In-Vitro Diagnostics Enzymes Market Size, Share, Trends and Forecast by Enzyme Type, Disease Type, Technology Type, End Use, and Region, 2025-2033

In-Vitro Diagnostics Enzymes Market Size and Share:

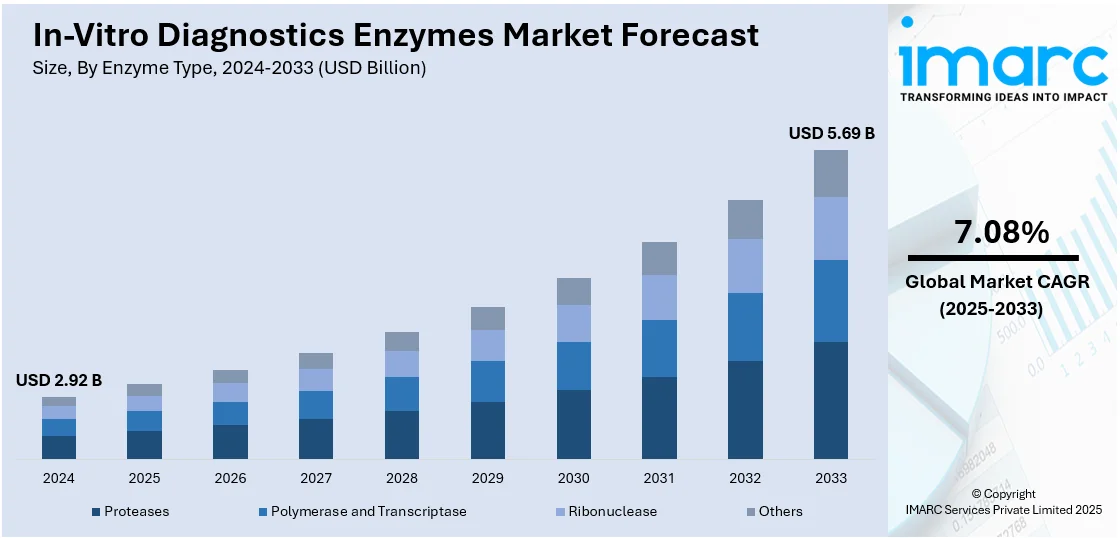

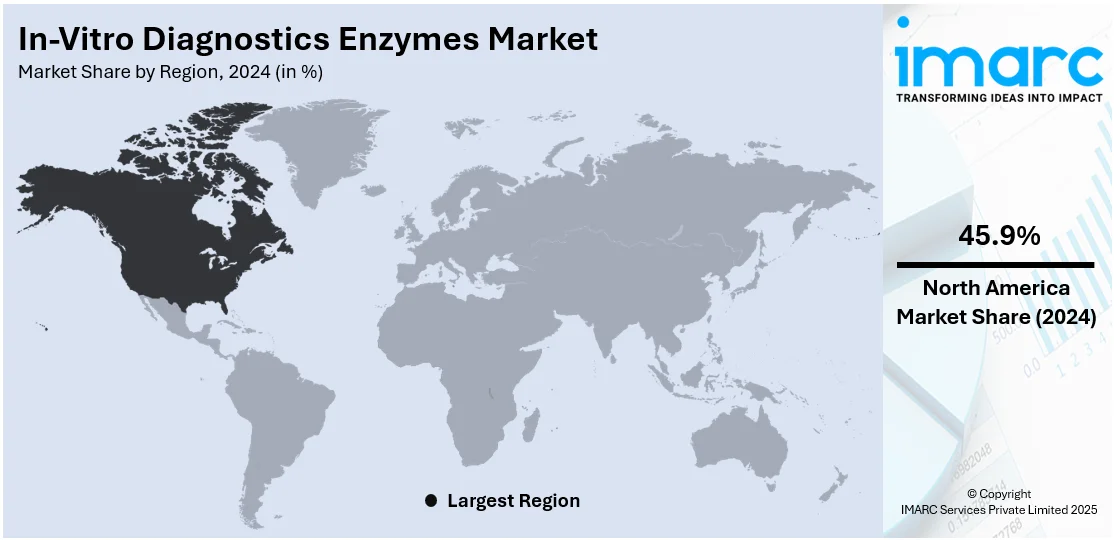

The global in-vitro diagnostics enzymes market size was valued at USD 2.92 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.69 Billion by 2033, exhibiting a CAGR of 7.08% during 2025-2033. North America currently dominates the market, holding a significant market share of around 45.9% in 2024. The market is driven by rising demand for early disease detection, growing prevalence of chronic conditions, and increasing adoption of point-of-care testing. Also, continual advancements in molecular diagnostics, personalized medicine, and next-generation sequencing are increasing the usage of specialized enzymes, including DNA polymerases, reverse transcriptase, and restriction enzymes. Additionally, expanding healthcare infrastructure and rising research and development (R&D) investments by diagnostic companies are expanding the in-vitro diagnostics enzymes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.92 Billion |

|

Market Forecast in 2033

|

USD 5.69 Billion |

| Market Growth Rate 2025-2033 | 7.08% |

The market is gaining momentum with the integration of point-of-care (PoC) diagnostics into routine clinical workflows, which require highly stable and fast-acting enzymes. Moreover, increasing investments in the development of microfluidic platforms that utilize enzymatic reactions for multiplex testing is expanding market applications. Additionally, the rise in demand for infectious disease monitoring further elevates the need for customized enzyme formulations. Notably, over 12 million dengue cases have been recorded in 2024 as per CDC, which makes it the highest year on record. This surge underscores the growing urgency of real-time infectious disease detection and tracking. As healthcare systems expand surveillance and diagnostics infrastructure, the demand for in vitro diagnostic (IVD) enzymes is accelerating. These enzymes are critical to the performance and reliability of diagnostic assays, especially in molecular and immunological testing platforms used to detect pathogens like the dengue virus.

In the United States, the market is driven by the expansion of decentralized diagnostic models in retail clinics and home-based testing, which is accelerating the use of enzyme-powered kits requiring minimal technical intervention. Besides this, increasing federal funding towards biomedical innovation is encouraging the development of next-generation enzymatic biomarkers. For example, Senate Bill 5637, named the "National Biomedical Research Act," proposes the establishment of a "Biomedical Innovation Fund" to promote biomedical research and development. The bill directs the US Treasury to allocate USD 10 Billion yearly to this fund from 2025 to 2034. The funds will be distributed to the National Institutes of Health (NIH) and the Food and Drug Administration (FDA) to facilitate biological research and regulatory science. In line with this, the robust presence of biotechnology firms in regions such as California and Massachusetts support continuous research and development (R&D) into enzyme stability and specificity enhancements.

In-Vitro Diagnostics Enzymes Market Trends:

Advancements in biotechnology and molecular diagnostics

The market is experiencing significant growth due to breakthroughs in biotechnology and molecular diagnostics. As per industry reports, the global molecular diagnostics market size reached USD 20.9 Billion in 2024. Also, the IMARC Group expects the market to reach USD 35.4 Billion by 2033. These advancements are leading to the development of more sensitive, specific, and efficient diagnostic assays, enhancing the accuracy and speed of disease detection. Additionally, the integration of novel biotechnological methods is enabling the identification of unique biomarkers and the utilization of sophisticated enzymes in diagnostic procedures, which is providing an impetus to the in-vitro diagnostics enzymes market growth. This progress is pivotal in catering to the rising demand for personalized medicine and targeted therapies, where precise diagnosis is crucial. Along with this, ongoing research and development (R&D) activities in this field are introducing innovative enzymes that can improve diagnostic capabilities, particularly in detecting genetic disorders, infectious diseases, and various types of cancer.

Increase in prevalence of chronic and infectious diseases

The escalation of chronic and infectious diseases worldwide is a key factor propelling the market. In addition, chronic conditions such as diabetes, cardiovascular diseases, and cancer require continual monitoring and diagnosis, which drives the demand for effective diagnostic enzymes. For instance, the diabetes cases are anticipated to increase from 529 million to 1.3 billion by 2050 across the world. Infectious diseases, especially in the wake of pandemics, underscore the need for rapid and accurate diagnostic tools. IVD enzymes play a crucial role in the detection and management of these diseases, offering quicker diagnosis and enabling timely treatment. Moreover, the growing global health burden of these diseases is prompting increased investments in healthcare infrastructure and diagnostics, further fueling the market expansion. This trend is particularly noticeable in emerging economies, where there is a rising focus on improving healthcare facilities and accessibility to advanced diagnostic methods.

Technological innovations and automation in diagnostic procedures

Continual technological advancements and the automation of diagnostic procedures are positively impacting the in-vitro diagnostics enzymes market outlook. Automation in laboratories leads to higher throughput, reduced error rates, and more consistent results, which is essential for reliable diagnostics. In confluence with this, the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in diagnostic devices is enhancing the efficiency and accuracy of enzyme-based tests. This technological evolution is improving the quality of diagnostics and making them more accessible and cost-effective. Furthermore, automation and digitalization are enabling remote diagnostics and real-time data analysis, which are critical in managing widespread health issues. The ongoing investments in research and technology are introducing more sophisticated and automated diagnostic solutions, further driving the market growth.

In-Vitro Diagnostics Enzymes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global in-vitro diagnostics enzymes market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on enzyme type, disease type, technology type, and end use.

Analysis by Enzyme Type:

- Proteases

- Polymerase and Transcriptase

- Ribonuclease

- Others

Polymerase and transcriptase lead the market with around 38.6% of market share in 2024 due to their critical roles in nucleic acid amplification technologies and molecular diagnostics. DNA polymerase and Taq polymerase find extensive applications in PCR-based tests for instant and precise identification of genetic material from pathogenic organisms like viruses and bacteria. Transcriptase’s, especially reverse transcriptase, play a pivotal role in the transcription of RNA into complementary DNA (cDNA), an initial step in reverse transcription PCR (RT-PCR), which is widely applied to detect RNA viruses like influenza and SARS-CoV-2. Increased point-of-care testing requirements, infectious disease diagnostics, and cancer screening needs have stimulated the demand for thermostable, high-fidelity, and process-effective polymerase and transcriptase enzymes. Their accuracy, consistency, and compatibility with automated systems render them essential to contemporary diagnostic platforms, further cementing their robust presence and commercial relevance in the market.

Analysis by Disease Type:

- Infectious Disease

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Diseases

- Others

Infectious disease leads the market with around 46.5% of market share in 2024. The segment is fueled by the demand for precise, fast, and high-volume detection of pathogens. Enzymes like polymerase and transcriptase play pivotal roles in molecular diagnostic tests such as PCR and RT-PCR, facilitating sensitive detection of viral and bacterial genetic material. The international reaction to outbreaks such as COVID-19, influenza, tuberculosis, and HIV has highlighted the role of enzyme-based analytical reagents in public health surveillance and patient care. The need for early-stage detection combined with the progress in point-of-care diagnostics and high-throughput screening has broadened the applications of IVD enzymes in hospitals, laboratories, and diagnostic centers. Recurring innovations in enzyme engineering to improve sensitivity, heat stability, and reaction rate further justify their extensive use in infectious disease testing. This category of disease remains the predominant sector in determining enzyme demand in the market.

Analysis by Technology Type:

- Histology Assays

- Molecular Diagnostics

- Clinical Chemistry

Histology assays lead the market with around 50.3% of market share in 2024. The segment is important, specifically in tissue sample analysis for disease diagnosis and research. Histology assays are dependent on enzymes like proteases, peroxidases, and phosphatases to enable tissue preparation, staining, and signal detection. Enzymes are employed to degrade cellular components, increase antigen retrieval, and amplify chromogenic or fluorescent signals, which render pathological details more apparent during microscopic observation. In cancer diagnosis, histology assays facilitate accurate tumor profiling and biomarker identification, facilitating early detection and treatment planning. With the increasing popularity of personalized medicine and targeted therapies, the need for high-specificity histological testing has grown, further enhancing the importance of enzyme-based assays. Advances in automated staining systems and multiplexed assays have also improved throughput and reproducibility of enzyme application in histology.

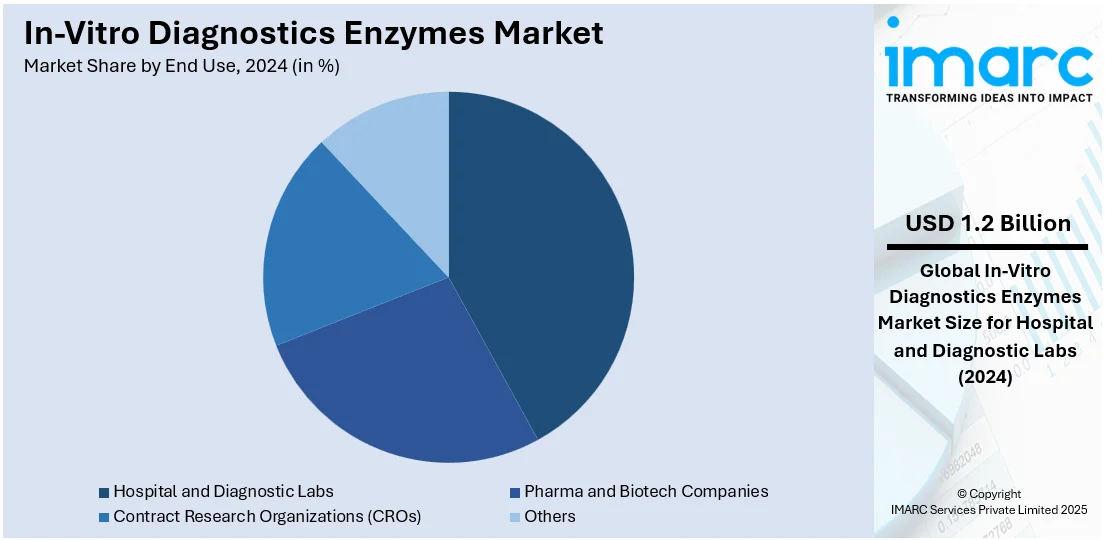

Analysis by End Use:

- Pharma and Biotech Companies

- Hospital and Diagnostic Labs

- Contract Research Organizations (CROs)

- Others

Hospital and diagnostic labs lead the market with around 42.0% of market share in 2024. These facilities depend significantly on enzyme-based assays for precise, timely detection and monitoring of a broad spectrum of conditions, such as infectious diseases, cancer, metabolic disorders, and genetic disorders. Enzymes like polymerases, kinases, and oxidases are utilized in clinical chemistry, immunoassays, and molecular diagnostics to catalyze reactions that provide measurable outcomes. Hospital settings need high-throughput and stable testing solutions for both routine screens and emergency diagnoses, while diagnostic laboratories need precision and reliability in test results. The growing usage of automated analyzers and integrated platforms in these settings has increased demand for highly stable and efficient enzymes. Increasing patient volumes, increased focus on early diagnosis, and the increasing incidence of chronic and infectious diseases continue to underpin the pivotal role of hospitals and laboratories in fueling the market demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 45.9% driven by its sophisticated healthcare infrastructure, high levels of diagnostic testing, and established presence of major industry players. The market has witnessed widespread application of enzyme-based diagnostic solutions in clinical laboratories, hospitals, and research institutions. The high prevalence of chronic diseases, coupled with the growing demand for personalized medicine and advanced diagnostic methods, fuels the market growth in this region. Furthermore, the market is expanding in the United States due to favorable reimbursement policies, continued research and development (R&D) investments, and high adoption of new diagnostic platforms. The region's aggressive response to addressing public health challenges like COVID-19 has further driven enzyme-based testing technology. In addition to this, strategic partnerships between biotech companies and diagnostic firms in North America have promoted enzyme innovation, test sensitivity, and speed.

Key Regional Takeaways:

United States In-Vitro Diagnostics Enzymes Market Analysis

The United States is witnessing a rising demand for in-vitro diagnostics enzymes due to the increasing prevalence of cardiovascular diseases. Notably, in 2022, the United States Centers for Disease Control and Prevention (CDC) reported 702,880 deaths due to heart disease. This is the equivalent of one in every five deaths. With cardiovascular conditions becoming more common across various age groups, clinical laboratories and diagnostic centers are adopting in-vitro diagnostics enzymes to enhance early detection and monitoring capabilities. This growing trend supports timely interventions and reduces long-term healthcare burdens. Healthcare providers are also emphasizing enzyme-based assays for their specificity and speed in identifying cardiac biomarkers. As a result, in-vitro diagnostics enzymes adoption is accelerating, driven by clinical demand and technology integration. Public and private stakeholders are encouraging routine screening practices that utilize enzyme diagnostics for cardiovascular diseases, reinforcing market penetration. Growing awareness campaigns and improved insurance coverage further support in-vitro diagnostics enzymes adoption as an essential diagnostic component in cardiovascular disease management.

Asia Pacific In-Vitro Diagnostics Enzymes Market Analysis

Asia-Pacific is experiencing a surge in in-vitro diagnostics enzymes adoption due to the escalating incidence of diabetes cases across diverse populations. For instance, in 2023, the prevalence of diabetes in India stood at 11.4%, while 35.5% of Indians suffer from hypertension. The increasing burden of both Type 1 and Type 2 diabetes has heightened the need for efficient, enzyme-based diagnostic methods that offer precision in glucose monitoring and related metabolic assessments. Diagnostic laboratories are expanding their capabilities by incorporating enzyme-linked assays to meet rising screening demands. This expansion aligns with growing healthcare accessibility and affordability in urban and rural areas. With diabetes becoming a long-term public health concern, medical practitioners are relying more on in-vitro diagnostics enzymes for consistent disease tracking and management. The implementation of government initiatives focusing on diabetes awareness and screening is also encouraging public health centers to integrate enzyme diagnostics as a core tool.

Europe In-Vitro Diagnostics Enzymes Market Analysis

The expanding elderly population in Europe is leading to an increased adoption of in-vitro diagnostic enzymes, which are used to treat age-related chronic illnesses. As per industry reports, the WHO European Region is experiencing a substantial increase in the population aged 60 and older. The population is expected to increase from 215 million in 2021 to 247 million in 2030 and above 300 million by 2050. As older adults become more susceptible to multiple health issues requiring ongoing diagnostics, enzyme-based testing plays a crucial role in ensuring accuracy and rapid clinical decision-making. In-vitro diagnostics enzymes are particularly effective in monitoring organ function, metabolic disorders, and degenerative diseases, which are more prevalent among aging populations. Healthcare systems across the region are prioritizing early diagnosis and disease prevention through laboratory expansion and advanced enzyme diagnostics. Geriatric care facilities are increasingly integrating enzyme-based solutions to support patient monitoring and therapy customization. This demographic trend fosters demand for efficient diagnostic tools, making in-vitro diagnostics enzymes essential in managing the health of the aging population. Continuous research and development (R&D) investments also support innovation tailored to geriatric diagnostics.

Latin America In-Vitro Diagnostics Enzymes Market Analysis

Latin America is advancing in-vitro diagnostics enzymes adoption, supported by the growing expansion of healthcare infrastructure and privatization efforts. Reports published by Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde) states that 62% of Brazil's 7,191 hospitals are privately owned. As public and private sectors increase investments in diagnostic capabilities, healthcare providers are integrating enzyme-based testing to meet clinical efficiency standards. The rise of private laboratories and hospital networks further accelerates the availability and application of in-vitro diagnostics enzymes across urban and semi-urban regions.

Middle East and Africa In-Vitro Diagnostics Enzymes Market Analysis

Middle East and Africa are witnessing an increased in-vitro diagnostics enzymes adoption due to growing cancer cases and the need for precise diagnostic tools. As per industry reports, cancer incidence in the Gulf region is projected to rise sharply, with Qatar expected to experience the strong growth, a 270% increase compared to 2020 levels by 2040. The UAE follows closely with a projected rise of 230%, while Saudi Arabia is anticipated to see an increase of 116%, effectively doubling its current burden. Enzyme-based diagnostics assist in early detection, staging, and treatment monitoring of various cancer types, making them valuable assets for oncology-focused healthcare settings. According to the in-vitro diagnostics enzymes market research report, the growing investment in healthcare infrastructure and diagnostic laboratories across GCC countries is further accelerating the market demand.

Competitive Landscape:

The market is characterized by intense competition, driven by ongoing innovation, product differentiation, and strategic alliances. Market players are concentrating on improving enzyme specificity, stability, and shelf life to address the changing requirements of diagnostic laboratories and point-of-care testing sites. Firms are investing in research and development (R&D) to develop high-performance enzymes that are compatible with various assay formats, such as molecular diagnostics, immunoassays, and clinical chemistry. Regulatory clearance and quality accreditation are important drivers of market positioning, particularly in markets where approval standards are tight. Players are also looking at opportunities in emerging markets through extended distribution networks and local partnerships to meet region-specific diagnostic requirements. According to the in-vitro diagnostics enzymes market forecast, the market is anticipated to expand at a steady rate over the decade, fueled by the increasing demand for rapid and accurate disease-detection technologies in the world. Competition pressure also results from advancements in diagnostics platforms that push manufacturers of enzymes to follow next-generation test systems.

The report provides a comprehensive analysis of the competitive landscape in the in-vitro diagnostics enzymes market with detailed profiles of all major companies, including:

- Advanced Enzymes Technologies Ltd.

- Affymetrix (Thermo Fisher Scientific)

- Amano Enzyme Inc.

- American Laboratories Inc.

- Amicogen Inc.

- BBI Solutions

- Biocatalysts Limited (Brain AG)

- Codexis Inc.

- Dyadic International Inc.

- F. Hoffmann-La Roche AG

- Merck KGaA

Latest News and Developments:

- April 2025: SEKISUI Diagnostics launched the Metrix® COVID/Flu Test, a rapid in-vitro diagnostics enzyme-based molecular assay that in 20 minutes identifies and differentiates SARS-CoV-2, Influenza A, and B. Designed for point-of-care and home use, the test expands access to affordable, multiplex diagnostics, marking a strategic advancement in SEKISUI’s enzyme-driven diagnostic portfolio.

- April 2025: QIAGEN is developing plans to offer three new sample preparation equipment—QIAsymphony Connect in 2025, followed by QIAsprint and QIAmini in 2026—to enhance lab automation and efficiency. The QIAsymphony Connect, featuring improved automation, higher assay sensitivity, and in-vitro diagnostics (IVD) compatibility, supports workflows in oncology, genomics, and pathogen detection.

- March 2025: Greylynx, a VivaChek subsidiary, earned the IVDR self-testing certificate for its Strep A Rapid Test, reinforcing its focus on accessible in-vitro diagnostics. This enzyme-based test delivers results in 5 minutes without equipment, supporting accurate self-screening across various settings.

- March 2025: Vitro appointed Biocare Medical as the exclusive U.S. distributor for its new NeoPATH Pro instrument, set to launch at USCAP 2025. Designed for high-throughput cancer diagnostics, NeoPATH Pro integrates advanced IHC, ISH, and FISH technologies and supports workflows involving in-vitro diagnostics enzymes. This collaboration aims to expand U.S. lab access to next-generation diagnostic solutions.

- February 2025: IIT Madras’ Centre for Responsible AI (CeRAI) partnered with Roche Diagnostics to advance R&D in Analytics and AI for in-vitro diagnostics (IVD) enzymes and services. This collaboration, formalized through a Gold Consortium MoU, aims to develop ethical AI solutions in digital health, integrating domain expertise with responsible technology practices.

In-Vitro Diagnostics Enzymes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Enzyme Types Covered | Proteases, Polymerase and Transcriptase, Ribonuclease, Others |

| Disease Types Covered | Infectious Disease, Diabetes, Oncology, Cardiology, Nephrology, Autoimmune Diseases, Others |

| Technology Types Covered | Histology Assays, Molecular Diagnostics, Clinical Chemistry |

| End Uses Covered | Pharma and Biotech Companies, Hospital and Diagnostic Labs, Contract Research Organizations (CROs), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Enzymes Technologies Ltd., Affymetrix (Thermo Fisher Scientific), Amano Enzyme Inc., American Laboratories Inc., Amicogen Inc., BBI Solutions, Biocatalysts Limited (Brain AG), Codexis Inc., Dyadic International Inc., F. Hoffmann-La Roche AG, Merck KGaA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the in-vitro diagnostics enzymes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global in-vitro diagnostics enzymes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the in-vitro diagnostics enzymes industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in-vitro diagnostics enzymes market was valued at USD 2.92 Billion in 2024.

The in-vitro diagnostics enzymes market is projected to exhibit a CAGR of 7.08% during 2025-2033, reaching a value of USD 5.69 Billion by 2033.

The market is driven by the rising global incidence of chronic and infectious diseases, increasing demand for point-of-care diagnostic solutions, growing elderly population, technological advancements in diagnostic platforms, and expanding use of molecular diagnostics and immunoassays in clinical and research applications.

North America currently dominates the in-vitro diagnostics enzymes market with the market share of 45.9%. The dominance is fueled by strong healthcare infrastructure, widespread adoption of advanced diagnostic technologies, high healthcare spending, presence of leading biotechnology firms, and continuous investment in research and development (R&D) for disease detection and monitoring tools.

Some of the major players in the in-vitro diagnostics enzymes market include Advanced Enzymes Technologies Ltd., Affymetrix (Thermo Fisher Scientific), Amano Enzyme Inc., American Laboratories Inc., Amicogen Inc., BBI Solutions, Biocatalysts Limited (Brain AG), Codexis Inc., Dyadic International Inc., F. Hoffmann-La Roche AG, and Merck KGaA, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)