Honey Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2025-2033

Honey Market Size and Share:

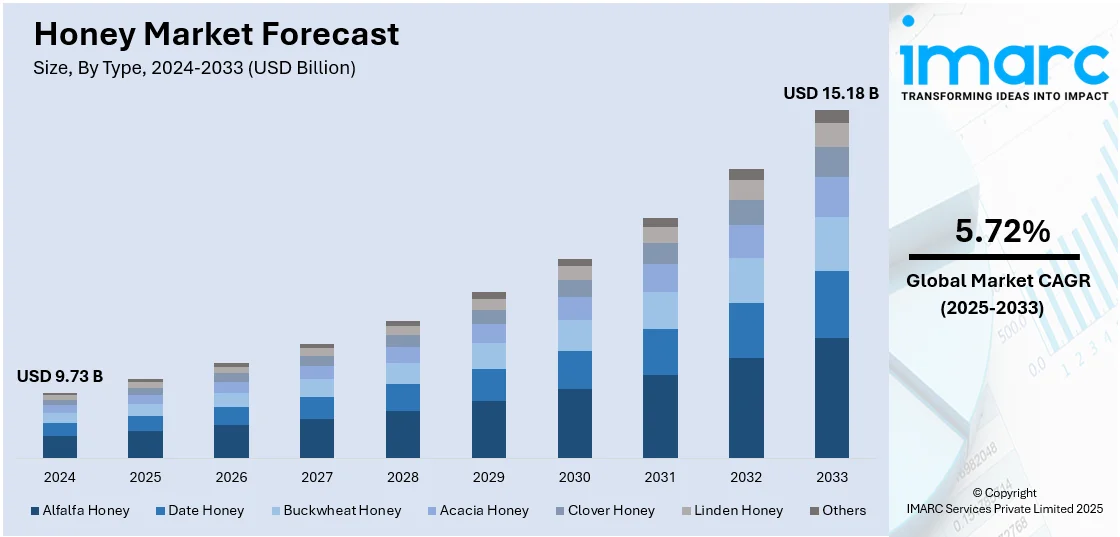

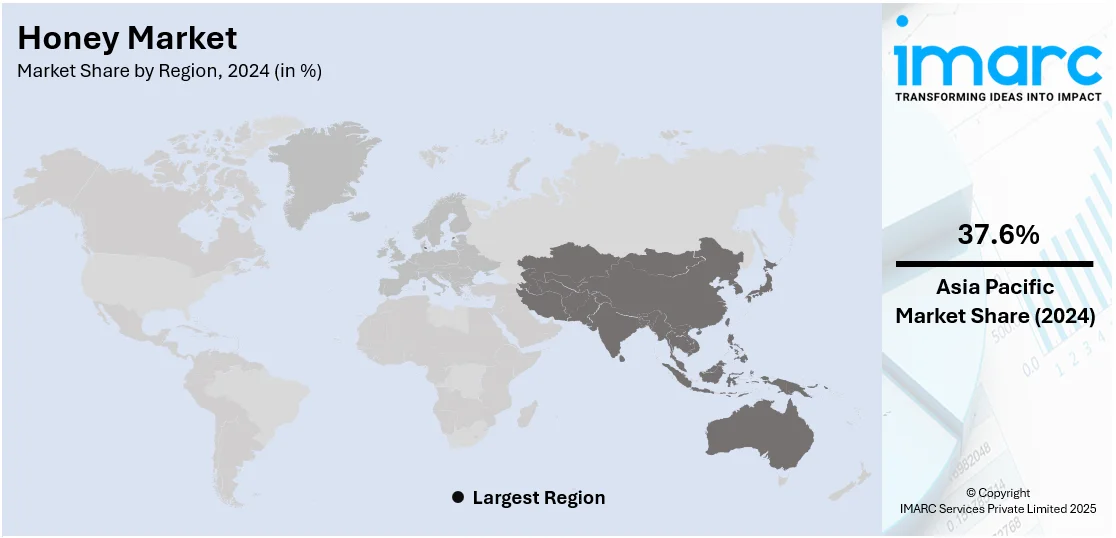

The global honey market size was valued at USD 9.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.18 Billion by 2033, exhibiting a CAGR of 5.72% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 37.6% in 2024. The market is witnessing significant growth due to rising consumer demand for natural sweeteners, health benefits, and organic products. Moreover, growing popularity of plant-based diets, clean-label products, and honey’s versatile uses in food, beverages, and wellness products are driving market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.73 Billion |

|

Market Forecast in 2033

|

USD 15.18 Billion |

| Market Growth Rate (2025-2033) | 5.72% |

Key drivers in the honey market include rising consumer demand for natural and organic sweeteners as people become more health conscious. The growing trend of plant-based and clean-label diets has further accelerated the shift towards honey as a healthier alternative to refined sugars. Additionally, honey’s versatility in both culinary applications and health benefits, such as its antimicrobial properties and antioxidants, are boosting its popularity. Increased awareness of honey’s sustainability and its natural production process also plays a significant role in driving honey market demand. For instance, in August 2024, Nestlé’s Nespresso launched honey and honey syrup under its new Nespresso Bloom line, marking its first expansion beyond coffee in 40 years. Sourced from bees pollinating Colombian coffee plants, the products aim to enhance sustainability and meet consumer demand for honey as a sweetener.

Key drivers in the United States honey market include increasing consumer preference for natural and organic sweeteners as part of a broader health-conscious trend. Growing awareness of honey’s health benefits, such as its antioxidants and antimicrobial properties, is encouraging its use as a natural remedy. The rise in clean-label and plant-based diets has also boosted demand for honey as a healthier alternative to refined sugars. Additionally, honey's versatility in cooking, baking, and beverages continues to support its strong market presence in the United States. For instance, in October 2024, Local Hive™ introduced three new Hot Honey flavors Original, Chipotle, and Sriracha available at Walmart and online. Each features U.S. raw & unfiltered honey infused with spicy peppers, enhancing a variety of dishes.

Honey Market Trends:

Growing awareness about health benefits

With its naturally occurring antioxidant, antibacterial, and anti-inflammatory properties, honey is considered as a clean replacement for refined sugar. It provides vitamins, minerals, and enzymes essential for various functions of the body. A recent survey indicates that almost 68% of American participants believe that maintaining healthy eating habits is crucial for increasing the likelihood of a long and healthy life. As individuals become more health-conscious and seek natural and organic food products, honey's reputation as a superfood has gained traction. Furthermore, the increase in chronic diseases such as diabetes and obesity has added momentum to this trend, with consumers seeking help for alternative sweeteners. Also, the extensive application of honey in folk and other conventional therapies for illnesses such as sore throat, and cough also contributes to the increased demand. This increasing knowledge and demand for natural food products with health benefits provide essential support to the honey market growth.

Increasing demand for natural sweeteners

The honey market forecast suggests steady growth driven by rising demand for natural sweeteners. Honey’s versatility in various culinary applications makes it an attractive option for both food processors and manufacturers. According to the Annual Survey of Industries (ASI) 2019-20, there were 41,481 food processing units in India. This trend is further bolstered by the growing inclination towards clean labeling, as consumers increasingly seek to avoid additives and preservatives in their daily diets. Honey, being an organic product, adeptly fulfills this niche, appealing to individuals who meticulously examine labels to avoid substances such as ADD, MSG, and preservatives. The everyday consumption of natural and minimally processed products has consequently caused an increased honey demand.

Increasing popularity of natural cosmetics and personal care products

The growing interest in natural cosmetics and personal care products is consequently driving the global market. The wide utilization of honey in the preparation of masks and other cosmetics to soften the skin and hair is further catalyzing the market. For instance, there are 5,146 businesses in the Cosmetic & Beauty products manufacturing industry in the United States. In addition to this, the use of honey in shampoos, lotions and beauty products are beneficial for consumers looking for natural and efficient skincare solutions. The expanding natural cosmetics and personal care market contributes significantly to the growth of the honey market, as manufacturers continue to innovate with honey as a key ingredient. These insights are highlighted in the honey market research report, underscoring the growing importance of honey in the beauty industry.

Honey Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global honey market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and distribution channel.

Analysis by Type:

- Alfalfa Honey

- Date Honey

- Buckwheat Honey

- Acacia Honey

- Clover Honey

- Linden Honey

- Others

Buckwheat honey stand as the largest type in 2024, holding around 30.0% of the market. Buckwheat honey dominates the global market, due to the rich taste of non-star honey and its nutritional value. This dark, robust honey is popular for its nutritional values, especially on account of its immune enhancement and antibacterial activity among the masses. Thus, due to its unique flavor profile, buckwheat honey is valued in numerous applications where gourmet and specialty foods are used. Its popularity in the health food sector has also been a significant factor in its market dominance. Its versatility in culinary applications, combined with the growing consumer preference for clean, minimally processed foods, further solidifies its leading position in the market and therefore creates a positive honey market outlook.

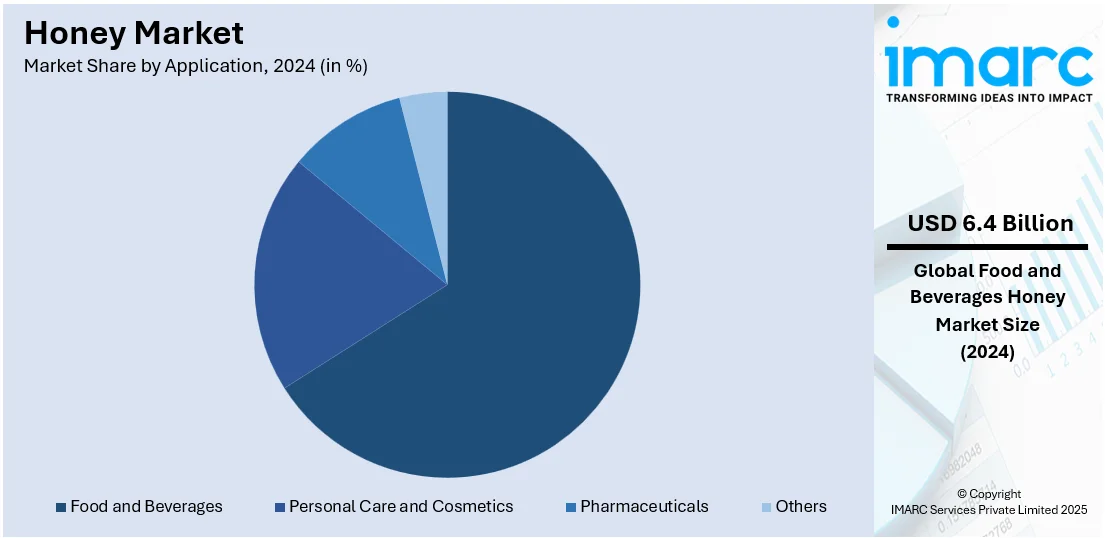

Analysis by Application:

- Food and Beverages

- Personal Care and Cosmetics

- Pharmaceuticals

- Others

Food and beverages leads the market with around 65.8% of market share in 2024. Honey is a natural food product with flavor enhancing and sweetening properties which plays a vital role within the food industry particularly in confectionery products, bakery products, beverages and sauces. The growth of clean label and natural ingredients in the food market has also led to the rise in honey consumption as customers are inclining towards more healthy and new offerings. Therefore, demand is further increasing in beverages including teas and health, and alcoholic drinks due to their valuable health feature and tasty preference. The honey industry overview reveals that this segment will continue to grow, and that the growth is attributed to new inventions in the food and beverages and shift towards use of natural products.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 43.7% of honey market share in 2024. Supermarkets and hypermarket retail outlets offer the public easy access to a great number of honey products, including everyday usage, up to the high-end, and special range. Supermarkets and hypermarkets are among the most important sectors that have achieved high levels of sales in honey due to their expansive coverage and high traffic rates. Since they are capable of storing bulk as well as different brands, they have a way of satisfying different consumers thus increasing the sales volume. Also, the constant promotion and offering of discounts within these stores also increases the demand for honey. Moreover, the honey market revenue from this segment is expected to remain robust, driven by the current trend of consumers prefer buying groceries, and the wide range of products offered.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 37.6%. The Asia Pacific region dominance is attributable to the region's significant honey production capabilities and the increasing rate of urbanization. Notably, major honey producers such as China and India, with their extensive bee colonies, contribute to the production of various types of honey. Increased awareness about healthy living in the region has also contributed to this increase in honey consumption since individuals in this region are embracing healthy foods. Besides this, increasing disposable income of the population and the growing middle-income earners in Asia Pacific also acted as major growth drivers. In addition, the honey market business opportunities in this region are substantial, with honey increasingly being utilized across various sectors, including food, cosmetics, and pharmaceuticals.

Key Regional Takeaways:

North America Honey Market Analysis

North America is witnessing a surge in honey adoption, driven by increasing demand for natural sweeteners in food and beverages. As consumers shift towards healthier, clean-label diets, honey has gained popularity as a preferred alternative to refined sugars and artificial sweeteners. The rising interest in organic, non-GMO, and sustainably sourced ingredients further boosts honey's presence in the market. In the food industry, honey is incorporated into a wide range of products, including energy bars, granola, dairy products, and salad dressings, aligning with growing health trends. Additionally, the wellness sector in North America is expanding, with honey being included in functional beverages, herbal teas, and health supplements due to its antimicrobial and anti-inflammatory properties. The rise in demand for natural skincare and beauty products also fuels honey's popularity in cosmetics, particularly in moisturizing creams, facial masks, and shampoos. This trend supports honey's increasing market share across North American retail and e-commerce platforms.

United States Honey Market Analysis

In 2024, the United States accounted for over 86.60% of the honey market in North America. United States sees increasing honey adoption driven by growing investment in the beauty industry and higher uptake of natural cosmetics and personal care products. For instance, in 2021, the beauty industry saw record-breaking investments with 388 deals and USD 3.3 Billion in venture capital raised. As consumers prioritize chemical-free skincare, honey-infused formulations in moisturizers, serums, and cleansers gain popularity. The demand for organic and sustainable ingredients supports product diversification, with brands incorporating honey for its hydrating and antibacterial properties. Rising preferences for cruelty-free beauty also fuel innovations in facial masks, lip balms, and shampoos. Additionally, premium skincare companies expand their honey-based offerings, aligning with the clean beauty trend. The emphasis on transparency and ethically sourced ingredients enhances consumer trust, accelerating honey’s market penetration. Natural personal care product formulations benefit from the soothing and anti-inflammatory properties of honey, reinforcing its presence in lotions and hair conditioners. The integration of honey into dermatological applications and artisanal beauty products continues strengthening its industry relevance.

Europe Honey Market Analysis

Europe experiences increased honey adoption due to the growing food and beverages sector. The rising demand for natural sweeteners in bakery, confectionery, and dairy products boosts honey’s usage in innovative formulations. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. As consumers shift towards reduced-sugar diets, honey emerges as a preferred alternative to artificial sweeteners in flavoured yogurts, cereals, and granola bars. Beverage manufacturers integrate honey into herbal teas, functional drinks, and sports nutrition products, aligning with the clean-label trend. The rising popularity of organic and locally sourced ingredients strengthens honey’s role in premium food categories. Artisanal producers highlight honey’s nutritional benefits in gourmet spreads and salad dressings, catering to health-conscious consumers. With increasing focus on sustainable food processing, honey’s role in plant-based recipes and non-dairy alternatives expands.

Latin America Honey Market Analysis

Latin America observes increasing honey adoption fuelled by growing urbanization and rising disposable incomes. For instance, Brazil Household Disposable Income data was reported at approximately USD 127,664 Million in Dec 2024. This records an increase from the previous number of approximately USD 121,298 Million for Nov 2024. As urban populations expand, shifting dietary preferences emphasize natural and nutrient-rich ingredients, positioning honey as a desirable choice. Higher purchasing power encourages greater spending on premium and organic food products, boosting honey-infused beverages, bakery items, and breakfast cereals. The demand for clean-label products supports honey’s integration into functional foods and ready-to-eat snacks. Growing awareness about natural remedies also encourages honey-based health supplements.

Middle East and Africa Honey Market Analysis

Middle East and Africa sees greater honey adoption supported by expanding e-commerce penetration. For instance, approximately two million people, or 20% of the UAE population, have transitioned to online shopping in recent years. This shift has increased the number of online shoppers from 4.5 million in 2019 to 6.5 million by 2024. The growing online retail landscape provides easier access to a diverse range of honey products, catering to both health-conscious consumers and traditional users. Digital platforms facilitate direct-to-consumer sales, enabling niche honey varieties to reach wider markets. The rise of online grocery shopping accelerates honey’s availability in premium food and wellness segments. Consumer preference for natural sweeteners strengthens honey’s positioning in health-focused product categories.

Competitive Landscape:

The competitive landscape of the honey market is characterized by a mix of large-scale producers, regional suppliers, and artisanal brands. Key players focus on product diversification, including organic, raw, flavored, and specialty honeys, to cater to the growing demand for natural and sustainable ingredients. Companies are increasingly emphasizing transparency, ethical sourcing, and eco-friendly packaging to align with consumer preferences for clean-label products. Innovations in functional honey products, such as those infused with added health benefits or used in skincare, are further driving competition. The rise of e-commerce platforms is enabling smaller niche players to reach broader consumer bases, intensifying market competition.

The report provides a comprehensive analysis of the competitive landscape in the honey market with detailed profiles of all major companies, including:

- Barkman Honey LLC

- Bee Maid Honey Limited

- Beeyond the Hive

- Capilano Honey Ltd.

- Comvita Limited

- Dabur India Ltd.

- Dutch Gold Honey Inc.

- New Zealand Honey Co

- Oha Honey LP

- Patanjali Ayurved Limited

- Streamland Biological Technology Ltd

Latest News and Developments:

- March 2025: Wisdom Natural Brands is launching Drizzle Honey in the U.S. this month after acquiring the Canadian brand last year. Golden Raw Honey, White Raw Honey, and Turmeric Gold Raw Honey will be sold at Fresh Thyme, Amazon, and Drizzle's website. Additional honey products and retail locations are expected later this year. Wisdom is also introducing SweetLeaf Beverage Syrups with Collagen, available this summer.

- February 2025: Blue Diamond Almonds launched Hot Honey Almonds in collaboration with Mike’s Hot Honey, blending honey and chili for a bold sweet-spicy crunch. This first-of-its-kind snack is perfect for on-the-go munching, salads, and charcuterie boards. Now available on Amazon and select Walmart locations, the snack caters to consumers craving exciting flavors. Blue Diamond and Mike’s Hot Honey share a passion for innovation, delivering a unique taste experience.

- May 2024: Rowse Honey relaunched its limited-edition ‘Hot Honey,’ available exclusively at Waitrose in-store and online. The spicy-sweet fusion returns in its signature jagged plastic bottle. Brand Manager Libby Nicholson highlights its appeal for heat-loving food enthusiasts. This comeback offers a simple yet bold flavor twist for mealtime.

- January 2024: Apis India Ltd launched its Organic Honey, emphasizing sustainability and responsible sourcing. Managing Director Amit Anand highlighted the brand’s commitment to nature and purity. The new offering delivers natural sweetness while supporting mindful consumer choices. This launch marks a significant step in Apis India's journey toward healthier products.

- January 2024: Dabur India Ltd. has declared the investment of around USD 0.16 billion to establish a new manufacturing plant in South India. The greenfield facility will produce various products, including Dabur Honey.

Honey Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Alfalfa Honey, Date Honey, Buckwheat Honey, Acacia Honey, Clover Honey, Linden Honey, Others |

| Applications Covered | Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Barkman Honey LLC, Bee Maid Honey Limited, Beeyond the Hive, Capilano Honey Ltd., Comvita Limited, Dabur India Ltd., Dutch Gold Honey Inc., New Zealand Honey Co, Oha Honey LP, Patanjali Ayurved Limited, Streamland Biological Technology Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the honey market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global honey market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the honey industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The honey market was valued at USD 9.73 Billion in 2024.

IMARC estimates the honey market to reach USD 15.18 Billion by 2033, exhibiting a CAGR of 5.72% from 2025-2033.

Key factors driving the honey market include rising consumer demand for natural and organic sweeteners, increasing health consciousness, and growing preferences for clean-label and sustainable ingredients. Additionally, honey’s versatility in food, beverages, skincare, and wellness products, coupled with a shift toward plant-based diets, is fueling market growth.

Asia Pacific currently dominates the honey market, driven by strong consumer demand for natural sweeteners, increasing health awareness, and the growing popularity of honey-based products in food, beverages, and skincare. Additionally, the region's expanding e-commerce platforms and agricultural production further support its market leadership.

Some of the major players in the honey market include Barkman Honey LLC, Bee Maid Honey Limited, Beeyond the Hive, Capilano Honey Ltd., Comvita Limited, Dabur India Ltd., Dutch Gold Honey Inc., New Zealand Honey Co, Oha Honey LP, Patanjali Ayurved Limited, Streamland Biological Technology Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)