Ice Cream Market in India Size, Share, Trends and Forecast by Type, Flavor, Format, End-User, Distribution Channel, and Region, 2026-2034

Ice Cream Market in India Summary:

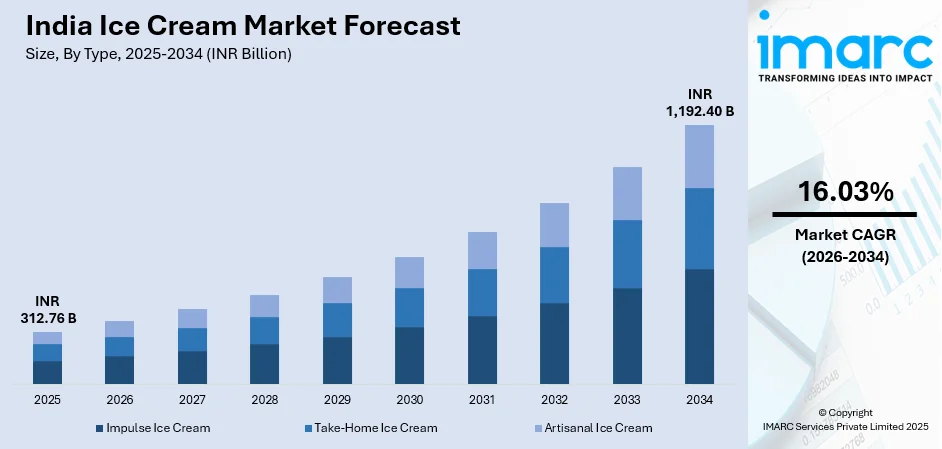

The ice cream market in India size was valued at INR 312.76 Billion in 2025 and is projected to reach INR 1,192.40 Billion by 2034, growing at a compound annual growth rate of 16.03% from 2026-2034.

The ice cream market in India is experiencing robust growth fueled by growing disposable incomes, quick urbanization, and changing consumer tastes for high-end, handcrafted frozen treats. The expansion of quick commerce platforms, improvements in cold chain infrastructure, and the growing penetration of organized retail channels are significantly contributing to market accessibility. Additionally, the introduction of innovative flavors, health-conscious formulations including vegan and low-sugar variants, and the transformation of ice cream from a seasonal indulgence to a year-round treat are bolstering the ice cream market in India share.

Key Takeaways and Insights:

-

By Type: Impulse ice cream dominates the market with 59.62% in 2025, driven by the convenience of home consumption, larger packaging options offering better value, and compatibility with home refrigerator storage enabling consumers to enjoy ice cream at their convenience.

-

By Flavor: Chocolate flavor leads the market with 31.05% in 2025, owing to its universal appeal across all age groups, versatility as a base for toppings and mix-ins, and its traditional preference among Indian consumers seeking familiar taste profiles.

-

By Format: Cup format represents the largest segment with 25.86% in 2025, attributed to its affordability, single-serve convenience, widespread availability at neighborhood retail outlets, and suitability for impulse purchases across all demographic segments.

-

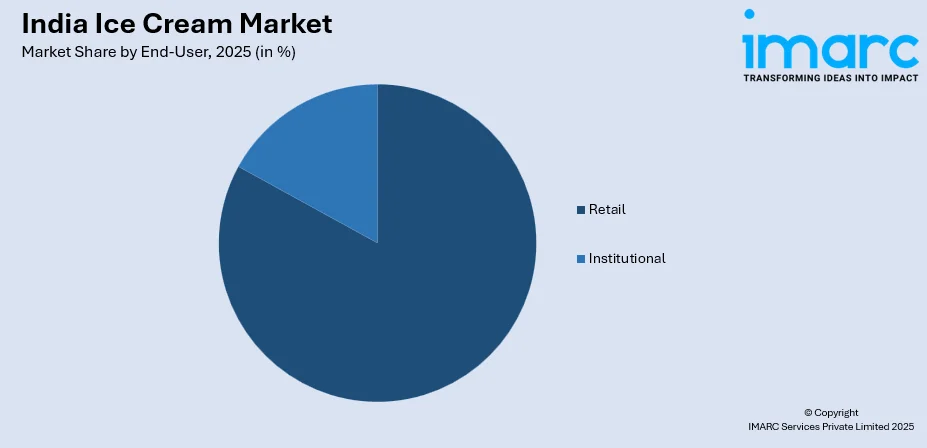

By End-User: Retail segment holds the largest share with 83% in 2025, supported by the extensive network of convenience stores, supermarkets, and general trade outlets that ensure product accessibility to mass consumers.

-

By Distribution Channel: General trade dominates the largest market with 39% share in 2025, taking advantage of their extended business hours, efficient checkout procedures that accommodate impulsive purchases, and ideal placement in residential and commercial regions.

-

By Region: Maharashtra exhibits a clear dominance in the market with 12% in 2025, led by metropolitan cities including Mumbai and Pune where higher purchasing power and cosmopolitan consumer preferences drive demand for premium ice cream products.

-

Key Players: The ice cream market in India exhibits a competitive landscape with established dairy cooperatives and multinational corporations competing alongside regional manufacturers and emerging health-focused startups. Major players, including GCMMF (Amul), Kwality Walls, Vadilal Group, Mother Dairy, Hatsun, and CreamBell, are focusing on distribution network expansion, product innovation, and strategic partnerships with quick commerce platforms to strengthen market presence.

To get more information on this market Request Sample

The ice cream industry in India has undergone significant transformation from a seasonal, unorganized segment to a thriving market characterized by innovation and intense competition. Rising per capita consumption over the past decade reflects the expanding addressable market and growing consumer appetite for frozen desserts across demographic segments. Distribution channels have been transformed by the growth of digital commerce platforms, which provide year-round accessibility and successfully accommodate urban consumers' impulsive purchasing habits. Quick commerce services ensure rapid delivery within minutes while maintaining product freshness and temperature integrity throughout the last mile. This transformation has converted ice cream from a seasonal indulgence into an everyday treat accessible at consumers' doorsteps. The market is witnessing premiumization trends with consumers increasingly seeking artisanal offerings featuring exotic flavors, superior-quality natural ingredients, and health-conscious alternatives including low-sugar, vegan, and protein-enriched formulations that balance indulgence with wellness goals.

Ice Cream Market in India Trends:

Rising Demand for Health-Conscious Ice Cream Formulations

Indian consumers are increasingly gravitating toward healthier ice cream alternatives including low-calorie, sugar-free, vegan, and protein-enriched variants. This trend reflects broader wellness consciousness and dietary awareness among urban populations. Health-focused startups are capitalizing on this shift by offering innovative formulations that balance indulgence with nutritional benefits. In October 2024, Iceberg Ice Cream launched its premium brand 'Organic Creamery' to address the rising demand for health-friendly ice cream products, planning expansion with an investment of approximately INR 11 Crore.

Quick Commerce Transformation of Ice Cream Distribution

The rapid emergence of quick commerce platforms has fundamentally transformed ice cream consumption patterns, enabling year-round accessibility and instant gratification for consumers. These platforms ensure swift doorstep delivery while maintaining product freshness and temperature integrity throughout the last mile. This shift has enabled brands to tap into impulse buying behavior across urban centers, converting ice cream from a seasonal treat into an everyday indulgence available on demand regardless of weather conditions.

Premiumization and Artisanal Product Innovation

Consumer preferences are shifting toward premium, handcrafted ice creams featuring unique flavors and superior-quality natural ingredients. This premiumization trend is driving manufacturers to introduce exotic flavor profiles including salted caramel, matcha green tea, and regional Indian specialties like kesar pista and gulkand. Artisanal brands utilizing minimal ingredients are gaining significant traction among quality-conscious consumers seeking authentic taste experiences. The demand for gourmet offerings with innovative inclusions and sophisticated presentations continues expanding, particularly among urban millennials and health-aware demographics willing to pay premium prices.

Market Outlook 2026-2034:

The ice cream market in India outlook remains highly positive, supported by favorable demographic trends, rising middle-class population, and continued urbanization across tier-two and tier-three cities. Government initiatives including the Pradhan Mantri Kisan Sampada Yojana are catalyzing cold chain infrastructure development, expanding market reach to previously underserved regions. The organized segment is poised to gain significant ground as consumer preferences shift toward branded and hygienic products. The market generated a revenue of INR 312.76 Billion in 2025 and is projected to reach a revenue of INR 1,192.40 Billion by 2034, growing at a compound annual growth rate of 16.03% from 2026-2034.

Ice Cream Market in India Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Impulse Ice Cream |

59.62% |

|

Flavor |

Chocolate |

31.05% |

|

Format |

Cup |

25.86% |

|

End-User |

Retail |

83% |

|

Distribution Channel |

General Trade |

39% |

|

Region |

Maharashtra |

12% |

Type Insights:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

The impulse ice cream dominates the largest share with 59.62% of the total ice cream market in India in 2025.

Impulse ice cream represents single-serve, individually packaged frozen treats purchased spontaneously at point-of-sale locations including convenience stores, supermarkets, and vending machines. This segment encompasses diverse formats such as ice cream bars, cones, cups, sandwiches, and novelty items designed for immediate consumption. The category benefits from strategic product placement near checkout counters and freezer displays, capitalizing on consumer impulse purchasing behavior during warm weather seasons and leisure activities.

The impulse ice cream segment continues evolving with manufacturers introducing innovative flavors, premium ingredients, and health-conscious alternatives to capture diverse consumer preferences. Portable packaging formats and portion-controlled offerings appeal to on-the-go consumers seeking convenient indulgence options. Seasonal promotional campaigns, attractive packaging designs, and strategic partnerships with entertainment venues and sporting facilities drive incremental sales, while expanding distribution networks across petrol stations and quick-service restaurants enhance product accessibility and visibility.

Flavor Insights:

- Chocolate

- Fruit

- Vanilla

- Others

The chocolate flavor leads the market with 31.05% of the ice cream market in India in 2025.

Chocolate flavor ice cream maintains its position as a perennial consumer favorite, commanding substantial market share across frozen dessert categories worldwide. The segment encompasses diverse variants including dark chocolate, milk chocolate, Belgian chocolate, and cocoa-infused formulations that appeal to varying taste preferences. Premium chocolate ice cream offerings leverage high-quality cocoa sourcing and artisanal production methods, while mainstream products deliver accessible indulgence through optimized flavor profiles and competitive pricing strategies across retail channels.

The chocolate ice cream segment continues expanding through innovative product development incorporating complementary ingredients such as nuts, caramel swirls, cookie pieces, and fruit inclusions. Manufacturers are increasingly sourcing sustainable cocoa through certified supply chains to address growing consumer demand for ethically produced confectionery products. Sugar-reduced and plant-based chocolate ice cream alternatives are gaining traction among health-conscious consumers, while single-origin chocolate variants attract premium-seeking customers willing to pay elevated price points.

Format Insights:

- Cup

- Stick

- Cone

- Brick

- Others

The cup format holds the largest market with 25.86% share of the ice cream market in India in 2025.

Cup format ice creams dominate the market due to their affordability and single-serve convenience that perfectly aligns with prevalent impulse purchase behavior patterns. These products are widely available at accessible entry-level price points across diverse retail channels, making them affordable to consumers across all economic segments throughout the country. The format's exceptional portability and ease of consumption without requiring additional utensils contribute significantly to its widespread popularity among on-the-go consumers seeking quick refreshment.

The cup format serves as an ideal vehicle for manufacturers to introduce new flavors and limited-edition offerings while effectively minimizing consumer risk perception. Premium cup variants featuring inclusions such as chocolate chips, fruit pieces, and nut toppings are gaining significant traction among urban consumers seeking elevated indulgence experiences. NIC Honestly Crafted Ice Creams introduced its NIC Waffle Cones product line, featuring innovative vacuum-packed packaging to maintain freshness and crunch quality.

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Institutional

The retail segment holds the highest share with 83% of the ice cream market in India in 2025.

The retail segment encompasses consumer purchases through various channels including convenience stores, supermarkets, hypermarkets, and online platforms, representing the primary consumption avenue for ice cream products nationwide. The extensive reach of organized retail networks ensures consistent product availability across urban, semi-urban, and emerging rural areas, catering effectively to diverse consumer demographics. Rising organized retail penetration and the continued expansion of modern trade formats are significantly strengthening this important market segment.

E-commerce and quick commerce platforms are rapidly emerging as increasingly significant retail channels, enabling consumers to conveniently order ice cream products for home delivery with guaranteed temperature maintenance throughout the entire cold supply chain. The strategic integration of leading ice cream brands with popular food delivery applications has substantially expanded market reach, enhanced consumer accessibility, and created new consumption occasions beyond traditional retail purchase points, driving significant incremental sales growth.

Distribution Channel Insights:

- General Trade

- Supermarkets/Hypermarkets

- Ice Cream Parlors

- Convenience Stores

- Online

- Others

The general trade represents the leading distribution channel with 39% of the ice cream market in India in 2025.

General trade represents the backbone of ice cream distribution in India, encompassing traditional retail formats including kirana stores, pan shops, and neighborhood grocery outlets that collectively form an extensive nationwide network. These establishments benefit from deep community relationships, convenient accessibility, and the ability to extend credit to regular customers. The channel's widespread presence across urban, semi-urban, and rural territories ensures ice cream availability to diverse consumer demographics seeking affordable indulgence options.

The general trade channel demonstrates remarkable resilience through its adaptability to local consumer preferences and flexible operating models that accommodate seasonal demand fluctuations. Store owners maintain personal rapport with customers, enabling effective product recommendations and building brand loyalty through trusted relationships. The installation of dedicated freezer units by manufacturers has strengthened cold chain integrity at retail endpoints, ensuring product quality consistency while expanding market penetration into previously underserved geographical areas.

Regional Insights:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Odisha

Maharashtra dominates the market with 12% of the total ice cream market in India in 2025.

Maharashtra represents one of India's largest ice cream markets, driven by its substantial urban population concentrated across Mumbai, Pune, Nagpur, and Nashik metropolitan areas. The state's tropical climate with extended summer seasons creates favorable conditions for year-round ice cream consumption. Rising disposable incomes among Maharashtra's growing middle-class population, combined with increasing exposure to premium frozen dessert offerings through organized retail expansion, continue propelling market growth across diverse consumer segments.

The Maharashtra ice cream market benefits from well-established cold chain infrastructure supporting efficient distribution networks across urban, semi-urban, and rural territories. Local manufacturers compete alongside national and international brands, offering diverse product portfolios spanning economy cups to premium artisanal variants. The state's vibrant food service industry, encompassing restaurants, cafes, and quick-service establishments in commercial hubs, creates substantial institutional demand while driving product innovation and flavor experimentation across market segments.

Market Dynamics:

Growth Drivers:

Why is the Ice Cream Market in India Growing?

Rising Disposable Incomes and Premiumization Trends

Increasing disposable incomes across Indian demographics are empowering consumers to invest in premium indulgences including high-quality ice cream products. The expanding middle class with growing purchasing power is increasingly willing to experiment with gourmet, artisanal, and internationally inspired ice cream variants. This economic uplift has shifted consumer preferences from basic commodity offerings toward premium products featuring superior ingredients and innovative flavor profiles. The premiumization trend is particularly evident in metropolitan cities where consumers actively seek distinctive taste experiences and quality-driven indulgence.

Expansion of Cold Chain Infrastructure and Distribution Networks

Significant improvements in cold chain logistics and temperature-controlled storage infrastructure are enabling ice cream manufacturers to extend their reach across urban and rural markets while maintaining product quality. Government initiatives including the Pradhan Mantri Kisan Sampada Yojana are catalyzing infrastructure development through modern food processing facilities and efficient supply chain management. The expansion of organized retail, supermarket chains, and convenience store networks has created numerous touchpoints for consumer access. Quick commerce platforms have revolutionized distribution by ensuring rapid delivery within minutes while maintaining temperature integrity. Under the Integrated Cold Chain and Value Addition Infrastructure scheme, 395 integrated cold chain projects have been approved with 291 already operational, significantly enhancing the storage and distribution capabilities for frozen products.

Evolving Consumer Preferences and Product Innovation

Indian consumers are demonstrating experimental attitudes toward new flavors, formats, and health-conscious ice cream formulations, driving continuous product innovation. The transformation of ice cream from a seasonal summer treat to a year-round indulgence is expanding consumption occasions and frequency. Health-aware consumers are seeking low-sugar, vegan, protein-enriched, and organic variants that align with wellness goals without compromising on taste. Regional and indigenous flavors including saffron, cardamom, mango, gulkand, and kulfi-inspired offerings are resonating with consumers seeking authentic Indian taste experiences. Devyani Food Industries launched its premium ice cream brand 'Infino' in January 2024 in collaboration with Liqvd Asia, introducing international flavors and comprehensive marketing campaigns to capture the expanding premium segment.

Market Restraints:

What Challenges the Ice Cream Market in India is Facing?

High Capital Requirements for Cold Chain Infrastructure

Ice cream requires stringent temperature maintenance between minus eighteen and minus twenty degrees Celsius to preserve quality, taste, and texture. The high capital investment needed for cold chain facilities, refrigerated transportation, and retail freezer units creates barriers for market expansion, particularly in remote and rural areas where infrastructure remains underdeveloped.

Seasonality and Climate Dependency

Despite year-round consumption trends in urban areas, ice cream sales remain significantly influenced by seasonal patterns with peak demand during summer months. Winter and monsoon seasons witness reduced consumption, creating challenges for manufacturers and retailers in maintaining steady sales volumes and effective cash flow management throughout the year.

Intense Competition and Market Fragmentation

The market faces growing fragmentation with regional brands, artisanal players, and health-focused startups intensifying competitive pressure alongside established national and multinational corporations. This heightened competition squeezes profit margins and necessitates continuous investment in product innovation, marketing differentiation, and brand positioning strategies. Companies must constantly evolve their offerings and communication approaches to maintain market relevance and consumer loyalty.

Competitive Landscape:

The ice cream market in India exhibits a competitive landscape characterized by the presence of established dairy cooperatives, multinational corporations, regional manufacturers, and emerging health-focused startups. Major players are focusing on distribution network expansion, product innovation, and strategic partnerships with quick commerce platforms. The market is witnessing consolidation trends with mergers and acquisitions enabling players to strengthen market presence and achieve operational synergies. Companies are investing in manufacturing capacity expansion, cold chain infrastructure, and digital marketing strategies to capture the growing consumer base. The competitive intensity is driving continuous innovation in flavors, formats, and health-conscious formulations across all market segments.

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the Indian ice cream industry include:

- GCMMF (Amul)

- Kwality Walls

- Vadilal Group

- Mother Dairy

- Hatsun

- CreamBell

Recent Developments:

-

August 2024: Lotte Wellfood announced the merger of its Indian subsidiaries, Lotte India and Havmor Ice Cream, forming an integrated entity named One India. The strategic move aims to strengthen market presence and achieve annual sales of approximately INR 6,000 crore through aggressive investments and operational synergies.

-

February 2024: Jungle Ventures invested $20 Million in Walko Food (NIC Ice Creams) to support expansion into the ice cream market. Walko strategically broadened its product range by introducing Yummo, a new ice cream brand tailored for the Indian mass retail market.

India Ice Cream Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion, Million Litres |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Flavors Covered | Chocolate, Fruit, Vanilla, Others |

| Formats Covered | Cup, Stick, Cone, Brick Others |

| End-Users Covered | Retail, Institutional |

| Distribution Channels Covered | General Trade, Supermarkets/Hypermarkets, Ice Cream Parlors, Convenience Stores, Online, Others |

| States Covered | Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, Odisha |

| Companies Covered | GCMMF (Amul), Kwality Walls, Vadilal Group, Mother Dairy, Hatsun, Cream Bell., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The ice cream market in India size was valued at INR 312.76 Billion in 2025.

The ice cream market in India is expected to grow at a compound annual growth rate of 16.03% from 2026-2034 to reach INR 1,192.40 Billion by 2034.

Impulse ice cream dominated the market, driven by the convenience of home consumption, larger packaging options offering better value, and the growing trend of at-home indulgence supported by quick commerce platforms.

Key factors driving the ice cream market in India include rising disposable incomes, expansion of cold chain infrastructure, growth of quick commerce platforms, increasing premiumization trends, and evolving consumer preferences toward health-conscious and innovative products.

Major challenges include high capital requirements for cold chain infrastructure, seasonal demand fluctuations affecting steady sales volumes, intense competition and market fragmentation, fluctuating raw material prices, and limited organized retail penetration in rural areas.

Some of the major players in the ice cream market in India include GCMMF, Kwality Walls, Vadilal, Mother Dairy, Hatsun, and Cream Bell.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)