Home Shopping Market Size, Share, Trends and Forecast by Product Type, Market Type, and Region, 2025-2033

Home Shopping Market Size and Share:

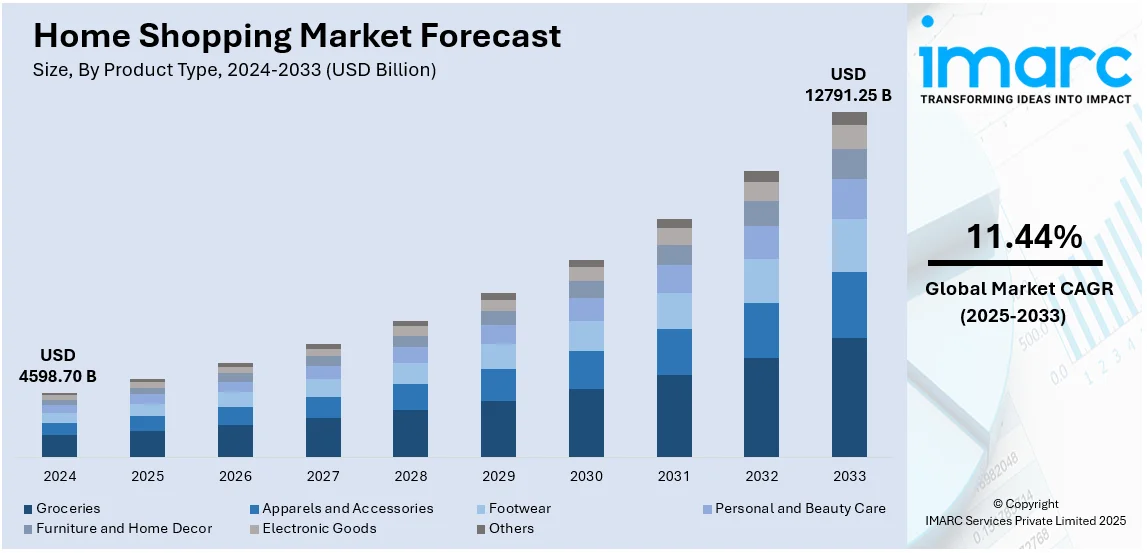

The global home shopping market size was valued at USD 4,598.70 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12,791.25 Billion by 2033, exhibiting a CAGR of 11.44% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 40.0% in 2024. The inflating disposable incomes of consumers, rapid digitalization, high adoption of online shopping through e-commerce sites, and the widespread adoption of home shopping models by businesses to reach and serve a broader consumer base, are some of the key factors fueling the home shopping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4,598.70 Billion |

|

Market Forecast in 2033

|

USD 12,791.25 Billion |

| Market Growth Rate (2025-2033) | 11.44% |

The market for home shopping is driven by several key factors, including the growing adoption of e-commerce, increasing internet penetration, and the convenience of shopping from home. The rise of mobile shopping apps, AI-powered recommendations, and personalized marketing enhances customer experience, boosting sales. Changing consumer lifestyles, busy schedules, and demand for contactless shopping have accelerated the shift to online and TV-based home shopping. Secure digital payment options, attractive discounts, and subscription-based shopping models also contribute to market expansion. Additionally, advancements in augmented reality (AR) and virtual reality (VR) enhance product visualization, increasing consumer confidence. The growing influence of social media, influencer marketing, and live-stream shopping further fuels demand, making home shopping a dominant retail trend.

The market for home shopping in the United States is driven by the increasing adoption of e-commerce, high internet penetration, and growing consumer preference for convenience. The rise of mobile shopping apps, AI-driven recommendations, and personalized marketing strategies enhance the shopping experience. Busy lifestyles, demand for contactless shopping, and flexible return policies further boost online and TV-based home shopping. Secure digital payment methods, same-day delivery options, and attractive discounts drive consumer engagement. Social media, influencer marketing, and live-stream shopping also contribute to market growth, making home shopping a preferred choice for a broad range of consumers across the country. For instance, in October 2024, 1WorldSync, the Chicago-based tech firm that supplies top brands and retailers with essential product details to assist consumers in their buying choices, published its 2024 Consumer Product Content Benchmark Report, which includes insights gathered from 1,750 shoppers throughout the United States and Canada. The in-depth research highlights the impact of product details on consumer behavior during the buying process in today's omnichannel retail landscape. 41% of shoppers indicate they have enhanced their engagement with retail e-commerce platforms and marketplaces relative to 2023, whereas merely 9% have decreased their involvement in these areas.

Home Shopping Market Trends:

Expanding E-commerce Sector

The increasing availability of numerous products such as apparels and accessories, footwear, personal and beauty care, etc., across e-commerce channels, offering a wide range of options to choose from, door-step delivery, and easy payment options, is creating a positive outlook for the overall market. In addition to this, the increasing penetration of the internet, facilitating easy access to inline marketplaces, is also contributing to the market growth. For instance, globally, 5.3 Billion people, 66% of the world's population, were using the Internet in 2022. This represents an increase of 24% since 2019, according to the International Telecommunication Union (ITU). Additionally, the increasing affordability of the internet and rising mobile phone ownership is also driving the sales in the home shopping market. Most internet users consider mobile phones the primary device for accessing home shopping. Thus, the growth potential for e-commerce in the market is directly correlated to internet and smartphone penetration, as mobile apps have emerged as a major gateway for customer purchases.

Increasing Integration of Smart Technology

The escalating adoption of artificial intelligence and machine learning, virtual reality, and augmented reality in home shopping is expected to create a positive home shopping market outlook. For instance, IKEA uses VR Experience to provide an in-app virtual shopping experience. Similarly, Lenskart, India's leading optical prescription eyewear retail chain, supports the '3D Try On' feature through its website and app, offering options to compare models and brands, saving time and effort, and offering better discounts or vouchers. Similarly, Burrow, a DTC furniture brand, utilizes AR to help customers visualize how their couches will look in their living rooms. Innovations like these are anticipated to propel the growth of the market. Moreover, various companies promoting their products through teleshopping and e-commerce are also offering newer and more convenient payment options, like Apple Pay, Paypal, and other financing options, that allow frictionless checkout. As per an industry report, 2.77 Billion individuals shopped online by 2025, accounting for 33% of the world’s population with a 2.2% annual increase. Forecasts project 2.86 Billion online shoppers by 2026, driven by growing internet penetration and eCommerce convenience. Additionally, key players are also adopting the subscription model for maintaining customers for long-term value. Such innovations are anticipated to increase the home shopping market revenue in the forecasted period.

Increasing Spend on Social Media Ads

Various retailers and business owners from several sectors are extensively spending on the social media platforms to promote and advertise their products and services. In addition to this, they are integrating advanced marketing strategies and methodologies to attract customers and increase sales, which is creating a positive outlook for the overall market. For instance, pay-per-click marketing technique is one of the growing trends in the home shopping market. It gives more control over search queries and audience reach. The most recent reports reveal that 72% of marketers spend more on social ads. Moreover, various retailers are also offering a video-calling service with in-store experts, which is further propelling the growth of the market. For instance, in June 2020, Currys PC World launched ShopLive, a video-calling service with in-store experts to assist while shopping online. Such initiatives are projected to cater to the growth of the market in the coming years.

Home Shopping Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global home shopping market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and market type.

Analysis by Product Type:

- Groceries

- Apparels and Accessories

- Footwear

- Personal and Beauty Care

- Furniture and Home Decor

- Electronic Goods

- Others

Groceries are expected to hold the largest share of the market due to the rising demand for convenience, rapid delivery options, and subscription-based grocery services. Busy lifestyles, urbanization, and the expansion of online grocery platforms like Instacart, Amazon Fresh, and Walmart+ drive market growth. Consumers prefer home delivery of fresh produce, packaged foods, and daily essentials, reducing the need for in-store visits. Additionally, AI-powered recommendations, contactless payments, and personalized shopping experiences enhance customer engagement and retention.

The apparel and accessories segment dominates home shopping demand due to the increasing influence of e-commerce, social media, and influencer marketing. Consumers prefer online shopping for fashion due to vast product selections, discounts, and personalized recommendations. Virtual try-on technologies, augmented reality (AR), and AI-powered sizing guides enhance user confidence in online purchases. Fast fashion brands and premium retailers leverage digital platforms for direct-to-consumer sales, while return-friendly policies and flexible payment options further drive online apparel shopping growth.

Footwear holds a significant share of the market due to digital innovations in sizing technology, customization options, and brand-exclusive online collections. Consumers prefer shopping online for sneakers, formal shoes, and casual footwear due to competitive pricing, detailed product descriptions, and hassle-free return policies. E-commerce platforms offer personalized recommendations based on browsing history, ensuring a tailored shopping experience. Additionally, limited-edition releases, influencer endorsements, and mobile shopping apps contribute to the growing preference for online footwear purchases over traditional retail shopping.

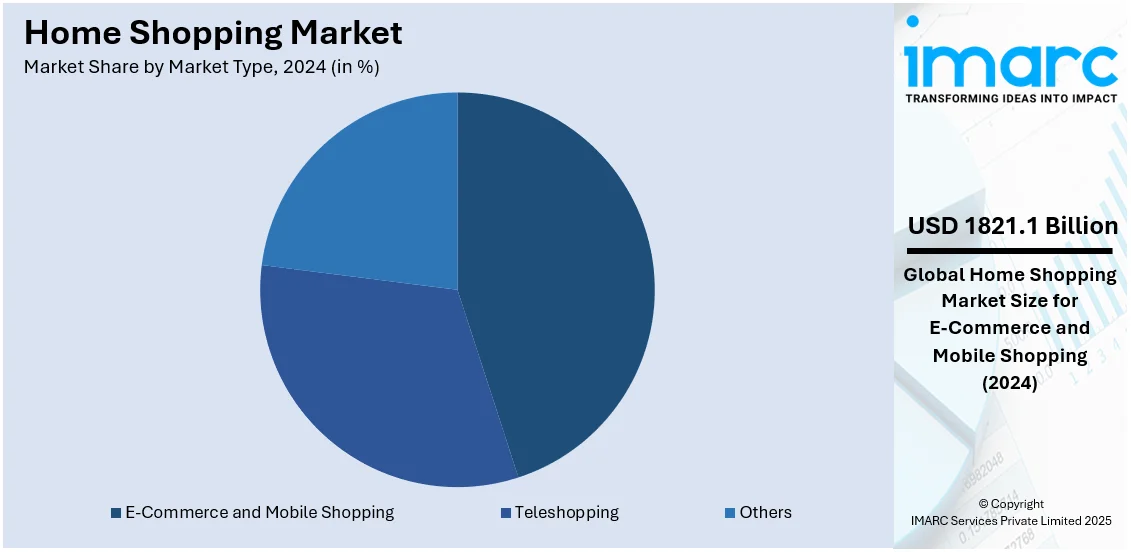

Analysis by Market Type:

- Teleshopping

- E-Commerce and Mobile Shopping

- Others

E-commerce and mobile shopping leads the market with around 39.6% of market share in 2024. The emerging trend of shopping online via e-commerce channels and quick commerce platforms enables customers to access a wide range of options from the convenience of their home, easy return and exchange policies, and doorstep delivery facilities. As global internet access and adoption rapidly increase, with over five Billion internet users worldwide, the number of people making purchases online is ever-increasing. In 2024, retail e-commerce sales are estimated to exceed US$ 6.3 Trillion worldwide, and this figure is expected to reach new heights in the coming years.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 40.0%. The home shopping market is highly dominated by Asia-Pacific, with China being the most prominent country in the region. Other countries, including South Korea, Singapore, Japan, and India, have accelerated the market's growth. Asia-Pacific is a rapidly growing region with increases in the inclination of consumers toward home shopping and a large number of imports from various countries. China's online shopping market has grown strongly in recent years, becoming the new economic development engine. The number of internet users in China has been increasing exponentially. The number of internet users in China in 2022 was 1051.14 Million, per the China Internet Network Information Center (CNNIC), thereby enabling this enormous growth in the APAC region.

Key Regional Takeaways:

North America Home Shopping Market Analysis

The home shopping market in North America is driven by increasing internet penetration, growing consumer preference for convenience, and advancements in e-commerce technology. The rise of mobile shopping apps, AI-powered recommendations, and personalized marketing enhances user experience. Secure digital payments, same-day delivery, and flexible return policies further boost online shopping adoption. Social media and influencer marketing play a critical role in forming purchasing decisions. Additionally, augmented reality (AR) and virtual try-ons improve consumer confidence. The demand for groceries, apparel, and electronics through home shopping channels continues to rise, supported by competitive pricing, exclusive online deals, and subscription-based models. For instance, in March 2024, Global design firm, West Elm, a brand under Williams-Sonoma, Inc., the leading digital-focused, design-oriented, and eco-friendly home retailer worldwide, revealed the introduction of a new mobile iOS design and shopping application. Designed with the customer journey at its core, the app enables users to filter based on their needs, delivering a customized shopping experience. The application is now accessible for free on the App Store®, allowing customers to discover and purchase West Elm’s products.

United States Home Shopping Market Analysis

In 2024, the United States accounted for over 87.5% of the home shopping market in North America. The home shopping market in the United States is significantly driven by strong digital integration and high consumer engagement. Retailers continue to innovate by leveraging advanced online platforms, personalized experiences, and new technologies such as augmented reality and live streaming to enhance product visualization. Increasing broadband access and mobile usage facilitate seamless shopping, while logistics networks ensure efficient delivery and customer satisfaction. The Department of Commerce’s National Telecommunications and Information Administration (NTIA) announced Middle Mile Grants to deploy over 12,000 miles of fiber across 350 counties, benefiting 6,961 community anchor institutions. Funded by the Bipartisan Infrastructure Law, these projects aim to extend high-speed Internet access nationwide. Additionally, the FCC’s ACP offers discounts of up to USD 30 per month for eligible households, or USD 75 for those on Tribal lands, improving affordability and promoting digital equity across the U.S. With a shift from traditional catalog shopping to dynamic eCommerce models, retailers are focusing on omnichannel strategies that integrate online and offline experiences. Consumer preference for convenience and an expanding range of product choices drives market growth. Data analytics are increasingly essential to optimize supply chains and personalize promotional campaigns. This continuously changing market sets the stage for future growth and technological advancements.

Europe Home Shopping Market Analysis

Europe’s market is expanding steadily, due to digital transformation, shifting consumer preferences, and diverse regulatory environments. Retailers are investing in online platforms, data-driven strategies, and innovative technologies to enhance customer engagement. Cross-border eCommerce is flourishing due to harmonized trade agreements, improved payment security, and increasing consumer trust. According to an industry report, in 2023, Europe's cross-border online market generated a turnover of EUR 237 Billion, marking a 32% increase from 2022. European online stores contributed EUR 107 Billion to this figure. Retailers are adopting artificial intelligence, virtual try-on tools, and automation to personalize experiences and optimize inventory management. The region's well-established logistics networks ensure efficient order fulfillment, while emerging markets add to the sector’s gradual expansion. Consumer behavior is increasingly influenced by convenience, competitive pricing, and sustainability considerations, leading businesses to incorporate ethical sourcing and environmentally friendly practices. As digital adoption accelerates across Europe, the home shopping market continues to change, blending traditional retail values with cutting-edge advancements, reinforcing its growth trend and competitive landscape.

Latin America Home Shopping Market Analysis

In Latin America, the market is propelled by the increasing internet access, urbanization, and a rising middle class. Local retailers use social media and mobile platforms to engage tech-savvy consumers, while international brands adopt localized strategies. Digital payment innovations and infrastructure improvements enhance the shopping experience. For instance, in 2024, Santander’s Getnet launched Getnet SEP, a unified payment system for Brazil, Argentina, Mexico, and Chile, processing EUR 205 Billion (USD 221Billion) annually across seven Billion payments, simplifying cross-border transactions as the region's e-commerce market targets EUR 800 Billion (USD 866 Billion) by 2026. Government initiatives improve cybersecurity and promote eCommerce, strengthening consumer trust. Retailers emphasize personalized engagement and logistics efficiency, adapting to local preferences. This changing market presents vast opportunities, solidifying Latin America’s role in global digital commerce.

Middle East and Africa Home Shopping Market Analysis

The Middle East and Africa home shopping market is undergoing rapid digital transformation, driven by increasing internet penetration and mobile adoption. Retailers invest in localized platforms and cybersecurity to navigate diverse economies and regulatory environments. Improved logistics and supply chains enhance delivery efficiency, bridging traditional and digital commerce. Cultural influences and evolving consumer expectations shape product offerings and personalized services. Governments support digital initiatives to modernize retail infrastructure and augment cross-border trade. The UAE’s Digital Economy Strategy aims to grow the digital economy’s share from 12% to 20% of non-oil GDP by 2030, with A.I. contributing USD 96 Billion and 13.6% of GDP. Despite infrastructural challenges, digital literacy and mobile commerce are expanding, creating significant opportunities for growth across the region.

Competitive Landscape:

The home shopping market is highly competitive, with major players focusing on e-commerce expansion, technological innovation, and personalized shopping experiences. Leading retailers like Amazon, Walmart, Target, and Alibaba dominate through vast product selections, fast delivery, and AI-driven recommendations. Emerging brands leverage social media, influencer marketing, and live-stream shopping to capture market share. Advancements in augmented reality (AR), virtual try-ons, and mobile apps enhance consumer engagement. Subscription-based models and exclusive online deals further intensify competition. Traditional retailers are adopting omnichannel strategies, integrating online and offline experiences. The market continues evolving, driven by convenience, digital transformation, and changing consumer shopping behaviors.

The report provides a comprehensive analysis of the competitive landscape in the home shopping market with detailed profiles of all major companies, including:

- Alibaba Group

- Amazon.com Inc.

- Best Buy

- Ebay Inc.

- Flipkart Internet Private Limited

- Naaptol Company

- The Home Depot Inc

- VGL Group

- Walmart Inc.

Latest News and Developments:

- February 2025: Wayfair launched Muse, an AI-powered tool for personalized home shopping. Muse offers a visual browsing experience, linking inspiration to Wayfair’s catalog. Users can search styles, explore AI-generated imagery, and apply designs to their spaces.

- January 2025: TheTake announced partnerships with LG and Samsung at CES 2025, expanding AI-powered shoppable TV. LG's Click to Search enables instant product identification, while Samsung offers trending TV shopping. With 59% U.S. smart TV market share, TheTake strengthens its leadership in interactive shopping technology.

- April 2024: Kizik launched its Motion Is Magic brand platform, debuting five new silhouettes and an NYC pop-up. Expanding into retail, wholesale, and international markets, Kizik plans 15 stores by 2025. The omnichannel campaign spans digital, mobile shopping, social media, and connected TV, enhancing consumer engagement.

- November 2023: The National Company Law Tribunal (NCLT) approved a joint proposal by luggage manufacturer Goblin India and financial services firm Khandwala Finstock for the acquisition of bankrupt Television Home Shopping Network. The proposal includes a merger or reverse merger of Khandwala Finstock with the company that operates TV home shopping channels.

- November 2023: Pottery Barn, a portfolio brand of Williams-Sonoma, Inc., the world’s largest digital-first, design-led and sustainable home retailer, announced today the launch of a new mobile iOS shopping and design app. Designed to deliver a seamless and convenient customer shopping experience, the new Pottery Barn mobile app also makes it easy for customer to create and manage a registry on-the-go.

- January 2023: Walmart and Salesforce are partnered to provide local fulfillment and delivery options for retailers. This partnership will enable retailers to sell their products on Walmart.com through Salesforce's e-commerce platform, providing them access to Walmart's large customer base. The partnership between Walmart and Salesforce will focus on the online marketplace.

Home Shopping Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Groceries, Apparels and Accessories, Footwear, Personal and Beauty Care, Furniture and Home Décor, Electronic Goods, Others |

| Market Types Covered | Teleshopping, E-Commerce and Mobile Shopping, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alibaba Group, Amazon.com Inc., Best Buy, Ebay Inc., Flipkart Internet Private Limited, Naaptol Company, The Home Depot Inc, VGL Group and Walmart Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the home shopping market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global home shopping market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the home shopping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home shopping market was valued at USD 4,598.70 Billion in 2024.

The home shopping market is projected to exhibit a CAGR of 11.44% during 2025-2033, reaching a value of USD 12,791.25 Billion by 2033.

The market is driven by e-commerce expansion, mobile shopping apps, AI-driven recommendations, fast delivery, secure digital payments, AR/VR technology, influencer marketing, omnichannel retail, personalized shopping experiences, rising consumer demand for convenience, exclusive online deals, and subscription-based shopping models.

Asia Pacific currently dominates the home shopping market due to e-commerce growth, mobile shopping apps, AI-driven recommendations, convenience, fast delivery, secure payments, AR/VR technology, influencer marketing, omnichannel retail, and personalized shopping.

Some of the major players in the home shopping market include Alibaba Group, Amazon.com Inc., Best Buy, Ebay Inc., Flipkart Internet Private Limited, Naaptol Company, The Home Depot Inc, VGL Group, Walmart Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)