Home Care Packaging Market Size, Share, Trends and Forecast by Product, Material Type, Packaging Type, and Region, 2026-2034

Home Care Packaging Market Size and Share:

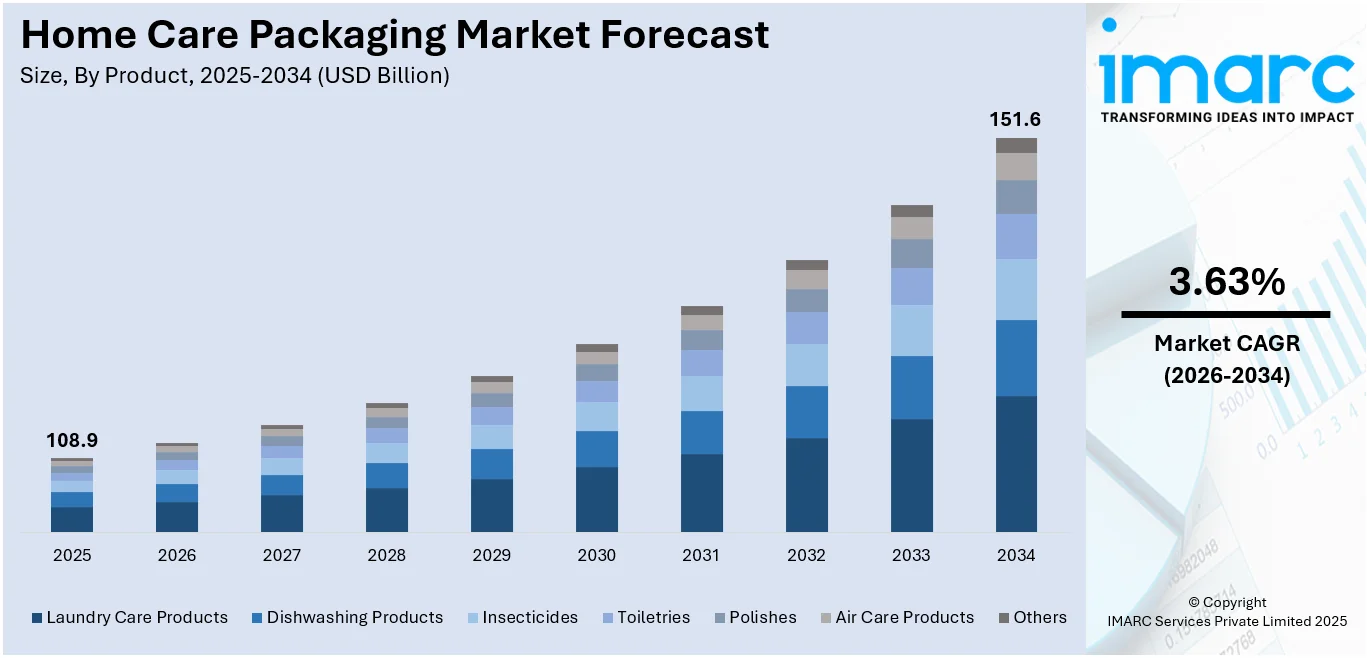

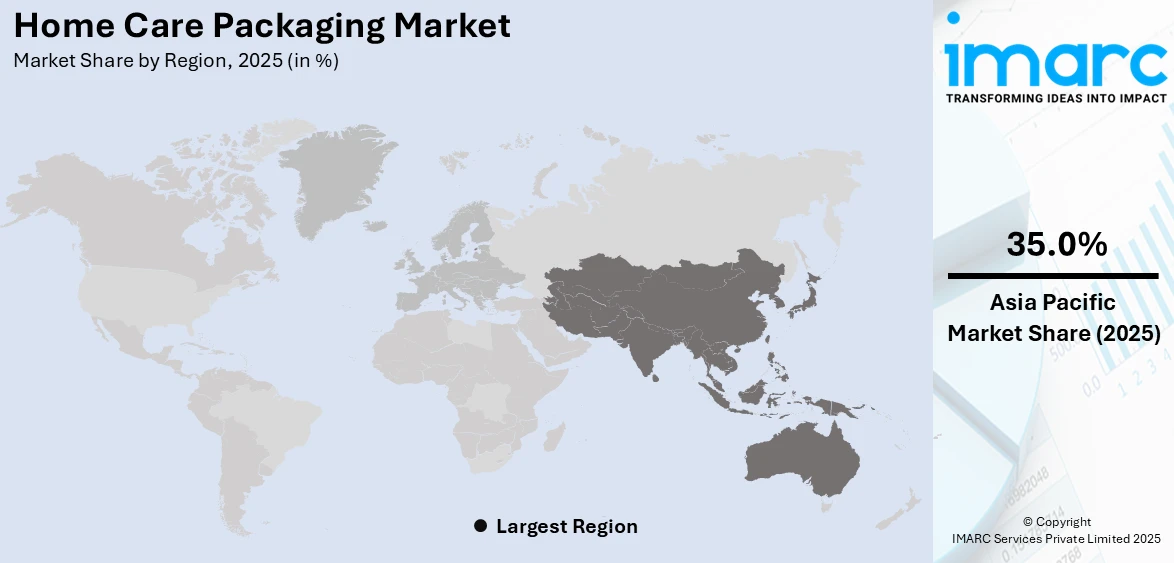

The global home care packaging market size was valued at USD 108.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 151.6 Billion by 2034, exhibiting a CAGR of 3.63% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of 35.0% in 2025. The dominance of the segment is attributed to its large population, increasing urbanization, and growing demand for consumer goods. Strong manufacturing capabilities, cost-effective production, and a rising middle-class user base contribute to the region's dominance in this sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 108.9 Billion |

|

Market Forecast in 2034

|

USD 151.6 Billion |

| Market Growth Rate 2026-2034 | 3.63% |

With the rise of online shopping, the demand for home care products packaged in ways that can withstand shipping challenges is increasing. Packaging needs to be durable and secure to prevent damage during transport. The expansion of e-commerce is catalyzing the demand for packaging that is easy to manage, opens effortlessly, and safeguards products from leakage or contamination. Besides this, advancements in packaging technology, including the implementation of smart packaging and innovations in barrier materials, are contributing to the market growth. These technologies improve the user experience through interactivity, monitoring, and enhanced product safety, allowing brands to stand out in a competitive landscape. Moreover, individuals are opting for packaging that offers convenience, such as easy-to-use spray nozzles, resealable pouches, or compact, lightweight designs. Packaging that enhances convenience in storage, transportation, and usage not only improves product appeal but also boosts sales.

To get more information on this market Request Sample

The United States is a crucial segment in the market, driven by stricter regulations and safety standards, which are encouraging manufacturers to adopt packaging solutions that comply with legal requirements. This encompasses features, such as child-proof lids and tamper-proof seals, to improve product safety. Moreover, there is a rise in the preference among individuals for eco-friendly packaging options, such as recyclable and biodegradable materials. This change is encouraging producers to create and implement eco-friendly methods in their packaging options. In 2025, TIPA (USA) introduced a home compostable metallized high-barrier film aimed at safeguarding snacks such as chips from oil, salt, and moisture. The 312MET Premium film provides a longer shelf life and is biodegradable, aiding worldwide initiatives to minimize plastic waste.

Home Care Packaging Market Trends:

Rising Demand for Household Insecticides

Household insecticides frequently include hazardous substances, so suitable packaging is crucial for safety and efficiency. The packaging needs to safeguard the contents from leaks or contamination while facilitating user convenience. Important elements such as child-proof caps, tamper-proof seals, and explicit labeling with usage guidelines are crucial for protecting users. Moreover, the packaging is crafted for effective dispensing and application, featuring elements like spray nozzles, trigger systems, and aerosol cans to guarantee proper use, reduce waste, and enhance performance. These characteristics not only improve safety but also add to the overall effectiveness of the product. The increasing need for home insecticides fuels the requirement for safe, effective packaging options. As per the report from the IMARC Group, the worldwide household insecticides market is projected to attain USD 30.1 billion by 2032, highlighting the significance of innovative packaging in this industry to enhance safety, convenience, and product efficiency.

Technological Advancements

Advancements in barrier materials and coatings are crucial for protecting home care products from external factors such as moisture, light, and oxygen, which can degrade or contaminate items like liquid detergents and cleaning agents. Technological progress is also driving the development of sustainable packaging solutions in the home care sector. This includes the use of biodegradable materials, recyclable packaging, and designs that minimize environmental impact, which are shaping the home care packaging market. In addition, smart features like near-field communication (NFC) tags, radio-frequency identification (RFID) chips, and nanotechnology are being integrated into packaging to enhance user interaction by providing engaging content and product information. In 2023, Amcor, a global leader in responsible packaging, announced a partnership with Nfinite Nanotechnology Inc. to validate the application of Nfinite's nanocoating technology in improving recyclable and compostable packaging, further advancing sustainability in the industry and promoting eco-friendly packaging solutions.

Expansion of E-Commerce Platforms

The IMARC Group’s report indicates that the global e-commerce market reached USD 21.1 trillion in 2023, prompting an increase in demand for packaging solutions that can withstand the challenges of shipping and handling. Home care products, in particular, require packaging that is durable, impact-resistant, and capable of protecting against leakage, damage, and contamination during transit. To meet these needs, packaging for e-commerce home care products often incorporates tamper-proof seals, secure closures, and protective barriers, ensuring the integrity of products during delivery. Additionally, efficient packaging designs help minimize dimensional weight fees, a crucial consideration in reducing transportation costs. The size and weight of packaging are continually optimized to strike a balance between cost-effectiveness and product safety. These advancements are vital for ensuring that home care items reach clients in perfect condition while also reducing logistical costs associated with worldwide distribution, thereby driving growth in the home care packaging market.

Home Care Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global home care packaging market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, material type, and packaging type.

Analysis by Product:

- Dishwashing Products

- Insecticides

- Laundry Care Products

- Toiletries

- Polishes

- Air Care Products

- Others

Laundry care products stand as the largest component in 2025, holding 28.5% of the market due to their essential nature, high user demand, and frequent employment in households globally. Laundry maintenance is an everyday essential for families globally, prompted by the constant demand for clean and sanitary garments. This persistent need guarantees a steady utilization of laundry detergents, fabric softeners, stain removers, and other related products, thus reinforcing the demand for robust packaging options. Apart from thus, the variety within the laundry care products, encompassing liquid detergents, powder detergents, pods, and fabric softeners, requires an assortment of packaging styles to satisfy various personal choices. Innovations in packaging such as easy-pour spouts, resealable lids, and ergonomic handles enhance convenience for users and product functionality, thus fueling the growth in the home care packaging market.

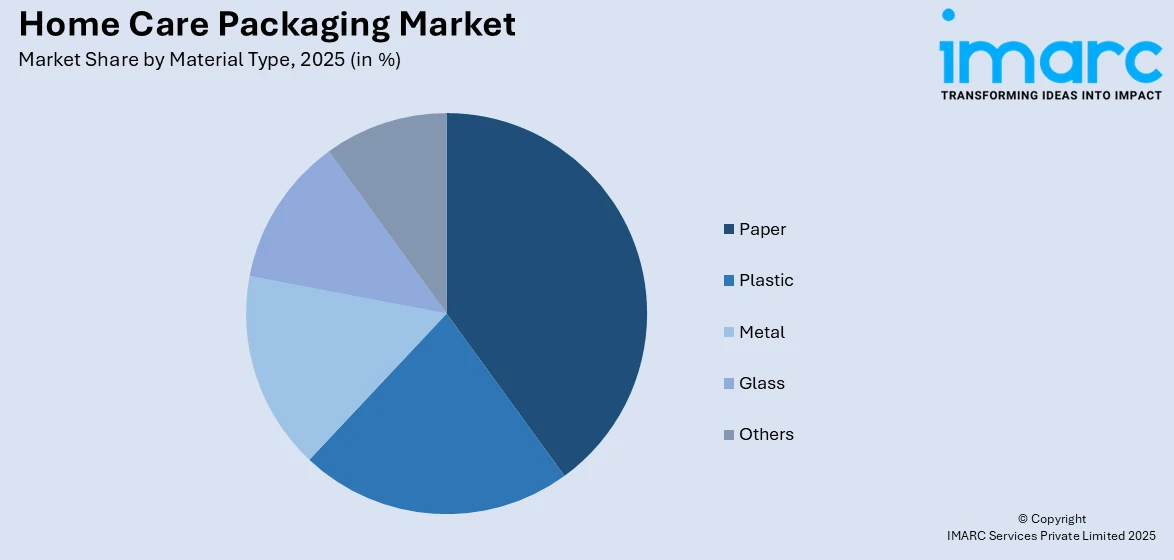

Analysis by Material Type:

Access the comprehensive market breakdown Request Sample

- Plastic

- Paper

- Metal

- Glass

- Others

In 2025, paper represented the largest segment, accounting 40.7% of the market share attributed to its sustainability, recyclability, and growing user preference for eco-friendly packaging options. Paper packaging is extremely adaptable, providing various options, ranging from boxes and cartons to bags and pouches, which is ideal for many household items like detergents, wipes, and tissues. Its adaptable design and printing features enable successful branding and product distinction on store shelves. Moreover, paper is both lightweight and robust, offering sufficient protection for items while remaining economical in comparison to other materials. In addition, the growing demand for environment-friendly packaging options and the worldwide initiative to minimize plastic waste is catalyzing the demand for paper in the home care packaging sector because of its sustainability and adaptability.

Analysis by Packaging Type:

- Bottles

- Metal Cans

- Cartons

- Pouches

- Others

Cartons dominate the market, holding approximately 35.8% of the share in 2025 because of their cost-effectiveness, versatility, and ability to provide robust protection while supporting sustainable packaging solutions. Cartons offer a safe and effective packaging option for household care items, such as detergents, cleaners, and personal care goods. Their sturdy construction enables the storage and transport of goods with minimal risk of breakage or leakage. Furthermore, cartons offer flexibility in design, which can be tailored through various printing techniques to enhance branding and visual appeal on store shelves. This lowers the expenses of transport and distribution, making it ideal for the expanding online market. In addition, cartons meet personal preferences for eco-friendly packaging options, as they are frequently produced from recyclable materials and can be obtained from renewable resources.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, the Asia-Pacific region held the biggest market share, with 35.0%, attributed to its large manufacturing base, growing urbanization, and rising demand for eco-friendly packaging. According to the National Bureau of Statistics of China’s website, the urbanization rate of permanent residents in 2023 hit 66.16 percent, an increase of 0.94 percentage points compared to the end of 2022. With numerous individuals relocating from countryside regions to urban centers, there is a significant rise in city households needing a range of home care items including detergents, cleaners, and personal care products. City residents frequently prioritize convenience, usability, and storage efficiency in their home care items, encouraging manufacturers to enhance packaging design and functionality. Moreover, regulatory bodies in the Asia Pacific area are enforcing strict rules on packaging materials and sustainability, motivating major companies to embrace environment-friendly and creative packaging solutions, which is bolstering the growth of the home care packaging market

Key Regional Takeaways:

United States Home Care Packaging Market Analysis

In North America, the market portion held by the United States was 88.20%, mainly fueled by increasing individual knowledge regarding hygiene and the burgeoning need for effective, easy-to-use packaging. A report from the industry revealed that 69% of people anticipate brands and retailers to provide sustainable packaging by 2025. Correspondingly, the rising number of dual-income families is encouraging the uptake of time-saving solutions that enhance convenience in everyday cleaning practices. The swift growth of e-commerce is shaping market evolution, maintaining product quality during transportation while improving visual attractiveness. Moreover, current urban lifestyle trends that demand compact, space-saving packaging appropriate for smaller households are contributing to the market growth. In addition, the transition towards refillable and reusable packaging types are transforming product distribution methods, which is in line with user sustainability demands. A market analysis revealed that around 63-67% of individuals in America view items packaged in cardboard or paper as appearing more upscale or expensive. The swift adoption of intelligent packaging technologies is also gaining momentum in the market, providing improved user engagement and traceability. Additionally, the rise of private-label brands, which inspires the creation of distinctive packaging designs, is enhancing market differentiation and client loyalty.

Europe Home Care Packaging Market Analysis

The European market is experiencing growth, driven by strict environmental regulations that encourage sustainable packaging, which is in line with the EU's goals for a circular economy. As a result, rising individual interest in sustainable living practices is promoting the use of recyclable and biodegradable packaging materials. Furthermore, the growing awareness about product safety and the demand for chemical-free cleaning solutions is fostering the use of inert and barrier-protective packaging technologies. The rising investments in packaging automation technologies, enhancing manufacturing efficiency and minimizing material waste, are bolstering the home care packaging market demand. In May 2025, Amazon installed hundreds of automated packaging machines throughout Europe, with over 70 in essential countries by 2025, to produce custom-sized boxes and paper bags. This minimizes waste, with lightweight bags being up to 90% lighter and saving 26g of packaging for each shipment. Moreover, the increasing appeal of refill stations and zero-waste retail formats, which are redefining conventional packaging approaches by encouraging reuse and minimizing ecological effects, is supporting the market expansion.

Asia Pacific Home Care Packaging Market Analysis

The home care packaging sector in Asia Pacific is significantly influenced by swift urban development and increasing disposable income levels. Additionally, increasing user awareness regarding hygiene and cleanliness is driving the use of tamper-evident and antimicrobial packaging solutions. Furthermore, the growth of e-commerce platforms throughout the region, increasing the need for sturdy, lightweight packaging to guarantee product safety during shipping. As per DPIIT, a variety of websites have been introduced in India recently to meet diverse user demands. By the end of last year, online shopping platforms combined produced an astonishing income of INR 138 Billion. Furthermore, beneficial government policies promoting sustainable packaging and waste management, encouraging manufacturers to create eco-friendly options, further improving market accessibility. The growth of contemporary retail formats, enhancing shelf attractiveness and client interaction, is supporting the market growth. In addition, ongoing improvements in smart packaging innovations, such as QR codes and NFC tags, are boosting product traceability and user engagement, thereby generating even more profitable market prospects.

Latin America Home Care Packaging Market Analysis

In Latin America, the market is progressing because of growing user interest in sustainable and biodegradable materials. Additionally, increasing urbanization and an expanding middle class are driving the need for convenient and innovative packaging options. Moreover, the growth of online shopping platforms is catalyzing the demand for sturdy, protective packaging to maintain product quality during shipping. Moreover, rising investments from local producers in advanced packaging technologies are boosting competitiveness and encouraging ongoing innovation in the market. In April 2025, Klabin launched Piracicaba II, the biggest and most sophisticated corrugated packaging facility. The facility in Brazil, with a USD 287 Million investment, generates 240,000 tons each year by utilizing Industry 4.0 technologies and automated logistics systems.

Middle East and Africa Home Care Packaging Market Analysis

The Middle East and Africa market is driven by rising government efforts aimed at sustainability and waste management changes in line with Vision 2030 and comparable national plans. Additionally, increasing individual interest in high-quality, sustainable packaging for personal care items is offering a favorable home care packaging market outlook. Moreover, the swift growth of e-commerce is catalyzing the demand for creative, sturdy packaging options designed for specific regional logistical issues. According to a report by EZDubai, the e-commerce market in the UAE reached AED 32.3 Billion (USD 8.8 Billion) in 2024 and is projected to surpass AED 50.6 Billion (USD 13.8 Billion) by 2029. Additionally, strategic partnerships among local manufacturers and international suppliers are improving technological skills and speeding up the use of advanced packaging materials.

Competitive Landscape:

Major participants in the market are emphasizing sustainability through the use of eco-friendly materials, including recyclable and biodegradable alternatives, to address the increasing demand for environmentally responsible products. They are also putting resources into creative packaging designs that improve convenience, usefulness, and visual attraction. These firms are investigating innovative technologies, such as intelligent packaging and digital printing, to provide tailored solutions and enhance the client experience. Leading companies are also are enhancing their positions through strategic acquisitions and partnerships to expand capabilities, strengthen market share, and drive innovation. In October 2024, Silgan Holdings completed its acquisition of Weener Plastics, a global provider of dispensing solutions. The EUR 700 Million deal strengthened Silgan’s position in personal care, food, and healthcare packaging. Expected synergies of EUR 20 Million and expanded capabilities aim to accelerate earnings and enhance global sustainable packaging operations.

The report provides a comprehensive analysis of the competitive landscape in the home care packaging market with detailed profiles of all major companies, including:

- Amcor Plc

- AptarGroup Inc.

- Ball Corporation

- DS Smith Plc

- Mondi Group

- ProAmpac

- Silgan Holdings

- Sonoco Products Company

- Tetra Laval International SA

- Winpak Ltd. (Wihuri Packaging Oy)

Latest News and Developments:

- May 2025: SUPA Innovations launched the world’s first plastic-free paper bottle for handwash, featuring a compostable pine-sap lining and reusable metal pump. This eco-mate innovation reflects growing efforts in dishwashing and personal care sectors to eliminate plastic and enable circular, sustainable packaging solutions.

- May 2025: Amcor completed its all-stock merger with Berry Global, strengthening its position in consumer and healthcare packaging. The deal is expected to generate USD 650 Million in synergies by FY28 and augment annual cash flow beyond USD 3 Billion, enhancing innovation, sustainability, and shareholder returns across global packaging markets.

- February 2025: Mondi and Proquimia launched recyclable, paper-based stand-up pouches for dishwasher tabs in Spain and Portugal. Made from over 85% paper using Mondi’s Functional Barrier Paper 95/5, the pouches reduce CO2 emissions, offer user-friendly features, and align with both companies’ sustainability and product protection goals.

- August 2024: ALPLA and zerooo introduced reusable, recyclable 300ml PET bottles for cosmetics and care products, featuring laser-engraved tracking codes. Launching in Germany in September and Austria in October, the system promotes circular economy goals with returnable packaging, extended bottle life, and reduced environmental impact through reuse and recycling.

Home Care Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Home Care Packaging Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dishwashing Products, Insecticides, Laundry Care Products, Toiletries, Polishes, Air Care Products, Others |

| Material Types Covered | Plastic, Paper, Metal, Glass, Others |

| Packaging Types Covered | Bottles, Metal Cans, Cartons, Pouches, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor Plc, AptarGroup Inc., Ball Corporation, DS Smith Plc, Mondi Group, ProAmpac, Silgan Holdings, Sonoco Products Company, Tetra Laval International SA, Winpak Ltd. (Wihuri Packaging Oy) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the home care packaging market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global home care packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the home care packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home care packaging market was valued at USD 108.9 Billion in 2025.

The home care packaging market is projected to exhibit a CAGR of 3.63% during 2026-2034, reaching a value of USD 151.6 Billion by 2034.

The home care packaging market is driven by the increasing user awareness about sustainability, demand for convenient and efficient packaging, innovations in eco-friendly materials, and the growth of the e-commerce sector. Additionally, rising disposable incomes, urbanization, and changes in individual preferences towards premium and personalized products further propel the market growth.

Asia Pacific currently dominates the home care packaging market, accounting for a share of 35.0%. The dominance of the region is because of its large manufacturing base, growing urbanization, and increasing demand for eco-friendly packaging. The region's expanding middle class, coupled with rising disposable incomes, drives individual spending on packaged home care products.

Some of the major players in the home care packaging market include Amcor Plc, AptarGroup Inc., Ball Corporation, DS Smith Plc, Mondi Group, ProAmpac, Silgan Holdings, Sonoco Products Company, Tetra Laval International SA, Winpak Ltd. (Wihuri Packaging Oy), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)