Huntington's Disease Treatment Market Size, Share, Trends and Forecast by Type, Drug Type, Age, Distribution Channel, End User, and Region, 2025-2033

Huntington's Disease Treatment Market Size and Share:

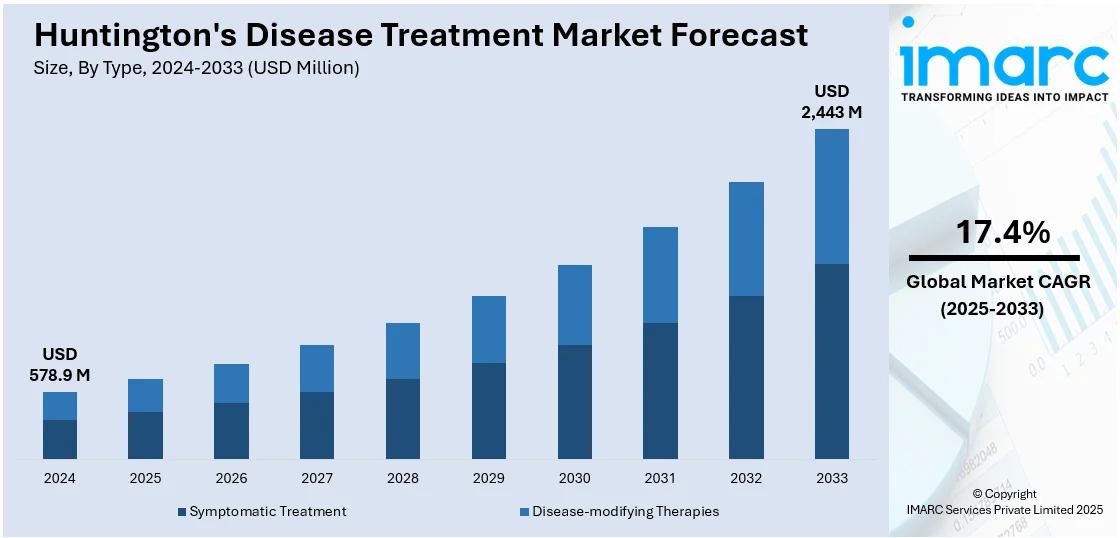

The global Huntington’s disease treatment market size was valued at USD 578.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,443 Million by 2033, exhibiting a CAGR of 17.4% from 2025-2033. North America currently dominates the market, holding a market share of 40.0% in 2024. An increase in research and development (R&D) efforts directed towards neurodegenerative conditions is impelling the market growth. This, along with the heightened awareness and continuous innovations in diagnostic equipment, is propelling the market growth. Apart from this, the rising focus on recognizing the unmet medical need in disease is playing a major role in expanding the Huntington's disease treatment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 578.9 Million |

|

Market Forecast in 2033

|

USD 2,443 Million |

| Market Growth Rate (2025-2033) |

17.4%

|

The treatment market for Huntington's disease is witnessing significant growth as various disruptive trends and drivers are working towards actively redefining its landscape. Biopharmaceutical firms are becoming increasingly interested in developing disease-modifying therapies, looking beyond symptomatic treatment. This trend is driven by the rising utilization of gene-targeting technologies, including antisense oligonucleotides and ribonucleic acid (RNA) interference, which are bringing new ideas for modifying the course of the disease. Concurrently, clinical research organizations are collaborating with pharma companies to speed up trial timelines, and this is contributing to faster cycles of innovation.

The United States Huntington's disease treatment market is transforming as research centers, drug makers, and regulatory bodies are heightening their focus to bring effective treatments to the market. Biotech companies are investing more in innovative gene therapies and RNA treatments intended to slow down or stop disease progression. Clinical trials are now being coordinated in many states, with academic centers and specialty neurology clinics working together to try new therapies under expedited timelines. This explosion of innovation is making the US a major center for research into Huntington's disease. Public awareness campaigns and patient advocacy initiatives are increasing early diagnosis and patient engagement in clinical research. In 2024, the Huntington's Disease Society of America (HDSA) celebrated its 32nd year of Huntington's disease month with the launch of an online initiative named #letstalkabouthd.

Huntington's Disease Treatment Market Trends:

Increasing Research and Development (R&D) Activities in Neurodegenerative Disorders

Rising research and development (R&D) efforts that are directed towards neurodegenerative conditions is impelling the market growth. Pharmaceutical, biotechnology organizations, and academies are stepping up efforts in funding to investigate the genetic and molecular underpinnings of Huntington's disease. Researchers are formulating cutting-edge strategies such as gene silencing therapies like antisense oligonucleotides, Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) gene editing, and stem cell-derived regenerative mechanisms. All these efforts are contributing to a healthy pipeline of investigational therapies, most of which are moving into advanced stages of clinical trials, thereby offering a favorable Huntington's disease treatment market outlook. Investment from the government and private funding agencies is also pouring in, increasing collaborative efforts between the public and private sectors. With the rise in understanding of the disease pathophysiology, new targets are being identified for therapies, thus broadening the horizon of treatment. In 2025, new research by the University of Rochester Medical Centre revealed that the brain of an adult can produce new neurons that incorporate into essential motor circuits. The research illustrates that activating natural brain functions can aid in fixing harmed neural networks in Huntington's disease and other disorders.

Growing Awareness and Diagnostic Advancements in Huntington’s Disease

Increasing awareness and continuous innovations in diagnostic equipment are propelling the Huntington's disease treatment market growth. Public health efforts, advocacy organization actions, and enhanced educational efforts are raising awareness among patients, caregivers, and providers, resulting in earlier diagnosis and intervention. Concurrently, diagnostic capacity is improving, with higher-quality genetic testing and neuroimaging methods being available and precise. These advances are allowing physicians to verify diagnoses earlier, enabling more timely treatment and trial entry. Pharmaceutical firms are also launching educational initiatives to inform patients and physicians about new therapies, thus enhancing treatment take-up. Additionally, the detection of pre-symptomatic carriers by predictive testing is opening up possibilities for early therapy, which is bringing a shift towards preventive and disease-modifying therapies. Companies are investing heavily in developing effective neuroimaging devices to improve the detection of diseases. For instance, in 2025, Hyperfine, Inc. revolutionized brain imaging with the first FDA-cleared portable magnetic resonance (MR) brain imaging system powered by AI, the Swoop® system, and declared a strategic partnership with NVIDIA . The partnership utilizes NVIDIA AI and accelerated computing to accelerate Hyperfine portable imaging technology, enabling brain magnetic resonance imaging (MRI) faster, smarter, and more accessible globally.

Expansion of Regulatory Support and Accelerated Approval Pathways

Regulatory agencies across key markets are expanding support for the development and commercialization of Huntington’s disease therapies. Health authorities are increasingly recognizing the unmet medical need in Huntington’s disease and are granting designations such as orphan drug, fast track, and breakthrough therapy to promising candidates. These regulatory incentives are shortening development timelines, reducing costs, and encouraging investment from biopharma companies. Agencies are also facilitating open dialogue with sponsors to streamline clinical trial design and address endpoints relevant to patient outcomes. This is fostering an environment conducive to innovation and quicker patient access to novel therapies. Simultaneously, post-marketing commitments and real-world evidence are increasingly being leveraged to support regulatory decisions. The regulatory landscape is thus actively shaping the trajectory of the Huntington’s disease treatment industry by reducing barriers to entry. In 2024, Swiss pharmaceutical company Novartis paid as much as $2.9 billion for PTC Therapeutics' (PTCT.O), promising experimental medicine for a neurological condition known as Huntington's disease. The medicine, code-named "PTC518," was undergoing a mid-stage trial for the rare condition that strikes around 30,000 individuals in the US.

Huntington's Disease Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Huntington’s disease treatment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, drug type, age, distribution channel, and end user.

Analysis by Type:

- Symptomatic Treatment

- Disease-modifying Therapies

Symptomatic treatment stands as the largest component in 2024, holding around 69.8% of the market. Symptomatic treatment for Huntington's disease is still taking center stage in the therapeutic picture, as it continues to help manage the broad range of physical, cognitive, and psychiatric symptoms attendant to the disease. Physicians are prescribing increasing amounts of antipsychotic medications, antidepressants, and mood stabilizers to help manage behavioral disruptions like depression, anxiety, and irritability. Meanwhile, clinicians are using treatments of motor symptoms such as tetrabenazine and deutetrabenazine in managing involuntary movement, including chorea. These medicines are being routinely improved for tolerability and for longer-term safety. Multidisciplinary team care is also incorporating non-medicine interventions in the form of physical therapy, occupational therapy, and speech therapy that are adding to patients' functional independence as well as enhancing the quality of their lives.

Analysis by Drug Type:

- Approved Drugs

- Tetrabenazine

- Deutetrabenazine

- Off-label Drugs

Approved drugs (tetrabenazine and deutetrabenazine) lead the market with around 60.0% of market share in 2024. Approved drugs like tetrabenazine and deutetrabenazine are still making up the mainstay of pharmacological management of Huntington's disease. These drugs are being increasingly prescribed by neurologists to mitigate involuntary movements by regulating dopamine activity in the brain. Tetrabenazine, the first FDA-approved medication for Huntington's chorea, is being used for its effectiveness in decreasing motor symptoms. Apart from this, deutetrabenazine is being more widely accepted as a safer and more tolerable option because of its altered pharmacokinetic profile, which is making less frequent dosing and better patient compliance possible. Pharmaceutical manufacturers are investing in post-marketing research and real-world evidence gathering to determine long-term safety and efficacy of these medications. Healthcare professionals are actively monitoring treatment response and dose adjustments to maximize therapeutic benefits.

Analysis by Age:

- Below 50 Years

- Above 50 Years

Below 50 years leads the market with 54.8% of market share in 2024. Treatment for individuals aged below 50 years is facing high demand with more cases of early-onset being diagnosed using genetic testing and enhanced clinical suspicion. Healthcare professionals are diagnosing symptomatic and pre-symptomatic individuals aged below 50 years with increased frequency, which enables earlier treatment and management. Younger patients are now actively enrolling in clinical trials and experimental treatment protocols, furthering the development of individualized therapeutic strategies. Researchers are concentrating efforts on developing treatment plans for this population, acknowledging that early intervention can slow the progression of symptoms and enhance long-term outcomes. Pharmaceutical firms are developing targeted treatments that meet the particular neurological and functional requirements of patients under the age of 50, who are still working and maintaining family responsibilities.

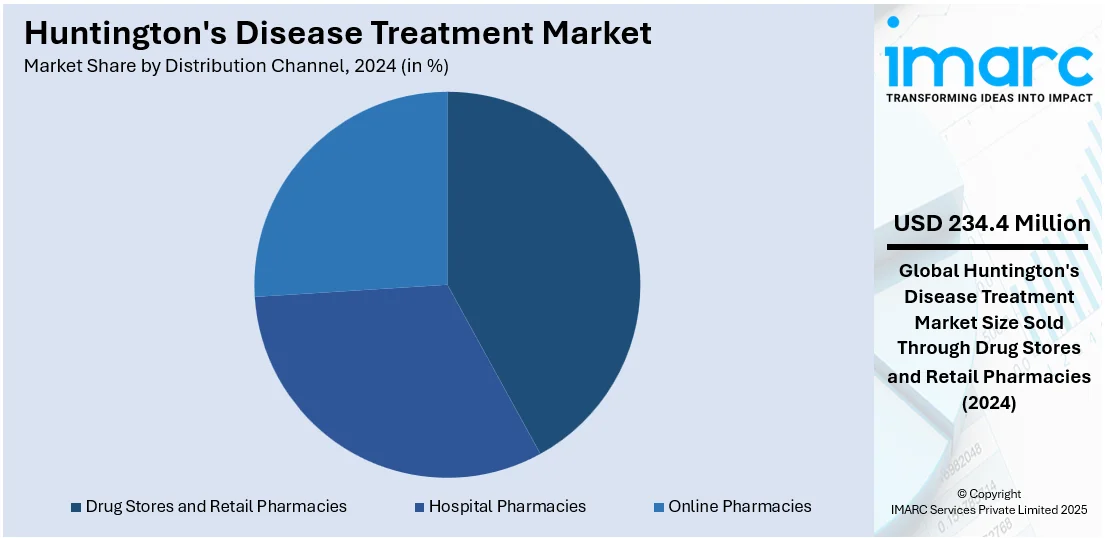

Analysis by Distribution Channel:

- Drug Stores and Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Drug stores and retail pharmacies lead the market with 40.5% of market share in 2024. They are increasingly becoming essential in the dispensing of treatments for Huntington's disease, especially approved symptomatic medications such as tetrabenazine and deutetrabenazine. The retail pharmacies are increasing their stock to include specialized medications for neurodegenerative disorders, making them available to patients on a consistent basis in both suburban and urban regions. Pharmacists are playing an active role in patient education through counseling on dosing, side effects, and medication adherence, which is improving treatment outcomes and patient activation. Retail chains are also collaborating with drug firms and healthcare providers to streamline the supply chain, promoting timely delivery and minimizing stockouts of highly demanded drugs. Furthermore, most drug stores are embracing digital platforms and online prescription services, providing patients with easy access to their medications via home delivery or appointment-based pickups.

Analysis by End User:

- Hospitals

- Homecare

- Specialty Clinics

- Others

Hospitals are serving as the primary centers for diagnosis, treatment initiation, and ongoing management of Huntington’s disease. These facilities are equipped with advanced diagnostic tools and multidisciplinary care teams, including neurologists, psychiatrists, genetic counselors, and rehabilitation specialists. Inpatient services and integrated care models allow hospitals to manage severe or complex cases, including those involving psychiatric crises or complications from motor dysfunction.

Homecare is emerging as a preferred option for patients in advanced stages of Huntington’s disease, offering comfort, convenience, and personalized support. Caregivers and visiting healthcare professionals are administering prescribed medications, managing mobility issues, and assisting with daily living activities. The growing availability of home-based rehabilitation services, including physical and speech therapy, is helping to maintain quality of life for patients outside of clinical settings.

Specialty clinics dedicated to neurodegenerative disorders are playing a crucial role in providing focused and continuous care for Huntington’s disease patients. These clinics offer specialized expertise, enabling precise diagnosis, tailored treatment planning, and close monitoring of disease progression. By integrating neurology, psychiatry, and rehabilitation services under one roof, specialty clinics are streamlining care and improving patient outcomes.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds 40.0% of the market share. North American Huntington's disease treatment sector is growing aggressively based on improvement in research, facilitating regulatory environment, and improving awareness of the disease. North American pharmaceutical players invest heavily in making gene therapy products and disease-altering medications by continuously performing several clinical trials throughout the United States and Canada. Scholarly research organizations and biotechnology companies are joining forces to determine new targets of therapy and improve current treatment methods. These alliances are speeding the rate of innovation and broadening the treatment pipeline. At the same time, regulatory bodies like the U.S. Food and Drug Administration (FDA) are granting fast-track and orphan drug designations to potential candidates, facilitating faster market access. Awareness groups are mounting public education campaigns, which are producing earlier diagnoses and enhanced patient involvement in treatment and clinical trials. As per Huntington’s disease treatment market report, healthcare systems are integrating telemedicine and digital health solutions to facilitate long-term disease management, thus consolidating market growth.

Key Regional Takeaways:

United States Huntington’s Disease Treatment Market Analysis

The United States holds around 90% share in North America. The growing incidence of Huntington's disease in the United States has significantly contributed to the increased adoption of Huntington's disease treatment. For instance, there are approximately 41,000 symptomatic Americans and more than 200,000 at-risk of inheriting the disease. With more individuals being diagnosed, there is a growing need for therapies aimed at managing symptoms and improving quality of life. This has led to advancements in treatment options, including the development of specialized medications and therapies. The rising awareness about Huntington's disease, coupled with the increasing number of healthcare facilities focusing on neurology, has further fueled treatment adoption. Additionally, ongoing research and clinical trials have played a vital role in enhancing treatment modalities, making them more accessible to patients. As the number of diagnoses is rising, the demand for effective treatments is presumed to keep growing.

Asia Pacific Huntington’s Disease Treatment Market Analysis

In the Asia-Pacific region, the growing number of hospital pharmacies has been a significant factor in the increased adoption of Huntington's disease treatments. For instance, the Delhi Government, in India, developed an extensive public health infrastructure with 38 hospitals including six super specialty hospitals and eight autonomous hospitals. Hospital pharmacies play a crucial role in dispensing specialized medications that cater to the needs of patients suffering from neurodegenerative diseases like Huntington's disease. With the expansion of healthcare infrastructure and the increased capacity of hospital pharmacies, the availability of advanced treatments has been improved. This growth in hospital pharmacies is accompanied by an increase in awareness about Huntington's disease and a shift toward more effective treatment options. Moreover, as healthcare systems in the region continue to evolve, access to new therapies is becoming more widespread, driving further adoption of Huntington's disease treatment.

Europe Huntington’s Disease Treatment Market Analysis

In Europe, the growing geriatric population has been a primary driving factor behind the rising adoption of Huntington's disease treatment. According to Eurostat, in January 2024, the EU population was estimated at 449.3 million people, and more than one-fifth (21.6%) of it was aged 65 years and over. As the aging population increases, so does the prevalence of neurodegenerative diseases, including Huntington's disease. Older adults are at a higher risk of developing Huntington's, and as such, the demand for treatment options has surged. Healthcare providers are increasingly focusing on developing treatments tailored to the unique needs of elderly patients, ensuring better disease management and quality of life. Additionally, the expanding healthcare infrastructure and improved access to specialized care have played a key role in facilitating treatment adoption across Europe. The region's commitment to research and development in neurology further supports the growth of Huntington's disease treatment.

Latin America Huntington’s Disease Treatment Market Analysis

In Latin America, the growing Huntington's disease treatment landscape is significantly shaped by the rising prevalence of neurodegenerative disorders, particularly those accompanied by neuropsychiatric symptoms (NPSs) such as depression, irritability, and psychosis. For instance, for instance, NPSs were highly prevalent in Hispanic populations with neurodegenerative disease; almost 34.3%, 56.1%, and 61.2% of the applicants with dementia, Parkinsonism, and PDD exhibited three or more NPSs, respectively. As awareness and diagnosis rates improve across the region, more patients are being identified at earlier stages, driving demand for advanced therapeutic approaches. Healthcare systems are increasingly prioritizing neurological care, and clinical trials focusing on NPS management are expanding. Pharmaceutical companies are also investing in region-specific drug development and distribution. This growing attention is fostering a robust environment for Huntington's disease treatment adoption throughout Latin America.

Middle East and Africa Huntington's Disease Treatment Market Analysis

In the Middle East and Africa, the growth of hospitals, homecare services, and specialty clinics has been crucial in driving the adoption of Huntington's disease treatment. According to the Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with a total number of licensed healthcare facilities up to 5,020 and commissioning 59,509 extremely efficient healthcare professionals, as of 2024. These healthcare providers are focusing on offering specialized care to patients with neurodegenerative disorders, including Huntington's disease. With a growing emphasis on improving healthcare infrastructure, patients now have better access to treatments tailored to their specific needs. Homecare services are also playing an important role in offering ongoing support for patients outside of traditional healthcare settings.

Competitive Landscape:

Market players are actively expanding their research portfolios and forming strategic collaborations to accelerate drug development. Biotechnology and pharmaceutical companies are investing in gene-editing technologies, RNA-targeting therapies, and neuroprotective agents to introduce more effective and durable treatment options. Many firms are entering licensing agreements and research partnerships with academic institutions and biotech startups to access novel platforms and expertise. Simultaneously, companies are initiating global clinical trials and seeking regulatory designations such as Orphan Drug and Fast Track to shorten development timelines. Marketing strategies are also shifting, with firms launching educational campaigns to raise awareness among healthcare providers and patients. As per the Huntington’s disease treatment market forecast, these coordinated efforts are expected to reinforce competitive positioning while contributing to sustained innovation in the treatment landscape.

The report provides a comprehensive analysis of the competitive landscape in the Huntington’s disease treatment market with detailed profiles of all major companies, including:

- AOP Health

- Apotex Inc.

- Dr. Reddy’s Laboratories Ltd.

- H. Lundbeck A/S

- Hikma Pharmaceuticals PLC

- Lupin Limited

- Prilenia Therapeutics

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- Vaccinex Inc.

Latest News and Developments:

- April 2025: UniQure's AMT-130 gene therapy for Huntington disease received breakthrough therapy designation from the FDA, adding to its previous orphan drug, regenerative medicine advanced therapy, and fast-track designations. As of April 2025, 45 patients have been treated with AMT-130 across two ongoing clinical trials.

- April 2025: Researchers at the Chinese University of Hong Kong identified a significant increase 4.5 times higher in the protein PAPD5 in the brains of Huntington's disease patients compared to healthy individuals. This elevation contributes to neuronal apoptosis, or nerve cell death. Their study demonstrates that inhibiting PAPD5 activity could mitigate these harmful effects, suggesting a promising new therapeutic target for Huntington's disease.

- February 2025: Latus Bio presented preclinical data on its investigational gene therapy for Huntington’s disease at the CHDI Therapeutics Conference. The therapy utilizes a novel AAV-DB-3 capsid to deliver an artificial microRNA targeting MSH3, a DNA repair enzyme implicated in CAG repeat expansions. In mouse models, this approach reduced somatic instability, potentially slowing disease progression.

- January 2025: Atalanta Therapeutics secured USD 97 million in Series B financing to advance its RNA interference (RNAi) therapies targeting central nervous system diseases, notably Huntington’s disease. The funding supports the progression of ATL-101, a di-siRNA therapy, which is designed to silence the HTT gene responsible for Huntington’s disease.

- January 2025: A UC Irvine-led team discovered molecular mechanisms behind RNA processing defects causing Huntington's disease, linking it to other neurodegenerative disorders like ALS and Alzheimer's. Researchers identified unique patterns of RNA modifications and splicing errors, highlighting alterations in TDP-43 binding and m6A chemical tags.

Huntington's Disease Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Symptomatic Treatment, Disease-modifying Therapies |

| Drug Types Covered |

|

| Ages Covered | Below 50 Years, Above 50 Years |

| Distribution Channels Covered | Drug Stores and Retail Pharmacies, Hospital Pharmacies, Online Pharmacies |

| End Users Covered | Hospitals, Homecare, Specialty Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AOP Health, Apotex Inc., Dr. Reddy’s Laboratories Ltd., H. Lundbeck A/S, Hikma Pharmaceuticals PLC, Lupin Limited, Prilenia Therapeutics, Sun Pharmaceutical Industries Limited, Teva Pharmaceutical Industries Ltd., Vaccinex Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Huntington’s disease treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global Huntington’s disease treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Huntington’s disease treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Huntington’s disease treatment market was valued at USD 578.9 Million in 2024.

The Huntington’s disease treatment market is projected to exhibit a CAGR of 17.4% during 2025-2033, reaching a value of USD 2,443 Million by 2033.

The market is being driven by increasing R&D investments in neurodegenerative disorders, rising awareness and early diagnosis, continuous innovation in diagnostic imaging, and strong regulatory support for accelerated therapy approvals.

North America currently dominates the Huntington’s disease treatment market, accounting for a share of 40.0% in 2024, supported by strong clinical research, healthcare infrastructure, and early adoption of gene-targeted therapies.

Some of the major players in the Huntington’s disease treatment market include AOP Health, Apotex Inc., Dr. Reddy’s Laboratories Ltd., H. Lundbeck A/S, Hikma Pharmaceuticals PLC, Lupin Limited, Prilenia Therapeutics, Sun Pharmaceutical Industries Limited, Teva Pharmaceutical Industries Ltd., Vaccinex Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)