Identity Verification Market Size, Share, Trends and Forecast by Type, Component, Deployment Mode, Organization Size, Vertical, and Region, 2025-2033

Identity Verification Market Size and Trends:

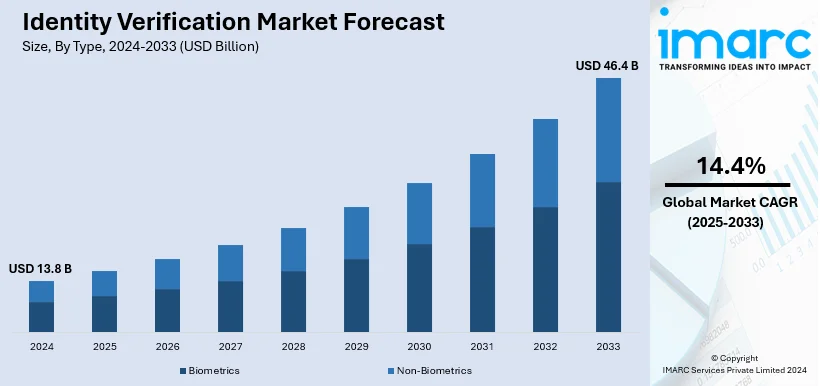

The global identity verification market size was valued at USD 13.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.4 Billion by 2033, exhibiting a CAGR of 14.4% from 2025-2033. North America currently dominates the market holing a significant identity verification market share. The dominance driven by an advanced technology adoption, stringent regulations, and the growing demand for secure identity verification solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.8 Billion |

| Market Forecast in 2033 | USD 46.4 Billion |

| Market Growth Rate 2025-2033 | 14.4% |

The rise in digital transactions across sectors, including e-commerce, banking, and telecommunications, is driving the need for robust identity verification solutions. As online payment systems expand, businesses are prioritizing verification systems to mitigate fraud and ensure secure transactions. Furthermore, cyberattacks and identity theft incidents are becoming more sophisticated, encouraging organizations to adopt advanced identity verification solutions. Multi-factor authentication and biometric systems are being integrated to prevent unauthorized access and enhance data security. Besides this, the shift towards remote work is driving the need for identity verification tools to authenticate employees and protect sensitive organizational data. This trend is leading to widespread adoption of cloud-based verification systems.

The United States has emerged as a crucial region in the market, driven by the strict regulatory requirements, increasing cyber threats, rapid digitalization, and the adoption of advanced verification technologies across industries. Additionally, artificial intelligence (AI) and machine learning (ML) advancements are enabling faster and more accurate identity verification. These technologies reduce false positives and improve fraud detection, making them indispensable for businesses aiming to secure digital operations. Apart from this, companies in sectors like social networking and online dating are implementing verification measures to enhance user authenticity and trust. These initiatives address concerns about scams and fraudulent activities while improving user experiences, reflecting a broader trend of prioritizing security and transparency in digital interactions. For instance, in 2024, Tinder announced the expansion of its ID verification program to various countries, including the US, aiming to enhance profile authenticity with a blue checkmark. Users will verify their identities through a video selfie and valid ID to combat rising scams and boost trust.

Identity Verification Market Trends:

Increasing instances of identity theft and fraud

Identity theft and fraud are the biggest threats in the present digital age. It poses a huge threat to both individuals and organizations. According to the 'Consumer Sentinel Network Data Book 2022,' the Federal Trade Commission (FTC) reported 441,882 cases of credit card fraud in 2022. It has emerged as the most common form of identity theft. The most common type of cybercrime in 2022 was phishing, which is broadly used to get personal information. In the year 2022, the FTC received 37,924 reports of military identity theft. Due to technological advancement, cybercriminals have devised very sophisticated ways of exploiting vulnerabilities and gaining unauthorized access to private and confidential information. Such incidents may lead to business losses of money, reputation, and legal issues. Other industries have also been looking for some solid identity verification solutions to curb fraudulent activities and protect clients' identities and assets from scammers.

Stringent regulations and compliance requirements

Governments and regulatory bodies all over the world are now using strict rules and regulations, along with compliance, in order to prevent identity theft, money laundering, and financing terrorism, among others. Examples of these rules include the General Data Protection Regulation (GDPR) set by the European Union, the Financial Action Task Force (FATF) recommendations for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF), which have increased the demand for customer due diligence and identification. In addition, laws like the USA PATRIOT Act and Know Your Customer (KYC) requirements in the United States compel organizations to conduct strong identity verification to reduce risk. Therefore, organizations are embracing reliable verification processes as these can verify their users, business partners, and employees appropriately so that they can always stay within the law provisions that help avoid fines. As the above trend also reveals, these new norms prompt technology development in AI, blockchain, and even biometrics to cope with increased complexity and amounts of verification requests without disregarding the data privacy and protection norms.

Rapid digitalization and need for a seamless user experience

Digital transformation is changing the way business work and engage with different services. However, as digitization is growing, so does the difficulty of creating trust and security for internet transactions. Users anticipate a smooth and easy experience when utilizing digital services, and complex identity verification procedures can impede client acceptance and contentment. Therefore, companies need advanced identity verification solutions to provide seamless user experiences, all while keeping the integrity and security of the digital identity ecosystem in place. The size of the global digital transformation market reached USD 809.1 Billion in 2024. According to IMARC Group, the market is expected to reach a value of USD 3,571.7 Billion by 2033, growing at a CAGR of 16.01% from 2025 to 2033. Some of the major growth areas are AI in the financial services and manufacturing sectors. These methods often use advanced technologies, such as biometrics, AI, and ML, to simplify the authentication process and deliver accurate and trustworthy results immediately.

Identity Verification Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global identity verification market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, deployment mode, organization size, vertical, and region.

Analysis by Type:

- Biometrics

- Non-Biometrics

Biometrics dominates the market, reflecting its growing adoption across industries for enhanced security and accuracy. Biometrics entails utilizing distinct physical or behavioral attributes like fingerprints, facial recognition, voice patterns, and iris scans for identity verification. This technology ensures high reliability by reducing the risk of fraud and removing the necessity for conventional passwords or documents, which are susceptible to breaches and counterfeits. Its prevalent utilization in financial services, healthcare, government programs, and online platforms highlights its success in guaranteeing secure access and transactions. Progress in AI and ML technologies continues to enhance the precision and efficiency of biometric solutions, leading to effortless user interactions. With the rise of cyber threats and identity fraud, companies are focusing on biometrics to meet regulatory requirements such as know your customer (KYC) and anti-money laundering (AML), making it the biggest and fastest-growing sector in the market.

Analysis by Component:

- Solutions

- Services

Solutions hold the biggest identity verification market share, driven by the demand for advanced technologies that ensure secure and efficient identity authentication. These solutions include software platforms and tools that help in identity verification by means of biometrics, document verification, database checks, and AI-based fraud detection. These solutions rely on the services offered by banking, health, and e-commerce businesses for security enhancement, client onboarding, and regulatory compliance, such as the KYC and AML standards. These are very scalable and flexible, which means they are suitable for use in any business setup- whether small startups or massive businesses around the globe. Innovative blockchains and AI in processes enable identity verification to become much more efficient and accurate over time. Increased cyber threats and moving transactions towards digital are driving identity verification market demand.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises is dominating the market, preferred by companies who value having complete authority over their data and infrastructure. This deployment method is especially favored in sectors with strict security and compliance needs, like banking, healthcare, and government, where it is essential to protect sensitive data from outside intrusions. On-site solutions provide advanced customization features for organizations to customize systems according to their specific operational requirements. Moreover, these solutions guarantee adherence to data protection laws in each region, which frequently require storing data within certain geographic limits. Businesses dealing with large amounts of sensitive data find advantages in the reliability and decreased latency provided by on-site systems. Despite the higher initial expenses for hardware and maintenance, the enhanced security and control provided by this deployment method are desirable for businesses looking to protect important assets and maintain uninterrupted operations in a secure environment.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises represent the largest segment because of the complicated security and compliance requirements they have. Robust identity verification is crucial for preventing fraud and data breaches in large enterprises that handle extensive sensitive data like customer information, employee records, and financial details. These organizations need solutions that adhere to a variety of regulatory frameworks while operating in different regions. Large enterprises use advanced technologies such as biometrics, AI-driven fraud detection, and blockchain in their identity verification systems to streamline procedures, boost security, and minimize operational risks. These systems are frequently customized to manage large volumes of verification, guaranteeing continuous and effective functioning. With the advancement of digitization, these businesses are using identity verification solutions more frequently to protect their online networks, combat changing cyber risks, and adhere to expanding compliance requirements thus creating a positive identity verification market outlook.

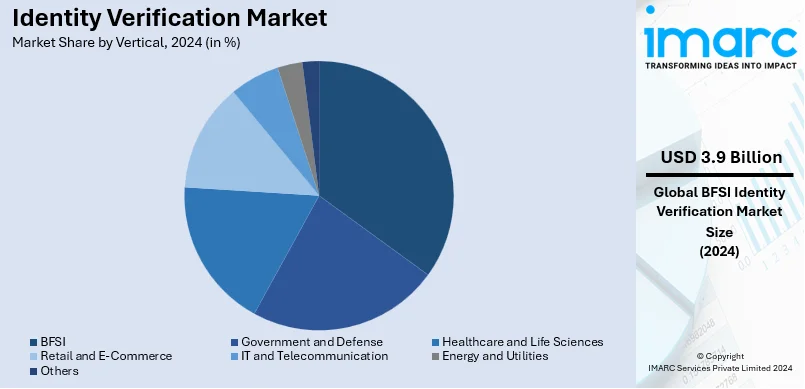

Analysis by Vertical:

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecommunication

- Energy and Utilities

- Others

BFSI dominates the market due to its vital role in ensuring security, preventing fraud, and complying with regulations. Financial organizations face increasing threats from cyber incidents, identity theft, and fraudulent activities, underscoring the necessity of robust identity verification measures. Adherence to international regulations is driving the demand for advanced verification technologies. The banking and financial sector heavily depends on biometrics, AI-powered fraud detection, and document authentication solutions to improve client onboarding, protect sensitive information, and simplify digital banking processes. The increase of online banking, digital wallets, and mobile payments is promoting the use of scalable, cloud-based verification systems for secure and smooth user interactions. Moreover, the increasing embrace of open banking and fintech advancements is creating a demand for immediate identity verification to establish user confidence and adhere to changing regulations.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the identity verification market forecast, North America leads the market because of its cutting-edge technology, stringent regulations, and wide adoption of digital services. Industries like banking, healthcare, and e-commerce in both the United States and Canada rely on robust identity verification solutions for support. Moreover, the rising prevalence of cyber threats and identity fraud has prompted businesses to implement advanced tools such as biometrics, AI, and blockchain in order to improve secure and efficient verification processes. North America remains the top market leader in the region due to its emphasis on innovation and extensive adoption of scalable solutions, particularly those utilizing cloud technology. In September 2024, Socure, a top firm focusing on AI technology to authenticate digital identities, check sanctions, and stop fraud, announced its new worldwide coverage for all ICAO-compliant travel documents, like passports, several EU national IDs, and NFC-enabled IDs. Moreover, the company extended its identity verification services to more than 190 countries in Europe, Asia, Oceania, Africa, North America, and South America.

Key Regional Takeaways:

United States Identity Verification Market Analysis

The identity verification market in the US is being driven by increasing cybercrime, tougher regulations, and widespread implementation of digital transformation projects. The United States had the highest number of cybercrime complaints in 2023 with 521,652 cases reported, as shown in the Federal Bureau of Investigation’s Internet Crime Report 2023. In the banking, financial services, and insurance (BFSI) sector, which must adhere to strict compliance regulations such as the USA PATRIOT Act and Anti-Money Laundering (AML) guidelines, organizations are now placing a greater emphasis on secure and trustworthy identity verification systems. The necessity for digital identity verification is increasing due to the quick expansion of online financial transactions and e-commerce. According to Digital Commerce 360's research of U.S. Department of Commerce data, e-commerce accounted for more than 22% of all retail transactions in the United States in 2023. As a result, businesses must use sophisticated verification procedures to prevent identity fraud and build consumer trust. Additionally, due to the provisions of the Health Insurance Portability and Accountability Act (HIPAA), healthcare providers are depending more and more on identity verification to guarantee safe access to patient data and stop fraud. Identity verification systems have also been adopted to secure enterprise networks as a result of the post-pandemic increase in remote labor. The precision and dependability of verification systems have increased due to developments in AI, ML, and biometrics, making them crucial.

Europe Identity Verification Market Analysis

The market for identity verification in Europe is driven by stricter regulations, more people using digital banking, and more cyberthreats. Businesses must utilize secure identity verification in order to protect user data and maintain compliance with the General Data Protection Regulation (GDPR) and the Revised Payment Services Directive (PSD2). Nearly a third of the quarter's breaches (28M) occurred in Europe, which fell to the second-most dangerous region from the previous quarter. Strong identity verification solutions are in high demand as a result of a 56% increase in European breaches in Q2 2023 over the previous quarter. According to Eurostat, 66% of internet users in 2022 utilized online banking services, up from 53% in 2012. 70% of adults between the ages of 25 and 64 choose online banking, compared to 59% of those between the ages of 16 and 24 and 54% of those between the ages of 65 and 74. Finland (97%), Denmark, and the Netherlands (both 96%) are the EU nations with the highest rates of internet banking usage. This is prompting banks to make investments in cutting-edge Know Your Customer (KYC) technologies. Furthermore, identity verification systems have also been deployed more quickly to fight fraud as a result of the identity verification market growth of fintech companies, especially in the UK, Germany, and France.

Asia Pacific Identity Verification Market Analysis

Rapid digitalization, rising cybercrime, and government programs supporting digital IDs are the main factors propelling the identity verification market in Asia-Pacific. The need for safe and scalable verification solutions has been driven by the e-commerce boom in nations like China and India, generating more than 50 percent of the world’s transactions. Government programs that have established standards for identity verification technology include China's adoption of digital identity cards and India's Aadhaar system, which has produced over 1.3 Billion unique IDs. The demand for sophisticated verification systems has increased because of these programs' notable improvements to citizens' access to government benefits, healthcare, and financial services. Furthermore, businesses are prioritizing verification solutions because of the increase in cybercrime in the area, with India and Japan being among the top 10 nations in the world for ransomware assaults. Tech-driven sectors like financial and telecoms are also using biometric and AI-driven solutions to expedite identification verification procedures.

Latin America Identity Verification Market Analysis

Growing e-commerce use, rising cybercrime, and increased financial inclusion initiatives are driving the identity verification industry in Latin America. The region’s unbanked population, estimated at 122 Million in 2021, has spurred financial institutions to deploy robust identity verification solutions to onboard new customers securely. The market has been further stimulated by initiatives that support digital banking and payments, especially in Brazil and Mexico. More than 1,600 cyberattacks are reported in Latin America per second, according to the Latin American Annual Report 2024, making cyberattacks one of the region's fastest-growing security issues. Despite ongoing infrastructure issues, the region is embracing mobile-based verification solutions more frequently, taking advantage of cellphones' extensive use to reach a wider audience.

Middle East and Africa Identity Verification Market Analysis

Growing digitalization, increased cyberthreats, and government-led initiatives are driving the Middle East and Africa (MEA) identity verification market. The adoption of secure digital identification solutions throughout the public and business sectors is a top priority in the UAE's Vision 2030, and nations like Saudi Arabia and the United Arab Emirates are making significant investments in digital transformation. As banks implement KYC and AML solutions to adhere to global requirements, the banking and financial services industry in the region, especially in GCC countries, is a major driver. The use of identity verification technology has been further boosted by government initiatives such as Saudi Arabia's e-Identity platform and South Africa's Smart ID card. The growing use of cloud-based and mobile-based solutions suggests substantial development, even though market penetration is restricted in some areas because of infrastructure issues.

Competitive Landscape:

Key players in the market are focusing on innovation and expanding their offerings to meet the growing demand for secure and efficient solutions. They are investing in advanced technologies like AI, ML, and biometrics to enhance accuracy and speed while addressing concerns around fraud and identity theft. Strategic partnerships, mergers, and acquisitions are being pursued to strengthen their market presence and broaden their user base. Additionally, these companies are tailoring solutions for industry-specific needs, such as financial services and healthcare, while ensuring compliance with evolving regulations and prioritizing privacy, accessibility, and user-friendly interfaces. In November 2024, Veridas, a global leader in identity verification and biometric solutions, announced the availability of its Identity Verification (IDV) platform on Google Cloud Marketplace, empowering organizations across the Google Cloud ecosystem with its advanced fraud protection solutions.

The report provides a comprehensive analysis of the competitive landscape in the identity verification market with detailed profiles of all major companies, including:

- Acuant Inc.

- AuthenticID Inc.

- Equifax Inc.

- Experian PLC

- Intellicheck Inc.

- Jumio Corporation

- Mastercard Inc.

- Mitek Systems Inc.

- Onfido

- Thales Group

- TransUnion

- Trulioo

Latest News and Developments:

- November 2024: Equal, an ID verification startup, secures its first institutional financing of USD 10 Million. Through connectivity with over 50 identity databases, Equal is developing a platform that assists companies in preventing fraud and streamlining their know your customer (KYC) procedures, which in turn aids in regulatory compliance.

- November 2024: Deutsche Bank's Corporate Venture Capital (CVC) group has made a strategic investment in identity security firm Akeyless.

- November 2024: Worldcoin has introduced its World ID service, extending its biometric identification verification infrastructure to Panama. Following previous rollouts in Guatemala and Malaysia, the deployment marks the company's most recent deployment of its decentralized digital identity verification system in Latin America as regulatory scrutiny of its operations continues to grow.

Identity Verification Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biometrics, Non-Biometrics |

| Components Covered | Solutions, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare and Life Sciences, Retail and E-Commerce, IT and Telecommunication, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acuant Inc., AuthenticID Inc., Equifax Inc., Experian PLC, Intellicheck Inc., Jumio Corporation, Mastercard Inc., Mitek Systems Inc., Onfido, Thales Group, TransUnion and Trulioo |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the identity verification market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global identity verification market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the identity verification industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Identity verification is the process of confirming that an individual is who they claim to be. It involves the use of various methods and technologies to authenticate personal information, such as government-issued identity cards, biometric data like fingerprints or facial recognition, or knowledge-based questions. It is critical for ensuring security, reducing fraud, and complying with regulatory requirements across industries like banking, e-commerce, healthcare, and government services.

The identity verification market was valued at USD 13.8 Billion in 2024.

IMARC estimates the global identity verification market to exhibit a CAGR of 14.4% during 2025-2033.

The global identity verification market is driven by the rising cyber threats, stringent regulatory requirements like KYC and AML compliance, and the growing adoption of digital services across industries. Advancements in biometrics, AI, and blockchain technologies enhance accuracy and efficiency, while increasing demand for secure online transactions and fraud prevention drives the need for robust identity verification solutions worldwide.

In 2024, biometrics represented the largest segment by type, driven by its accuracy, enhanced security features, and widespread adoption across industries to combat fraud and ensure compliance with regulatory requirements.

Solutions dominate the market by component owing to their scalability, advanced features like biometrics and AI integration, and their ability to streamline identity verification processes while ensuring regulatory compliance and data security.

On-premises is the leading segment by deployment mode attributed to its enhanced control over data security, compliance with strict regulatory requirements, and suitability for industries managing sensitive and confidential information.

Large enterprises hold the biggest market share by organization size accredited to their need for robust identity verification systems to secure vast data volumes, comply with global regulations, and mitigate cyber threats effectively.

BFSI is the leading segment by vertical due to its need to prevent fraud, ensure regulatory compliance, secure digital transactions, and enhance customer onboarding through advanced identity verification technologies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global identity verification market include Acuant Inc., AuthenticID Inc., Equifax Inc., Experian PLC, Intellicheck Inc., Jumio Corporation, Mastercard Inc., Mitek Systems Inc., Onfido, Thales Group, TransUnion and Trulioo, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)