India A2 Ghee Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2025-2033

India A2 Ghee Market Size and Share:

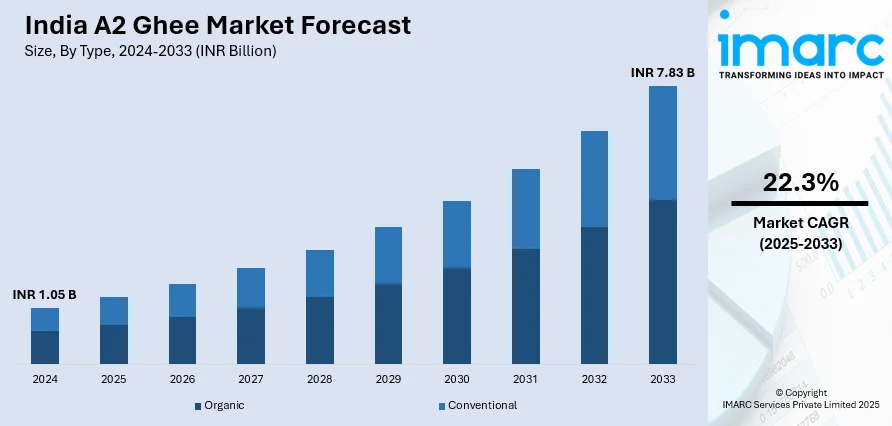

The India A2 ghee market size reached INR 1.05 Billion in 2024. The market is expected to reach INR 7.83 Billion by 2033, exhibiting a growth rate (CAGR) of 22.3% during 2025-2033. The market growth is attributed to the increasing consumer awareness of the health benefits of A2 protein, such as improved digestion and reduced inflammation, compared to regular ghee. Rising demand for natural, chemical-free, and premium dairy products is positively impacting the market demand. Also, growing health consciousness, rapid urbanization, and higher disposable incomes are further fueling market expansion across the country.

Market Insights:

- On the basis of region, West and Central India was the largest market for India A2 ghee in 2024.

- Based on the type, conventional represented the largest segment in 2024.

- On the basis of the application, food accounted for the largest market share in 2024.

- Based on the distribution channel, offline accounted for the largest market share in 2024.

Market Size and Forecast:

- 2024 Market Size: INR 1.05 Billion

- 2033 Projected Market Size: INR 7.83 Billion

- CAGR (2025-2033): 22.3%

A2 ghee is prepared from the A2 cow milk that is free from A1 beta-casein protein. It is rich in taste and aroma with a grainy texture and yellow appearance due to the presence of beta-carotene. It is a rich source of antioxidants, omega-3 fatty acids, healthy amino acids, and various vitamins, including B2, B12, B6, C, E, and K. It assists in regulating the immune system and improving cardiovascular health. It also helps in nourishing the body and stimulating the secretion of digestive acids in the stomach that aid in breaking down food. It nourishes the brain and nervous system, enhances cognitive functioning, and increases memory, intellect, and concentration power. It also reduces inflammation and prevents bone degeneration, which keeps the bones strong. At present, key market players are introducing A2 ghee in plastic and glass jars, paper cartons, and tins across India.

To get more information on this market, Request Sample

Hectic working schedules and the increasing prevalence of health issues, such as obesity, constipation, and joint pain, represent one of the primary factors catalyzing India A2 ghee market demand. In addition, the growing popularity of A2 ghee as a superfood and the shifting dietary preferences of individuals toward eating healthy and nutritious food are fueling the growth of the market in the country. Apart from this, A2 ghee offers a higher smoke point and does not release poisonous gases when cooked at a high temperature, as compared to ordinary oil that generates toxic fumes on heating. As a result, A2 ghee is utilized as a safer and healthier alternative to butter and vegetable oil. In line with this, an increasing number of people suffering from irritable bowel syndrome (IBS) and lactose intolerance are catalyzing the demand for A2 ghee. Moreover, leading market players operating in the country are extensively investing in marketing campaigns to promote the benefits of A2 ghee. They are also introducing A2 ghee-based food items to attract a wide range of consumers. Furthermore, the increasing penetration of high-speed internet and the growing usage of mobile applications that facilitate easy accessibility of A2 ghee via doorstep delivery are driving the India A2 ghee market share across the country. Other factors, such as increasing consumer awareness about the benefits of A2 ghee, expansion of the e-commerce sector, and the rising milk production, are stimulating the growth of the market in the country.

India A2 Ghee Market Trends:

Rising Health and Wellness Consciousness

One of the most significant trends shaping the market is the surge in health and wellness awareness among consumers. In addition, the increasing concern over lifestyle diseases like obesity, diabetes, and digestion issues is propelling the shift towards better alternatives in their everyday food. A2 ghee, which is obtained from the milk of native cow breeds that yield the A2 beta-casein protein, is gaining increasing popularity for its enhanced nutritional quotient. Apart from this, the consumer is connecting it with healthier digestion, anti-inflammatory effects, and better cardiovascular health when compared to normal ghee. The product is known for its natural source of essential fatty acids, vitamins, and antioxidants that promote immunity and overall well-being. Besides, social media personalities, nutritionists, and Ayurvedic experts are promoting these benefits further, thus driving demand. This health-conscious preference is especially evident in urban and upper-middle-class demographics, where premiumization and movement towards natural, minimally processed foods are rapidly gaining traction.

Premiumization and Expansion of Online Retail Channels

The rapid premiumization of dairy products, coupled with the expansion of online retail platforms, is positively influencing the India A2 ghee market outlook. With more consumers giving importance to quality, purity, and authenticity, A2 ghee is being increasingly positioned as a premium health product. This is supported through creative packaging, organic seals, and branding that focuses on traceability and ethical procurement from native cow breeds. At the same time, the emergence of e-commerce channels, quick commerce, and direct-to-consumer (D2C) channels has enhanced access to A2 ghee in different geographies. Online marketplaces do not just provide convenience but also allow consumers to compare brands, view comprehensive product information, and enjoy promotional offers. The exposure provided by digital marketing and influencer-driven promotional campaigns further enhances the product's appeal. Smaller start-ups and niche brands are also using online distribution to reach health-conscious consumers, avoiding retail obstacles, and thus increasing competition in the segment.

Growth, Opportunities, and Barriers in the India A2 Ghee Market:

- Growth Drivers: The market is witnessing rapid expansion due to rising consumer awareness of the health benefits associated with A2 protein. Increasing urbanization, higher disposable incomes, and lifestyle-related health concerns are prompting a shift toward premium, natural, and chemical-free dairy products. Social media campaigns, influencer endorsements, and Ayurvedic recommendations are boosting consumer trust and adoption. Additionally, the growing popularity of indigenous cow breeds and government support for sustainable dairy farming are strengthening market growth.

- Traceability and Authenticity Assurance: As the India A2 ghee industry grows, ensuring product authenticity has become a key differentiator for brands. Consumers are increasingly demanding transparent sourcing, ethical farming practices, and proof of origin from indigenous cow breeds. Companies are adopting blockchain, QR codes, and certification labels to assure traceability and build trust. These measures not only reduce counterfeit risks but also enhance consumer confidence in premium-positioned A2 ghee.

- Market Opportunities: The rising demand for functional and Ayurvedic foods is creating lucrative opportunities for A2 ghee manufacturers. Expansion into online retail, direct-to-consumer channels, and international markets offers scope for scaling brands beyond regional boundaries. Product diversification into flavored A2 ghee, ready-to-eat nutritional snacks, and wellness supplements can further broaden consumer appeal. Collaborations with health practitioners and fitness experts also open avenues for targeted niche marketing.

- Market Challenges: Despite strong growth, as per the India A2 ghee market analysis, the market faces barriers such as high pricing, which limits affordability among mass consumers. The limited supply of indigenous cow milk restricts large-scale production and scalability for many brands. Counterfeit products and mislabeling in the market pose a significant threat to consumer trust. Moreover, the lack of standardized regulations for A2 certification creates inconsistencies, making it difficult for buyers to distinguish genuine products.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India A2 ghee market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, application, and distribution channel.

Type Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the India A2 ghee market based on the type. This includes organic and conventional. According to the report, conventional represented the largest segment.

Application Insights:

- Food

- Personal Care

- Medical

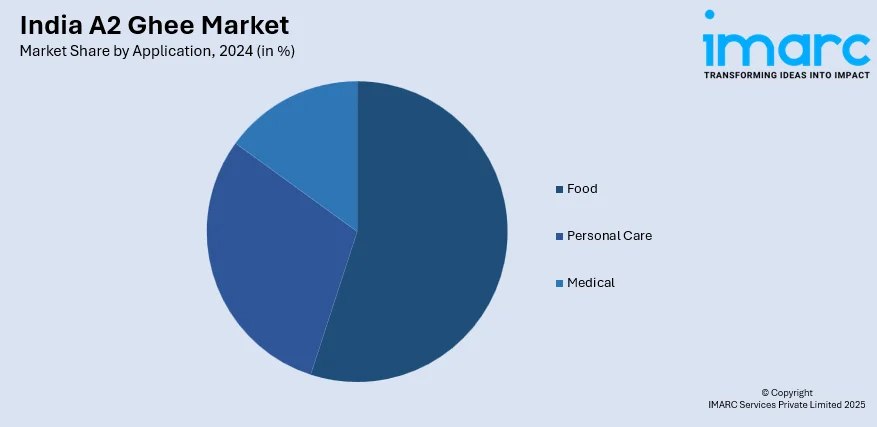

A detailed breakup and analysis of the India A2 ghee market based on the application has also been provided in the report. This includes food, personal care, and medical. According to the report, food accounted for the largest market share.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the India A2 ghee market based on the distribution channel has also been provided in the report. This includes online and offline. According to the report, offline accounted for the largest market share.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India. According to the report, West and Central India was the largest market for India A2 ghee. Some of the factors driving the West and Central India A2 ghee market included the easy availability, increasing prevalence of health issues, high production of A2 milk in the region, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India A2 ghee market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR |

| Segment Coverage | Type, Application, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India A2 ghee market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India A2 ghee market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India A2 ghee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the India A2 ghee market to exhibit a CAGR of 22.3% during 2025-2033.

The rising awareness regarding numerous health benefits of A2 ghee, such as curing constipation, reducing inflammation, relieving joint pain, strengthening bones, regulating stomach acids, etc., is primarily driving the India A2 ghee market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of A2 ghee across the nation.

Based on the type, the India A2 ghee market can be categorized into organic and conventional. Currently, conventional accounts for the majority of the total market share.

Based on the application, the India A2 ghee market has been segregated into food, personal care, and medical. Among these, the food industry currently holds the largest market share.

Based on the distribution channel, the India A2 ghee market can be bifurcated into online and offline. Currently, offline channel exhibits a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India A2 ghee market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)