Heat Exchanger Market Size, Share, Trends and Forecast by Product, Material, End User Industry, and Region, 2025-2033

Heat Exchanger Market Size and Share:

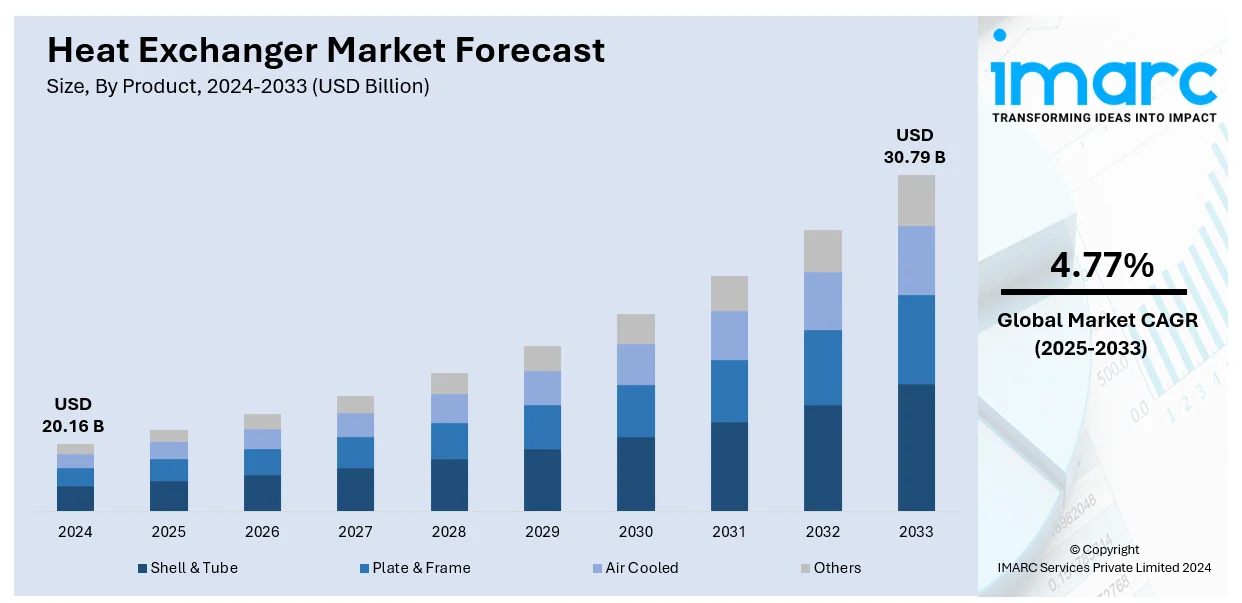

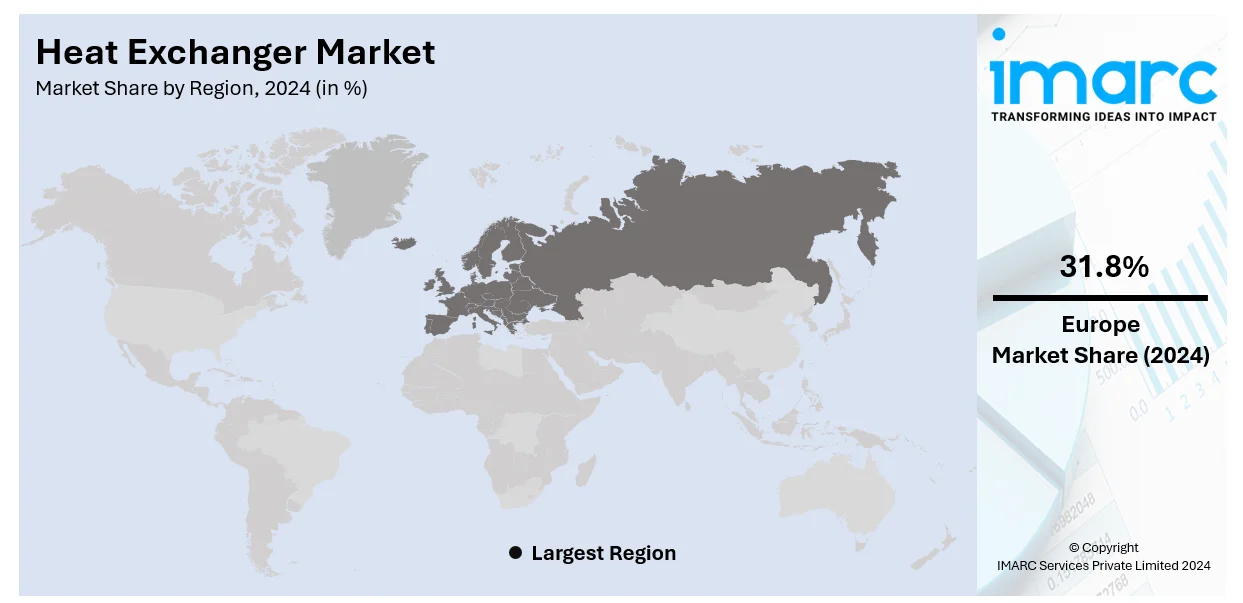

The global heat exchanger market size was valued at USD 20.16 Billion in 2024. Looking forward, the market is projected to reach USD 30.79 Billion by 2033, exhibiting a CAGR of 4.77% from 2025-2033. Europe currently dominates the market, holding a market share of over 31.8% in 2024. The market is driven by the increasing adoption of energy-efficient solutions across key industries and the accelerated pace of industrialization in developing regions, which together boost demand for optimized thermal management. Stringent emission regulations and environmental sustainability initiatives further compel industries to implement advanced heat exchangers that lower carbon footprints. These factors, combined with rising investments in renewable energy projects, are fueling continuous market growth, further augmenting the global heat exchanger market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20.16 Billion |

| Market Forecast in 2033 | USD 30.79 Billion |

| Market Growth Rate (2025-2033) | 4.77% |

The heat exchanger market demand is rising, driven by the need to control energy costs along with the increasing concern for the environment. In addition, rising industrialization and urbanization, particularly in developing countries increases the demand for efficient heating and cooling equipment, aiding the market growth. Besides this, growing standards of environmental protection and sound requirements to reduce the negative impact on the environment make firms implement energy-saving measures, fueling the market demand. Furthermore, the increasing investments in renewable energy (RE) projects including geothermal and solar are impelling the market growth. For example, RE generation capacity is expected to be 5,500 GW by 2030 with an annual increment of nearly 940MW representing a shift to its sources, further driving the need for heat exchangers. Moreover, the growth in the chemical and petrochemical industries for temperature-sensitive processes is providing an impetus to the market.

To get more information on this market, Request Sample

The United States holds a share of 75.00% in the heat exchanger market. The demand in the region is expanding, driven by the increasing popularity of home improvement and interior decoration, as they grow the need for fashionable and superior-quality bed linens. In line with this, rising consumer consciousness about the significance of sleep health makes them focus on comfort, strengthening the market share. Concurrently, the increasing number of double-income families is encouraging consumers to adopt comfortable and easy-to-maintain beds, driving the market demand. Apart from this, the rising demand for energy-saving solutions in industries for cost-cutting measures and reduction of environmental degradation, are thereby propelling the market forward.

Heat Exchanger Market Trends:

Rising focus of decarbonization

The concept of decarbonization is becoming increasingly popular around the world as countries, companies, and people become aware of the need to fight climate change. It entails the prevention or minimization of carbon dioxide emissions which are a result of combustion of fossil fuels, the major causes of global warming. The rising efforts to minimize emissions, nations have compelled manufacturers to seek cleaner and more efficient technologies such as heat exchangers. For instance, India introduced the goal to reach net zero by 2070. Besides the general goal for 2070, India has also assigned targets for 2030, these include 500 GW of non-fossil fuel installed capacity, reduction of carbon emission by 1 billion tons, and renewable energy accounting for 50 percent of its demand. Furthermore, heat exchangers support companies’ compliance with environmental standards and maximize their sustainability. Moreover, the continuous improvements in heat exchanger technologies and materials are encouraging industries to integrate this technology into processes as they become more effective in terms of cost. For example, in April 2024 Alfa Laval began production of printed circuit heat exchanger (PCHE) in the new line at the Vicarb plant in Le Fontanil, Isère. This new line employs state-of-the-art diffusion-welding (bonding) technology to develop a highly integrated solution that helps drive the energy transition across multiple sectors (energy and marine sectors) and specifically in hydrogen applications. These factors are further contributing to the growth of the heat exchanger market share.

Growing demand for heat pumps

The increasing demand for heat pumps is one of the significant factors adding to the heat exchanger market growth. Heat pumps rely on heat exchangers as a fundamental component of their operation. Heat exchangers facilitate the transfer of heat between different fluids, enabling heat pumps to extract heat from one source (such as the air, ground, or water) and transfer it to another for heating or cooling purposes. Moreover, heat pumps are known for their high energy efficiency compared to traditional heating systems like furnaces or boilers. As energy costs continue to rise and environmental concerns become more prominent, consumers are increasingly turning to heat pumps as a sustainable heating and cooling solution. For instance, according to the report published by NREL in February 2024, using a heat pump could result in lower energy expenditures for 62% to 95% of the U.S. population, depending on the efficiency of the heat pump. Enhancing a home's weatherization, like adding more insulation, would raise the range to 82% to 97%. Apart from this, many governments offer incentives, rebates, or tax credits for installing energy-efficient heating and cooling systems, including heat pumps. These incentives can significantly reduce the upfront cost of purchasing and installing a heat pump, making them more financially attractive to consumers. For instance, in October 2023, the government boosted heat pump grants by 50%, from £5,000 (€5,795) to £7,500 (€8,692). The Boiler Upgrade Scheme offered schemes to assist consumers in switching from traditional fossil fuel heating to more efficient, low-carbon heating systems. These comprise air-source and ground-source heat pumps. These factors are bolstering the heat exchanger market revenue.

Technological advancements

Temperature is every time a critical factor in the course of the reaction and usually requires accurate control. Ongoing technological developments are the main factors causing the enhancements of the heat exchanger market. There have been improvements in the material available and used in the fabrication of heat exchanger parts in terms of corrosion allowance, thermal conductivity, and mechanical strength due to new materials and coatings. These materials enable the design and manufacturing of compact, lighter, and more robust heat exchangers to operate in demanding conditions. For instance, in May 2024, Hayward Holdings Inc., a Pool Equipment Designer, Manufacturer, and Marketer announced the HeatPro Series of Heat+Chill Heat Pumps that features the first-ever microchannel heat exchanger. The technique allows pool owners to cool, chill, and heat their pools using the same equipment. The chill feature, which can cool water to 4 degrees Celsius, moves the cold plunge, which was before, available just for luxurious spas and fitness centers, to the backyard. The cooling feature allows pool owners to lower the temperature of their pools during the hottest month or even by a couple of degrees. The series uses Trivalent Chromium Process (TCP) coating in conjunction with the US government for long life in the harshest environments and for protection against corrosion. These factors are further contributing to the growth of the heat exchanger market forecast.

Rising Demand for Energy Efficiency and Emission Compliance

The heat exchanger market is witnessing amplified growth due to the escalating demand for energy-efficient technologies across diverse industrial sectors. Rapid industrialization in emerging economies is intensifying the need for advanced heat exchange systems that optimize energy consumption and reduce operational costs. Concurrently, stricter emission standards and environmental regulations are compelling manufacturers and end-users to adopt heat exchangers that facilitate lower carbon footprints and enhanced sustainability. These combined factors are accelerating the integration of innovative heat exchanger solutions tailored to meet evolving energy and environmental challenges.

Challenges and Opportunities:

The heat exchanger market faces challenges such as material corrosion, fouling, and the high initial investment cost associated with advanced technologies, which can hinder adoption, especially in cost-sensitive regions. Additionally, the complexity of designing heat exchangers for highly specialized applications requires continuous R&D efforts. However, these challenges present significant opportunities for innovation, including the development of corrosion-resistant materials, smart sensors for predictive maintenance, and compact, high-efficiency designs. Growing investments in renewable energy and stricter environmental policies further open avenues for market expansion and technological advancement.

Heat Exchanger Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global heat exchanger market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, material, and end user industry.

Analysis by Product:

- Shell & Tube

- Plate & Frame

- Air Cooled

- Others

Shell & Tube leads the market with around 34.8% of the market share in 2024. These heat exchangers consist of a shell that houses a bundle of tubes. The material of the tube has a high heat transfer coefficient, which is to be done effectively. This design is very flexible and can be used for high-pressure and high-temperature applications. For example, in February 2024, Sandvik, a manufacturer of advanced stainless steels, special alloys, titanium, and other high-performance materials, introduced a new cold-finishing tube manufacturing line in Mehsana Mill in Gujarat, Western India. The new line of cold finishing emphasizes heat exchanger tube sizes for duplex, austenitic, and nickel-based alloys that could be U-bent or straight for tube and shell heat exchangers which can be cleaned and plugged.

Analysis by Material:

- Carbon Steel

- Stainless Steel

- Nickel

- Others

Stainless steel led the market with around 33.8% of the market share in 2024. According to the heat exchanger market outlook, stainless steel is favored for its corrosion resistance and strength, which makes it ideal for more aggressive fluids and higher-temperature applications. It is widely used in sections such as the pharmaceuticals, F&B, and chemicals industries in which hygiene and the absence of rusting are respected. Furthermore, constant technological developments in heat exchanger products and manufacturing techniques are enhancing performance, decreasing expenses on maintenance, and enhancing the durability of stainless-steel heat exchangers, which is pushing the market even higher. Besides this, with the rising global concern towards sustainability, there is a trend towards the use of environmentally sustainable and recyclable materials and systems. Such sustainability goals include material reusability and product durability, and stainless steel ticks both of these boxes.

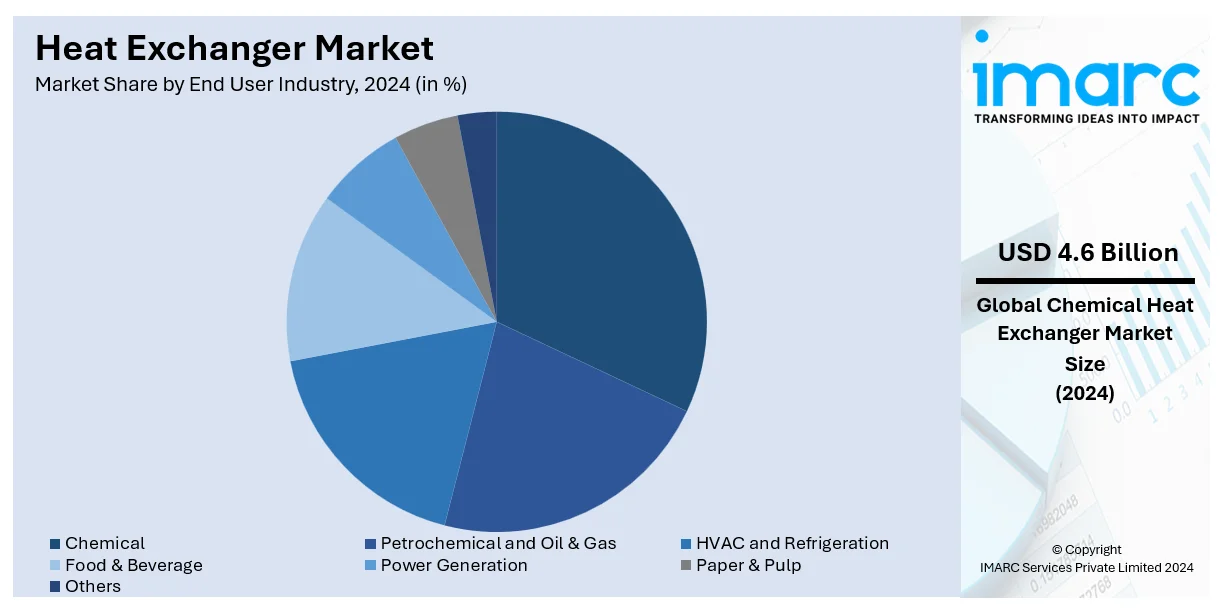

Analysis by End User Industry:

- Chemical

- Petrochemical and Oil & Gas

- HVAC and Refrigeration

- Food & Beverage

- Power Generation

- Paper & Pulp

- Others

Chemicals lead the market with around 22.7% of the market share in 2024. According to the heat exchanger market overview, in the chemical industry, heat exchangers are commonly used for controlling temperature during chemical reactions and in separation processes. The heat exchangers in this industry are exposed to aggressive chemicals, and the materials of construction may include stainless steel or nickel alloys. Some of the most common uses are distillation columns, evaporators, and condensers. Effective heat transfer is very important if efficiency is to be achieved, and costs kept to a minimum. For instance, in November 2023, the advanced stainless steel, special alloys, and industrial heating manufacturing firm known as Alleima revealed that it had finished the last phase of expansion at the Mehsana production facility in India that started in 2019. The firm launched a new heat exchanger tube manufacturing line that signaled a new level of the company’s capacity to develop complex alloys for critical uses in the chemical, petrochemical, and renewable energy industries.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, Europe accounted for the largest market share of over 31.8%. According to the heat exchanger market statistics, the increasing investment in wind, solar, and geothermal energy projects that necessitate efficient heat exchangers to optimize performance represents one of the primary factors bolstering the market growth in Europe. Moreover, the rising number of data centers is favoring the growth of the market in the region. Besides this, the growing production of luxury vehicles is influencing the market positively. For instance, in September 2023, Samsung Electronics launched the A-40% Washing Machine and the EHS Mono R290 heat pump at IFA 2023 in Berlin, Germany. The EHS Mono R290 has a larger heat exchanger that can transfer more heat at once than a standard outdoor unit.

Key Regional Takeaways:

North America Heat Exchanger Market Analysis

The heat exchanger market in North America is growing because of the significant demand across major sectors such as chemical processing, oil & gas, power generation, and heat, ventilation, and air conditioning (HVAC). For instance, America was the leading producer of oil with an average annual production of more than 12.9 million barrels per day in 2023 which demands improved heat exchange equipment in extraction and refining operations. Moreover, rising investment in petrochemicals and manufacturing is driving the demand in the chemical industry. Additionally, the increased energy efficiency requirements along with emission controls are significantly contributing to the market expansion. Besides this, the increasing use of RE sources like geothermal and solar power is also providing lucrative growth opportunities in the market. Furthermore, the surging energy demand and usage, is leading to the need for better heat transfer means in waste heat recovery, cooling systems, and HVAC applications, especially in the industrial regions of North America, thereby impelling the market growth.

United States Heat Exchanger Market Analysis

Strong industrial sector growth and rigid environmental laws, along with growth in demand for energy-efficient systems, are driving growth in the heat exchanger market in the United States. According to data obtained from the U.S. Energy Information Administration, 33% of all energy consumed in the United States and 35% of all end-use energy consumed in 2022 came from the industrial sector, which is highly dominated by HVAC, petrochemical, and chemical applications. Therefore, efficient heat management systems are needed. Due to the high demand in refineries and gas processing facilities, the oil and gas industry, especially in regions like Texas and North Dakota, requires a significant number of shell and tube heat exchangers. Also, government regulations such as the Clean Air Act have driven businesses to implement energy-efficient and emission-lowering technology.

The HVAC industry is one of the major end-users of heat exchangers, with around 8% of the energy consumption of the nation being attributed to this industry alone, which is fueled by the rise in residential and commercial building projects, as indicated by the data from the U.S. Energy Information Administration. For instance, to abide by the rules of energy efficiency, the U.S. Department of Energy (DOE) focuses on the adoption of complex heating and cooling systems. In addition, the market for heat exchangers used in energy conversion systems is also enhanced by the increasing demand for renewable energy projects, such as solar thermal and geothermal power plants. Market growth is also facilitated by the increasing trend of electrification and the emergence of data centers, which require precise cooling solutions.

Europe Heat Exchanger Market Analysis

The European market for heat exchangers is enhanced by increasing renewable energy projects, stringent environmental regulations, and industrial growth. The Green Deal of the European Union is forcing businesses in diverse sectors, such as HVAC, power, and chemicals, to adopt energy-efficient heat exchangers to meet the carbon neutrality target by 2050. The UK, France, and Germany are at the forefront of implementing the most advanced heat exchanger technologies to achieve industrial decarbonization. Heat exchangers are widely used in solar thermal, wind power, and biomass applications in Europe's renewable energy industry, where solar and wind energy account for more than 25% in 2023, according to the data by Ember Energy. For example, space heating is responsible for as much as 52% of DH in the EU, followed by process heating at around 30%, and finally household hot water at around 10%. Investments in the chemical industry, being one of the largest consumers of heat exchangers have been rising, especially in Central and Eastern Europe. Besides, the Europe automobile manufacturing industry produces around 13 million vehicles per year and demands heat exchangers mainly in engine cooling and battery thermal management.

Asia Pacific Heat Exchanger Market Analysis

Asia-Pacific area is the largest consumer because of increased energy consumption urbanization, and industrialization in this region. The market is dominated by nations like China and India, with China producing almost half of the industrial output in the region. The chemical and petrochemical sectors are major driving forces behind the use of heat exchangers in the region. For example, the chemical and petrochemical (CPC) sector in India is already worth USD 178 Billion and is expected to exceed USD 300 Billion by 2025, thereby assuming an important position in the world market, as stated in the Department of Chemicals and Petrochemicals, Government of India. There is a significant need for heat exchangers in applications such as waste heat recovery and steam condensers due to growing investments in power generation, including thermal and renewable energy plants. Rising temperatures and growing urbanization, particularly in Southeast Asia, are helping the HVAC industry grow. Furthermore, the food and beverage sector, which is expanding significantly per year, is largely dependent on heat exchangers for refrigeration and pasteurization processes.

Latin America Heat Exchanger Market Analysis

The heat exchangers market in Latin America is influenced by the growth of the energy sector, industrialization, and energy efficiency. The largest contributors to this market are Mexico and Brazil; according to the International Trade Administration, in 2023, Brazil's oil production will exceed 3 million barrels per day, which will boost the demand for heat exchangers by refineries and petrochemical facilities. Heat exchangers find substantial use in processing applications in the food and beverage industry, which is expanding rapidly due to the presence of multiple transnational players. Growing power generation investments, such as Argentinean and Chilean renewable projects, also contribute to market expansion. The growing automotive industry in Mexico, which produces more than 3.5 million vehicles a year, according to data from the International Trade Administration, also fuels the need for heat exchangers in cooling and thermal management systems.

Middle East and Africa Heat Exchanger Market Analysis

Industrial development and expanding energy efficiency programs in the region and oil and gas sector led to the growth of the heat exchanger market in the Middle East and Africa. More than half of the world's proven oil reserves are in the Middle East, where nations like Saudi Arabia and the United Arab Emirates make large investments in petrochemical projects and refinery renovation. Heat exchangers are fundamental for cooling and heat recovery in such industries. Industrialization and investments in power generation increase the demand in Africa, especially South Africa and Nigeria. According to an industrial report, it is estimated that 600 million people in sub-Saharan Africa lack access to electricity. World Bank Group and African Development Bank promised access to electricity to 300 million people in the said region by 2030.

Competitive Landscape:

The leading companies are incorporating sensors and real-time monitoring systems that allow for proactive monitoring of performance metrics and early detection of issues like fouling or leaks, thereby improving efficiency and reducing downtime. They are also developing new materials, such as graphene and ceramic composites that offer higher thermal conductivity and greater resistance to corrosion, which enables heat exchangers to operate under more demanding conditions. Furthermore, main stakeholders are implementing computational fluid dynamics (CFD) software which comprises of modelling belonging to the fluid flow and heat transfer and is valuable to designers in determining efficiency of heat exchanger before the real prototypes are produced, a factor that affords much time and resources.

The report provides a comprehensive analysis of the competitive landscape in the heat exchanger market with detailed profiles of all major companies, including:

- Alfa Laval AB

- API Heat Transfer

- Boyd

- Chart Industries

- Danfoss

- GE Vernova

- GEA Group Aktiengesellschaft

- Hisaka Works, Ltd.

- IHI Plant Services Corporation

- Johnson Controls

- Kelvion Holding GmbH

- Mersen

- Modine Manufacturing Company

- SPX FLOW, Inc.

- Xylem

Latest News and Developments:

- March 2025: Vertiv launched its CoolLoop RDHx, a chilled water rear door heat exchanger capable of handling up to 80kW per rack, aimed at AI and high-performance computing (HPC) applications with rising thermal loads. Designed for modular compatibility (600mm and 800mm racks), the solution integrates with direct-to-chip liquid cooling loops and features an optional pressure-independent control valve for precision water flow regulation.

- February 2025: Jebel Ali Free Zone (JAFZA) signed an agreement with Germany’s Allied Heat Exchange AG (A-HEAT) to develop the largest heat exchanger manufacturing facility in the GCC, spanning 1.2 million sq ft with 400,000 sq ft of built-up area. Operated by A-HEAT’s flagship brand Güntner, the facility will support data center and industrial cooling demands across GCC, India, China, Africa, and Asia, with capabilities to produce CO₂- and ammonia-based energy-efficient exchangers and smart control systems that reduce energy use by up to 30% and water consumption by up to 90%.

- February 2025: Metalforms Heat Transfer, a division of TransTech Group, announced the appointment of four new channel partners to strengthen its direct customer support for Twisted Tube® and Brown Fintube® heat exchanger product lines across North America. The new partners—Heat Transfer Specialists (Louisiana), Apogee Equipment Solutions (Texas), Andersen & Associates (Western U.S.), and Thermal Transfer Solutions Ltd. (Western Canada)—will enhance service responsiveness and provide localized technical expertise in the refining, petrochemical, and industrial sectors.

- January 2025: NANO Nuclear Energy contracted Thermal Engineering International (TEi) to design and fabricate the primary and secondary heat exchangers for its ODIN microreactor, a portable, low-pressure nuclear reactor under development. TEi, a subsidiary of Babcock Power with over a century of experience in power generation heat transfer systems, will lead the design and production process in collaboration with NANO Nuclear's engineering team.

- May 2024: Hayward Holdings, Inc., a global designer, manufacturer, and marketer of pool and outdoor living equipment, launched the HeatPro Series of Heat+Chill Heat Pumps, including industry-first microchannel heat exchanger technology.

- April 2024: Alfa Laval launched a new printed circuit heat exchanger (PCHE) production line at its Vicarb factory in Le Fontanil, Isère.

- February 2024: Danfoss India launched Microchannel Heat Exchanger (MCHE) technology at the ACREX India 2024 show. With its innovative Next Gen Evaporator, this energy-efficient invention revolutionizes air-cooled units, outperforming standard fin tube heat exchangers.

Heat Exchanger Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Shell and Tube, Plate and Frame, Air Cooled, and Others |

| Materials Covered | Carbon Steel, Stainless Steel, Nickel, Others |

| End-Use Industries Covered | Chemical, Petrochemical and Oil & Gas, HVAC and Refrigeration, Food and Beverage, Power Generation, Paper and Pulp, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Alfa Laval AB, API Heat Transfer, Boyd, Chart Industries, Danfoss, GE Vernova, GEA Group Aktiengesellschaft, Hisaka Works, Ltd., IHI Plant Services Corporation, Johnson Controls, Kelvion Holding GmbH, Mersen, Modine Manufacturing Company, SPX FLOW, Inc., Xylem, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the heat exchanger market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global heat exchanger market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the heat exchanger industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global heat exchanger market was valued at USD 20.16 Billion in 2024.

IMARC Group estimates the market to reach USD 30.79 Billion by 2033, exhibiting a CAGR of 4.77% from 2025-2033.

Key factors driving the demand for heat exchangers include growing demand for energy efficiency in industries, rising environmental concerns, the need for advanced HVAC systems, increased industrialization, and expanding renewable energy projects. Additionally, technological advancements and stricter regulatory standards are boosting adoption across various sectors.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global heat exchanger market include Alfa Laval AB, API Heat Transfer, Boyd, Chart Industries, Danfoss, GE Vernova, GEA Group Aktiengesellschaft, Hisaka Works, Ltd., IHI Plant Services Corporation, Johnson Controls, Kelvion Holding GmbH, Mersen, Modine Manufacturing Company, SPX FLOW, Inc., Xylem, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)