India A2 Milk Market Size, Share, Trends and Forecast by Distribution Channel, End-Use, and Region, 2025-2033

India A2 Milk Market Overview:

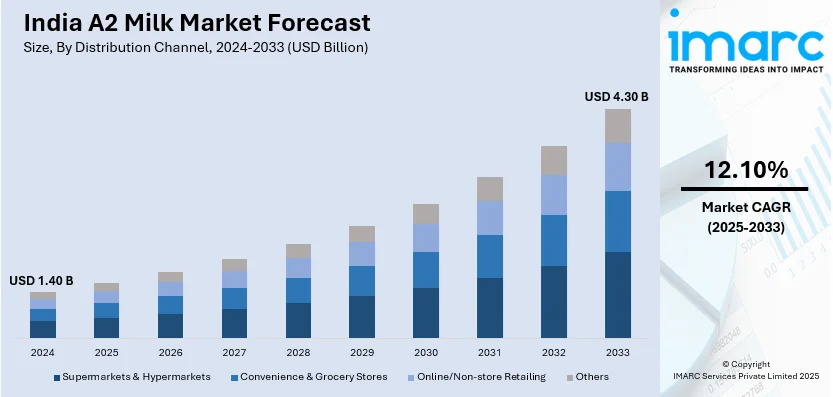

The India A2 milk market size reached USD 1.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.30 Billion by 2033, exhibiting a growth rate (CAGR) of 12.10% during 2025-2033. The market is expanding due to rising consumer demand for natural, easily digestible dairy, with major players ranging from established brands to niche start-ups offering farm-fresh, organic options, while increasing retail and e-commerce channels enhance accessibility in urban and semi-urban areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.40 Billion |

| Market Forecast in 2033 | 4.30 Billion |

| Market Growth Rate 2025-2033 | 12.10% |

India A2 Milk Market Trends:

Rising Consumer Awareness and Demand for Healthier Dairy Alternatives

Consumer knowledge of the health advantages of A2 milk is propelling high growth in India's dairy industry. A2 milk, with only the A2 beta-casein protein, is gaining popularity due to its easier digestibility and ability to combat inflammation over normal A1 milk. With an increase in lactose intolerance and digestive problems, urban consumers are actively looking for healthier dairy options. Wellness-focused consumers, fitness aficionados, and mothers are opting for A2 milk as it has a perceived better nutritional profile such as more Omega-3 fatty acids and calcium. Social campaigns on social media and government movements have also served to promote the goodness of A2 milk. Increased demand due to these marketing campaigns has provided further retail points of presence through supermarkets, organics stores, and online, hence positioning A2 milk firmly as a mass choice. With the ongoing consumer education, the business is likely to grow even bigger, prompting additional dairy players to fund the production of A2 milk.

To get more information on this market, Request Sample

Expansion of Premium and Organic Dairy Brands

India's dairy sector is observing an upsurge in premium and organic dairy brands that deal in high-quality, hormone-free milk. For example, in September 2023, Le Organics launched certified A2 cow milk in tetra packs in Bengaluru. This packaging increases the shelf life of the milk to six months without removing natural fat, providing consumers with milk in its purest form. [AB1] Moreover, in view of accelerating consumer concerns about adulteration and the use of synthetic hormones in mainstream dairy, high-income consumers are willing to pay extra for ethically produced and organic A2 milk. Such brands highlight old-fashioned agricultural practices and milk production from native cow breeds, such as Gir, Sahiwal, and Hallikar. In contrast to standard dairy, higher-end A2 milk brands put emphasis on environmentally friendly packaging, farm-to-table freshness, and low processing for preserving natural nutrients. Supermarkets, hypermarkets, and digital grocery stores are contributing significantly toward increasing market size. The trend of subscription-based milk delivery helps ensure convenience to urban consumers further, driving up demand. With the increasing demand for natural and pure dairy products, the growth of premium A2 milk brands is likely to pick up pace, transforming India's dairy sector towards a healthier and ethical future.

Growth of Online and Direct-to-Consumer (DTC) Distribution

E-commerce and direct-to-consumer (DTC) models are key drivers in the expansion of India's A2 milk market. As more consumers become fond of doorstep delivery of fresh and organic milk, brands are using online channels, mobile apps, and subscription models to maintain convenience. For instance, in December 2024, A2 Buffalo Milk was launched by Sid's Farm, reaching large Indian cities through e-commerce. Aseptic packaging provides longer shelf life, sustainability, and preservative-free purity for health-conscious buyers[AB2] . Moreover, startups and conventional dairy companies alike are pouring money into their online presence, providing subscription schemes and traceability options to ensure consumers of milk purity and origin transparency. This is especially prevalent in metro cities, where hectic urban lifestyles provide a reason for online shopping for groceries as a preferred solution. Moreover, DTC brands also tend to offer farm-to-home supply chains, cutting down the need for conventional retail networks and providing fresher delivery of milk. As online payments gain popularity and online grocery shopping goes mainstream, the A2 milk category will continue to reap the rewards of the e-commerce revolution, changing India's dairy distribution scene.

India A2 Milk Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on distribution channel and end use.

Distribution Channel Insights:

- Supermarkets & Hypermarkets

- Convenience & Grocery Stores

- Online/Non-store Retailing

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets & hypermarkets, convenience & grocery stores, online/non-store retailing, and others.

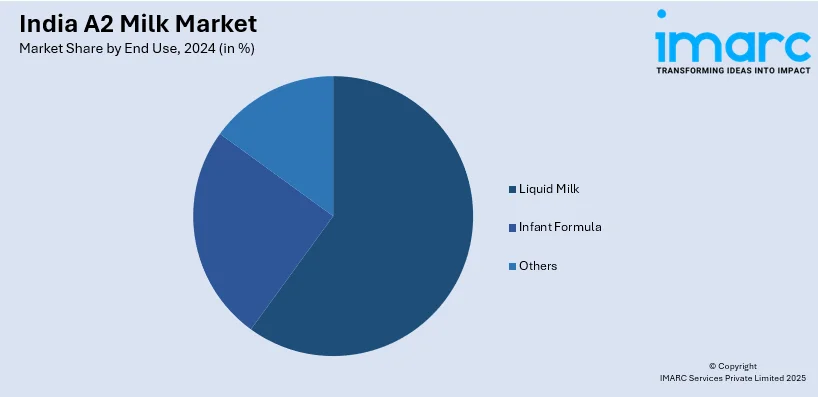

End Use Insights:

- Liquid Milk

- Infant Formula

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes liquid milk, infant formula, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India A2 Milk Market News:

- In November 2024, Farmery introduced A2 Cow Milk in eco-friendly glass packaging in New Delhi NCR. Made from indigenous breeds, such as Sahiwal and Gir, the chemical-free, unprocessed milk is brought fresh within a 12-hour delivery window to maintain high nutritional value and health sustainability for consumers.[AB3]

- In January 2024, Mother Dairy introduced buffalo milk in Delhi-NCR, which contains 6.5% fat and A2 protein for enhanced creaminess and flavor. To meet growing demand for high-fat, digestible A2 milk, the company plans to take it pan-India and make it a ₹500 crore brand by March 2025.[AB4]

India A2 Milk Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Distribution Channels Covered | Supermarkets & Hypermarkets, Convenience & Grocery Stores, Online/Non-store Retailing, Others |

| End-Uses Covered | Liquid Milk, Infant Formula, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India A2 milk market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India A2 milk market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India A2 milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The A2 milk market in India was valued at USD 1.40 Billion in 2024.

The India A2 milk market is projected to exhibit a CAGR of 12.10% during 2025-2033, reaching a value of USD 4.30 Billion by 2033.

The A2 milk market in India is expanding owing to the increasing health consciousness, rising awareness about A2 milk’s nutritional benefits, and growing consumer preference for natural and organic products. Expanding urban populations, higher disposable incomes, and concerns over lactose intolerance also contribute to the market demand. Additionally, improved supply chains and marketing efforts are strengthening market presence and accessibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)