India Active Pharmaceutical Ingredients Market Size, Share, Trends and Forecast by Drug Type, Manufacturer Type, Synthesis Type, Therapeutic Application, and Region, 2025-2033

India Active Pharmaceutical Ingredients Market Overview:

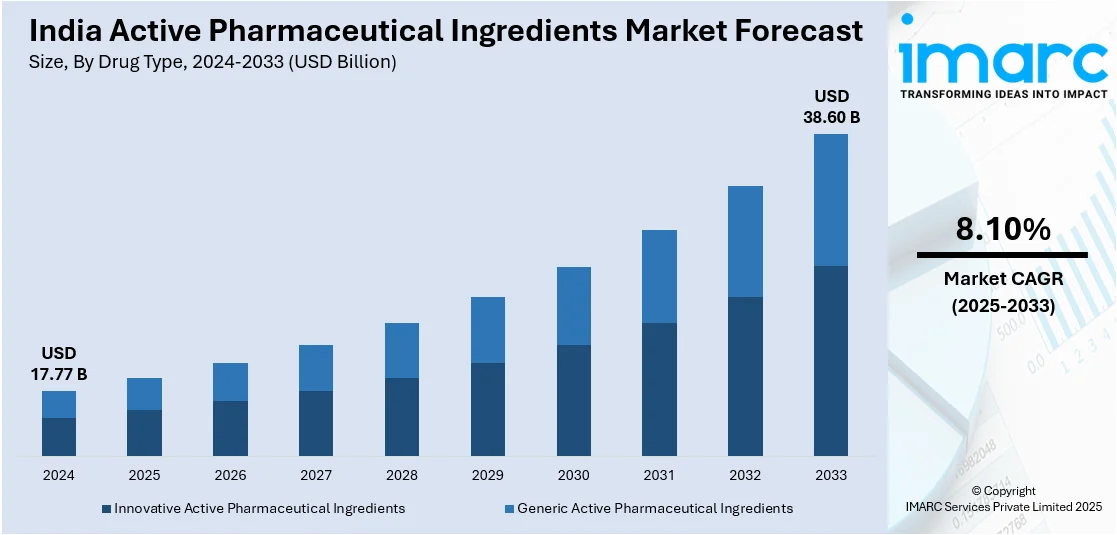

The India active pharmaceutical ingredients market size reached USD 17.77 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 38.60 Billion by 2033, exhibiting a growth rate (CAGR) of 8.10% during 2025-2033. Rising generic drug demand, government incentives, API self-reliance, patent expirations, increasing chronic diseases, biologics expansion, cost advantages, foreign investments, export growth, R&D advancements, regulatory support, contract manufacturing, biosimilars adoption, and pharma sector expansion are driving India's API market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.77 Billion |

| Market Forecast in 2033 | USD 38.60 Billion |

| Market Growth Rate (2025-2033) | 8.10% |

India Active Pharmaceutical Ingredients Market Trends:

Government Initiatives Promoting Domestic API Manufacturing

In an effort to reduce reliance on imports and encourage self-reliance within the pharmaceutical sector, the Indian government has launched a number of initiatives to enhance domestic production of active pharmaceutical ingredients (APIs). A significant initiative is the approval of the Production Linked Incentive (PLI) scheme, allocating INR 6,940 crore to boost domestic manufacturing of essential APIs, pharmaceutical intermediates, and Key Starting Materials (KSM). This policy project aims to build a robust local API manufacturing ecosystem in response to the vulnerabilities exposed during global supply chain disruptions. Significant investments are being made in the PLI project, including the expansion of current manufacturing facilities and the establishment of new ones. Furthermore, the government's 'Pharmaceuticals Vision 2020' initiative, with a budget of Rs.15,000 crore, aims to make India one of the world's leading manufacturing pharma centers by encouraging innovation and investment in the industry. These efforts are presenting lucrative opportunities for the market expansion.

To get more information on this market, Request Sample

Rising Prevalence of Chronic Diseases Driving API Demand

The growing number of chronic diseases like cardiovascular disease (CVDs), diabetes, and cancer in India has a direct bearing on the pharmaceutical sector, which is propelling the API market forward. A study conducted by the Thought Arbitrage Research Institute (TARI), indicated that the prevalence of chronic diseases in India in 2021 was 116 per 1,000 population, and out of these, two-thirds are between 26 and 59 years. The increasing disease burden of chronic diseases demands an uninterrupted and assured supply of APIs for the manufacturing of effective curative drugs. In addition, by 2030, NCDs are expected to contribute about 67% of India's disease burden, meaning that there will be a health emergency in the forecasted period. These increased cases of chronic diseases have urged the pharmaceutical sector to concentrate on manufacturing and producing APIs that target these prevalent health ailments. The trend not only addresses increasing healthcare needs but also encourages India's API market growth and diversification.

India Active Pharmaceutical Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on drug type, manufacturer type, synthesis type, and therapeutic application.

Drug Type Insights:

- Innovative Active Pharmaceutical Ingredients

- Generic Active Pharmaceutical Ingredients

The report has provided a detailed breakup and analysis of the market based on the drug type. This includes innovative active pharmaceutical ingredients and generic active pharmaceutical ingredients.

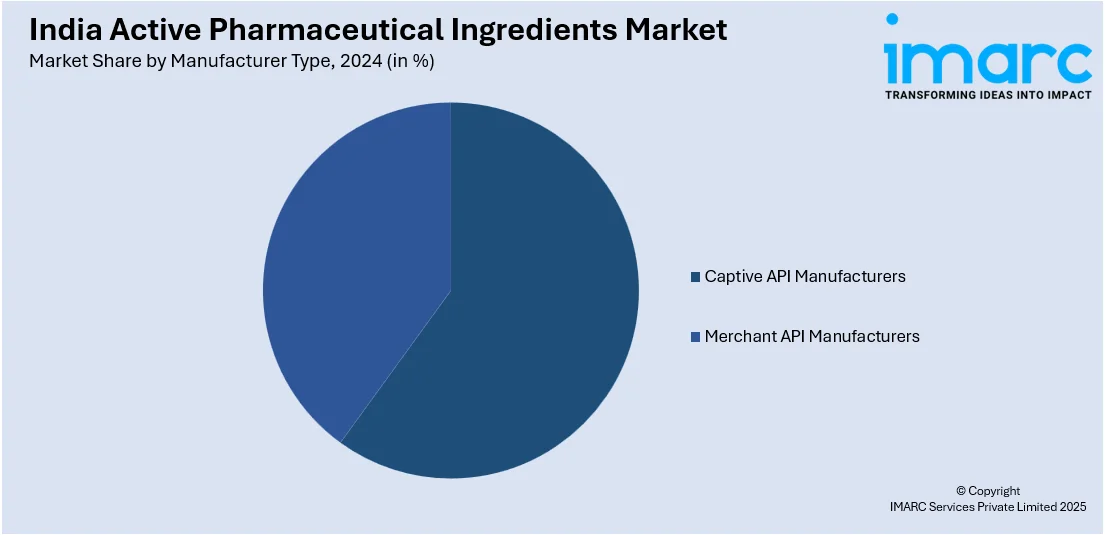

Manufacturer Type Insights:

- Captive API Manufacturers

- Merchant API Manufacturers

- Innovative Merchant API Manufacturers

- Generic Merchant API Manufacturers

A detailed breakup and analysis of the market based on the manufacturer type have also been provided in the report. This includes captive API manufacturers and merchant API manufacturers (innovative merchant API manufacturers, and generic merchant API manufacturers).

Synthesis Type Insights:

- Synthetic Active Pharmaceutical Ingredients

- Innovative Synthetic APIs

- Generic Synthetic APIs

- Biotech Active Pharmaceutical Ingredients

- Market by Drug Type

-

- Innovative Biotech APIs

- Biosimilars

-

- Market by Product Type

-

- Monoclonal Antibodies

- Vaccines

- Cytokines

- Others

-

- Market by Expression System Type

-

- Mammalian Expression System

- Microbial Expression System

- Yeast Expression System

- Others

-

- Market by Drug Type

The report has provided a detailed breakup and analysis of the market based on the synthesis type. This includes synthetic active pharmaceutical ingredients (innovative synthetic APIs and generic synthetic APIs) and biotech active pharmaceutical ingredients [drug type (innovative biotech APIs, and biosimilars), product type (monoclonal antibodies, vaccines, cytokines, and others), and expression system type (mammalian expression system, microbial expression system, yeast expression system, and others)].

Therapeutic Application Insights:

- Oncology

- Cardiovascular and Respiratory

- Diabetes

- Central Nervous System Disorders

- Neurological Disorders

- Others

A detailed breakup and analysis of the market based on the therapeutic application have also been provided in the report. This includes oncology, cardiovascular and respiratory, diabetes, central nervous system disorders, neurological disorders, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Active Pharmaceutical Ingredients Market News:

- September 2024: India's first API fermentation factory in Nalagarh began large-scale production, with yields of up to 6.5% in the first few months. The facility delivers API to states such as Gujarat and Uttarakhand, accounting for 60% of total domestic demand. When the plant reaches its peak production capacity, it will manufacture 400 tons of potassium clavulanate API every year.

India Active Pharmaceutical Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Innovative Active Pharmaceutical Ingredients, Generic Active Pharmaceutical Ingredients |

| Manufacturer Types Covered |

|

| Synthesis Types Covered |

|

| Therapeutic Applications Covered | Oncology, Cardiovascular and Respiratory, Diabetes, Central Nervous System Disorders, Neurological Disorders, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India active pharmaceutical ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India active pharmaceutical ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India active pharmaceutical ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The active pharmaceutical ingredients market in the India was valued at USD 17.77 Billion in 2024.

The India active pharmaceutical ingredients market is projected to exhibit a CAGR of 8.10% during 2025-2033, reaching a value of USD 38.60 Billion by 2033.

The key drivers of the India active pharmaceutical ingredients (API) market are expanding domestic and international demand for generic pharmaceuticals, government initiatives in the form of schemes such as PLI (Production Linked Incentive), contract manufacturing growth, and expanding healthcare spend. Moreover, India's competitive production costs and having a robust chemical manufacturing infrastructure improve its position as a global API manufacturer.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)