Hydropower Market Size, Share, Trends and Forecast by Size, Application, and Region, 2025-2033

Hydropower Market Size and Share:

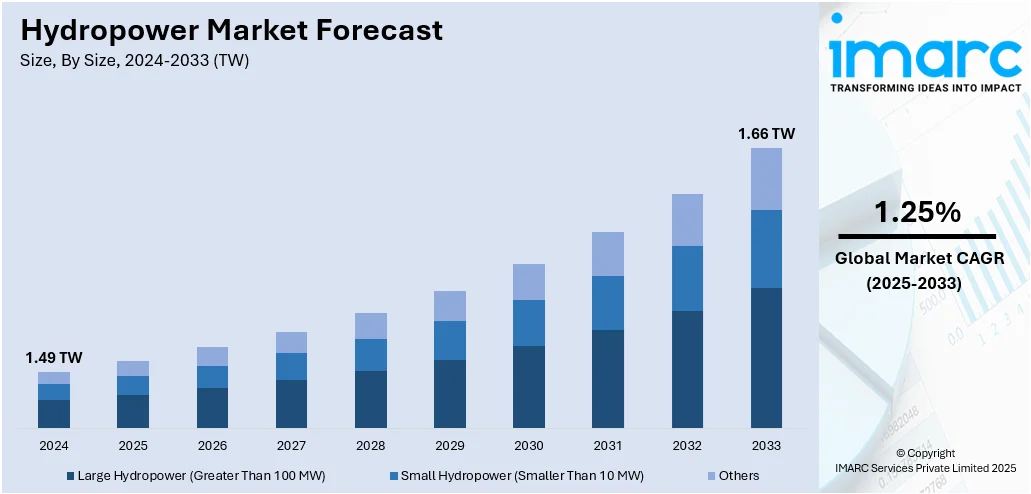

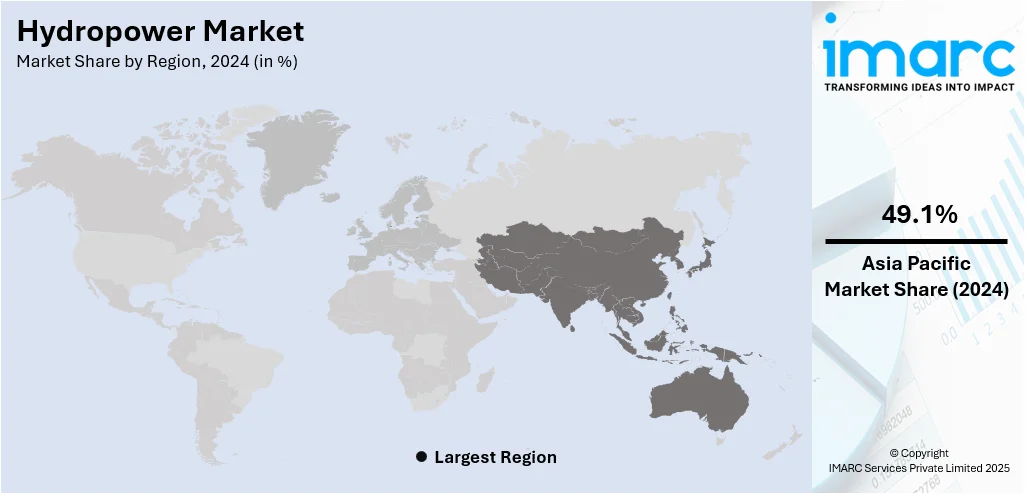

The global hydropower market size reached 1.49 TW in 2024. Looking forward, IMARC Group estimates the market to reach 1.66 TW by 2033, exhibiting a CAGR of 1.25% during 2025-2033. Asia Pacific dominated the market, holding a significant market share of over 49.1% in 2024. Abundant water resources, strong investments, rising power demand, and supportive government policies are some of the factors contributing to the hydropower market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1.49 TW |

|

Market Forecast in 2033

|

1.66 TW |

| Market Growth Rate 2025-2033 | 1.25% |

The market is primarily driven by growing global electricity demand and the shift toward cleaner energy sources. Many countries are investing in hydropower to reduce reliance on fossil fuels and meet climate targets. Government incentives, renewable energy mandates, and emission reduction commitments further boost development. Hydropower also provides grid stability and storage through pumped storage plants, making it attractive for balancing variable renewable sources like solar and wind. In addition, technological improvements have made older plants more efficient and cost-effective. Developing regions with untapped water resources offer significant growth potential. Hydropower’s long operational life and relatively low operating costs increase its appeal for long-term energy planning. Environmental concerns and regulatory hurdles can slow progress, but overall, the demand for sustainable, reliable electricity continues to support the hydropower market growth.

To get more information on this market, Request Sample

In the US, recent funding supports efforts to boost hydropower’s role in balancing increasingly variable energy sources. As wind and solar adoption grows, flexible hydropower operations are gaining attention for their ability to stabilize grids. These developments signal a shift toward modernization and integration of existing capacity into a more responsive power system. For instance, in November 2024, the US Department of Energy funded nine projects with nearly USD 15 Million to improve hydropower’s flexibility. This aims to help balance electric grids as wind and solar use grow. Hydropower currently generates 27% of US renewable electricity and 6% of total utility-scale power.

Hydropower Market Trends:

Resilient Growth in Clean Energy

Hydropower continues to hold a steady position in the shift toward cleaner electricity sources. Its ability to deliver consistent output makes it a valuable anchor for power grids facing increasing reliance on solar and wind. As interest in low-carbon energy options grows, older hydro facilities are being modernized and upgraded for better efficiency. New project development remains selective, often shaped by environmental considerations and regulatory approvals. Hydropower market trends reflect a balance between preserving legacy assets and adapting to evolving clean energy goals. While not expanding as quickly as some newer technologies, hydro remains a core part of long-term energy planning due to its dependability and integration value. According to the US Department of Energy, hydropower currently accounts for 27% of total US. utility-scale renewable electricity generation and 5.86% of total US utility-scale electricity generation, underscoring its vital role in the country’s clean energy portfolio.

Expanding Role in Net-Zero Energy Goals

Hydropower is being recognized as a critical piece in global decarbonization efforts. Energy experts agree that reaching net-zero targets by mid-century will require a major scale-up of installed capacity. This points to a growing focus on project development, technology upgrades, and supportive policy frameworks aimed at unlocking untapped potential. Future investments are expected to center on both new sites and the modernization of aging infrastructure. Environmental impact and permitting remain key challenges, but international targets are driving renewed attention to this sector. The hydropower market outlook shows rising interest as climate goals push this long-standing energy source back into global energy planning. Its ability to provide stable output makes it a valuable complement to other renewable technologies. For example, the International Hydropower Association (IHA), citing joint findings from the IEA and IRENA, states that in order to achieve a cost-effective and feasible global net-zero energy system by 2050, the existing hydropower capacity must double, from current levels to between 2,500 GW and 3,000 GW.

Key Progress in Northeast Hydropower Development

A major step has been taken in advancing large-scale hydro infrastructure in Arunachal Pradesh. With a significant payout allocated for land compensation, groundwork is being laid for dam and powerhouse construction in the Dibang Valley. This move supports long-term energy planning in a region with vast untapped potential. Beyond boosting regional capacity, it reflects a wider commitment to diversifying clean energy sources and strengthening power availability in the Northeast. The project’s development is expected to drive further interest in high-capacity installations in remote areas, where hydropower remains one of the most viable options. The hydropower market forecast in India continues to build around such landmark initiatives, where financing and land acquisition signal real momentum. For instance, in April 2025, SJVN Ltd released INR 269.97 Crore as land compensation for the 3,097 MW Etalin Hydro Electric Project in Arunachal Pradesh's Dibang Valley. The funds supported land acquisition for two dams and an underground powerhouse, marking a key milestone in India's renewable energy goals and Northeast hydropower infrastructure development.

Hydropower Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydropower market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on size and application.

Analysis by Size:

- Large Hydropower (Greater Than 100 MW)

- Small Hydropower (Smaller Than 10 MW)

- Others

Large hydropower (greater than 100 MW) stood as the largest size in 2024, holding around 66.3% of the market due to its ability to deliver consistent, utility-scale electricity. These plants contribute significantly to national grids, supporting base load demand and stabilizing supply during peak periods. Their operational flexibility allows them to ramp generation up or down quickly, complementing intermittent renewables like wind and solar. Governments often prioritize large hydropower in long-term energy strategies because of its proven reliability and long asset lifespan. Infrastructure investment in this segment attracts public-private partnerships and international financing, especially in regions with untapped river systems. Its scale also enables integration of modern control systems and energy storage capabilities, further improving performance. As energy security and emissions targets gain urgency, large hydropower remains a central force in shaping renewable power development.

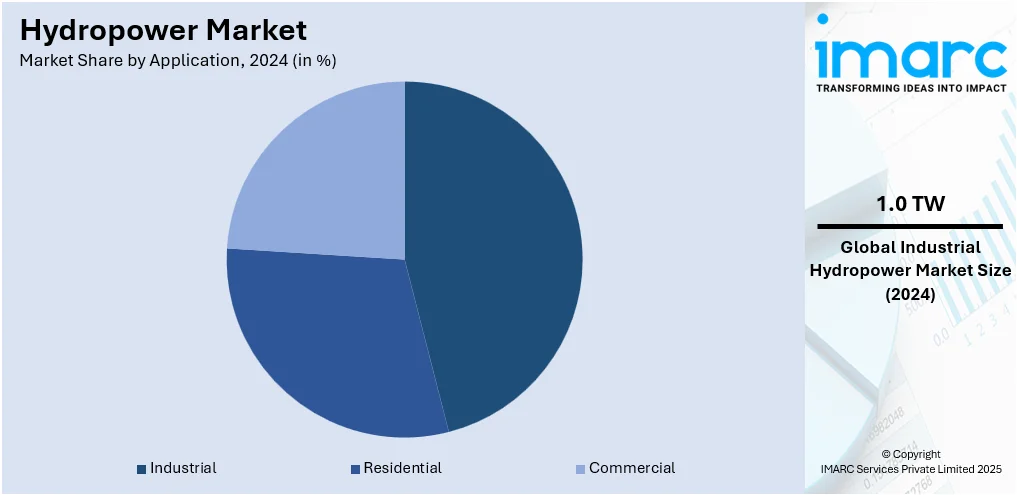

Analysis by Application:

- Industrial

- Residential

- Commercial

Industrial led the market with around 45.7% of market share in 2024 due to its high and consistent electricity demand. Industries such as mining, manufacturing, and chemical processing require large volumes of stable, low-cost power, making hydropower an attractive option. In regions with abundant water resources, industries often invest in captive or nearby hydropower facilities to reduce dependence on grid electricity and mitigate exposure to fossil fuel price volatility. Hydropower’s reliability and low operating costs help industries meet sustainability goals while maintaining operational efficiency. Additionally, industries are under increasing pressure to decarbonize, and using renewable energy sources like hydropower supports corporate ESG commitments. This demand encourages both new project development and modernization of existing plants, positioning industrial consumption as a steady, long-term growth factor in the overall hydropower market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 49.1%, owing to a combination of geographic, economic, and policy factors. Countries like China, India, Vietnam, and Indonesia have vast river systems and favorable topography, enabling large-scale hydropower development. China is the world’s largest producer of hydroelectricity, supported by massive investments and a clear focus on clean energy expansion. India is rapidly expanding its capacity to meet rising power demand and reduce reliance on coal. Governments across the region promote hydropower through policy incentives, long-term energy planning, and infrastructure funding. Growing populations, industrialization, and urbanization increase electricity needs, making stable and renewable sources like hydropower essential. Many countries also use hydropower for grid stability and flood control. Continued economic growth and energy security priorities ensure Asia Pacific remains the leading region in hydropower development.

Key Regional Takeaways:

United States Hydropower Market Analysis

In 2024, the United States accounted for 87.50% of the market share in North America. The United States hydropower market is witnessing steady growth, supported by the modernization of aging infrastructure and the integration of digital monitoring technologies. With an increased focus on grid resilience and flexible energy solutions, hydropower is being positioned as a dependable backup to intermittent renewable sources like wind and solar. According to the US Energy Information Administration (EIA), hydropower generation in the US is projected to increase by 7.5% in 2025, reflecting the sector’s expanding contribution to national energy needs. Government-backed investments in low-impact and run-of-river projects are encouraging sustainable expansion while minimizing ecological disruption. Additionally, the growing demand for pumped storage facilities is enhancing the management of peak load. Technological innovation in turbine efficiency and automation is further contributing to operational optimization. In rural and off-grid areas, small-scale hydropower installations are gaining traction, offering decentralized power generation and energy independence. The increasing involvement of research institutions and public-private partnerships is accelerating innovation and implementation. Furthermore, favorable regulatory frameworks and financial incentives for clean energy adoption are fostering the deployment of advanced hydropower systems. With hydropower contributing significantly to renewable energy portfolios, its role in decarbonization strategies is expanding.

Europe Hydropower Market Analysis

The hydropower market in Europe is experiencing a dynamic transformation driven by the continent’s push for energy diversification and decarbonization. Emphasis on interconnecting regional power systems is encouraging cross-border hydroelectric trade, maximizing the flexibility of existing resources. According to reports, a combination of solar growth and a recovery in hydropower led to renewables contributing nearly 47% of the EU’s total power generation, while clean sources overall reached a record 71%. The increasing integration of variable renewables has elevated the role of hydropower as a balance and frequency regulation tool. Upgrades in reservoir management techniques enable optimized water use, contributing to enhanced energy output and water conservation. In addition, policies supporting climate resilience are prompting innovations in hydro infrastructure to withstand changing weather patterns. The European commitment to circular economy principles is encouraging the adoption of environmentally sensitive technologies, including fish-friendly turbines and sediment control mechanisms.

Asia Pacific Hydropower Market Analysis

Asia Pacific’s hydropower market is expanding rapidly, fueled by rising electricity demand from industrial, commercial, and residential sectors. The increasing development of high-capacity hydroelectric projects in river basins is supporting long-term energy security strategies. As per the International Hydropower Association (IHA), China is pursuing ambitious targets to add up to 80 GW of additional pumped storage hydropower (PSH) capacity by 2027, signaling significant regional growth in hydro-based energy storage. The region is witnessing enhanced deployment of smart grid technologies that optimize hydroelectric output within broader renewable energy networks. Innovations in modular turbine systems enable the utilization of untapped low-head and micro-hydro resources in remote and hilly terrains. The drive toward sustainable development is fostering the construction of multipurpose hydropower plants that also provide irrigation, flood control, and drinking water supply. In addition, favorable policy mechanisms such as streamlined project approvals and performance-based incentives are contributing to sectoral growth.

Latin America Hydropower Market Analysis

The Latin American hydropower market is evolving due to growing interest in renewable baseload energy solutions that support economic development and rural electrification. The region benefits from abundant freshwater resources and mountainous geography, offering high hydropower potential. According to Brazil’s Ministry of Mines and Energy (MME), electricity consumption in the country is expected to rise by 3.6% in January 2025, indicating robust demand that hydropower is well-positioned to fulfill. Recent emphasis on energy transition has stimulated investment in digitalization and remote monitoring of hydro plants for performance enhancement. The market is also witnessing increasing public engagement in environmental governance, prompting the use of socially inclusive hydro development models. Additionally, advancements in energy storage and hybridization are allowing hydropower systems to complement solar and wind installations.

Middle East and Africa Hydropower Market Analysis

In the Middle East and Africa, the hydropower market is gaining momentum due to the need for diversified energy sources that reduce reliance on fossil fuels. Water infrastructure development is being integrated with energy generation, enabling multi-functional use of river systems. Saudi Arabia’s initiative to recycle over 2 Billion cubic metres of water, amounting to nearly 70% of its renewable water sources, through a USD 4 Billion investment by 2030, as reported, illustrates the strategic synergy between water management and hydropower potential. Growing interest in transboundary energy cooperation is driving investment in cross-border hydroelectric projects, enhancing regional energy interconnectivity. Hydropower is being promoted for its potential in rural water pumping, desalination, and agriculture, and for electrifying underserved communities through small-scale and mini-grid hydro systems.

Competitive Landscape:

The hydropower market is marked by strong government support, research-focused initiatives, and collaborative efforts. Most developments center around improving grid flexibility, modernizing infrastructure, and integrating with other renewables. Common practices include government-backed R&D, strategic partnerships, and long-term agreements between public and private sectors. Funding programs often support innovations in pumped storage and digital controls. New product development is less frequent but emerging, especially in small-scale and modular systems. Overall, partnerships and government initiatives remain the most consistent strategies, helping drive upgrades, policy alignment, and technology adoption across regions. These approaches aim to enhance reliability, environmental performance, and compatibility with evolving energy systems, positioning hydropower as a reliable anchor within broader renewable integration efforts.

The report provides a comprehensive analysis of the competitive landscape in the hydropower market with detailed profiles of all major companies, including:

- American Hydro

- Andritz AG

- China Yangtze Power Co., Ltd

- Électricité de France SA

- ENGIE

- GE Vernova

- Iberdrola, S.A.

- RusHydro

- Siemens Energy

- Statkraft Group

- Tata Power Company Limited

- Voith GmbH & Co. KGaA

Latest News and Developments:

- June 2025: The Philippines and JICA launched a three-year nationwide inventory project, to map large-scale hydropower sites above 100MW. The initiative aimed to boost renewable energy targets, enhance energy security, and support climate resilience through data-driven planning, Japanese technical support, and expanded public-private investment in hydropower.

- May 2025: Azerbaijan advanced its green energy goals by launching two small hydropower plants, Zabux and Qarıqışlaq, in Laçın. They generated 21 Million kWh of clean electricity. These 6.8 MW plants showcased eco-friendly design, reduced emissions, and enhanced decentralized energy access, aligning with global renewable energy trends.

- April 2025: DVC signed power purchase agreements with SJVN to source hydropower from the under-construction Sunni Dam and Luhri Stage-I projects in Himachal Pradesh. This move aimed to meet renewable purchase obligations and manage peak industrial demand, offering grid flexibility while maintaining DVC’s thermal-dominant energy mix of 6,500 MW.

- February 2025: Cameroon launched the pre-selection process for companies to build the 500 MW Kikot hydroelectric dam, set to be the country’s largest energy project. Jointly developed by EDF and the Cameroonian government, the EUR 1 Billion project attracted World Bank funding and was scheduled to begin construction in 2025.

Hydropower Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | TW |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sizes Covered | Large Hydropower (Greater Than 100 MW), Small Hydropower (Smaller Than 10 MW), Others |

| Applications Covered | Industrial, Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Hydro, Andritz AG, China Yangtze Power Co., Ltd, Électricité de France SA, ENGIE, GE Vernova, Iberdrola, S.A., RusHydro, Siemens Energy, Statkraft Group, Tata Power Company Limited, Voith GmbH & Co. KGaA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydropower market from 2019-2033.

- The hydropower market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydropower industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydropower market reached 1.49 TW in 2024.

The hydropower market is projected to exhibit a CAGR of 1.25% during 2025-2033, reaching 1.66 TW by 2033.

The hydropower market is driven by rising electricity demand, supportive government policies, efforts to reduce carbon emissions, and the need for reliable, renewable energy. Technological upgrades, water resource availability, grid expansion, and energy security concerns also contribute to increased investment and development in the sector.

Asia Pacific dominated the hydropower market in 2024, accounting for a share of 49.1% due to abundant water resources, strong government support, rising energy needs, and large-scale projects in China, India, and Southeast Asian countries.

Some of the major players in the hydropower market include American Hydro, Andritz AG, China Yangtze Power Co., Ltd, Électricité de France SA, ENGIE, GE Vernova, Iberdrola, S.A., RusHydro, Siemens Energy, Statkraft Group, Tata Power Company Limited, Voith GmbH & Co. KGaA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)