Healthcare IT Consulting Market Size, Share, Trends and Forecast by Consulting Type, End User, and Region, 2025-2033

Healthcare IT Consulting Market Size and Share:

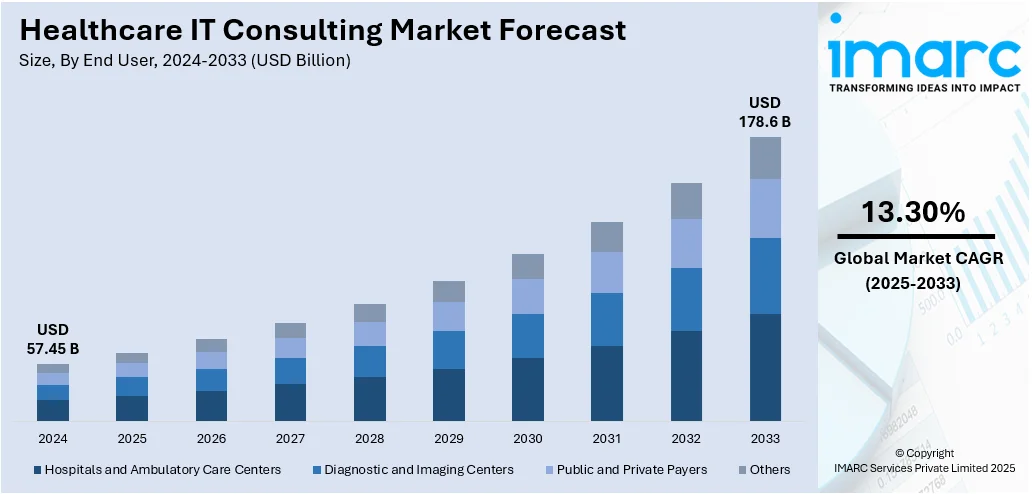

The global healthcare IT consulting market size was valued at USD 57.45 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 178.6 Billion by 2033, exhibiting a CAGR of 13.30% during 2025-2033. North America currently dominates the market, holding a significant market share of 39.7% in 2024. The market is expanding due to higher demand for secure digital patient records and remote care tools. In addition, strong focus on advanced data systems, cloud integration, and compliance support continues to strengthen global healthcare IT consulting market share across hospitals, clinics, and specialized care networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 57.45 Billion |

|

Market Forecast in 2033

|

USD 178.6 Billion |

| Market Growth Rate (2025-2033) | 13.30% |

The steady shift toward digital solutions is fueling global healthcare IT consulting market growth as hospitals and clinics look for better ways to handle patient information and daily operations. Many healthcare systems want secure, connected platforms that store records, track treatments, and manage appointments without extra hassle for medical staff. Consultants step in to guide hospitals through choosing, setting up, and running these complex systems. Growing telehealth services push this further, as patients now expect care without always visiting in person. Governments around the world continue tightening rules on data security, so providers rely on outside experts to meet new standards and avoid costly mistakes. Cloud technology makes sharing information smoother but requires strong planning to prevent data leaks or system downtime.

To get more information on this market, Request Sample

In the United States, hospitals and clinics are investing more in systems that support custom treatment plans for each patient. Medical teams look for ways to gather and use detailed health information, so they count on consultants to help pick and roll out the right mix of tools. Many hospitals want smarter software that can link lab work, prescriptions, and wearable monitors, giving doctors a clearer view of each patient’s progress. Artificial intelligence and predictive analytics play a growing role by spotting risks early or suggesting care options that might work best for an individual’s condition. To handle this safely, healthcare providers depend on consulting firms to plan secure systems that keep patient data private while meeting all state and federal rules.

Healthcare IT Consulting Market Trends:

Technological advancements

Fast progress in areas like telehealth, artificial intelligence (AI), and smart medical devices is pushing providers to seek specialist help. The IMARC Group reports the global telemedicine market hit USD 91.53 Billion in 2024 and should reach USD 539.95 Billion by 2033, expanding at a CAGR of 21.71% from 2025-2033. Consulting companies give direction on choosing, merging, and improving these tools to raise care quality and boost daily operations. These experts also help clinics and hospitals move to digital platforms for smoother record-keeping, stronger patient links, and remote treatments. They encourage using AI and advanced data tools to turn patient information into practical insights for custom treatment and prediction-based care. They also support the smooth merging of various setups and healthcare IT consulting trends to ensure clear and complete patient histories.

Regulatory compliance and security

Strict rules on protecting medical data and a growing wave of cyber threats push more providers to lean on consulting expertise. The UN found in a 2021 survey that more than a third of healthcare groups faced at least one ransomware hit in the prior year. The Journal of Medical Internet Research noted about 24% of global breaches across industries from 2018 to 2019 happened in healthcare. From 2009 to 2021, the US Department of Health and Human Services reported 4,419 breaches leading to over 314 Million medical records exposed. This same agency tracked at least two healthcare leaks daily in 2021. Consultants design strong security layers and help meet rules like HIPAA. Their expert advice protects IT setups from hacks and data leaks while lowering legal risks. Firms also roll out fresh policies to align tech systems with HIPAA rules, securing patient details. Many consultants now run deep risk checks to spot weak points and shape plans to guard sensitive medical information.

Value-based care and efficiency enhancement

Switching to value-focused care pushes hospitals to sharpen workflows and results, which helps drive the healthcare IT consulting market growth. IT consulting boosts daily tasks, trims costs, and lifts patient satisfaction. Hospitals’ growing trust in outside advisors also lifts demand. Consultants review current tasks and suggest smarter, tech-based upgrades that remove waste, raise teamwork, and cut mistakes. In October 2024, IQVIA, a global consulting leader in clinical studies and health data services, rolled out the IQVIA AI Assistant. This new conversational AI tool delivers clear, fast insights, letting clients pose simple or complex questions and get useful, verified answers in seconds instead of waiting hours or days. Advisors also help bring in remote tracking and virtual care setups that widen care options and lower hospital returns. Industry findings say the worldwide telehealth market stood at USD 22.8 Billion in 2024 and is set to expand at an 18.9% CAGR during 2025-2033. Rising use of healthcare data tools adds to the market’s strong outlook.

Healthcare IT Consulting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global healthcare IT consulting market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on consulting type, and end user.

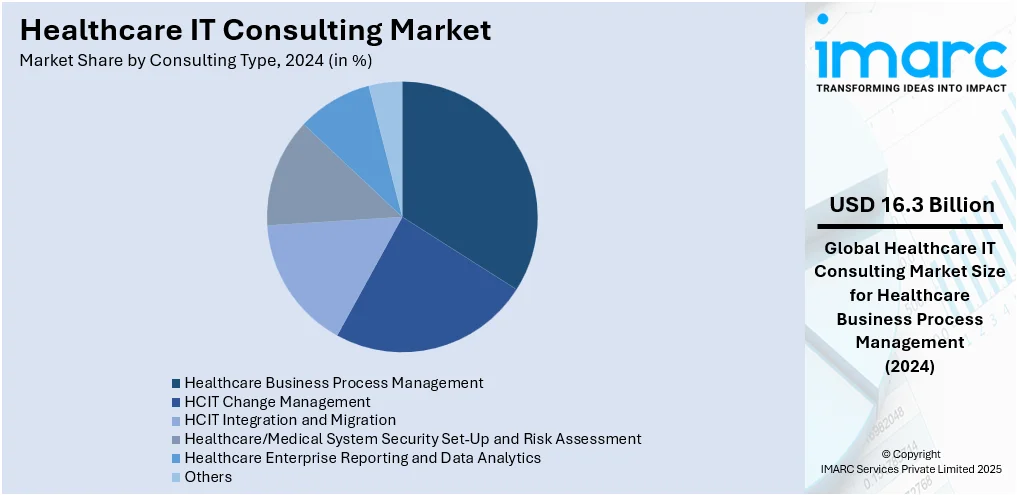

Analysis by Consulting Type:

- HCIT Change Management

- Healthcare Business Process Management

- HCIT Integration and Migration

- Healthcare/Medical System Security Set-Up and Risk Assessment

- Healthcare Enterprise Reporting and Data Analytics

- Others

As per the healthcare IT consulting market outlook, in 2024, the healthcare business process management segment led the market, accounting for 28.3% of the total market share. focusing on better workflows, cutting waste, and raising efficiency in both administrative and medical tasks, BPM helps healthcare groups run smoother and make the best use of resources. Putting these systems in place cuts costs too by spotting where time and money are lost, removing repetitive manual tasks, and adding smart automation that saves hospitals and clinics money long term. On top of that, BPM upgrades the patient experience by making it easier to set appointments, handle payments, and process claims, which builds trust and loyalty among patients.

Analysis by End User:

- Hospitals and Ambulatory Care Centers

- Diagnostic and Imaging Centers

- Public and Private Payers

- Others

Hospitals and ambulatory care centers turn to experienced consultants to get the best out of electronic health records (EHRs), telehealth tools, and patient care platforms. Consultants work closely with doctors and nurses to tie these systems together properly so that data moves quickly, tasks flow better, and care standards stay high in busy medical environments.

Imaging and diagnostic centers need reliable tech to handle large volumes of complex test results and scans. IT experts help roll out picture archiving and communication systems (PACS) and radiology information systems (RIS) that store, manage, and share these files safely and smoothly.

Pharmacies, both public and private, look for IT advisors to fine-tune how they handle prescriptions, manage stock, and interact with patients. These consultants build or upgrade pharmacy management software that keeps track of inventory, ensures correct dispensing, and sticks to all legal rules.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the healthcare IT consulting market forecast, in 2024, the North America segment led the market, accounted for the largest market share of over 39.7%. As the region has strong healthcare facilities and quick tech adoption, giving IT consultants plenty of room to support new digital projects. The region’s healthy economy means bigger budgets for investing in better medical technology and expert consulting help. A strong base of healthcare providers big hospital chains, outpatient clinics, drug makers, and research centers fuels steady demand for smart IT guidance. Plus, North America’s reputation as a leader in technology helps bring out new ideas and keeps local providers ahead with modern healthcare IT tools that meet changing needs and patient expectations..

Key Regional Takeaways:

United States Healthcare IT Consulting Market Analysis

In 2024, the United States accounted for 83.20% of the healthcare IT consulting market in North America, driven by multiple medical and economic factors. The United States healthcare IT consulting market has grown due to a mix of regulatory, technological, and operational factors. Providers face ongoing pressure to comply with changing federal policies like HIPAA and CMS rules, which call for secure, compliant data frameworks. Simultaneously, there is growing investment to modernize aging systems, especially electronic health records (EHR) and revenue cycle tools. Based on the Office of the National Coordinator for Health IT, by 2021, 96% of non-federal acute care hospitals and about 78% of office-based doctors had a certified EHR in place. This marks major growth from 2011 when just 28% of hospitals and 34% of doctors used EHRs. Additionally, large systems aim to boost patient results through analytics, population health tools, and better workflows, which often need external consulting input. The ongoing push for value-based care is helping the industry expand as consultants guide payment shifts and align systems with quality goals. Workforce gaps and clinician burnout have also raised the need for automation and AI, encouraging more hospitals and practices to hire consultants for smooth transitions.

Asia Pacific Healthcare IT Consulting Market Analysis

The Asia Pacific healthcare IT consulting market is advancing due to higher healthcare spending, digital projects, and fast-growing medical infrastructure in China, India, Japan, and Australia. In India, healthcare funding rose to Rs. 5.85 Lakh Crores for FY 2023-24, up from Rs. 2.43 Lakh Crores in FY 2017-18, equal to 1.9% of India’s GDP, according to the Press Information Bureau. Many governments now promote digital upgrades for public healthcare, such as wide-scale EHR rollouts, telehealth options, and health data networks. Consultants provide guidance for connecting systems, choosing vendors, and ensuring rules are met. Private hospitals expanding digital offerings further drive need for experts in analytics, cloud moves, and automated workflows. The spread of AI for better diagnostics and large-scale health tracking is boosting demand for tailored consulting to handle set-up and process updates.

Europe Healthcare IT Consulting Market Analysis

The Europe healthcare IT consulting market is moving forward thanks to rising needs for custom care and smarter decision-making systems. Clinics want to use genetic data and live patient info, and consultants help blend large sets of data into daily practice. The region’s switch to cloud tools and data centers means hospitals and labs turn to consultants for system design and transfer plans. Different countries vary in digital readiness, so experts help match tech roadmaps to local rules and funding plans. The European Commission noted that by 2024, the EU hit a 79% maturity score for its eHealth measure, up from 72% in 2023. More cyber risks in healthcare are raising the need for advice on threat checks, response steps, and safe network design. Hospitals and clinics face more attacks like ransomware and phishing, which has led to urgent steps to boost digital protection. In January 2024, the European Commission revealed a new plan to help hospitals guard against cyber threats, with a focus on stronger detection, response, and emergency handling in medical settings.

Latin America Healthcare IT Consulting Market Analysis

The Latin America healthcare IT consulting market is significantly influenced by efforts to modernize healthcare systems, improve access, and enhance operational efficiency. Governments in countries such as Brazil, Mexico, and Colombia are investing in digital health infrastructure, creating demand for consulting support in EHR implementation, system integration, and data standardization. For instance, in 2020, Brazil launched the Brazilian National Digital Health Strategy 2020-2028, with the overall objective of directing digital health initiatives from 2020 to 2028. The initiative also outlines the set of tasks to be completed, and the materials needed for implementing the Digital Health Vision in Brazil. Numerous healthcare providers are also adopting telehealth and remote monitoring tools, which require external expertise to align these technologies with clinical workflows.

Middle East and Africa Healthcare IT Consulting Market Analysis

The Middle East and Africa healthcare IT consulting market is experiencing robust growth as governments and private providers invest in digital transformation to expand access to care and improve efficiency. Countries such as the UAE and Saudi Arabia are increasingly prioritizing national health digitization plans, creating demand for consulting in EHR deployment, health data interoperability, and system integration. Consultants are also helping providers implement telemedicine, patient engagement tools, and cloud infrastructure to support modern care delivery. According to a report by the IMARC Group, the telemedicine market in the Middle East reached USD 4,049.2 Million in 2024 and is forecasted to grow at a CAGR of 17.38% during 2025-2033. The region’s rising cybersecurity risks, particularly with more connected devices and online health platforms, have also led to increased consulting around data protection and compliance with privacy regulations.

Competitive Landscape:

Companies are actively developing innovative solutions to address evolving technological needs in the industry. Additionally, they are implementing advanced data analytics techniques to derive insights from healthcare data for improved decision-making. Apart from this, many companies are working on enhancing interoperability between different healthcare IT systems to ensure seamless data exchange and comprehensive patient information. Furthermore, many firms are focusing on optimizing telehealth platforms to facilitate remote patient consultations, which makes healthcare services more accessible and convenient. Moreover, these companies are actively collaborating with healthcare providers to align IT strategies with organizational goals, streamlining operations and enhancing patient care.

The report provides a comprehensive analysis of the competitive landscape in the healthcare IT consulting market with detailed profiles of all major companies, including:

- Accenture plc

- Cognizant

- Deloitte Touche Tohmatsu Limited

- Genpact Ltd.

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- IQVIA Inc.

- McKesson Corporation

- Oracle Corporation

- Siemens Healthineers

- Veradigm LLC

- Vertiv Group Corp.

Latest News and Developments:

- April 2025: FirstHx, a provider of AI-powered healthcare technologies, revealed plans to expand operations in the United States in collaboration with Jevan Consulting, a prominent healthcare consulting firm. Through this partnership, FirstHx’s revolutionary patient intake service will be available to numerous medical facilities across the United States through Jevan Consulting, enabling the company to meet the evolving demands of the United States healthcare sector seamlessly.

- February 2025: FTI Consulting, Inc. launched a Healthcare & Human Services industry practice in Australia. This novel practice will primarily focus on assisting clientele with important industry agendas, including digitization and productivity.

- January 2025: Healthcare IT Leaders, a provider of healthcare IT consultancy services, established a partnership with USA Health, the medical center of the University of South Alabama, for the provision of its comprehensive managed services. As part of this partnership, Healthcare IT Leaders will take on the role of continuously monitoring, maintaining, and supporting the Oracle Health Millennium clinical application for USA Health.

- December 2024: Piramal Alternatives announced an investment of approximately Rs. 185 Crore via convertible instruments in 3Gen Consulting, a provider of healthcare consulting and healthcare revenue cycle management (RCM) services based in Pune. The funding is expected to support the expansion of 3Gen’s operations and strengthen its position in the Indian healthcare IT consulting market.

- October 2024: Accenture successfully acquired consus.health, a renowned provider of healthcare management consultancy services based in Germany. consus.health provides a wide range of services, including procurement and logistics, patient management, infrastructure management, and medical strategy. By integrating the strategy and consulting expertise of consus.health with its digital transformation capabilities, Accenture will be better equipped to assist hospitals and healthcare providers in Austria, Germany, and Switzerland in raising their standards of healthcare.

Healthcare IT Consulting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Consulting Types Covered | HCIT Change Management, Healthcare Business Process Management, HCIT Integration and Migration, Healthcare/Medical System Security Set-Up and Risk Assessment, Healthcare Enterprise Reporting and Data Analytics, Others |

| End Users Covered | Hospitals and Ambulatory Care Centers, Diagnostic and Imaging Centers, Public and Private Payers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Cognizant, Deloitte Touche Tohmatsu Limited, Genpact Ltd., HCL Technologies Limited, Infosys Limited, International Business Machines Corporation, IQVIA Inc., McKesson Corporation, Oracle Corporation, Siemens Healthineers, Veradigm LLC, Vertiv Group Corp., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the healthcare IT consulting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global healthcare IT consulting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the healthcare IT consulting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare IT consulting market was valued at USD 57.45 Billion in 2024.

The healthcare IT consulting market is projected to exhibit a CAGR of 13.30% during 2025-2033, reaching a value of USD 178.6 Billion by 2033.

The healthcare IT consulting market is driven by growing demand for digital records, telemedicine expansion, stricter data privacy regulations, cloud-based solutions, and rising interest in AI and analytics. Providers rely on consultants to modernize systems, improve patient care, cut costs, and meet compliance standards.

In 2024, North America dominated the healthcare IT consulting market, accounting for 39.7% of the total market share, driven by strong adoption of digital health records, rising telehealth use, strict data security rules, hospital system upgrades, and ongoing investments in advanced healthcare technologies and compliance solutions.

Some of the major players in the global healthcare IT consulting market include Accenture plc, Cognizant, Deloitte Touche Tohmatsu Limited, Genpact Ltd., HCL Technologies Limited, Infosys Limited, International Business Machines Corporation, IQVIA Inc., McKesson Corporation, Oracle Corporation, Siemens Healthineers, Veradigm LLC, Vertiv Group Corp., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)