Home Fitness Equipment Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Home Fitness Equipment Market Size and Share:

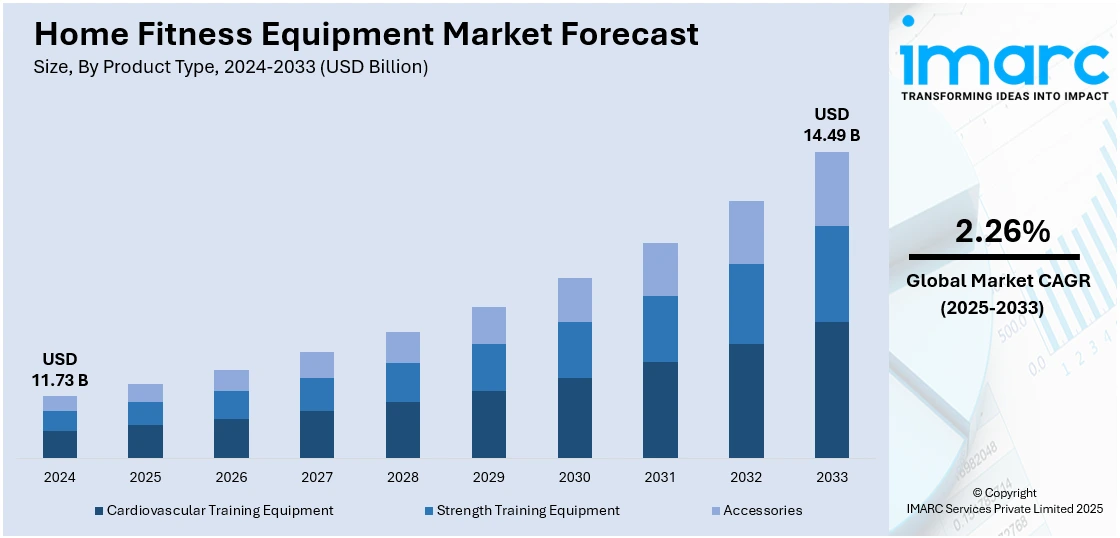

The global home fitness equipment market size was valued at USD 11.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.49 Billion by 2033, exhibiting a CAGR of 2.26% during 2025-2033. North America currently dominates the market, holding a significant market share of 35.3% in 2024. The growing health consciousness among consumers, rising awareness regarding the product’s convenience, significant technological advancements, increasing disposable incomes, development of specialized equipment for niche workout forms, and aggressive marketing and branding activities by manufacturers are some of the major factors propelling the home fitness equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.73 Billion |

| Market Forecast in 2033 | USD 14.49 Billion |

| Market Growth Rate (2025-2033) | 2.26% |

The growing health consciousness and awareness about the importance of regular physical activity are encouraging individuals to invest in home fitness solutions. Additionally, the convenience of working out at home without the need for gym memberships or travel is attracting busy professionals. Technological advancements, including smart fitness equipment with features such as virtual workouts, performance tracking, and connectivity to apps, are enhancing the user experience and attracting tech-savvy consumers. Moreover, the impact of the COVID-19 pandemic has significantly influenced the market, as lockdowns and gym closures led people to purchase home fitness equipment, and the trend has continued post-pandemic as individuals prefer the flexibility and privacy of home-based workouts.

The U.S. home fitness equipment market growth is driven by growing health consciousness and the desire for convenient workout options at home, without the need for gym memberships, which are key motivators. Technological advancements like smart equipment with virtual classes, tracking features, and connectivity attract tech-savvy users. The convenience of home workouts fits busy lifestyles and schedules, further boosting demand. Lastly, the COVID-19 pandemic played a significant role, with gym closures leading many to purchase home fitness equipment. This shift to home-based exercise has persisted, influencing long-term market growth in the U.S. For instance, in September 2023, Centr, a health and wellness platform established by Chris Hemsworth, unveiled 27 new products, which encompass curated Fitness Kits (Strength, Core, Workout, Recovery) and Strength Training Equipment now accessible on Walmart.com and in 3,000 Walmart locations across the country. Providing top-notch products that are affordable and offer outstanding value, the new Centr equipment, featuring the Centr 1 Home Gym, a fresh functional fitness cable machine, and fitness accessories, was designed to enhance home settings with its elegant, sleek, and streamlined appearance. Centr’s latest physical offerings advance the company’s goal of delivering complete tools and resources for people to lead longer, healthier, and happier lives.

Home Fitness Equipment Market Trends:

The growing health consciousness among consumers

The increasing emphasis on health consciousness stands as a dominant driver in the expanding home fitness equipment market. Sedentary lifestyles have become the norm in fast-paced lifestyles, leading to obesity, diabetes, and cardiovascular diseases, which are causing consumers to be more proactive about their health. For instance, obesity among males climbed from 4.8% to 14.0% between 1990 and 2022, while among women, it increased from 8.8% to 18.5%, according to the Obesity Evidence Hub, a global database that analyzes adult body mass index (BMI) data from 200 nations. The number of obese adults worldwide increased from 194 million in 1990 to 878 million in 2022, which is in line with this development. Furthermore, information dissemination through digital platforms is amplifying awareness about the necessity of regular physical exercise for long-term wellness. Besides this, educational content from healthcare providers, influencers, and organizations is reaching consumers more effectively than ever, outlining the dire consequences of neglecting physical health. According to the home fitness equipment market forecast, the surging healthcare costs for treating lifestyle-related ailments are causing consumers to see the value in preventive measures. As a result, the escalating investment in home fitness equipment is becoming a rational decision when evaluated against the potential impact of lifestyle diseases.

The rising awareness regarding product’s convenience

The convenience offered by home fitness equipment is a compelling factor driving the market growth. Modern-day consumers face a range of commitments, such as professional responsibilities and social obligations, which makes it challenging to carve out time for a visit to the gym. As per WHO, in 2022, 31% of adults (1.8 billion) lacked sufficient physical activity, with inactivity projected to reach 35% by 2030. Furthermore, the travel time to and from the gym and the availability of gym equipment during peak hours add layers of complexity to an already busy schedule. Home fitness equipment offers the flexibility to exercise at any time, be it early morning or late at night, effectively eliminating the logistical barriers associated with gym workouts. Moreover, it allows consumers to multitask and possibly catch up on news, answer emails, or even attend virtual meetings while using certain types of home fitness equipment. This multipurpose utility appeals to time-conscious consumers who are always looking to optimize their schedules, which is further creating a positive impact on the home fitness equipment market outlook.

The significant technological advancements

Technology integration is a pivotal factor boosting the market growth. The latest generation of home fitness devices comes embedded with smart features, including digital touchscreens, heart rate monitors, and Bluetooth connectivity. According to an industry report, around 45% of active adults use fitness apps for progress tracking and motivation, while 35% rely on wearables like smartwatches and fitness trackers to monitor activity levels and health metrics. These features transform a traditional workout into an interactive experience, elevating user engagement and motivation. Furthermore, several home fitness equipment brands are also compatible with various health and exercise apps, allowing users to track and analyze their performance metrics effortlessly, thereby contributing to a more informed and efficient workout regimen. Besides this, the introduction of interactive and live-streaming workouts, allowing users to join virtual classes or training sessions, is acting as another crucial factor enhancing the home fitness equipment market size. These technological features not only add value but also create a sense of community and accountability, making users more likely to stick to their fitness routines.

Home Fitness Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global home fitness equipment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Cardiovascular Training Equipment

- Air Bike

- Elliptical Machines

- Punching Bag

- Rowing Machine

- Treadmill

- Others

- Strength Training Equipment

- Ab Wheel

- Adjustable Dumbbells

- Adjustable Kettlebell

- Medicine Ball

- Mini Resistance Bands

- Pull Up Bars

- Weight-Lifting Bench

- Others

- Accessories

- Foam Roller

- Weighted Jump Rope

- Others

Cardiovascular training equipment stand as the largest product type in 2024, holding around 60.2% of the market due to escalating awareness of the importance of cardiovascular health among the masses. Additionally, cardiovascular equipment, such as treadmills, ellipticals, and exercise bikes, is versatile and caters to a wide range of fitness levels. Furthermore, they are designed to be compact and foldable, making them highly suitable for home use where space might be limited. Apart from this, cardiovascular equipment is user-friendly, requiring little to no prior experience for effective usage, which makes it more accessible to people who are new to exercising at home. Besides this, modern cardiovascular equipment often comes with advanced features such as heart rate monitors, Bluetooth connectivity, and interactive training programs, enhancing the training experience and offering more value to consumers.

Analysis by Distribution Channel:

- Offline

- Online

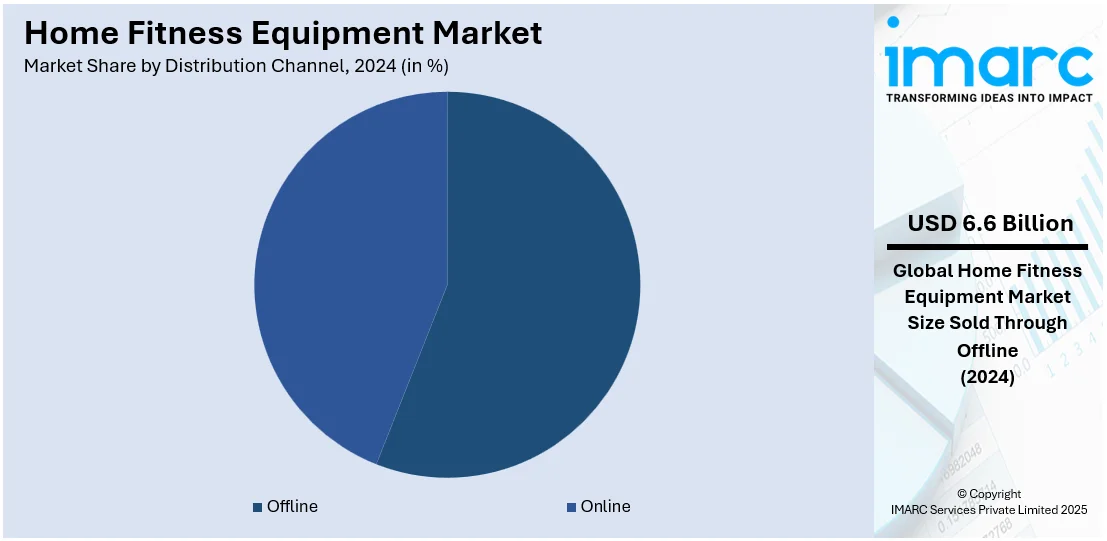

Offline leads the market with around 56.2% of market share in 2024 due to the need for hands-on product experience. Before purchasing, consumers prefer to physically test equipment like treadmills, bikes, and weights to assess quality, comfort, and functionality. Specialized fitness stores and large sporting goods retailers offer expert advice, demonstrations, and after-sales services that build customer trust. Additionally, high-value fitness equipment often involves a significant investment, making buyers more cautious and inclined toward in-person purchases. Promotions, financing options, and personalized customer service further strengthen the offline buying experience, maintaining its dominance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.3%. North America has a high standard of living and disposable income, enabling consumers to invest in home fitness equipment as a one-time cost against recurring gym membership fees. Furthermore, the strong emphasis on health and wellness among the regional population, owing to the public awareness campaigns and educational initiatives, is supporting the home fitness equipment market demand. Additionally, North America is at the forefront of technological innovations in the fitness industry, such as digital connectivity, virtual trainers, and workout analytics, which aid in attracting more consumers. Besides this, the fast-paced nature of life in the region makes it challenging for individuals to allocate time for gym visits, making home fitness equipment an attractive option. Apart from this, the robust e-commerce sector in North America, which has made it easier for consumers to research and purchase home fitness equipment online, is facilitating the market growth.

Key Regional Takeaways:

United States Home Fitness Equipment Market Analysis

In 2024, the United States accounted for over 88.20% of the home fitness equipment market in North America. The United States home fitness equipment market is primarily driven by the rising prevalence of sedentary lifestyles and obesity encouraging convenient, long-term health management. According to CDC population data from 2023, 23 states reported adult obesity rates exceeding 35%, a sharp increase from 2013 when no state had reached this level. Additionally, at least 20% of adults in every U.S. state are living with obesity, highlighting the urgent need for accessible fitness solutions. Similarly, continual advancements in smart fitness technology, including AI-powered coaching and interactive workout programs, enhancing user engagement by offering personalized experiences is impelling the market. The growing affordability and accessibility of connected fitness equipment, such as smart treadmills and resistance training machines, is bolstering market development. Furthermore, the rising interest in multifunctional, space-saving equipment appealing to urban dwellers with limited living areas is encouraging the higher product adoption. Additionally, increasing employer-sponsored wellness programs and health incentives encouraging individuals to incorporate fitness into their daily routines is supporting market demand. Moreover, rising disposable incomes and increased consumer spending on health and wellness further is creating lucrative market opportunities.

Europe Home Fitness Equipment Market Analysis

The Europe equipment market is expanding due to the increasing aging population prioritizing health and mobility. In the WHO European Region, the population aged 60 and older is growing rapidly, from 215 million in 2021 to a projected 247 million by 2030 and over 300 million by 2050. Similarly, rising awareness of preventive healthcare foe the requirement of maintaining long-term well-being is propelling the market growth. The ongoing shift toward remote and hybrid work models driving demand for convenient at-home workout options is fostering market expansion. An industry survey revealing that 75% of employees in Europe prefer a hybrid work arrangement. Furthermore, the increasing adoption of high-intensity interval training (HIIT) and functional training fueling demand for compact, multi-purpose fitness equipment is impelling the market. The growing consumer preference for eco-friendly fitness equipment, such as manually operated treadmills and sustainable materials, is shaping market trends. Besides this, the rising popularity of personalized fitness apps and on-demand digital coaching making at-home exercise more accessible and engaging is positively influencing the market.

Asia Pacific Home Fitness Equipment Market Analysis

The home fitness equipment market in Asia Pacific is propelled by rapid urbanization, rising incomes, and changing consumer preferences. According to the United Nations Development Programme, over 50% of Asia and the Pacific’s population now resides in urban areas, accounting for 54% of the global urban population. This shift, combined with increasing middle-class incomes, is driving higher discretionary spending on home fitness solutions. Furthermore, the growing popularity of virtual fitness communities and app-based coaching is augmenting market demand. Similarly, high population density in major cities encouraging consumers to invest in compact, space-efficient workout machines suited for smaller living spaces is impelling the market. The growth in post-pandemic health awareness further motivating individuals to adopt home-based fitness routines for long-term well-being is stimulating market appeal. Apart from this, the expansion of direct-to-consumer fitness brands and e-commerce platforms, enabling consumers to invest in personalized workout solutions that align with their fitness goals is improving market accessibility.

Latin America Home Fitness Equipment Market Analysis

The Latin America home fitness equipment market expansion is attributed to the growing concerns over lifestyle diseases, including obesity and cardiovascular issues. In accordance with this, the increasing penetration of high-speed internet and digital platforms augmenting demand for connected fitness equipment with virtual coaching and on-demand workout programs is impelling the market. According to an industry report, 5G connections in Latin America rose to 67 million in Q3 2024, with 11 million new connections added, reflecting a strong 19% growth rate. Moreover, the rise of fitness influencers and social media-driven workout trends encouraging individuals to embrace home-based exercise routines tailored to their fitness goals are impacting the market trends.

Middle East and Africa Home Fitness Equipment Market Analysis

The market for home fitness equipment in Middle East and Africa is mainly influenced by growing disposable incomes and an expanding middle class. In addition to this, the rise of hybrid fitness models that integrate virtual coaching with connected fitness gear, is fostering expansion in the market. An industry report noted that, hybrid fitness classes gained traction with 25% interest in KSA and 22% in the UAE. Meanwhile, high-tech workouts, including AI coaching and virtual fitness, appealed to 19% in KSA and 15% in the UAE, indicating rising digital fitness adoption. Furthermore, extreme climate conditions in many regions rendering indoor exercise more practical, is propelling growth in the market. Besides this, growing government-led health awareness campaigns promoting active lifestyles are providing an impetus to the market.

Competitive Landscape:

The market for home fitness equipment is substantially competitive, with several players providing a range of products. Major companies lead the industry with their innovative smart equipment and integrated workout apps. Technogym focuses on high-end, luxury fitness solutions, while ProForm targets budget-conscious consumers. The rise of app-based platforms like Centr and Tonal has intensified competition, offering customized workout experiences and smart machines. New entrants, such as Hydrow for rowing and FightCamp for boxing, are carving out niche segments. The market is further driven by growing consumer demand for convenience, connected fitness, and personalized solutions. As consumers increasingly prioritize health and fitness, competition among these brands is expected to intensify, fostering innovation and expansion in the sector.

The report provides a comprehensive analysis of the competitive landscape in the home fitness equipment market with detailed profiles of all major companies, including:

- Adidas AG

- Brunswick Corporation

- PureGym Limited

- Hoist Fitness Systems Inc.

- iFIT Health & Fitness Inc.

- Johnson Health Tech. Co. Ltd.

- Technogym S.p.A.

- True Fitness Technology Inc.

- Vectra Fitness Parts LLC

Latest News and Developments:

- February 2025: Interactive Strength Inc. (TRNR) acquired Sportstech, a USD40M+ connected fitness company, expanding its global presence in home fitness. The all-stock deal strengthens TRNR’s portfolio, integrating Sportstech’s smart equipment and app-based fitness solutions. The acquisition supports TRNR’s strategy for growth in the fragmented wellness market.

- January 2025: QNET India launched MyHomePlus Mini HomeGym, a compact, advanced fitness machine for home workouts. It enables seven strength training exercises, featuring an adjustable bench, improved safety, durable frame, and ergonomic design. Ideal for busy individuals, it offers convenience, stability, and effectiveness for achieving fitness goals at home.

- November 2024: Speediance unveiled two new at-home fitness products: the VeloNix Stationary Bike and Gym Monster 2. The VeloNix features motor-controlled resistance and real-time tracking, while the Gym Monster 2 offers AI-powered weight recommendations and Velocity-Based Training. Speediance continues expanding smart, accessible fitness solutions globally.

- October 2024: Echelon introduced Strength Home, a compact, connected strength training system featuring smart resistance, a 24" HD touchscreen, and customizable workouts. Designed for home use without wall installation, it offers guided training, community workouts, and seamless integration with Echelon's fitness ecosystem, starting at USD 2,499.99.

- September 2024: iFIT launched a new lineup of smart fitness equipment featuring an updated iFIT OS and AI Coach. The lineup includes 40+ smart products across NordicTrack and ProForm home fitness brands, with advanced incline training, SmartAdjust, and ActivePulse technology. AI Coach personalizes workouts, integrates entertainment, and enhances the fitness experience.

Home Fitness Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, Brunswick Corporation, PureGym Limited, Hoist Fitness Systems Inc., iFIT Health & Fitness Inc., Johnson Health Tech. Co. Ltd., Technogym S.p.A., True Fitness Technology Inc., Vectra Fitness Parts LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the home fitness equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global home fitness equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the home fitness equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home fitness equipment market was valued at USD 11.73 Billion in 2024.

The home fitness equipment market is projected to exhibit a CAGR of 2.26% during 2025-2033, reaching a value of USD 14.49 Billion by 2033.

The home fitness equipment market is driven by increasing health consciousness, technological advancements (smart, connected devices), growing demand for convenience (home workouts), and the impact of COVID-19. These factors have fueled interest in accessible, flexible fitness solutions, with consumers preferring home-based options over gym memberships.

North America currently dominates the home fitness equipment market due to increasing health consciousness, technological advancements in smart fitness devices, and the impact of COVID-19, which has led to a shift towards home-based workouts. These factors have contributed to a growing demand for accessible and convenient fitness solutions.

Some of the major players in the home fitness equipment market include Adidas AG, Brunswick Corporation, PureGym Limited, Hoist Fitness Systems Inc., iFIT Health & Fitness Inc., Johnson Health Tech. Co. Ltd., Technogym S.p.A., True Fitness Technology Inc., Vectra Fitness Parts LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)