilities improve interoperability between healthcare providers and reduce delays in patient care. Furthermore, analytics supports resource allocation, optimizing hospital management and patient flow, especially in urban areas. By leveraging real-time insights, health systems can address critical challenges like disease outbreaks or emergency situations more effectively, ensuring better outcomes and reduced operational costs. These advantages underline the transformative role of analytics in modern healthcare systems.

Europe Healthcare Big Data Analytics Market Analysis

The increasing burden of chronic diseases and aging populations has amplified the demand for effective healthcare solutions. Big data analytics addresses these challenges by analyzing vast quantities of medical data, identifying patterns, and predicting patient needs. Strategic investments in analytics tools empower healthcare providers to enhance diagnostic accuracy and optimize treatment strategies. This proactive approach improves care delivery while reducing costs. For instant, European healthtech funding reached USD 11.2 Billion in 2024, up from USD 9.7 Billion in 2023, according to reports. The growing investments, expected to rise further, highlight robust support for innovations in healthcare big data analytics. This surge is poised to drive advanced data-driven solutions, enhancing efficiency and patient outcomes. Additionally, data-driven insights guide research into emerging health issues, supporting preventive measures and long-term planning. Improved collaboration between stakeholders, facilitated by analytics, ensures streamlined decision-making and resource allocation. These advancements reflect the sector's shift towards more efficient, patient-centric healthcare delivery.

Asia Pacific Healthcare Big Data Analytics Market Analysis

The expanding scope of healthcare services underscores the growing importance of big data analytics. According to reports, India's healthcare infrastructure has expanded significantly after the pandemic outbreak, with hospitals increasing from 43,500 in 2019 to over 54,000 in 2024. Private hospitals drove this growth, rising by 27% to 38,000 in 2024. This expansion bolsters healthcare big data analytics, offering vast datasets for enhanced insights. The growing sector enables improved patient outcomes and optimized resource allocation. Innovations in data processing provide actionable insights into patient behavior, treatment efficacy, and disease trends. Analytics aids in tailoring healthcare solutions, bridging gaps in access and affordability. The use of data analytics streamlines clinical trials, enabling faster drug development while maintaining stringent quality standards. Public health initiatives benefit immensely, as analytics identifies trends in disease prevalence, guiding policymakers to implement proactive measures. Enhanced training programs for healthcare professionals also integrate analytics, fostering a more skilled workforce. The sector's growth is reinforced by technological advancements, ensuring that healthcare remains accessible and adaptable.

Latin America Healthcare Big Data Analytics Market Analysis

The growing emphasis on health management, coupled with the widespread adoption of Electronic Medical Records (EMRs), is propelling advancements in healthcare analytics. According to International Trade Administration, Brazil, the largest healthcare market in Latin America, allocates 9.47% of its GDP equivalent to USD 161 Billion toward healthcare, with 62% of its 7,191 hospitals being privately operated. Approximately 50.7 Million Brazilians benefit from private healthcare, driving substantial data generation. This surge in data creates significant opportunities for healthcare big data analytics to enhance efficiency and decision-making. Enhanced patient data collection processes are enabling more precise diagnostics and personalized treatment strategies. Integration of wearable devices and mobile applications is further enriching the data pool for advanced analytics. Improved regulatory support for digital healthcare initiatives has strengthened data standardization, fostering seamless interoperability. Increased utilization of predictive analytics tools for managing chronic diseases and optimizing resource allocation is reshaping healthcare operations. Investments in infrastructure for data storage and security are enabling scalable analytics solutions.

Middle East and Africa Healthcare Big Data Analytics Market Analysis

The rising number of healthcare facilities and professionals is encouraging the adoption of analytics for operational efficiency. According to Dubai Healthcare City Authority report, by 2022, Dubai had 4,482 private medical facilities, including 56 hospitals and 55,208 licensed medical professionals. With projected growth of 10-15% in medical professionals and 3-6% in facilities, healthcare expansion is set to enhance big data analytics capabilities. This growth supports improved patient care through advanced data-driven insights. Enhanced access to patient data through digitized systems is streamlining care delivery processes. Deployment of advanced imaging technologies and telemedicine platforms is generating a wealth of data for analysis. Efforts to reduce patient wait times and improve treatment workflows are encouraging the implementation of data-driven insights. Increased focus on training healthcare staff in utilizing analytics tools is boosting adoption rates. Strategic partnerships with global research entities are contributing to the development of region-specific analytics frameworks. Expanding use of population health analytics is supporting preventive care strategies, driving better health outcomes and resource optimization.

Competitive Landscape:

Key players in the market focus on innovation, strategic partnerships, and acquisitions to expand their capabilities and market presence. They invest heavily in research operations to enhance analytics platforms, integrate advanced technologies like AI and ML, and improve interoperability. Companies also emphasize tailoring solutions to meet the growing demand for personalized care and predictive analytics. Collaboration with healthcare providers and organizations helps in co-developing solutions that address specific industry challenges. In November 2024, healthcare AI company Suki has allied itself with MEDENT and Azalea Health to develop its EHR program. By linking Suki's AI-enabled platform into the customers' EHR systems, they would focus more on user experience as well as patient care. These tie-ups are expansions based on existing partnerships that were also made with athenahealth and MEDITECH.

The report provides a comprehensive analysis of the competitive landscape in the healthcare big data analytics market with detailed profiles of all major companies, including:

- Cloudera, Inc.

- Cognizant

- Cotiviti, Inc.

- Epic Systems Corporation

- GE HealthCare

- HP Development Company, L.P.

- Merative

- Koninklijke Philips N.V.

- Optum, Inc.

- Oracle Corporation

- SAS Institute Inc.

- Siemens AG

- Veradigm LLC

- Wipro Limited

Latest News and Developments:

- December 2024: CarolinaEast Health System has implemented a new electronic health record system aimed at enhancing patient care. The system streamlines medical processes, ensuring improved efficiency and accuracy. This advancement marks a significant step in modernizing healthcare delivery. Patients are anticipated to gain from improved service quality and care coordination.

- November 2024: All private hospitals in Singapore will be connected to the national electronic medical record system, the Ministry of Health announced. From next year, patient data integration with the national electronic health record will enhance healthcare coordination. This move ensures streamlined information sharing between public and private sectors. The initiative aims to improve patient outcomes through comprehensive medical records access.

- November 2024: Oracle unveiled its latest EHR system that builds on Oracle Cloud Infrastructure. Oracle's new EHR now uses AI and real-time data analytics to simplify workflows and minimize administrative tasks while providing a path toward more personalized care. The innovation is designed to transform healthcare delivery through simplification of the complex task of traditional EHRs. The launch speaks for Oracle's commitment to digital transformation in the healthcare sector.

Healthcare Big Data Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Analytics Types Covered | Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Cognitive Analytics |

| Delivery Models Covered | On-Premise Delivery Model, On-Demand Delivery Model |

| Applications Covered | Financial Analytics, Clinical Analytics, Operational Analytics, Others |

| End-Users Covered | Hospitals and Clinics, Finance and Insurance Agencies, Research Organizations |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Cloudera, Inc., Cognizant, Cotiviti, Inc., Epic Systems Corporation, GE HealthCare, HP Development Company, L.P., Merative, Koninklijke Philips N.V., Optum, Inc., Oracle Corporation, SAS Institute Inc., Siemens AG, Veradigm LLC, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the healthcare big data analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global healthcare big data analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the healthcare big data analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global healthcare big data analytics market was valued at USD 46.80 Billion in 2024.

IMARC Group estimates the market to reach USD 123.51 Billion by 2033, exhibiting a CAGR of 11.28% from 2025-2033.

The global healthcare big data analytics market is driven by increasing adoption of EHRs, rising demand for personalized medicine, advancements in data analytics technologies, and the growing healthcare costs. Factors such as improved patient outcomes, regulatory requirements for data-driven decisions, and the integration of AI and ML further support the market growth, enabling more efficient and effective healthcare delivery.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global healthcare big data analytics market include Cloudera, Inc., Cognizant, Cotiviti, Inc., Epic Systems Corporation, GE HealthCare, HP Development Company, L.P., Merative, Koninklijke Philips N.V., Optum, Inc., Oracle Corporation, SAS Institute Inc., Siemens AG, Veradigm LLC, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)