Healthy Snacks Market Size, Share, Trends, and Forecast by Product, Distribution Channel, and Region, 2026-2034

Healthy Snacks Market Size and Share:

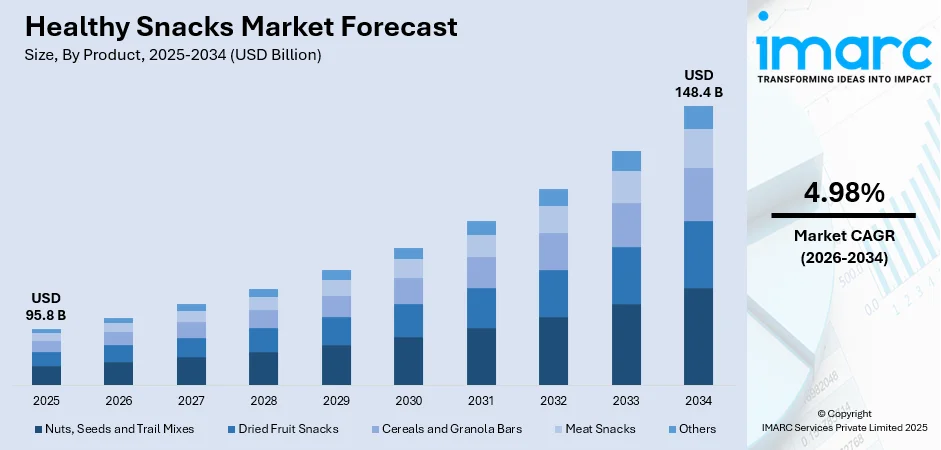

The global healthy snacks market size was valued at USD 95.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 148.4 Billion by 2034, exhibiting a CAGR of 4.98% from 2026-2034. North America currently dominates the market, holding a market share of over 39.6% in 2025. The growing emphasis on healthy diets that address chronic diseases and dietary restrictions through gluten-free options with sustainable packaging innovations; growing consumer health consciousness driving demand for nutritious, organic, and plant-based products; and technological advancements enabling improved processing methods, functional ingredients, and eco-friendly packaging solutions are the driving forces behind the market for healthy snacks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 95.8 Billion |

| Market Forecast in 2034 | USD 148.4 Billion |

| Market Growth Rate 2026-2034 | 4.98% |

The rising consciousness about health among people worldwide is a significant factor impelling the healthy snacks market growth. It is resulting in the wider consumption of nutritious snacks as they offer multiple advantages like enhancing bone health, managing blood sugar levels, and reducing the risk of conditions, such as heart diseases, diabetes, obesity, digestive problems, and cancer. Furthermore, the escalating demand for quick, convenient, and portable healthy snacks is supporting the market growth due to busy schedules and fast-paced lifestyles of people worldwide. The increasing emphasis on the importance of healthy eating due to the prevalence of chronic diseases is providing a favorable market outlook. Furthermore, the growing prevalence of lactose intolerance and celiac disease in society is resulting in the development of gluten-free, plant-based, and organic product alternatives. Moreover, the market is influenced by the implementation of attractive and eco-friendly packaging choices that are portable, lightweight, decrease carbon emissions, and enhance consumer convenience through attributes, such as effortless opening and resealing.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for healthy snacks owing to the evolving consumer preferences for nutritious and convenient food options. Snacks that blend taste and health advantages are becoming more and more popular among the nation's health-conscious consumers. A growing understanding about the importance of diet in preserving general health and averting diseases linked to lifestyle has a significant impact on this change. As a result, there is a growing desire for snacks that are prepared with natural foods, devoid of chemical additives, and enhanced with useful nutrients like vitamins, fiber, or protein. Snacks made with plant-based proteins, nuts, seeds, and legumes are becoming more and more popular as vegan and vegetarian diets are gaining popularity. These products cater to a broad range of consumers, including those who are environmentally conscious or looking to reduce their meat consumption. Brands are increasingly innovating in this space, offering options like chickpea crisps, lentil chips, and almond-based protein bars. In 2024, Barbells released a lime pie protein bar with zero added sugar in the US. This new launch expands Barnell’s protein bar flavors which also include birthday cake, banana caramel, cookies& cream, creamy crisp, salty peanut, and many more.

Healthy Snacks Market Trends:

Increasing Consumer Health Consciousness

The rising health awareness among people worldwide represents a fundamental driver propelling the healthy snacks market forward. The heightened consciousness is translating into increased consumption of nutritious snack products that offer multiple health benefits, including enhanced bone health, regulated blood sugar levels, and reduced risk of cardiovascular diseases, diabetes, obesity, digestive problems, and cancer. Dietary patterns are experiencing a significant transformation as health-conscious consumers actively seek whole foods that support their wellness objectives. The demand for organic fruits and vegetables, minimally processed products, and plant-based alternatives continues to surge, reflecting a fundamental shift towards foods that promote better long-term health outcomes. Modern consumers are scrutinizing ingredient labels more carefully, deliberately steering away from artificial additives and selecting nutrient-rich options that support sustained energy and overall vitality. This trend is witnessing growth owing to the increasing popularity of convenient, portable healthy snacks that accommodate busy schedules and fast-paced lifestyles, enabling consumers to maintain their nutritional goals without compromising on convenience or accessibility in their daily routines.

Growing Emphasis on Healthy Diets

The heightened emphasis on healthy dietary habits, driven by the increasing prevalence of chronic diseases worldwide, is significantly supporting market expansion. The growing occurrence of lactose intolerance and celiac disease among populations has catalyzed the development and introduction of gluten-free, plant-based, and organic product variants that address these specific dietary restrictions. Manufacturers are responding to these evolving consumer needs by launching snack options devoid of common allergens while maintaining nutritional value and taste appeal. The market is further propelled by the introduction of attractive and sustainable packaging solutions that enhance consumer convenience through features such as portability, lightweight design, easy-tear mechanisms, and resealable closures. These packaging innovations align with growing environmental consciousness while improving product accessibility for on-the-go consumption. Additionally, manufacturers are intensifying their focus on developing healthy snack options with significantly improved taste profiles, enhanced textures, and visually appealing designs that make nutritious eating more enjoyable and desirable. For instance, Sitavatika launched its premium range of nuts and dry fruits in 2024, comprising the finest quality foxnuts, cashew nuts, almonds, pistachios, and other premium nuts that are hand-picked and sourced from the best farms, demonstrating the industry's commitment to quality and consumer satisfaction.

Technological Advancements and Innovation

Technological advancements in food processing and packaging are playing a pivotal role in accelerating healthy snacks market growth and development. Modern food processing technologies enable manufacturers to produce snacks with enticing flavors and appealing textures while preserving essential nutritional value and health benefits. Advanced methods such as extrusion, air frying, and freeze-drying allow brands to satisfy consumer demand for healthier alternatives without compromising on taste, texture, or convenience factors. Innovation extends beyond processing techniques to encompass product development, as companies increasingly experiment with functional ingredients including probiotics, adaptogens, and superfoods that offer additional health advantages. These value-added components cater to consumers seeking snacks that provide more than basic nourishment, delivering benefits such as enhanced immunity, improved digestive health, stress reduction, and sustained energy levels. Furthermore, improvements in environmentally friendly packaging solutions address consumer demands for sustainable products, enhancing brand appeal and market positioning. In 2024, Pakka Limited declared its partnership with Brawny Bear to introduce date energy bars in compostable flexible packaging. These bars utilize innovative compostable packaging technology, directly addressing the growing concern about plastic waste in India and demonstrating the industry's commitment to environmental sustainability and responsible manufacturing practices that resonate with eco-conscious consumer segments.

Healthy Snacks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global healthy snacks market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, distribution channel, and region.

Analysis by Product:

- Nuts, Seeds and Trail Mixes

- Dried Fruit Snacks

- Cereals and Granola Bars

- Meat Snacks

- Others

Nuts, seeds and trail mixes stand as the largest segment in 2025, holding 36.8% of the market. Moreover, nuts, seeds, and trail mixes contribute significantly due to their high levels of nutrients, providing a range of fiber, healthy fats, and proteins. In addition, nuts are known for their many health benefits. Cashews, walnuts, pistachios, and almonds have high levels of antioxidants and heart-healthy monounsaturated fats. Apart from this, frequent intake of these foods is associated with lower cholesterol levels, reduced inflammation, and improved heart health. Additionally, seeds like chia, flax, sunflower, and pumpkin contain essential nutrients like omega-3 fatty acids, zinc, and magnesium. Trail mixes are also gaining popularity as a comprehensive and convenient snack option, which is encouraging manufacturers to launch various innovative trail mix products. In 2024, Nutraj launched NutrajSnackrite Daily Nutrition Pack, which is a delectable combination of trail mixe. The pack contains 21 trail mix pouches weighing 25 grams, facilitating healthy snacking.

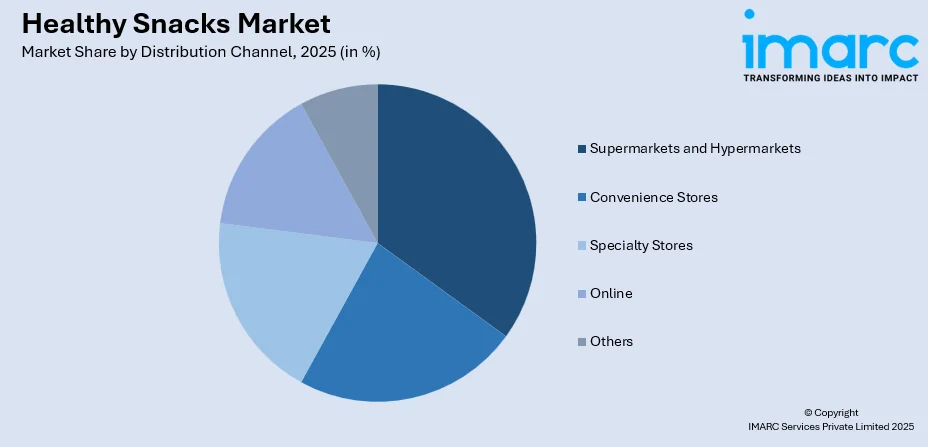

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets lead the market with 44.8% of market share in 2025. Supermarkets and hypermarkets hold a notable healthy snacks market share for distribution channel, offering a wide variety of healthy snacks in one place, as well as enticing discounts and benefits for buying in bulk. Furthermore, supermarkets and hypermarkets play a critical role in increasing sales for customers who are always busy and seek fast and convenient ways to get access to healthy snacks. Supermarkets and hypermarkets prioritize product freshness and offer customers high-quality, nutritious food. Moreover, supermarkets and hypermarkets attract budget-conscious consumers with their affordable prices and frequent promotions. Furthermore, they cater to specific markets with a focus on premium, natural, or specialty products that attract discerning and health-conscious customers. This diverse network of hypermarkets and supermarkets ensures broad availability.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of 39.6%. The healthy snacks market report identifies consumer preferences, health and wellness awareness, and convenient eating habits as pivotal drivers of the market growth. As brands in the area adapt to changing consumer preferences, they are creating new products that offer both nutrition and great taste. Single-serving packaging, pouches with resealable options, and convenient formats are becoming the norm in the industry. These items are designed for busy consumers seeking fast hunger remedies while staying true to their dietary aspirations. This tendency is especially noticeable in millennials and Gen Z, who favor practical but health-conscious snack choices. Therefore, companies are introducing a variety of innovative snack products. In 2024, Herbalife, a top health and wellness company, community, and platform, launched Protein Chips in the United States and Puerto Rico. The item offers customers a convenient and tasty option to assist in meeting their daily nutritional needs in a healthy way.

Key Regional Takeaways:

United States Healthy Snacks Market Analysis

The United States accounts for 82.2% of the total North American market share, demonstrating substantial market dominance and growth potential. The healthy snacks industry in the US is experiencing significant expansion driven by several region-specific factors and evolving consumer preferences. The trend towards plant-based and functional snacks continues to accelerate as consumers increasingly seek vegan, high-protein, and nutrient-dense options that align with their health and ethical values. The rising demand for clean-label products is profoundly impacting the market landscape, as American consumers actively scrutinize ingredient lists and avoid artificial additives and preservatives in their food choices. This preference for transparency and simplicity in ingredient composition is driving manufacturers to reformulate products and communicate ingredient sourcing more effectively. Additionally, the proliferation of innovative snack packaging options, including resealable pouches and portion-controlled packs, is enhancing consumer convenience and aligning with the fast-paced American lifestyle. In 2024, Barbells released a lime pie protein bar with zero added sugar in the US market, expanding its protein bar flavor portfolio to include options like birthday cake, banana caramel, cookies & cream, and salty peanut varieties.

Asia Pacific Healthy Snacks Market Analysis

The healthy snacks industry in the Asia Pacific area is experiencing rapid expansion, fueled by specific local influences. Consumers are more and more choosing snack choices influenced by traditional Asian ingredients such as matcha, sesame, and seaweed, mixing regional tastes with wellness advantages. Also, there is a fast-increasing need for plant-based snacks, particularly in countries such as India and China, where vegetarianism and flexitarian diets are becoming more popular. Individuals are increasingly mindful of the snacks they eat, placing emphasis on ingredients, portion size, and diversity. Furthermore, authorities and health groups in nations like Japan, South Korea, and Australia are actively pushing for awareness initiatives regarding obesity and chronic diseases, urging individuals to opt for healthier options.

Europe Healthy Snacks Market Analysis

The European healthy snacks market is experiencing significant growth driven by distinctive regional trends and consumer preferences across major markets. Consumers in countries including Germany, France, and the United Kingdom are increasingly prioritizing organic and sustainably produced snacks, influenced by strong environmental and ethical considerations in their purchasing decisions. This emphasis on sustainability extends throughout the supply chain, from ingredient sourcing to packaging materials and production methods. Plant-based snacks manufactured from pulses, grains, and alternative proteins are gaining substantial traction in countries such as Italy and Spain, where dietary diversity and vegetarianism are experiencing notable growth among younger demographics. The evolving work culture is also reshaping consumption patterns significantly, particularly as remote and hybrid work arrangements remain prevalent across the region. The growing trend towards healthy snacking during work hours, especially in remote and flexible work environments, is fundamentally changing consumption habits in countries like the UK and France where work-from-home setups continue to be widely adopted.

Latin America Healthy Snacks Market Analysis

The healthy snacks market in Latin America is growing rapidly, driven by unique regional factors. Consumers in countries like Brazil and Mexico are increasingly choosing snacks made from indigenous superfoods such as quinoa, chia seeds, and acai, aligning with a rising interest in locally sourced and nutrient-rich ingredients. Moreover, the region is also witnessing a surge in demand for low-sodium and high-protein snacks, particularly among urban populations managing lifestyle-related conditions such as hypertension and diabetes.

Middle East and Africa Healthy Snacks Market Analysis

The healthy snacks market in the Middle East and Africa is expanding significantly, fuelled by unique regional dynamics. In Gulf Cooperation Council (GCC) countries like Saudi Arabia and the UAE, consumers are increasingly adopting healthy snack options with low sugar and high protein content, driven by rising obesity rates and lifestyle-related health concerns. Additionally, the demand for date-based snacks and products incorporating traditional ingredients like tahini and almonds is surging, blending local flavours with health benefits. For instance, in 2020, an Emirati healthy snack bar Grapes and Dates has opened its doors in Dubai, complete with vibrant, retro-futuristic interiors that fuse Italian and Middle Eastern design.

Competitive Landscape:

One of the primary ways that companies are improving their business is through constant product innovation. Recognizing the demand for functional snacks, brands are introducing products fortified with health-boosting ingredients such as protein, probiotics, fiber, and adaptogens. Functional snacks like protein bars, immunity-enhancing nut mixes, and low-sugar cookies cater to consumers seeking nutrition alongside taste. For instance, in 2024, Danone S.A. announced its plan to capitalize on the increase in consumer snacking with Remix, which is a newline of yogurt and dairy snacks. Additionally, brands are expanding their portfolios to include plant-based snacks, gluten-free options, and allergen-friendly products, ensuring they cater to a diverse customer base. The growing importance of e-commerce is prompting healthy snack brands to enhance their online presence. Companies are investing in user-friendly websites, partnerships with online retailers, and direct-to-consumer (DTC) channels to reach a broader audience. Subscription services, where consumers receive curated boxes of healthy snacks on a regular basis, are becoming a key strategy to build customer loyalty and generate consistent revenue.

The report provides a comprehensive analysis of the competitive landscape in the healthy snacks market with detailed profiles of all major companies, including:

- B&G Foods Inc.

- Danone S.A.

- Del Monte Foods Inc. (Del Monte Pacific Ltd.)

- General Mills Inc.

- Kellogg Co.

- Kind LLC (Mars Incorporated)

- Mondelez International Inc.

- Nestlé S.A.

- Tyson Foods Inc.

- Unilever plc

Latest News and Developments:

- September 2025: Global superfruit company Fruitist announced a new collaboration with 888 Midas, a strategic investment company started by Caleb Williams, a professional football player. Through the deal, 888 Midas joins Fruitist's investment base, contributing funds to help the business grow further in the healthy snacking market.

- August 2025: SnackPure, a premium snacking brand from Zuari International, introduced five exciting new chip variants that aim to influence the healthy snacking category. The new lineup comprises Black Chana Chips, Makhana Chips, Corn Tikka Chips, Mix Veg Chips, and Brown Rice Chips, offering flavorful snacks to health-conscious consumers who refuse to compromise on taste.

- May 2025: Healthy food company Farmley has successfully raised $40 million in a Series C funding round headed by international consumer-focused investment firm L Catterton. In addition to breaking into unexplored regional markets and creating new product formulations, the business claims that this deal would help it solidify its position in India's expanding healthy snacking industry.

- May 2025: In its pre-Series A round, headed by Fireside Ventures, the kids' nutrition-focused food business Troovy, located in Gurugram, raised INR 20 crore (USD 2.3 Million). Veltis Capital, Spring Marketing Capital, and Sharrp Ventures also participated in the round. The money will go towards expanding the brand's distribution network throughout India and speeding up product development.

Healthy Snacks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Nuts, Seeds and Trail Mixes, Dried Fruit Snacks, Cereals and Granola Bars, Meat Snacks, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B&G Foods Inc., Danone S.A., Del Monte Foods Inc. (Del Monte Pacific Ltd.), General Mills Inc., Kellogg Co., Kind LLC (Mars Incorporated), Mondelez International Inc., Nestlé S.A., Tyson Foods Inc., Unilever plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the healthy snacks market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global healthy snacks market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the healthy snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthy snacks market was valued at USD 95.8 Billion in 2025.

IMARC estimates the healthy snacks market to exhibit a CAGR of 4.98% during 2026-2034.

The healthy snacks market is driven by rising consumer health consciousness spurring demand for nutritious, organic, and plant-based products; growing emphasis on healthy diets addressing chronic diseases and dietary restrictions through gluten-free options with sustainable packaging innovations; and technological advancements enabling enhanced processing methods, functional ingredients, and eco-friendly packaging solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the healthy snacks market include B&G Foods Inc., Danone S.A., Del Monte Foods Inc. (Del Monte Pacific Ltd.), General Mills Inc., Kellogg Co., Kind LLC (Mars Incorporated), Mondelez International Inc., Nestlé S.A., Tyson Foods Inc., Unilever plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)