Ice Maker Market Size, Share, Trends and Forecast by Product Type, End-Use Sector, and Region, 2025-2033

Ice Maker Market Size and Share:

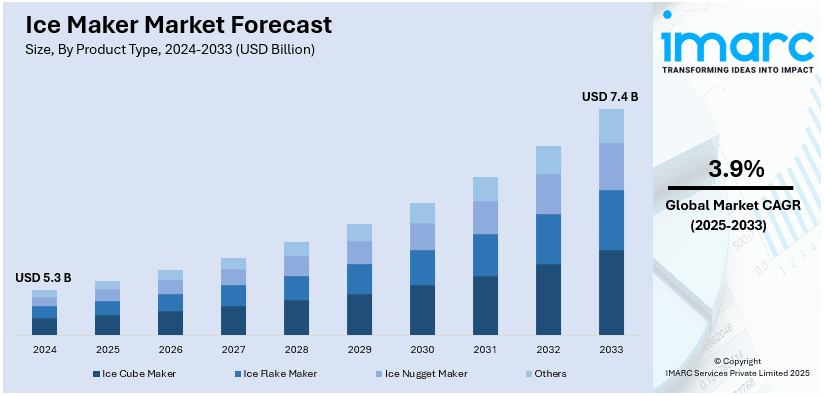

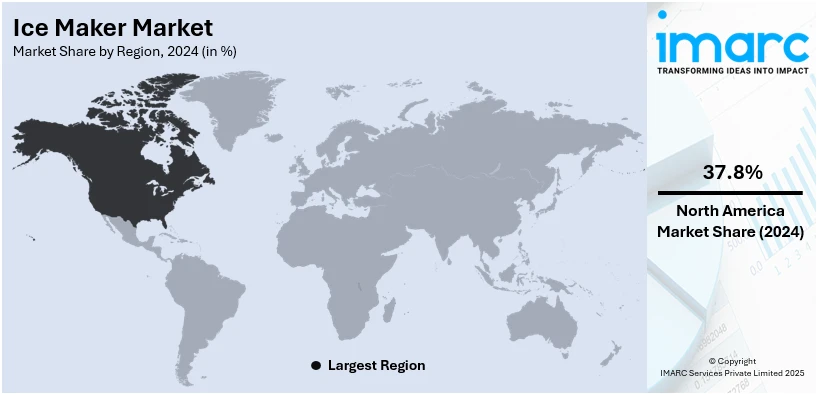

The global ice maker market size was valued at USD 5.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.4 Billion by 2033, exhibiting a CAGR of 3.9% from 2025-2033. North America currently dominates the market, holding a market share of over 37.8% in 2024. The market witnessing steady growth, driven by rising demand in foodservice, hospitality, healthcare, and residential sectors. Furthermore, advancements in energy-efficient, compact, and automatic models are enhancing adoption, supported by increasing cold beverage consumption across global markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.3 Billion |

|

Market Forecast in 2033

|

USD 7.4 Billion |

| Market Growth Rate (2025-2033) | 3.9% |

The ice maker market is driven by rising demand from the foodservice industry, including restaurants, cafés, bars, and hotels, where consistent ice supply is essential. Growing adoption of ice machines in healthcare, convenience stores, and offices further boosts ice maker market demand. Technological advancements such as energy-efficient models, compact designs, and touchless dispensers are also attracting buyers. For instance, in September 2023, Aizopa launched on Kickstarter, introducing a fast ice maker that produces 1,000 cubes per hour in just five minutes. Compact and energy-efficient, it features easy operation and cleaning with UV light. Additionally, rising consumer preference for cold beverages, especially in warm climates and urban areas, continues to support steady growth across commercial and residential segments.

To get more information on this market, Request Sample

The United States ice maker market is driven by the expanding foodservice and hospitality sectors, where consistent and hygienic ice production is essential for operations. For instance, in March 2023, Southeastern Grocers launched a robotic ice-making micro-factory in Jacksonville, Florida, in partnership with Relocalize. The facility produces "Party Cubes," a sustainable packaged ice. This innovative approach reduces waste and cuts greenhouse gas emissions, marking a significant shift in ice production and distribution for the grocer's operations. Rising demand for cold beverages in quick-service restaurants, convenience stores, and bars supports steady equipment adoption. Additionally, increasing installations in healthcare facilities for medical cooling and patient care add to the market’s momentum. Advancements in energy-efficient and compact ice makers, along with growing consumer interest in residential countertop models, further contribute to overall market growth.

Ice Maker Market Trends:

Increasing consumer preferences for automated appliances

Consumers are increasingly seeking ways to make their lives more convenient, efficient, and smart. One area where this inclination is visibly affecting the market dynamics is the appliance industry, particularly automated and intelligent appliances. Smart ice makers, for example, offer features such as remote operation through mobile apps, energy-saving modes, and predictive maintenance alerts. These value-added functionalities resonate with consumer expectations, who are willing to invest in advanced features that simplify their lives and contribute to higher standards of living. Features such as energy-saving modes align well with the consumer's growing awareness of their environmental footprint. The cumulative effect of these consumer preferences is significant market expansion for ice makers with intelligent functionalities. Companies are taking note of this trend and are investing in R&D to create innovative, consumer-friendly, smart appliances, thereby driving further market growth. According to reports, 65% of Americans have a smart device in their homes.

Continual decline in natural ice availability

Climate change is an environmental issue that is causing wide-reaching impacts across various sectors, and the ice-making market is no exception. Rising global temperatures are causing natural ice reserves to dwindle, particularly in regions where ice fishing or natural ice storage was previously common. For instance, global temperatures are rising, with 2024 being the warmest year on record, exceeding 1.5°C above pre-industrial levels. The reduction in natural ice availability is driving a growing need for artificial ice-making technologies. In areas experiencing significant temperature increases, ice makers are transitioning from being a luxury item to a necessity. The link between climate change and the rising demand for these solutions is a significant market trend. In response, companies are focusing on creating ice makers that prioritize efficiency and environmental sustainability, with the goal of minimizing the carbon footprint associated with ice production.

Stringent regulatory compliance requirements

Compliance with food safety standards and regulations is becoming increasingly important in the commercial sector. Regulatory bodies worldwide are enhancing guidelines that stipulate hygienic food storage and service conditions. This regulatory landscape is causing businesses, particularly in the hospitality and food industry, to invest in reliable and certified ice-making equipment. Non-compliance isn't just about legal repercussions; it also risks brand reputation and customer trust, which are invaluable assets. As a result, there is a growing necessity for ice makers that meet stringent safety and hygiene standards. Manufacturers are focusing on developing units that not only comply with existing regulations but are also designed for easy cleaning and maintenance to minimize bacterial growth.

Ice Maker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ice maker market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type and end-use sector.

Analysis by Product Type:

- Ice Cube Maker

- Ice Flake Maker

- Ice Nugget Maker

- Others

Ice cube maker stand as the largest product type in 2024, holding around 41.5% of the market. The ice cube maker segment of the market is experiencing growth due to several driving factors. Convenience and efficiency are at the forefront, as ice cube makers offer quick and automated production of ice, saving both time and effort. Innovations in smart technologies are also contributing to this segment, with features such as Wi-Fi connectivity and smartphone control becoming increasingly popular. Additionally, the demand for gourmet ice cubes, which are clear and odorless, has sparked interest in specialized ice cube makers. Energy-efficient models that adhere to environmental standards are gaining traction, aligning with global sustainability efforts. The versatility of ice cube makers, which cater to both residential and commercial uses, further broadens their appeal. Lastly, enhanced food safety regulations are compelling consumers to invest in certified and reliable ice cube-making machines.

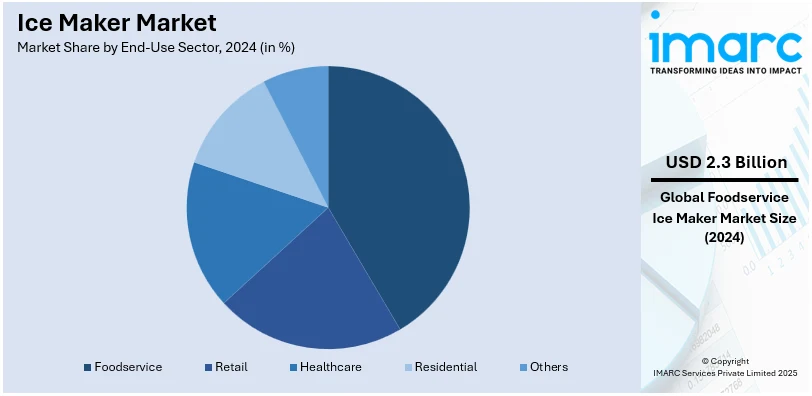

Analysis by End-Use Sector:

- Foodservice

- Retail

- Healthcare

- Residential

- Others

Foodservice leads the market with around 43.5% of ice maker market share in 2024. In the foodservice sector, the need for a consistent and reliable supply of ice is paramount, driving the demand for specialized ice makers. Operational efficiency is critical in this sector, making fast-producing, high-capacity machines highly desirable. The regulatory landscape also has a considerable impact, with stricter food safety standards compelling businesses to invest in certified equipment that ensures hygienic ice production and storage. Trends in mixology and culinary presentation are additionally fueling demand for various types of ice, from nugget to flake, to enhance the customer experience. Seasonal factors, such as increased restaurant visits during the summer, also create a spike in demand for ice makers. The ongoing growth in the foodservice industry, in general, contributes to a larger customer base in need of ice-making solutions.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 37.8%. North America has a well-established foodservice industry, which inherently demands a high volume of ice for various applications, thereby driving sales for ice makers. The cultural emphasis on convenience and automation is significant, making smart, efficient appliances, including ice makers, highly desirable.

Growing consumer awareness regarding energy consumption and environmental responsibility is also notably high in this region, creating demand for energy-efficient and environmentally friendly ice-making options. Additionally, North America is subject to stringent regulatory standards concerning food safety and appliance efficiency, compelling both businesses and individuals to invest in compliant equipment.

Additionally, seasonal variations, including hot summers and holiday seasons, induce increased usage of ice in beverages and food preservation, thereby influencing market trends. The region's economic affluence provides consumers with the financial capability to invest in high-end, feature-rich ice makers. Lastly, the rapid pace of technological innovation in North America fuels ongoing upgrades and replacements, sustaining a robust demand cycle thereby creating a positive ice maker market outlook across the region.

Key Regional Takeaways:

United States Ice Maker Market Analysis

In 2024, the United States accounted for over 87.60% of the ice maker market in North America. The United States exhibits a steady surge in ice maker adoption driven by increasing consumer awareness regarding energy consumption and environmental responsibility. This heightened consciousness has intensified demand for energy-efficient and environmentally friendly ice-making options across residential and commercial sectors. As sustainability becomes a priority, manufacturers are aligning with energy standards, further boosting product adoption. Ice makers with eco-conscious refrigerants and lower energy consumption are gaining traction. Alongside these developments, enhanced designs catering to smart home integration are supporting adoption in modern households. Commercial establishments also prefer such units for reduced operational costs. This rising preference for sustainability-aligned technologies, coupled with growing lifestyle changes, is enhancing product visibility. The United States market is being shaped by stringent energy guidelines and growing ecological awareness among end users, significantly impacting purchase behavior.

Asia Pacific Ice Maker Market Analysis

Asia-Pacific is experiencing increased ice maker adoption due to the rapidly expanding retail sector. According to India Brand Equity Foundation, the Indian retail sector in 2024 saw the opening of over 750 new stores and a total of Rs. 12,000 crore (USD 1.38 Billion) raised, as per the data compiled by IndiaRetailing Insights. The proliferation of supermarkets, hypermarkets, and convenience stores across both urban and semi-urban areas has amplified the demand for on-site ice production. As retail environments evolve to offer fresh food and chilled beverages, the need for compact and efficient ice makers becomes more critical. Technological advancements and affordable units are further accelerating penetration. Modern retail formats are focusing on providing superior customer experiences, which include freshness and display of chilled products. Furthermore, increased disposable income and shifting consumer habits are supporting this transformation. In-store operations are benefitting from quick and reliable ice-making systems that align with space and energy requirements. These developments in Asia-Pacific’s retail infrastructure are key factors driving sustained demand for ice makers.

Europe Ice Maker Market Analysis

Europe's ice maker adoption is strongly influenced by the expanding food and beverage industry. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. As consumer demand for chilled drinks and perishable items increases, commercial foodservice businesses are investing in efficient ice-making systems. Restaurants, cafes, and catering services require continuous ice supply to meet operational demands, especially in high-volume periods. The food and beverage industry’s emphasis on hygiene and consistent product quality has led to a preference for high-performance ice machines. Compliance with environmental and safety regulations also promotes the use of advanced, eco-friendly units. With innovations in refrigeration technologies and better energy standards, businesses are upgrading legacy systems. The evolving foodservice landscape across Europe supports steady integration of ice makers, as vendors aim to enhance service quality, reduce energy use, and comply with sustainable operating practices.

Latin America Ice Maker Market Analysis

Latin America sees growing ice maker adoption due to the rising urban population and increasing residential demand. Urbanization has led to a shift toward modern living standards, where home appliances like ice makers are becoming common. As households seek convenience and improved lifestyle experiences, compact and energy-efficient ice-making units are being integrated into kitchens. Rising awareness of hygiene and demand for chilled beverages further drives this trend. The residential segment continues to expand, fueling sustained demand in Latin America.

Middle East and Africa Ice Maker Market Analysis

The Middle East and Africa are witnessing increased ice maker adoption due to the expansion of healthcare facilities. According to the Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities by 2022. Hospitals and medical centers require reliable and hygienic ice production for various applications, including patient care and preservation of medical supplies. With the healthcare sector expanding, demand for specialized ice makers that ensure sanitary standards and temperature consistency is growing. Energy efficiency and durability are also vital features sought by facility managers. These factors are contributing to sustained demand for ice makers in the region.

Competitive Landscape:

Key players in the global market are heavily investing in research and development to innovate new features and functionalities, enhancing the overall user experience. These market leaders are also focusing on creating energy-efficient models to not only meet regulatory requirements but also cater to increasing consumer demand for sustainable products. To broaden their customer base, key players are offering a range of products that cater to both residential and commercial sectors. Simultaneously, these companies are strengthening their distribution networks, both online and offline, to make their products more accessible to a global audience. Collaborations and partnerships with other stakeholders in related industries are another tactic being employed to expand their product offerings. Furthermore, to comply with food safety regulations, major players are making sure their products meet or exceed hygiene standards by obtaining relevant certifications.

The report provides a comprehensive analysis of the competitive landscape in the ice maker market with detailed profiles of all major companies, including:

- A&V Refrigeration

- Ali Group

- Cornelius (Marmon Foodservice Technologies, Inc.)

- DC Products

- Electrolux Professional Group

- Hoshizaki America, Inc

- Manitowoc Ice

- Maxx Ice

- Newair

- Scotsman Ice Systems

- The Middleby Corporation

- Whynter LLC

Latest News and Developments:

- March 2025: ecozy unveiled a new sphere ice maker featuring advanced CrystalFlux and GlacioLock technologies. Designed for home bars and small businesses, it produces premium, crystal-clear ice spheres at high speed.

- January 2025: Hoshizaki Corporation announced that it would upgrade 22 cube ice maker models by transitioning from HFCs to natural refrigerants, aligning with environmental goals. Covering daily capacities of 20 kg to 115 kg, the changes span countertop, undercounter, self-contained, sliding-door, and modular types.

- December 2024: ecozy launched its Smart-Panel Nugget Ice Maker, introducing the IceLumix full-color smart panel for a more intuitive and stylish home ice-making experience. This 44lbs capacity appliance features voice control, app integration, and double-layer insulation for longer ice retention.

- October 2024: ecozy launched two new commercial ice makers—the undercounter model and the ice maker champion—marking its expansion from household countertop units to broader commercial solutions. The machines are designed for high-performance and adaptability in both small-scale and large-volume operations.

- June 2024: GE Profile™ unveiled the Opal 2.0 Ultra Nugget Ice Maker, a sleekly redesigned upgrade to its popular line. This new model introduces enhanced maintenance-reducing features, including a scale-inhibiting water filter and a reusable air filter for cleaner, fresher ice.

Ice Maker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Ice Cube Maker, Ice Flake Maker, Ice Nugget Maker, Others |

| End Use Sectors Covered | Foodservice, Retail, Healthcare, Residential, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | A&V Refrigeration, Ali Group, Cornelius (Marmon Foodservice Technologies, Inc.), DC Products, Electrolux Professional Group, Hoshizaki America, Inc, Manitowoc Ice, Maxx Ice, Newair, Scotsman Ice Systems, The Middleby Corporation, Whynter LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ice maker market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ice maker market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ice maker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ice maker market was valued at USD 5.3 Billion in 2024.

IMARC estimates the ice maker market to reach USD 7.4 Billion by 2033, exhibiting a CAGR of 3.9% from 2025-2033.

Key factors driving the ice maker market include rising demand from the foodservice and hospitality sectors, increased consumption of cold beverages, and expanding applications in healthcare and residential settings. Technological advancements in energy efficiency, automation, and compact design are further encouraging widespread adoption.

North America currently holds the largest share of the ice maker market, driven by strong demand from the foodservice, hospitality, and healthcare industries. The region benefits from high consumer preference for cold beverages, advanced infrastructure, and widespread adoption of commercial ice-making equipment.

Some of the major players in the ice maker market include A&V Refrigeration, Ali Group, Cornelius (Marmon Foodservice Technologies, Inc.), DC Products, Electrolux Professional Group, Hoshizaki America, Inc, Manitowoc Ice, Maxx Ice, Newair, Scotsman Ice Systems, The Middleby Corporation, Whynter LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)