HPV Testing and PAP Test Market Size, Share, Trends and Forecast by Test Type, Product, Application, End User, and Region, 2025-2033

HPV Testing and PAP Test Market Size and Share:

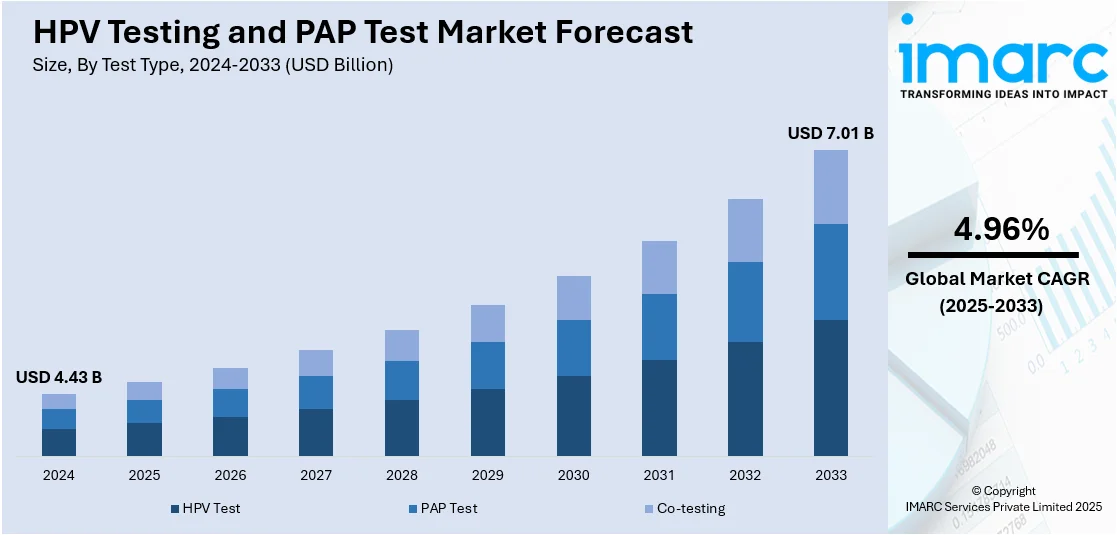

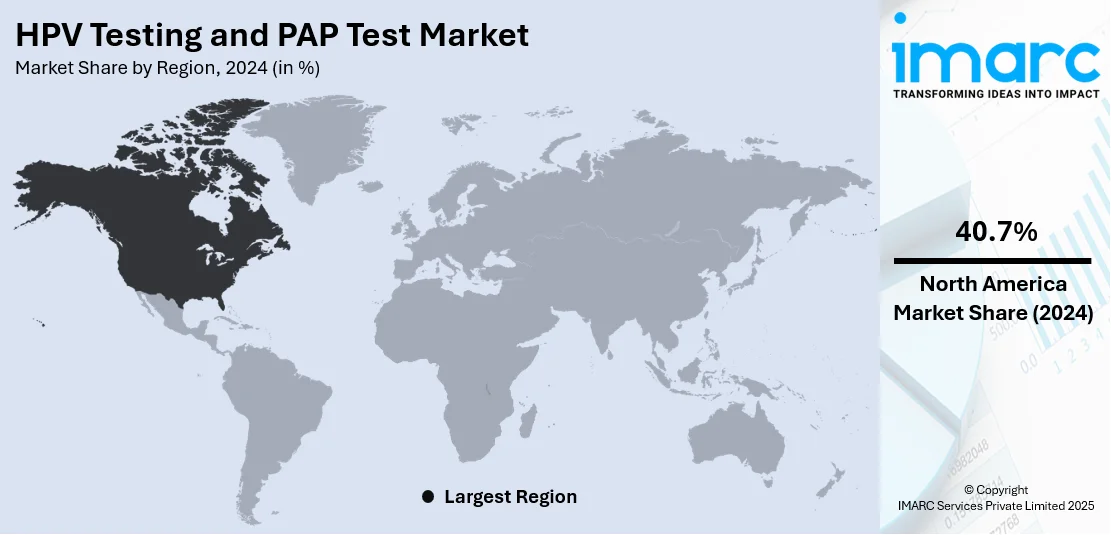

The global HPV testing and Pap test market size was valued at USD 4.43 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.01 Billion by 2033, exhibiting a CAGR of 4.96% from 2025-2033. North America currently dominates the market, holding a market share of 40.7% in 2024. The market is driven by the rising awareness of cervical cancer prevention, increasing government and public health initiatives promoting regular screening, and technological advancements such as molecular diagnostics and AI-assisted analysis. The growing preference for early and accurate detection methods is pushing demand for Human Papillomavirus (HPV) Human Papillomavirus (DNA) testing and liquid-based cytology. Additionally, the introduction of at-home self-sampling kits is enhancing accessibility, particularly in remote or underserved areas, encouraging more women to participate in routine cervical cancer screening programs thus surging the HPV testing and Pap test market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.43 Billion |

|

Market Forecast in 2033

|

USD 7.01 Billion |

| Market Growth Rate (2025-2033) | 4.96% |

One major driver of the HPV testing and Pap test market is the rising awareness and emphasis on early detection of cervical cancer. Public health initiatives, educational campaigns, and government-supported screening programs have significantly improved knowledge about the importance of regular cervical screening among women. As a result, more individuals are seeking timely tests to detect potential pre-cancerous changes or HPV infections before they progress into serious conditions. This growing awareness has not only increased patient participation in screening but has also encouraged healthcare providers to adopt advanced testing methods like HPV DNA testing, driving HPV testing and Pap test market growth and technological innovation in diagnostics.

The U.S. HPV testing and Pap test market plays a critical role in early detection and prevention of cervical cancer along with 87.70% market share. Increased awareness of women’s health, advancements in screening technologies, and support from healthcare organizations have driven demand for both tests. While Pap smears remain a standard method for detecting abnormal cervical cells, HPV testing is gaining prominence as a reliable tool for identifying high-risk infections that can lead to cancer. The introduction of at-home HPV kits and AI-assisted diagnostics is enhancing accessibility and accuracy. Co-testing approaches, combining both methods, are also becoming more common in routine cervical cancer screening programs.

HPV Testing and PAP Test Market Trends:

Growth of At-Home Self-Sampling Kits

A significant trend transforming the HPV testing market is the growing adoption of at-home self-sampling kits, offering women the ability to collect samples privately without visiting clinics or undergoing pelvic exams. This approach enhances comfort, convenience, and privacy, encouraging participation from individuals who might otherwise avoid traditional screenings due to fear, embarrassment, or logistical challenges. Notably, a large UK trial involving 27,000 women demonstrated that mailing self-sampling kits directly could boost screening participation rates from around 70% to 77%, potentially leading to an additional 400,000 tests annually. Such outcomes highlight the effectiveness of self-sampling in improving screening coverage, particularly among underserved or remote populations. The increasing acceptance of these kits by healthcare providers and regulatory authorities marks a shift toward more personalized, accessible, and user-friendly cervical cancer diagnostic solutions that align with modern healthcare demands.

Adoption of Molecular Diagnostics and Liquid-Based Cytology

The market is increasingly shifting toward molecular diagnostic techniques and liquid-based cytology (LBC), moving away from traditional Pap smears due to their superior accuracy and reliability. Molecular tests directly detect high-risk HPV strains by analyzing genetic material, providing better insight into cancer risk compared to conventional cell examination. LBC improves sample preservation and preparation, allowing for clearer, more comprehensive analysis while minimizing sample contamination and degradation. These advancements enhance laboratory workflow efficiency and reduce diagnostic errors, thereby boosting confidence among healthcare providers. Notably, LBC has captured approximately 35% of the cervical cytology market, surpassing the 25% share held by conventional cytology, reflecting its growing adoption in clinical practice. As healthcare facilities continue upgrading to modern testing platforms, these technologies are becoming the standard in cervical cancer screening, ensuring faster, more precise, and consistent detection of potential abnormalities.

Integration of AI-Driven Screening and Automation

Artificial Intelligence (AI) and automation are becoming integral to HPV and Pap test diagnostics, significantly enhancing the accuracy and efficiency of cervical cancer screening. AI-powered tools assist in analyzing cell images to detect abnormal patterns indicative of precancerous or cancerous changes, minimizing dependence on manual interpretation, which can lead to errors or inconsistencies. Automated systems not only speed up the diagnostic process but also reduce the workload of pathologists, enabling quicker delivery of results to patients. Notably, AI-assisted cytology systems have demonstrated impressive accuracy rates, reaching 98.1% at the smear level and 99.0% at the cell level, ensuring high reliability in screening outcomes. Furthermore, AI technology facilitates remote diagnostics or telepathology services, making screening accessible in regions with limited medical resources. As these technologies advance, AI is expected to become a routine feature in laboratory workflows, enhancing diagnostic consistency and expanding screening coverage worldwide.

HPV Testing and PAP Test Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global HPV testing and Pap test market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on test type, product, application, and end user.

Analysis by Test Type:

- HPV Test

- PAP Test

- Co-testing

Pap tests currently hold the majority share of 64.2% in the HPV testing and Pap test market outlook, largely due to their long-standing role as the primary screening method for cervical cancer detection. Their widespread acceptance among healthcare providers, affordability, and inclusion in routine gynaecological exams contribute to their dominance. Pap tests are considered a reliable first-line tool for identifying abnormal cervical cells, making them a standard in many clinical guidelines and public health programs. Despite the emergence of advanced HPV DNA testing, many healthcare systems continue to prioritize Pap smears because of established infrastructure, familiarity among clinicians, and ease of implementation. This ongoing reliance helps sustain Pap tests as the preferred choice in cervical cancer screening, particularly in traditional and resource-limited settings.

Analysis by Product:

- Instruments

- Consumables

- Services

Consumables hold the largest market share of 65.0% in the HPV testing and Pap test market due to their essential and recurring role in every diagnostic procedure. Items such as sample collection kits, reagents, slides, brushes, and liquid-based cytology vials are critical for both Pap smears and HPV tests, ensuring accurate sample collection, preservation, and analysis. As these materials are single-use and must be replenished regularly, they drive consistent demand across laboratories, hospitals, and diagnostic centers. Additionally, the rise of molecular diagnostics and self-sampling kits has expanded the need for specialized consumables, further boosting their market share. The cost-effectiveness, disposability, and regulatory requirements for sterile, high-quality materials ensure that consumables remain a central and irreplaceable component of cervical cancer screening workflows.

Analysis by Application:

- Cervical Cancer Screening

- Vaginal Cancer Screening

Based on the HPV testing and Pap test market forecast, the cervical cancer screening dominates the market with a share of 77.7% owing to its critical role in early detection and prevention of cervical cancer. Screening programs, including Pap smears and HPV tests, are widely recommended by healthcare authorities as essential for identifying pre-cancerous changes and high-risk HPV infections before they progress into malignancies. The growing awareness among women about the importance of regular cervical screening, supported by public health campaigns and government initiatives, has fueled demand. Additionally, the adoption of new technologies such as liquid-based cytology, molecular testing, and self-sampling kits has made cervical cancer screening more accurate, convenient, and accessible. As a result, this segment continues to drive market growth, accounting for the largest share in diagnostic applications.

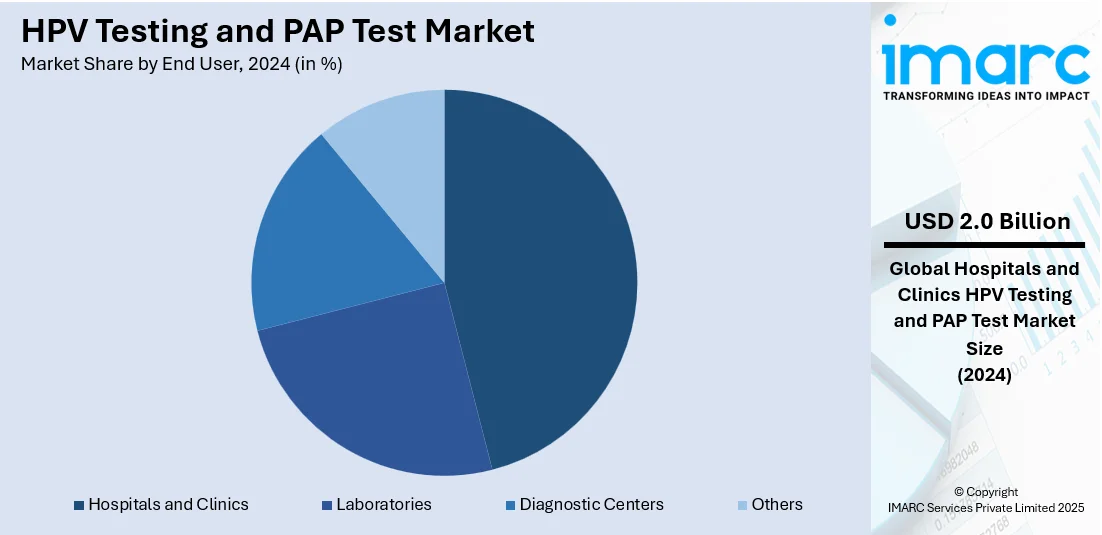

Analysis by End User:

- Hospitals and Clinics

- Laboratories

- Diagnostic Centers

- Others

Hospitals and clinics represent the largest share of 45.8% in the HPV testing and Pap test market due to their central role in providing comprehensive diagnostic and treatment services. These healthcare settings are the primary points of contact for women undergoing routine cervical cancer screening as part of their gynaecological care. Hospitals and clinics offer access to trained medical professionals, advanced laboratory facilities, and immediate follow-up care if abnormalities are detected, making them the preferred choice for both patients and healthcare providers. Their ability to handle high patient volumes, ensure accurate sample collection, and integrate new technologies such as liquid-based cytology and molecular diagnostics further strengthens their market position. Additionally, insurance coverage and reimbursement policies often favor hospital- and clinic-based screenings, driving continued demand.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is the leading region with a market share of 40.7% due to its well-established healthcare infrastructure, widespread awareness of cervical cancer prevention, and strong adoption of advanced diagnostic technologies. The region benefits from comprehensive screening programs supported by government policies, insurance coverage, and public health initiatives that encourage routine testing among women. Additionally, North America is home to major research institutions and diagnostic laboratories that drive innovation in molecular testing, liquid-based cytology, and AI-assisted screening methods. The growing availability of at-home self-sampling kits further enhances accessibility and participation rates. High healthcare spending, early adoption of new technologies, and collaborations between healthcare providers and diagnostic companies contribute to North America’s dominant market position in cervical cancer screening services.

Key Regional Takeaways:

United States HPV Testing and PAP Test Market Analysis

The growing incidence of cervical cancer and the significance of early detection are the main factors propelling the HPV and PAP test market in the United States. The American Cancer Society estimates that in 2025, there will be about 13,360 new cases of invasive cervical cancer diagnosed in the US. Moreover, cervical cancer is projected to be the cause of death for nearly 4,320 women in 2025. As healthcare professionals emphasize preventive measures, more women are seeking regular screenings to reduce the risk of cancer. The increasing prevalence of HPV infections, which are linked to various cancers, is another major driver of market growth, with HPV testing becoming an essential tool for identifying high-risk strains of the virus. Additionally, advancements in testing technologies are contributing substantially to industry expansion, offering more accurate and less invasive options compared to traditional methods. The availability of self-sampling kits has also increased accessibility and convenience, encouraging more women to participate in regular screenings. Other than this, government initiatives and recommendations from organizations such as the CDC are promoting routine HPV and PAP tests, further influencing market demand. The growing focus on women's health is also supporting the expansion of the HPV and PAP test market, with both public and private sectors contributing to the ongoing growth.

Asia Pacific HPV Testing and PAP Test Market Analysis

The growing awareness of cervical cancer and the part HPV plays in its development is driving growth in the Asia Pacific market for PAP and HPV testing. The Rajiv Gandhi Cancer Institute and Research Centre (RGCIRC), for example, reports that 80–85% of cervical malignancies in India are caused by HPV types 16 and 18. As a result, increasing government initiatives, such as national screening programs and public health campaigns, are encouraging women to undergo regular screenings. The expanding healthcare infrastructure in developing countries in the region is also making these tests more accessible, supporting industry expansion. Furthermore, the rise in disposable incomes and healthcare spending, combined with the adoption of modern diagnostic tools, is boosting demand. For instance, healthcare expenditure in India increased to 5.85 Lakh Crores in FY 2023-24, accounting for 1.9% of the GDP of the country, as per the Press Information Bureau (PIB). Regional collaborations and international support are also helping to improve access to these vital tests across the Asia Pacific region.

Europe HPV Testing and PAP Test Market Analysis

The market for PAP and HPV tests in Europe is expanding due in large part to growing awareness of the connection between HPV and cervical cancer. Women are more likely to get frequent screenings as a result of European governments and health organizations placing a higher priority on prevention, which increases demand for PAP smears and HPV testing. For example, in order to identify strategies for raising public awareness of HPV, HPV screening, and HPV vaccination in Romania, the European Cancer Organization (ECO) and the European Parliamentary Forum for Sexual and Reproductive Rights (EPF) launched the HPV Prevention Policy Atlas 2023 in June 2023. Overall, the Atlas is a collaborative project that assigns rankings to nations across Europe based on their cervical cancer screening and HPV immunization programs, encouraging HPV vaccination efforts to prevent deaths from HPV-related cervical cancer. According to the European Parliamentary Forum, cervical cancer is responsible for the death of more than 25,000 women in Europe every year. As a result, numerous European countries are implementing national cervical cancer screening programs, which is further boosting the adoption of HPV testing and PAP tests. The increasing emphasis on personalized healthcare and precision medicine has also heightened the demand for HPV tests that offer tailored insights into an individual's health status.

Latin America HPV Testing and PAP Test Market Analysis

The Latin America HPV testing and PAP test market is significantly influenced by increasing government initiatives focused on reducing the incidence of cervical cancer. For instance, in 2022, 18,715 new cases of cervical cancer were recorded in Brazil, as per the World Cancer Research Fund. Growing public health campaigns to raise awareness about HPV and its role in cancer development are also supporting market growth. Moreover, rising healthcare access, particularly in urban areas, is improving women's ability to undergo regular screenings. The growing adoption of HPV vaccination programs is also complementing efforts in testing. Advancements in testing technologies, such as more affordable and accurate HPV tests, are also making screenings more accessible, facilitating industry expansion.

Middle East and Africa HPV Testing and PAP Test Market Analysis

The Middle East and Africa HPV testing and Pap test market is experiencing robust growth due to increasing awareness about the link between HPV and cervical cancer, alongside growing public health efforts to improve women's healthcare. Government-led initiatives and partnerships with international organizations are promoting routine screenings and providing subsidized services, particularly in underserved areas. For instance, in April 2025, the UAE Ministry of Health and Prevention (MoHAP) launched an extensive national initiative to lower the incidence of cervical cancer and other illnesses caused by HPV. The initiative aims to implement regular cervical cancer screening for women beginning at age 25, along with the ambitious target of vaccinating 90% of girls against HPV before the age of 15 by 2030.

Competitive Landscape:

The competitive landscape of the HPV testing and Pap test market is dynamic and evolving, driven by innovation, technological advancements, and expanding screening programs. Companies in this space focus on developing more accurate, cost-effective, and patient-friendly diagnostic solutions, including molecular HPV tests, liquid-based cytology systems, and self-sampling kits. The market also sees strong competition around automation and AI-driven tools that enhance the efficiency and reliability of test interpretation. Strategic collaborations with healthcare providers, research institutions, and public health organizations are common to improve market reach and awareness. Moreover, regulatory approvals and the integration of at-home testing options are intensifying competition, as players aim to differentiate their offerings by prioritizing accessibility, early detection capabilities, and ease of use in cervical cancer screening.

The report provides a comprehensive analysis of the competitive landscape in the HPV testing and Pap test market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Arbor Vita Corporation

- AstraZeneca plc

- Becton Dickinson and Company

- Biocon Limited

- bioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Hologic Inc.

- NURX Inc. (Thirty Madison Inc.)

- Qiagen N.V.

- Quest Diagnostics Incorporated

- Seegene Inc.

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- April 2025: In Delhi, reasonably priced, locally produced HPV testing kits for cervical cancer diagnosis were offered. As part of the Department of Biotechnology's (DBT) Grand Challenges India (GCI) collaboration program, the Biotechnology Industry Research Assistance Council (BIRAC) developed the test kits.

- April 2025: Quest Diagnostics unveiled a novel approach to increase access to HPV screening in order to detect women who may be at risk of cervical cancer. Doctors can now provide patients with the option to gather their own specimens for HPV screening in a doctor's office or other healthcare facility. Quest also intends to roll out the self-collection option for patients at its 2,000 Quest patient service centers around the country starting May 2025.

- March 2025: The Waterloo Wellington Regional Cancer Program (WWRCP) at Grand River Regional Cancer Centre, in collaboration with other healthcare professionals, announced that they will begin offering HPV testing as the primary cervical cancer screening tool. This new HPV-based test was introduced provincially and prevents the long-term effects of cervical cancer by enabling early detection.

- February 2025: Metropolis Healthcare established a partnership with Roche Diagnostics India and Neighbouring Markets to launch a self-sampling HPV DNA test for the detection of cervical cancer in India. According to Roche, this test is a clinically verified, FDA-approved, and WHO-prequalified method that can identify 14 high-risk HPV genotypes in a single tube.

HPV Testing and PAP Test Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | HPV Test, PAP Test, Co-testing |

| Products Covered | Instruments, Consumables, Services |

| Applications Covered | Cervical Cancer Screening, Vaginal Cancer Screening |

| End Users Covered | Hospitals and Clinics, Laboratories, Diagnostic Centers, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Arbor Vita Corporation, AstraZeneca plc, Becton Dickinson and Company, Biocon Limited, bioMérieux SA, Danaher Corporation, F. Hoffmann-La Roche AG, Hologic Inc., NURX Inc. (Thirty Madison Inc.), Qiagen N.V., Quest Diagnostics Incorporated, Seegene Inc. and Thermo Fisher Scientific Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the HPV testing and PAP test market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global HPV testing and PAP test market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the HPV Testing and PAP Test industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The HPV testing and PAP test market was valued at USD 4.43 Billion in 2024.

The HPV testing and PAP test market is projected to exhibit a CAGR of 4.96% during 2025-2033, reaching a value of USD 7.01 Billion by 2033.

Key factors driving the HPV Testing and Pap Test market include rising awareness of cervical cancer prevention, technological advancements in molecular diagnostics, and increased government and public health initiatives. The growing demand for early, accurate detection methods and the introduction of self-sampling kits also contribute significantly to market growth.

North America currently dominates the HPV testing and PAP test market, accounting for a share of 40.7% due to its advanced healthcare infrastructure, strong awareness of cervical cancer prevention, and widespread adoption of innovative diagnostic technologies. Supportive government initiatives, insurance coverage, and the availability of self-sampling kits further boost screening rates, solidifying the region’s market leadership.

Some of the major players in the HPV testing and PAP test market include Abbott Laboratories, Arbor Vita Corporation, AstraZeneca plc, Becton Dickinson and Company, Biocon Limited, bioMérieux SA, Danaher Corporation, F. Hoffmann-La Roche AG, Hologic Inc., NURX Inc. (Thirty Madison Inc.), Qiagen N.V., Quest Diagnostics Incorporated, Seegene Inc., Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)