India AdTech Market Size, Share, Trends and Forecast by Solution, Advertising Type, Platform, Enterprise Size, Industry Vertical, and Region, 2025-2033

India AdTech Market Overview:

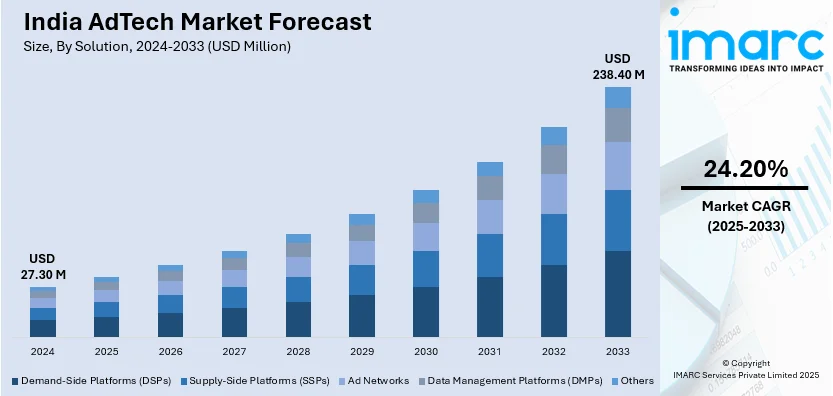

The India AdTech market size reached USD 27.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 238.40 Million by 2033, exhibiting a growth rate (CAGR) of 24.20% during 2025-2033. Rapid digital adoption, the rise of AI-driven personalized advertising, and the surge in e-commerce, programmatic advertising, and mobile marketing are fueling the market expansion. Additionally, regulatory advancements and investments in data analytics enhancing targeted ad strategies are propelling the market forward.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27.30 Million |

| Market Forecast in 2033 | USD 238.40 Million |

| Market Growth Rate 2025-2033 | 24.20% |

India AdTech Market Trends:

Integration of Artificial Intelligence and Machine Learning in Advertising

The combination of AI and ML technologies has revolutionized India's AdTech scene, allowing for hyper-personalized advertising, real-time campaign optimization, and improved targeting accuracy. AI-driven data analysis enables organizations to better understand consumer behavior, tastes, and purchase habits, allowing them to create highly tailored advertising that increases engagement and conversions. Furthermore, machine learning algorithms constantly analyze ad performance, making real-time modifications to optimize resource allocation and maximize return on investment (ROI). AI-powered programmatic advertising automates ad buying, assuring precise targeting and reducing ad spend waste. This efficiency has played a crucial role in the rapid growth of India’s digital advertising sector. In 2023, the industry expanded by 36.6%, reaching a market size of ₹40,685 crore, largely driven by AI and ML adoption. The trend is expected to continue, with projections indicating a market value of ₹62,045 crore by 2025, growing at a CAGR of 23.49%. As AI and ML technologies continue to refine advertising strategies, businesses can leverage data-driven insights to enhance audience engagement, improve ad performance, and drive higher revenues in the evolving digital ecosystem.

To get more information on this market, Request Sample

Rise of Connected TV (CTV) and Over-The-Top (OTT) Platforms

The rise of CTV and OTT platforms has revolutionized advertising, combining traditional television’s broad reach with digital advertising’s precision targeting. With the number of CTV households in India expected to reach 100 million by 2027, advertisers have a growing audience to engage with tailored content. This surge in viewership is driving increased ad spending, projected to reach $400 million by 2027 at a CAGR of 45%, as advertisers prioritize platforms that offer measurable results and targeted reach. Additionally, CTV and OTT platforms enable interactive ad formats, fostering higher engagement compared to traditional media. The integration of CTV with mobile advertising enhances campaign effectiveness, with studies showing a 67% increase in unaided brand recall when using both strategies. Furthermore, 74% of CTV advertisers assess campaign success through reach and frequency metrics, underscoring the platform’s effectiveness. As the digital landscape evolves, the synergy between CTV, OTT, and mobile advertising is expected to redefine brand engagement, offering advertisers new opportunities to connect with audiences in more dynamic and measurable ways.

India AdTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on solution, advertising type, platform, enterprise size,and industry vertical.

Solution Insights:

- Demand-Side Platforms (DSPs)

- Supply-Side Platforms (SSPs)

- Ad Networks

- Data Management Platforms (DMPs)

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes demand-side platforms (DSPs), supply-side platforms (SSPs), ad networks, data management platforms (DMPs), and others.

Advertising Type:

- Programmatic Advertising

- Search Advertising

- Display Advertising

- Mobile Advertising

- Email Marketing

- Native Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the advertising type. This includes programmatic advertising, search advertising, display advertising, mobile advertising, email marketing, native advertising, and others.

Platform Insights:

- Mobile

- Web

- Others

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile, web, and others.

Enterprise Size Insights:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises (SMEs), and large enterprises.

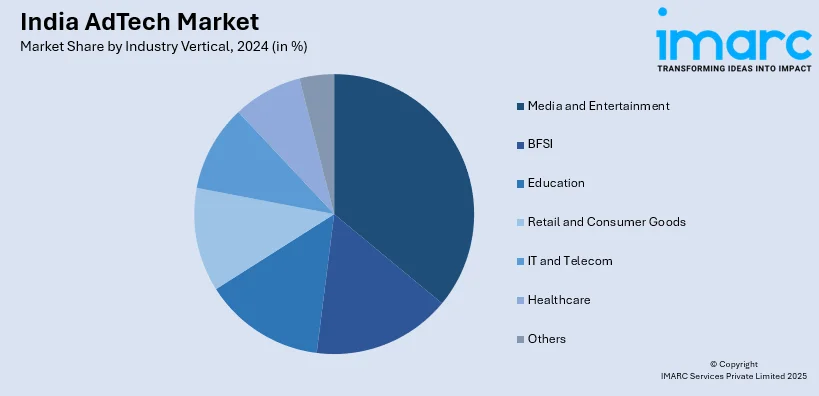

Industry Vertical Insights:

- Media and Entertainment

- BFSI

- Education

- Retail and Consumer Goods

- IT and Telecom

- Healthcare

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes media and entertainment, BFSI, education, retail and consumer goods, IT and telecom, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India AdTech Market News:

- February 2025: Google announced intentions to include adverts in the Gemini AI chatbot in the future. The AI chatbot's UI may offer suggested content or items based on user questions or replies, most likely for free-tier Gemini users.

- January 2025: Meta Platforms announced it will introduce advertisements on its social networking platform Threads, which has over 300 million monthly active members. During early testing, picture advertising will be displayed in the Threads home feed, wedged between content postings for a small number of users. Meta will also begin testing an inventory filter for advertisements in Threads, powered by AI, which will allow advertisers to select the sensitivity level of the organic material their ads display next to.

India AdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Demand-Side Platforms (DSPs), Supply-Side Platforms (SSPs), Ad Networks, Data Management Platforms (DMPs), Others |

| Advertising Types Covered | Programmatic Advertising, Search Advertising, Display Advertising, Mobile Advertising, Email Marketing, Native Advertising, Others |

| Platforms Covered | Mobile, Web, Others |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Industry Verticals Covered | Media and Entertainment, BFSI, Education, Retail and Consumer Goods, IT and Telecom, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India AdTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India AdTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India AdTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India adTech market was valued at USD 27.30 Million in 2024.

The India adtech market is projected to exhibit a CAGR of 24.20% during 2025-2033, reaching a value of USD 238.40 Million by 2033.

The India adtech market is driven by growing digital ad spending across mobile, video, and connected TV channels. Widespread smartphone penetration and affordable data foster precise audience targeting. Demand for real-time bidding, programmatic buying, and AI-enabled analytics grows. Additionally, brand safety and compliance standards in regional languages strengthen trust and adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)