Hydrogen Fuel Cell Vehicle Market Size, Share, Trends and Forecast by Technology, Vehicle Type, and Region, 2026-2034

Hydrogen Fuel Cell Vehicle Market Summary:

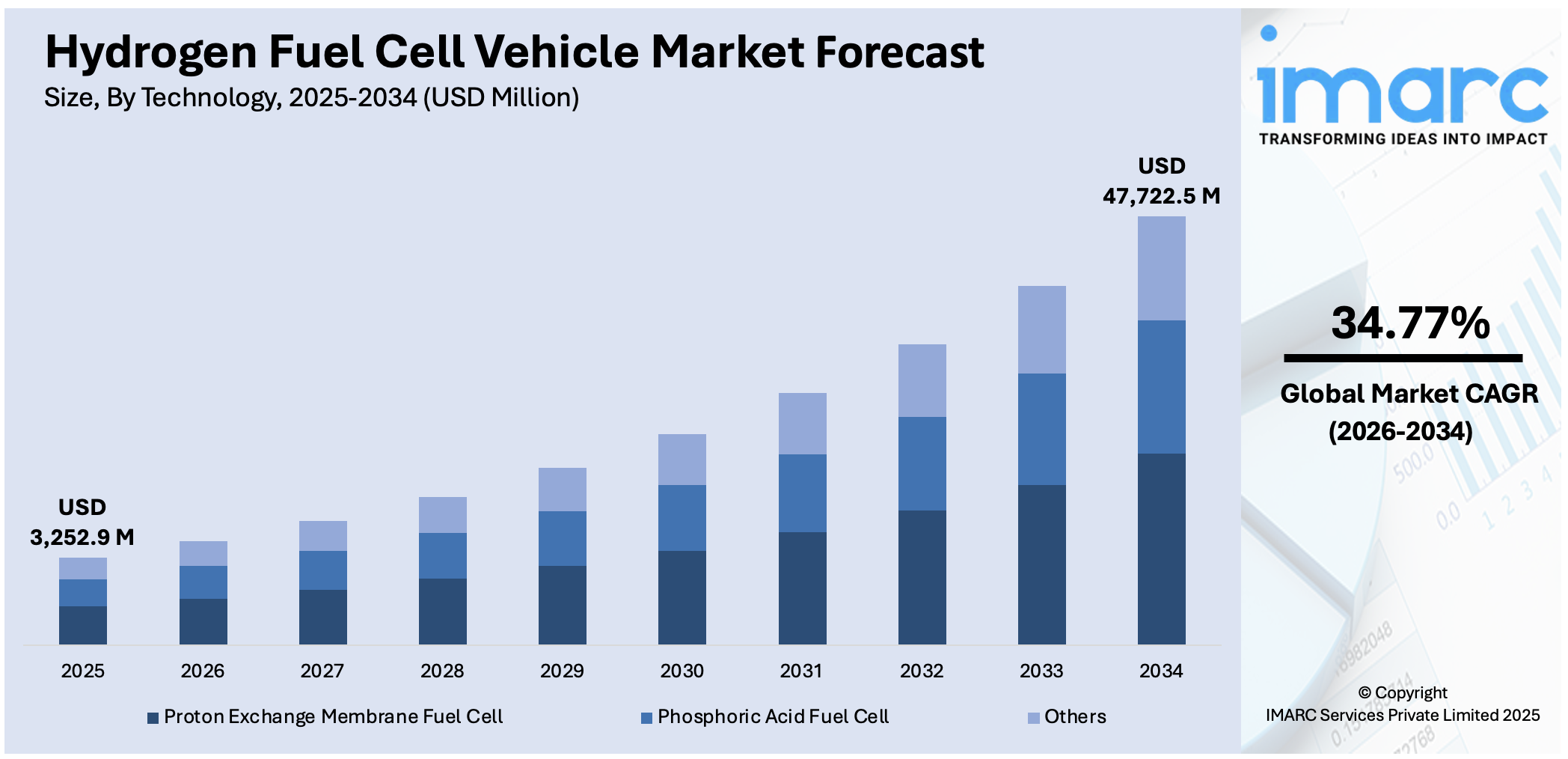

The global hydrogen fuel cell vehicle market size was valued at USD 3,252.9 Million in 2025 and is projected to reach USD 47,722.5 Million by 2034, growing at a compound annual growth rate (CAGR) of 34.77% from 2026-2034. The market growth is fueled by increasing efforts across various sectors to develop and commercialize vehicles powered by hydrogen fuel cells, which produce electricity to run electric motors efficiently and sustainably.

Market Size & Forecasts:

- Hydrogen fuel cell vehicle market was valued at USD 3.25 Billion in 2025.

- The market is projected to reach USD 47.72 Billion by 2034, at a CAGR of 34.77% from 2026-2034.

Dominant Segments:

- Technology: Proton exchange membrane fuel cells (PEMFC) dominate the hydrogen fuel cell market, accounting for 41.9% of the share. Their widespread adoption is attributed to their high efficiency, compact design, and quick start-up capabilities.

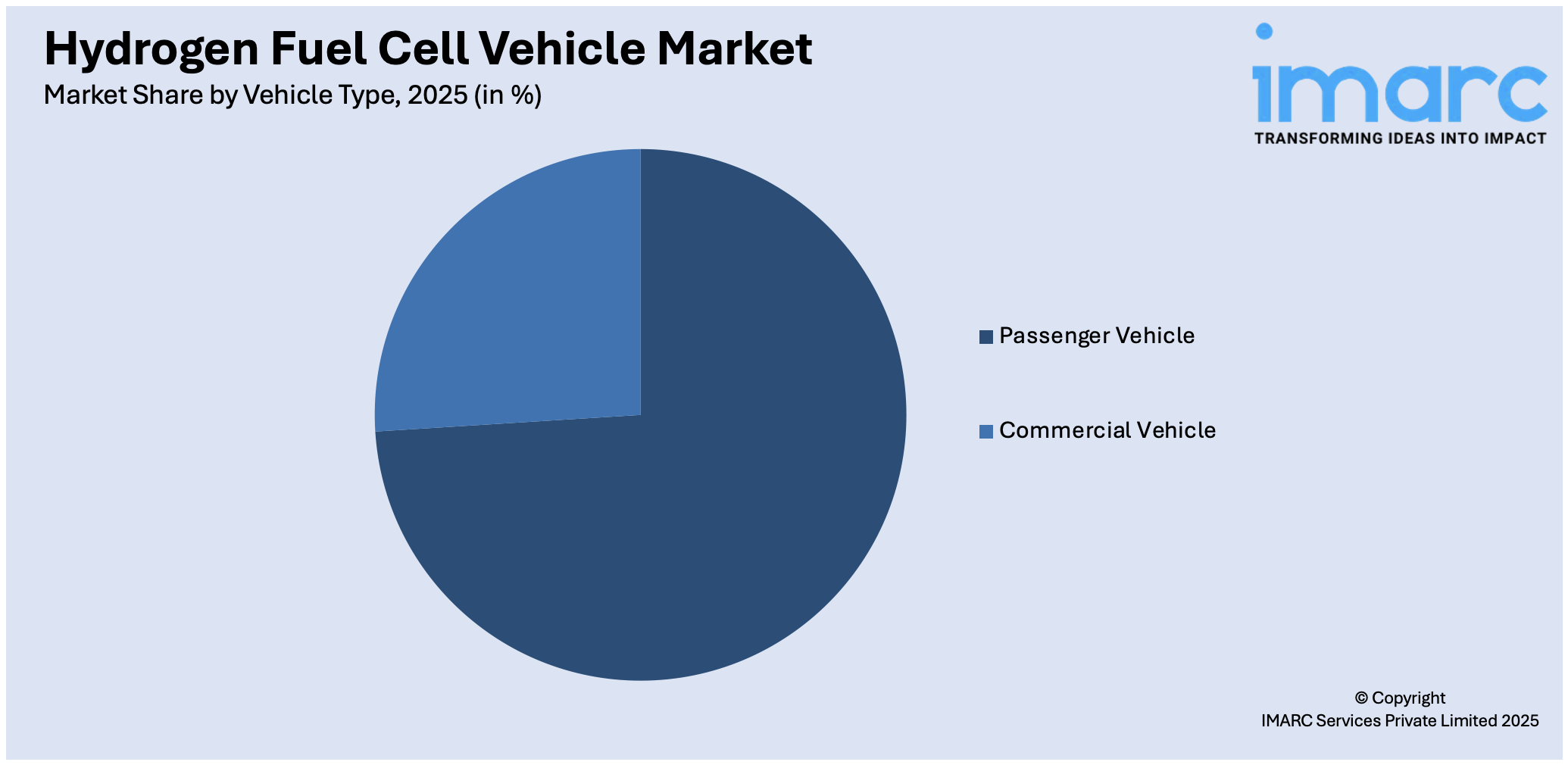

- Vehicle Type: With a commanding 74.0% share, passenger cars lead the hydrogen fuel cell vehicle (HFCV) market, driven by their practicality for daily travel, long-range capabilities, and quick refueling advantages.

- Region: Asia Pacific leads the hydrogen fuel cell vehicle (HFCV) market, holding a dominant 45.9% share. This regional advantage is driven by aggressive clean energy initiatives, significant investments in hydrogen infrastructure, and firm government commitments to lowering carbon emissions.

Key Players:

- The leading companies in HFCV market include Ballard Power Systems, BMW, Cummins, General Motors, Hyundai, and Toyota.

Key Drivers of Market Growth:

- Environmental Awareness: Heightened concern over air pollution and the impact of greenhouse gas emissions is accelerating the shift toward cleaner energy solutions such as hydrogen fuel cells.

- Governmental Backing: Worldwide governments are playing a proactive role in promoting hydrogen technology through investments in infrastructure and offering incentives to drive fuel cell vehicle adoption.

- Technological Progress: Continuous advancements, particularly in proton exchange membrane (PEM) fuel cells, are enhancing performance, durability, and affordability.

- Infrastructure Expansion: Robust investments in hydrogen refueling networks are playing a pivotal role in enabling the broader rollout of hydrogen-powered vehicles.

- Rising Fuel Prices: As the cost of conventional petroleum-based fuels continues to climb, hydrogen fuel cell vehicles are becoming an increasingly appealing and economical alternative.

Future Outlook:

- Strong Growth Outlook: The hydrogen fuel cell vehicle market is expected to see sustained expansion, driven by ongoing technological innovations, supportive government policies, and rising environmental awareness.

- Market Evolution: The sector is anticipated to shift from niche use to widespread adoption across diverse vehicle types and global regions.

To get more information on this market Request Sample

One of the key drivers in the market is increasing demand for clean energy solutions and lower carbon emissions. With governments across the globe implementing stricter environmental policies to address climate change, hydrogen fuel cells provide a zero-emission solution compared to conventional internal combustion engine vehicles. FCVs produce only water vapor, which makes them a popular choice among environmentally conscious consumers and industries looking to achieve sustainability targets. Moreover, technology development in hydrogen production, storage, and infrastructure expansion, and governmental incentives are propelling market growth and placing hydrogen at the center of a cleaner transportation shift.

The U.S. hydrogen FCV market is key to the clean energy transition, though it's hindered by limited infrastructure and high costs along with a market share of 84.40%. With the majority of the country's hydrogen refueling stations, California is a leader in this regard. Though FCV adoption has been sluggish, vehicle development and infrastructure investment by manufacturers persists, attempting to overcome the current hurdles. But sales in 2024 plummeted with just 322 FCVs sold during the first half of the year, an 82% decrease from the previous year. The U.S. continues to be a focal point for FCV development, with ongoing efforts to propel technological innovations and increase consumer demand.

Hydrogen Fuel Cell Vehicle Market Trends:

Increasing awareness among the masses about the benefits of using hydrogen FCVs

The increasing concern of the general public regarding the multiple benefits offered by hydrogen FCVs is strengthening the market. As word gets around concerning the ecological benefits of FCVs, i.e., they can reduce emissions and also prevent air pollution, customers are getting attracted towards these new-generation vehicles. Additionally, as people become increasingly aware of the extended driving distances and fast refueling abilities of hydrogen FCVs, their impression of these cars as serious alternatives to conventional gasoline-powered vehicles is strengthening. This growing awareness drives higher demand for hydrogen FCVs, encouraging automakers to invest in R&D to meet this demand. Promoting the economic and environmental benefits of hydrogen FCVs through positive word-of-mouth publicity and information campaigns is increasingly driving the hydrogen fuel cell vehicle market share and propelling the automotive sector towards a cleaner, greener future.

Development of hydrogen fuel cell infrastructure worldwide

The growth of hydrogen fuel cell infrastructure is gaining momentum, and it will give rise to the future of clean, sustainable transport. Nations across the globe recognize the utilization of hydrogen fuel cells as an excellent option to reduce carbon emissions as well as energy diversification. According to studies, compared to conventional cars with internal combustion engines, hydrogen fuel cell vehicles use between 29 and 66% less energy and release between 31 and 80% fewer greenhouse gas (GHG) emissions. Governments, along with private sector stakeholders, are putting funds into the implementation of hydrogen refueling stations, a key factor in the mass use of hydrogen fuel cell vehicles (FCVs). This infrastructure deployment is propelled by environmental issues, tight emission legislation, and the need to decrease dependence on fossil fuels. Areas such as Europe, Japan, and certain locations in North America have led the charge in hydrogen infrastructure establishment, investing in a chain of refueling stations to enable FCV takeup. These initiatives are research projects, policy inducements, and collaborations with automakers and energy firms to speed the installation of hydrogen refueling infrastructure. With the buildup of the infrastructure, it removes one of the most important impediments to FCV adoption by making convenient refueling available to consumers. This in turn induces automakers to manufacture more hydrogen-powered vehicles, and in the process, creates a favorable feedback loop that drives the market. Hydrogen fuel cell infrastructure expansion is not just restricted to passenger cars but also includes use in public transportation, commercial fleets, and even heavy-duty vehicles. These developments represent a collective commitment to lowering carbon emissions and embracing sustainable transportation options. With governments and industries continuing to partner and invest in hydrogen infrastructure, the platform for a cleaner, hydrogen-powered mobility ecosystem is being built around the world.

Depleting fossil fuel reserves

The exhaustion of fossil fuel resources is an acute problem with global consequences for energy security, economic stability, and ecological sustainability. The world reserves are estimated to remain available at around 139 years for coal, 56 years for petroleum, and 49 years for gas at prevailing rates of consumption, as indicated in industry estimates. With the finite existence of fossil fuels more and more in evidence, the need to move towards other energy sources grows. This scarcity has hastened the move toward renewable and cleaner forms of energy such as solar, wind, hydroelectric, and nuclear, as well as the creation of new technologies such as hydrogen fuel cells. The uncertainty about future fossil fuel supplies has led governments, industries, and scientists to find these alternatives to an assured and sustainable energy future. Though fossil fuel depletion creates problems, it also presents a chance to avoid climate change and lower greenhouse gas emissions. Shifting away from fossil fuels is in line with world efforts towards limiting temperature increase and becoming carbon neutral. But this shift will need huge investments in research, infrastructure, and policy structures to enable the up-scaling of renewable and low-carbon technologies. The depletion of fossil fuel reserves calls for a holistic process that involves embracing innovation, cooperation, and policies of the future. By so doing, societies can position themselves for the challenges of depleting fossil fuel resources while catching the opportunities of cleaner and more sustainable energy systems.

Key Growth Drivers of Hydrogen Fuel Cell Vehicle Market:

Improved fuel efficiency and driving range

Hydrogen fuel cell electric vehicles (FCEVs) transform hydrogen into electricity via a clean electrochemical process, delivering high energy efficiency with minimal environmental impact. These vehicles can travel greater distances on a single refueling compared to battery electric vehicles (BEVs) and internal combustion engine (ICE) vehicles, making them suitable for long-haul and commercial transportation. The quick refueling time, often comparable to gasoline and diesel vehicles, adds further convenience for users and fleet operators. As energy costs and environmental concerns are growing, the demand for vehicles that combine range, performance, and sustainability continues to rise. FCEVs also maintain performance in extreme weather conditions and require fewer moving parts, reducing maintenance costs. FCEVs outperform ICE vehicles in fuel efficiency and range, providing a cleaner and longer-lasting drive. These advantages are potentially catalyzing the demand for automotive fuel cells as industries are shifting towards greener transport solutions.

Government policies and regulations

Government policies and regulations are offering a favorable market outlook. Many government agencies are actively promoting clean transportation to decrease greenhouse gas emissions and dependence on fossil fuels. Supportive policies include tax credits, purchase subsidies, reduced registration fees, and funding for research and development (R&D) activities, which are making hydrogen vehicles more attractive to users and manufacturers. Regulations mandating lower emissions from the transport sector are further motivating automakers to invest in fuel cell technologies. Government agencies are also investing in building hydrogen refueling stations, creating the infrastructure needed to support widespread adoption. Public-private partnerships help advance hydrogen production and distribution, ensuring fuel availability. Policies like California’s funding for hydrogen refueling stations and the US Inflation Reduction Act’s tax credits are directly enhancing FCEVs production and sales. These strategic actions are not only encouraging user adoption but also driving innovations, minimizing costs, and expanding the market, making FCEVs a viable solution for the future of sustainable transportation.

Hydrogen Fuel Cell Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydrogen fuel cell vehicle market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on technology and vehicle type.

Analysis by Technology:

- Proton Exchange Membrane Fuel Cell

- Phosphoric Acid Fuel Cell

- Others

Proton exchange membrane fuel cells (PEMFC) capture most of the hydrogen fuel cell market shares of 41.9% along with the high efficiency, compact form, and fast start-up feature. PEMFCs are most suited for usage in the automotive industry, particularly for passenger cars, because they are made to operate at low temperatures. Customers require greater driving range and fuel efficiency, which they can assist because to their light weight and quick power generation. Furthermore, PEMFCs work perfectly with infrastructure that refuels hydrogen. The continuous advancement of PEMFC technology and the broad availability of hydrogen have made them the preferred technology for automakers seeking to produce high-performance, zero-emission automobiles. PEMFCs are therefore still the most popular technology available.

Analysis by Vehicle Type:

Access the comprehensive market breakdown Request Sample

- Passenger Vehicle

- Commercial Vehicle

Based on the hydrogen fuel cell vehicle market forecast, the passenger cars currently rule the hydrogen fuel cell vehicle (FCV) market with a market share of 74.0% because of their adaptability for daily commutes, range, and fast refueling benefits. Governments from around the globe are encouraging adoption by providing subsidies, tax incentives, and investment in hydrogen refueling stations. Moreover, developments in fuel cell technology have improved vehicle performance and lowered costs, making FCVs more affordable to customers. Automakers are now more intensely concentrating on hydrogen-powered passenger models due to the increased consumer demand for cleaner modes of transportation. Notwithstanding limitations such as few refueling stations, the interplay between environmental advantage, government incentives, and technological advancements makes passenger vehicles the top segment in the FCV market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The Asia Pacific region leads the hydrogen FCV market, holding a dominant share of 45.9%. This growth is driven by several key factors, including strong government support for clean energy initiatives, significant investments in hydrogen infrastructure, and a commitment to reducing carbon emissions. Countries like Japan, South Korea, and China have been at the forefront, with Japan's Toyota and South Korea’s Hyundai pioneering hydrogen fuel cell technologies. Additionally, the region's increasing focus on sustainable transportation solutions and partnerships between governments and automakers have further accelerated the adoption of hydrogen FCVs. The growing interest in hydrogen as an alternative energy source is positioning Asia Pacific as the leader in the global market.

Key Regional Takeaways:

North America Hydrogen Fuel Cell Vehicle Market Analysis

North America is witnessing a significant rise in the Hydrogen FCV market, driven by increasing investments in clean energy technologies, a growing commitment to reducing greenhouse gas emissions, and the development of hydrogen infrastructure. The United States, in particular, plays a pivotal role, with key automakers like Toyota, Hyundai, and Honda introducing fuel cell vehicles to the market. Government initiatives, such as tax incentives and grants, support the growth of hydrogen adoption in the transportation sector, particularly in California, which leads the way in hydrogen fueling stations. Additionally, collaborations between automakers, fuel providers, and government agencies are accelerating the rollout of hydrogen refueling stations and fueling infrastructure. While challenges such as the high cost of hydrogen production and limited fueling infrastructure remain, North America’s commitment to transitioning to a sustainable and low-emission transportation system, alongside technological advancements, positions the region for continued growth in the FCV market. The increasing focus on diversifying fuel options and reducing dependency on fossil fuels further solidifies North America's role in the future of hydrogen fuel cell vehicles.

United States Hydrogen Fuel Cell Vehicle Market Analysis

United States hydrogen fuel cell car market is driven mainly by federal and state-level supportive incentives, such as tax credits and grants. Conforming to the same, higher U.S. Department of Energy's investments in hydrogen infrastructure, especially through Hydrogen Shot, are enhancing access to refueling networks and driving the market. Also, expanding corporate fleet decarbonization targets inviting logistics and transportation firms to investigate FCEVs for long-haul and heavy-duty usage, is driving market expansion. Rising partnership among automakers and fuel cell technology companies driving next-generation powertrain deployment, is promoting market growth. Also, greater hydrogen car inclusion in state zero-emission mandates, particularly in California, is driving product adoption in both consumer and business markets. According to an industry report, California has most of the fuel cell electric vehicles (FCEVs) in the U.S., along with 66 hydrogen-fueled buses. In 2021, the state equalled world leaders Japan, South Korea, and Germany in the deployment of hydrogen fueling infrastructure. In addition, strategic public-private collaborations enabling pilot projects in important sectors like public transport and waste management is also leading to increased market preparedness and public acceptance of hydrogen mobility solutions.

Europe Hydrogen Fuel Cell Vehicle Market Analysis

Europe hydrogen fuel cell vehicle market is being fueled by the European Union's Fit for 55 package and Hydrogen Strategy give unambiguous legislative support to hydrogen mobility. Also, increased investments in hydrogen refueling stations, especially along key freight corridors, are fueling market optimism. European Investment Bank (EIB) provided EUR 25 Million to Resato Hydrogen Technology to expand hydrogen refuelling infrastructure and R&D. Headquartered in the Netherlands, Resato is aiming to have 1,000 stations operational by 2030 to facilitate heavy transport decarbonization. In addition, national governments such as Germany and France progressively providing subsidies and procurement incentives is catalyzing FCEV take-up in logistics and public transport. In addition, many European automakers expanding their hydrogen research and development (R&D) activities, is enabling market growth. The accelerated adoption of hydrogen fuel cell buses in urban fleets validating emissions goals and augmenting local air quality measures, is underpinning market demand. Similarly, expanding partnerships among energy firms and auto OEMs promoting fuel cell technologies and application, is driving the market. Besides this, growing use of hydrogen-powered ground equipment at airports and ports in Europe, backing transport sector decarbonization, is aiding the hydrogen fuel cell vehicle market growth.

Asia Pacific Hydrogen Fuel Cell Vehicle Market Analysis

The market in Asia Pacific is being driven by the rising national hydrogen roadmaps in countries like Japan, South Korea, and China providing clear targets and funding for development. In accordance with this, favorable government-led public transport initiatives integrating hydrogen buses and taxis into urban mobility systems, is driving market growth. Furthermore, increasing investment in domestic green hydrogen production reinforcing supply chain security and aligning with net-zero goals, is augmenting product sales. According to the China Hydrogen Energy Industry Association, China launched over 60 new green hydrogen projects between January and November 2023, with investments totaling more than RMB 410 billion. The strategic alliances between automakers and fuel cell system developers, fast-tracking commercialization of next-generation FCEVs, is expanding market scope. Additionally, increasing deployment of hydrogen-powered logistics and cargo handling vehicles in port cities reducing emissions in high-traffic zones, is fueling market expansion. Moreover, continual advancements in hydrogen storage, refueling bridging infrastructure gaps and augmenting FCEV viability for commercial and consumer use, are impacting the hydrogen fuel cell vehicle market trends.

Latin America Hydrogen Fuel Cell Vehicle Market Analysis

The Latin America hydrogen fuel cell vehicle market is gaining momentum through a combination of regional energy initiatives and strategic investments. Furthermore, rapid integration of hydrogen into national energy transition plans, prioritizing its role in decarbonizing heavy transport, is impelling the market. The growing interest in exporting green hydrogen encouraging the development of supporting infrastructure, including refueling stations for mobility applications, is bolstering market development. As such, Brazil approved the first phase of Fortescue's USD 3.6 Billion green hydrogen project in Ceará. The plant will produce 500 tons of green hydrogen daily using 1.2 GW of renewable energy, and position Ceará as a future green hydrogen export hub. Apart from this, numerous partnerships with global fuel cell technology providers enabling pilot programs for buses and commercial fleets, is affecting market competitiveness.

Middle East and Africa Hydrogen Fuel Cell Vehicle Market Analysis

The market in the Middle East and Africa is experiencing growth influenced by increasing national hydrogen strategies focused on economic diversification and decarbonization. The UAE’s National Hydrogen Strategy 2050 targets production of 1.4 mtpa by 2031, 7.5 mtpa by 2040, and 15 mtpa by 2050. In order to support net-zero pledges, it seeks to reduce emissions in hard-to-abate sectors by 25% by 2031 and 100% by 2050. In addition to this, growing investment in green hydrogen production and export capabilities in Saudi Arabia and the UAE, driving demand for FCEV-compatible infrastructure, is strengthening hydrogen fuel cell vehicle market demand. Furthermore, pilot programs for hydrogen-powered public transport and logistics fleets demonstrating regional commitment to low-emission mobility, is accelerating market expansion. Moreover, various global partnerships driving technology transfer and speeding up hydrogen vehicle deployment in emerging urban and industrial areas, is positively influencing the market.

Competitive Landscape:

The market for hydrogen FCV is highly competitive, with several companies fighting for supremacy. Automakers are investing heavily in research and development to enhance fuel cell technology, improve vehicle performance, and reduce production costs. Additionally, there is a focus on expanding hydrogen refueling infrastructure, which remains a critical challenge for wider adoption. Governments play a key role by providing incentives, funding, and regulations that promote clean energy vehicles. Collaboration between automakers, energy providers, and technology firms is common, as partnerships help accelerate the development of both vehicles and the necessary fueling infrastructure. Market competition is increasingly centered around innovation, cost-effectiveness, and the ability to scale up operations efficiently.

The report provides a comprehensive analysis of the competitive landscape in the hydrogen fuel cell vehicle market with detailed profiles of all major companies, including:

- Ballard Power Systems Inc.

- Bayerische Motoren Werke AG

- Cummins Inc.

- General Motors Company

- Hyundai Motor Company

- Toyota Motor Corporation

Latest News and Developments:

- April 2025: Hyundai Motor Company unveiled the new XCIENT Fuel Cell Class-8 heavy-duty truck, highlighting its commitment to hydrogen-powered clean logistics in North America. The truck features a 180-kW hydrogen fuel cell system, 350 kW e-motor, up to 450-mile range, and advanced driver-assistance systems. Hyundai’s partnerships, such as the NorCAL ZERO Project and HTWO Logistics, have enabled large-scale hydrogen truck deployments, supporting decarbonized freight operations and infrastructure expansion, including a new hydrogen refueling station in Georgia.

- February 2025: Toyota presented its new third-generation fuel cell (FC) system, developed for a hydrogen society. This system, designed for the commercial sector, matches diesel engine durability while improving fuel efficiency and reducing costs. It will be launched in Japan, Europe, North America, and China after 2026 and unveiled at the H2 & FC EXPO in Tokyo.

- October 2024: Hyundai Motor Company unveiled its INITIUM hydrogen fuel cell electric vehicle (FCEV) concept, previewing a new production FCEV planned for the first half of next year. The INITIUM concept debuts the company’s new ‘Art of Steel’ design language. The concept has a targeted driving range of more than 650 km between refueling, achieved through large hydrogen fuel tanks, aerodynamic wheels, and low rolling resistance tires. It also includes a FCEV-specific route planner, a spacious interior, and a Vehicle-to-Load (V2L) feature.

- October 2024: Hyzon secured North America’s first order for 12 hydrogen-powered refuse Fuel Cell Electric Vehicles (FCEVs) from GreenWaste, a sustainability leader in waste management. This landmark deal follows successful trials of Hyzon’s zero-emission refuse trucks, which produce no tailpipe emissions and support GreenWaste’s goal to reduce greenhouse gas emissions by 45% by 2030. The vehicles will be co-manufactured with New Way Trucks, an industry-leading refuse truck body maker.

- September 2024: BMW announced plans to launch its first series production hydrogen-powered fuel cell electric vehicle (FCEV) in 2028, developed in partnership with Toyota. This follows BMW’s iX5 Hydrogen pilot fleet testing and aligns with its goal to reduce CO2 emissions by 40% per vehicle by 2030 and achieve 50% electric vehicle sales. The collaboration, ongoing since 2013, focuses on developing third-generation fuel cell systems, cost reduction, and expanding hydrogen infrastructure to promote sustainable hydrogen supply and accelerate FCEV adoption globally.

- June 2024: Honda began the production of the 2025 CR-V e:FCEV at its Performance Manufacturing Center in Ohio, making it the only fuel cell electric vehicle (FCEV) manufactured in America and the first U.S. production FCEV to combine a U.S.-made fuel cell system with plug-in EV charging. The compact CUV offers a 270-mile EPA range, including 29 miles of pure EV driving. The next-gen fuel cell, co-developed with GM, is more efficient, durable, and cost-effective, supporting Honda’s carbon neutrality goals.

- May 2024: Volvo Trucks announced the launch of hydrogen-powered trucks with combustion engines by the end of the decade, with customer testing beginning in 2026. These trucks, suitable for long distances where charging infrastructure is limited, offer similar performance to diesel trucks but with potentially net-zero CO2 emissions. Utilizing High-Pressure Direct Injection (HPDI) technology, these trucks achieve higher energy efficiency. Volvo has partnered with Westport Fuel Systems for HPDI tech, aiming for operational status in Q2 2024. These hydrogen trucks complement Volvo's other sustainable solutions like battery electric and fuel cell electric trucks.

Hydrogen Fuel Cell Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cell, Others |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ballard Power Systems Inc., Bayerische Motoren Werke AG, Cummins Inc., General Motors Company, Hyundai Motor Company, Toyota Motor Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydrogen fuel cell vehicle market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hydrogen fuel cell vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydrogen fuel cell vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydrogen fuel cell vehicle market was valued at USD 3,252.9 Million in 2025.

The hydrogen fuel cell vehicle market size reached USD 47,722.5 Million in 2034, exhibiting a CAGR of 34.77% during 2026-2034.

The key factors driving the hydrogen fuel cell vehicle market include stringent environmental regulations, advancements in fuel cell technology, and increasing government support. Governments worldwide are implementing stricter emission standards and offering incentives to promote zero-emission vehicles. Simultaneously, technological improvements are enhancing fuel cell efficiency and reducing costs.

Asia Pacific dominates the hydrogen fuel cell vehicle market due to strong government support, investments in hydrogen infrastructure, and leading automakers like Toyota and Hyundai driving innovation. Japan, South Korea, and China focus on clean energy solutions, making the region a hub for hydrogen adoption and sustainable transportation technologies.

Some of the major players in the hydrogen fuel cell vehicle market include Ballard Power Systems Inc., Bayerische Motoren Werke AG, Cummins Inc., General Motors Company, Hyundai Motor Company, Toyota Motor Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)