Hemodynamic Monitoring Market Size, Share, Trends and Forecast by Product, Monitoring, End-User, and Region, 2025-2033

Hemodynamic Monitoring Market Size and Share:

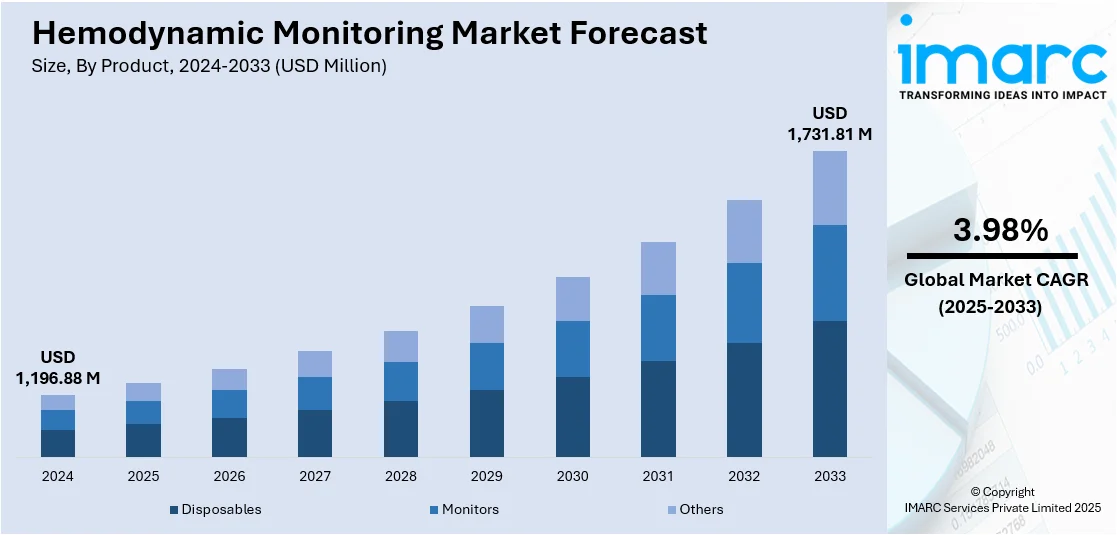

The global hemodynamic monitoring market size was valued at USD 1,196.88 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,731.81 Million by 2033, exhibiting a CAGR of 3.98% during 2025-2033. North America dominated the market, holding a significant market share of 35% in 2024. High healthcare spending, advanced hospital infrastructure, widespread adoption of monitoring technologies, skilled professionals, and strong regulatory support are some of the factors contributing to the hemodynamic monitoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,196.88 Million |

|

Market Forecast in 2033

|

USD 1,731.81 Million |

| Market Growth Rate (2025-2033) | 3.98% |

The market is driven by several key factors. There's a growing demand for advanced monitoring systems in critical care due to the rising incidence of cardiovascular and respiratory diseases. An aging population and increased surgical procedures contribute to this demand. Hospitals and ICUs are prioritizing real-time, accurate monitoring to improve patient outcomes. Minimally invasive and non-invasive technologies are gaining popularity, as they reduce complications and recovery time. Technological improvements in sensors, data analytics, and wireless connectivity are making these systems more efficient and user-friendly. Additionally, government investments in healthcare infrastructure and an increased focus on early diagnosis and preventive care are supporting hemodynamic monitoring market growth. As healthcare systems push for better patient management, the adoption of hemodynamic monitoring tools in both acute and ambulatory settings is expected to continue expanding.

In the United States, AI-powered monitoring platforms are gaining attention for their ability to predict complications and support real-time decision-making. Advanced features like cerebral blood flow indicators, voice and gesture controls, and customizable interfaces reflect a shift toward smarter, more responsive tools that enhance clinical efficiency and improve outcomes in high-acuity care settings. For instance, in April 2025, BD launched HemoSphere Alta, an AI-powered hemodynamic monitoring platform. It features a cerebral autoregulation index (CAI) for blood flow stability and predictive software for hypotension. The system enhances clinician workflows with a customizable touchscreen, voice, and gesture controls, aiming to improve patient care.

Hemodynamic Monitoring Market Trends:

Growing Burden of Heart-Related Complications Driving Monitoring Use

Persistent cases of hypertensive heart conditions and related deaths have reinforced the medical need for precise cardiovascular assessment. As more individuals face complications linked to unmanaged blood pressure, hospitals and care centers are placing stronger emphasis on early-stage intervention. The hemodynamic monitoring market trend reflects that continuous patient tracking, especially for those with chronic cardiac issues, is becoming routine in intensive care and surgical recovery. This shift is encouraging the adoption of advanced systems that offer accurate, real-time feedback on heart function. With clinicians prioritizing timely risk detection and intervention, demand is steadily building for tools that can support informed decisions and improve outcomes across both acute and long-term care settings. As per an industry report, in 2021, global hypertensive heart disease (HHD) had a prevalence of 12.51 Million and a mortality rate of 1.33 Million. By 2022, the prevalence rose to 13.01 Million, with a mortality rate of 1.35 Million, showing consistent figures.

Rising Healthcare Investment Fuels Monitoring Technology Uptake

Global health spending has grown to occupy a substantial portion of economic output, reflecting increased attention to disease prevention, patient safety, and outcome-driven care. This broader commitment to healthcare is shaping the hemodynamic monitoring market outlook by influencing procurement strategies, with more resources being directed toward technologies that can deliver measurable clinical value. Hemodynamic monitoring systems are increasingly viewed as essential tools, especially in high-dependency environments where real-time cardiovascular data informs critical decisions. As funding expands across both public and private sectors, hospitals are better equipped to invest in solutions that support precision medicine, improve response times, and reduce complications during surgical or intensive care. The push for data-informed care pathways and better resource utilization is accelerating the integration of advanced monitoring devices, especially those that are minimally invasive and compatible with digital health ecosystems. This shift points to growing reliance on diagnostic clarity and continuous tracking to manage complex cases with greater accuracy. For example, in 2021, global health spending reached an astounding USD 9.8 Trillion, representing 10.3% of the world's GDP, according to the World Economic Forum.

Shift toward Integrated and User-Friendly Monitoring Platforms

There is a growing movement toward compact, multifunctional systems in hemodynamic monitoring. Clinicians are seeking tools that merge accuracy with ease of use, especially in critical care and operating rooms where time and space are limited. The shift includes increased preference for platforms that combine multiple monitoring technologies in one device, reducing the need for separate setups. Features like touchscreen interfaces, mobile design, and rechargeable power are gaining traction, offering flexibility and continuous support in high-pressure settings. Simpler interfaces and faster setup times help clinical teams respond quickly, while integrated data from various sources enhances decision-making. As per the hemodynamic monitoring market forecast, the focus is clearly on improving both workflow and patient safety through smarter, more adaptable tools that meet the evolving demands of acute care environments. For instance, in July 2024, Getinge launched Pulsiocare, an advanced hemodynamic monitoring platform with a CE certificate. It combines PiCCO and ProAQT technologies into a single mobile monitor with a rechargeable battery, touchscreen, and an intuitive user interface, designed for critical care and operating room environments.

Hemodynamic Monitoring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hemodynamic monitoring market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, monitoring, and end-user.

Analysis by Product:

- Disposables

- Monitors

- Others

Monitors stood as the largest product in 2024, holding around 63% of the market. These devices provide continuous, real-time tracking of cardiovascular parameters such as blood pressure, cardiac output, and oxygen levels, which are essential for managing critically ill patients. Hospitals and emergency care units rely on these monitors to make fast, informed decisions during surgeries, trauma, or intensive care. The demand is increasing due to rising cardiovascular disease cases, expanding ICU admissions, and the shift toward minimally invasive procedures that still require detailed monitoring. Technological improvements like wireless connectivity and integration with electronic health records also make these systems more attractive, supporting broader adoption across healthcare facilities. As a result, monitors are a key revenue-driving segment in this space.

Analysis by Monitoring:

- Invasive Monitoring

- Minimally Invasive Monitoring

- Noninvasive Monitoring

Invasive monitoring led the market in 2024 due to its accuracy and reliability in critical care. These systems involve the insertion of catheters or sensors directly into the body, allowing precise measurement of parameters like arterial pressure, central venous pressure, and pulmonary artery pressure. Clinicians prefer invasive methods for high-risk surgeries, trauma cases, and severe cardiac conditions, where non-invasive tools may not provide sufficient data. The growing number of complex surgical procedures, especially in cardiac and transplant units, is boosting demand. Advancements in catheter design and integration with digital monitoring platforms have also improved safety and usability, leading to higher adoption in operating rooms and ICUs across both developed and emerging healthcare systems.

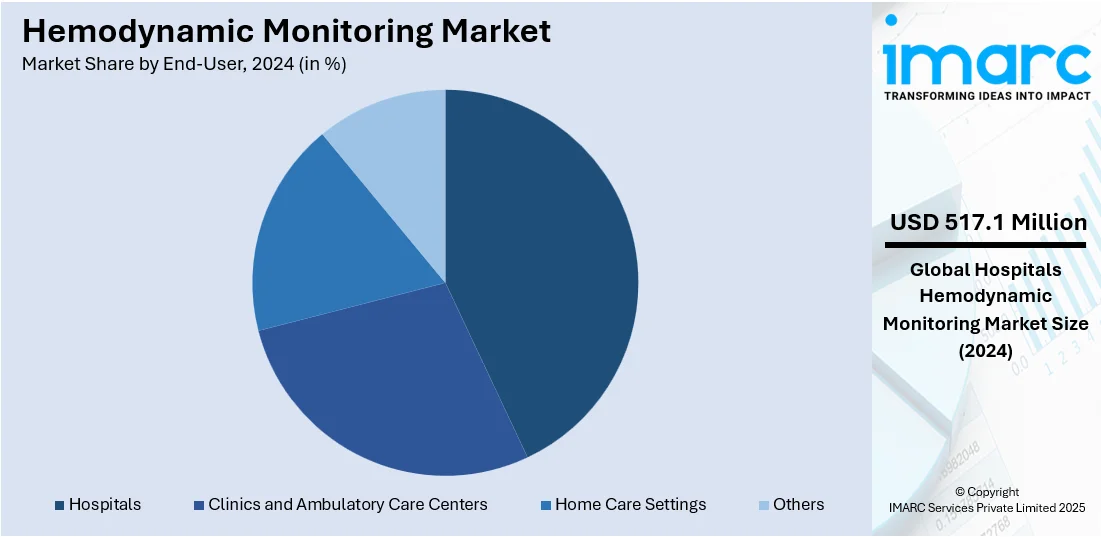

Analysis by End-User:

- Hospitals

- Clinics and Ambulatory Care Centers

- Home Care Settings

- Others

Hospitals led the market with around 43.2% of market share in 2024, owing to the high volume of critical care, surgical, and emergency procedures performed in these settings. Hospitals have the infrastructure and trained personnel to support invasive and non-invasive monitoring technologies, making them the primary users of advanced hemodynamic systems. Rising admissions for cardiovascular diseases, sepsis, and multi-organ failure cases drive the need for continuous and accurate monitoring. Government investments in hospital infrastructure, especially in emerging economies, further support adoption. Integration of monitoring systems with hospital information systems improves workflow and patient management, encouraging upgrades. As patient loads grow and clinical demands increase, hospitals continue to be the leading buyers of hemodynamic monitoring equipment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 35% due to a combination of advanced healthcare infrastructure, high healthcare spending, and early adoption of innovative medical technologies. The region has a large base of critical care and surgical procedures, which increases the need for precise monitoring tools. The presence of major medical device manufacturers, strong distribution networks, and continuous investment in research and development contribute to market leadership. Additionally, the rising prevalence of cardiovascular and respiratory diseases, especially among the aging population, drives demand for both invasive and non-invasive hemodynamic monitoring systems. Favorable reimbursement policies, widespread use of electronic health records, and skilled healthcare professionals further support adoption. The U.S. accounts for the largest share within the region, reflecting its robust hospital networks and ongoing emphasis on improving patient outcomes through advanced monitoring solutions.

Key Regional Takeaways:

United States Hemodynamic Monitoring Market Analysis

In 2024, the United States accounted for 88.1% of the market share in North America. The US hemodynamic monitoring market is primarily driven by the increasing prevalence of cardiovascular diseases (CVDs) and other chronic conditions. The American Heart Association (AHA) reported that in 2022, cardiovascular disease (CVD) caused 941,652 deaths in the U.S. Between 2017 and 2020, 127.9 Million adults had CVD. The total direct and indirect costs of CVD from 2020 to 2021 were USD 417.9 Billion. In line with this, the growing adoption of minimally invasive technologies, enabling safer and more efficient patient care, is propelling the market growth. Additionally, the rising demand for early detection and personalized treatment strategies is fostering market expansion. The ongoing shift toward value-based healthcare models, which prioritize improved patient outcomes, is further encouraging the use of hemodynamic monitoring systems. Furthermore, continual technological advancements in artificial intelligence and machine learning are enhancing data analytics and predictive capabilities, augmenting product sales. Similarly, the aging population’s growing healthcare needs promoting demand for intensive care solutions, is strengthening market demand. Moreover, the rising healthcare spending by both public and private sectors supporting the adoption of cutting-edge monitoring systems, is providing an impetus to the market.

Europe Hemodynamic Monitoring Market Analysis

The European hemodynamic monitoring market is experiencing growth due to the increasing prevalence of cardiovascular diseases (CVDs) and hypertension. In accordance with this, the region’s focus on improving patient outcomes through precision medicine is encouraging the adoption of hemodynamic monitoring systems. Similarly, the growing elderly population requiring intensive care is further strengthening market demand. The rise in non-invasive sensor technologies, which offer enhanced accuracy and patient comfort, is fueling market expansion. Additionally, Europe’s strong healthcare infrastructure and investments in advanced medical technologies are supporting the widespread use of hemodynamic monitoring devices. As such, in December 2024, the European Investment Bank (EIB) provided EUR 35 Million in financing to GVM Group, supported by InvestEU. The funds will support medical technology development, clinical research, and digital infrastructure improvements across GVM's healthcare facilities, with projects to be completed by 2027. Furthermore, favorable reimbursement policies in countries like Germany and the UK are promoting market development. The increasing emphasis on early detection and prevention of complications is also facilitating market growth. Besides this, the growing number of surgical procedures requiring real-time monitoring is creating lucrative opportunities in the market.

Asia Pacific Hemodynamic Monitoring Market Analysis

The market in Asia Pacific is predominantly propelled by the rapid expansion of healthcare infrastructure, which is improving access to advanced medical technologies across the region. In addition to this, the rising prevalence of lifestyle diseases such as diabetes and hypertension is augmenting demand in the market. According to the 2023 Indian Council of Medical Research – India Diabetes (ICMR INDIAB) study, the prevalence of diabetes in India stands at 10.1 crores. Similarly, the growing adoption of smart healthcare technologies, including wearable devices, is contributing to market growth. Furthermore, increasing healthcare expenditure by both governments and private sectors is facilitating the higher implementation of advanced hemodynamic monitoring systems. Likewise, the rising number of surgical procedures and critical care cases in countries like China and India is further propelling the market development. Moreover, the region's heightened focus on improving healthcare quality and patient outcomes through early intervention is impacting the market trends.

Latin America Hemodynamic Monitoring Market Analysis

In Latin America, the hemodynamic monitoring market is progressing, driven by the increasing healthcare investment from both public and private sectors. Furthermore, the rising awareness about early diagnosis and proactive patient management is fueling market demand. Additionally, the growing prevalence of cardiovascular diseases across the region is contributing to market growth. Apart from this, the expansion of healthcare facilities, especially in emerging markets like Brazil and Mexico, is enhancing access to advanced monitoring technologies, thus expanding the market's scope. Accordingly, in September 2024, Rede D'Or, Brazil's leading hospital group, plans to invest BRL 7.5 Billion by 2028, adding 5,400 beds, increasing capacity by 46%. The expansion will augment efficiency, with the company aiming for 200-bed hospitals and investing BRL 1.5 Million per bed.

Middle East and Africa Hemodynamic Monitoring Market Analysis

The market in the Middle East and Africa is significantly influenced by increasing government investments in healthcare infrastructure. In parallel, the rising prevalence of chronic diseases like hypertension and diabetes is driving market growth. Industry analysis reported that in Abu Dhabi, the age-adjusted hypertension prevalence increased from 24.5% at baseline to 35.2% in 2023. Also, the proportion of hypertensive patients with controlled blood pressure rose from 61.8% at baseline to 74.3% in 2023. Additionally, the region's growing focus on medical tourism, particularly in countries such as the UAE and Saudi Arabia, is stimulating market appeal. Besides this, the heightened adoption of digital health solutions and telemedicine is improving patient monitoring capabilities, thereby strengthening the market presence.

Competitive Landscape:

The market is seeing increased activity across product launches, partnerships, agreements, funding rounds, and R&D efforts. Companies are prioritizing real-time data integration, AI-based analytics, and minimally invasive technologies. Collaborations between device manufacturers and software firms are helping integrate advanced monitoring with existing clinical systems. Strategic agreements are also being used to expand distribution channels and enhance regional presence. Research is focused on improving predictive monitoring and patient outcomes in critical care settings. Government support is driving innovation, especially in public health systems adopting remote or advanced ICU technologies. Among these, product launches and collaborative agreements have become common practices, often used to introduce next-generation platforms or strengthen market positioning without building from scratch.

The report provides a comprehensive analysis of the competitive landscape in the hemodynamic monitoring market with detailed profiles of all major companies, including:

- Edwards Lifesciences Corporation

- Lidco Group PLC

- Deltex Medical Group PLC

- Pulsion Medical Systems SE

- GE Healthcare

- Osypka Medical GmbH

- Tensys Medical

- Teleflex Incorporated

- ICU Medical Inc.

- Argon Medical

- Schwarzer Cardiotek GmbH

Latest News and Developments:

- April 2025: Medtronic expanded its Acute Care & Monitoring portfolio by entering a distribution agreement with Retia Medical for the Argos cardiac output monitor. This advanced hemodynamic tool offers accurate data using Multi-Beat Analysis to support critically ill patients, complementing Medtronic's existing technologies and enhancing care in operating rooms and ICUs.

- March 2025: Forcura and Medalogix merged to create a leading post-acute care platform, enhancing patient care through intelligent decision support and streamlined transitions. The platform integrates AI and data analytics, focusing on home-based care, improving outcomes, and advancing hemodynamic monitoring capabilities, supported by investments from Berkshire Partners and The Vistria Group.

- September 2024: BD completed the acquisition of Edwards Lifesciences' Critical Care product group, renaming it BD Advanced Patient Monitoring. The acquisition strengthens BD's portfolio with advanced hemodynamic monitoring technologies, including AI-enabled clinical decision tools, predictive analytics, and integration capabilities for future closed-loop monitoring and treatment solutions.

Hemodynamic Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Disposables, Monitors, Others |

| Monitoring Covered | Invasive Monitoring, Minimally Invasive Monitoring, Noninvasive Monitoring |

| End-Users Covered | Hospitals, Clinics and Ambulatory Care, Centers, Home Care Settings, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Edwards Lifesciences Corporation, Lidco Group PLC, Deltex Medical Group PLC, Pulsion Medical Systems SE, GE Healthcare, Osypka Medical GmbH, Tensys Medical, Teleflex Incorporated, ICU Medical Inc., Argon Medical and Schwarzer Cardiotek GmbH |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hemodynamic monitoring market from 2019-2033.

- The hemodynamic monitoring market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hemodynamic monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hemodynamic monitoring market was valued at USD 1,196.88 Million in 2024.

The hemodynamic monitoring market is projected to exhibit a CAGR of 3.98% during 2025-2033, reaching a value of USD 1,731.81 Million by 2033.

Key factors include rising demand for critical care, increasing prevalence of cardiovascular and respiratory diseases, growing adoption of minimally invasive monitoring technologies, advancements in sensor and data integration, and supportive healthcare infrastructure investments. These trends are fueling interest from hospitals, emergency care providers, and ambulatory surgical centers.

North America dominated the hemodynamic monitoring market in 2024, accounting for a share of 35% due to advanced healthcare infrastructure, high adoption of innovative technologies, growing chronic disease cases, and strong presence of key medical device manufacturers.

Some of the major players in the hemodynamic monitoring market include Edwards Lifesciences Corporation, Lidco Group PLC, Deltex Medical Group PLC, Pulsion Medical Systems SE, GE Healthcare, Osypka Medical GmbH, Tensys Medical, Teleflex Incorporated, ICU Medical Inc., Argon Medical, Schwarzer Cardiotek GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)