India Advanced Packaging Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

India Advanced Packaging Market Overview:

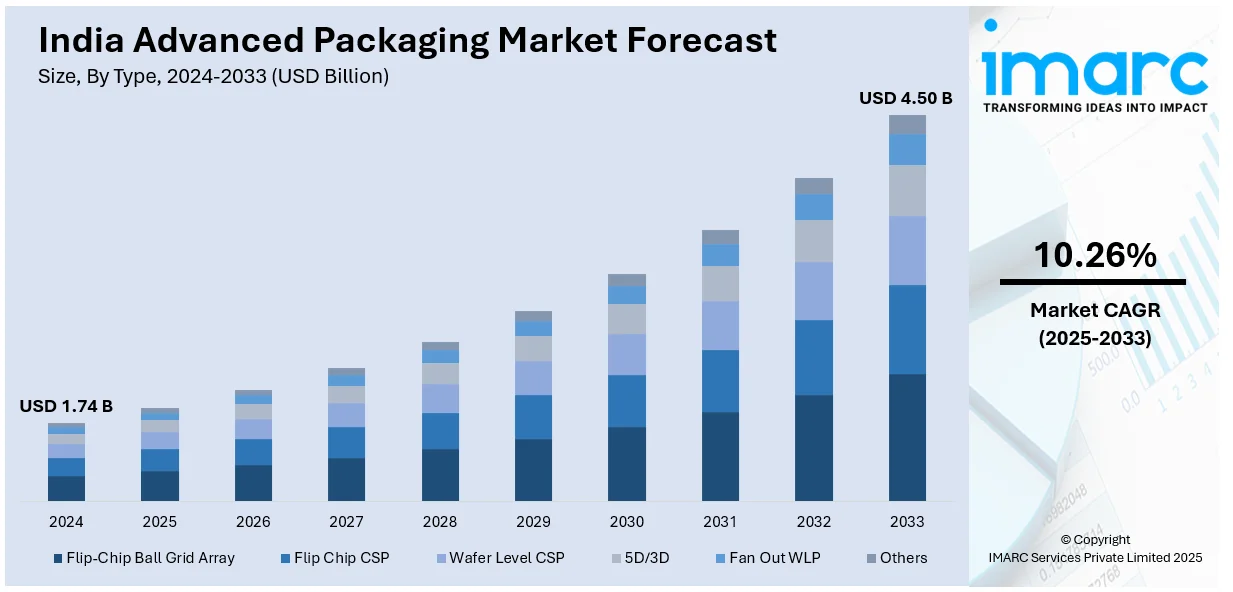

The India advanced packaging market size reached USD 1.74 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.50 Billion by 2033, exhibiting a growth rate (CAGR) of 10.26% during 2025-2033. The market is driven by the rising demand for miniaturized electronics, including smartphones, wearables, and IoT devices, alongside the adoption of 5G technology. Additionally, the growing automotive electronics sector, fueled by EVs and ADAS, and government initiatives including the PLI scheme are key factors augmenting the India advanced packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.74 Billion |

| Market Forecast in 2033 | USD 4.50 Billion |

| Market Growth Rate 2025-2033 | 10.26% |

India Advanced Packaging Market Trends:

Increasing Demand for Miniaturized Electronics

The rise in demand for miniaturized electronics, driven by the rapid adoption of smartphones, wearables, and IoT devices, is favoring the India advanced packaging market growth. A report indicates that 84% of smartphone users in India examine their devices within 15 minutes of rising, dedicating 31% of their waking hours to smartphone usage. The duration of time spent on smartphones has increased significantly, rising from 2 hours in 2010 to 4.9 hours in 2023, with an average of 80 checks per day, supporting the high traffic on e-commerce and fast commerce sites. With consumers favoring smaller, lighter, and more powerful devices as the industry moves towards devices integrating more functionality into a single unit, manufacturers are improving back-end packaging with the adoption of fan-out wafer-level packaging (FO-WLP) and system-in-package (SiP) technology. By using these technologies, it is possible to combine multiple components in smaller form factors with better performance and energy efficiency. Moreover, the increasing focus on 5G and the rise of connected devices are also driving this trend. Semiconductor and electronics manufacturers exploring advance packaging techniques target both Indian and global markets. The government is also supporting this momentum through initiatives such as Production Linked Incentive (PLI), which focuses on enhancing local manufacturing and decreasing import dependency while encouraging innovation in the advanced packaging domain.

To get more information on this market, Request Sample

Rising Adoption of Automotive Electronics

The automotive sector in India is emerging as a key driver for the market, fueled by the increasing integration of electronic components in vehicles. The automotive industry in India produced 30.6 million vehicles in 2024, of which 4.27 million passenger cars, 0.95 million commercial vehicles, and 19.5 million two-wheelers were sold domestically. In December, it recorded production of 1.92 million units, reflecting strong market demand. The trend of expanding automotive sector is seen as having a positive effect on the market, driven by increasing automotive production and the growth of electrification trends. As a result, this is creating a positive India advanced packaging market outlook. A growing number of electric vehicles (EVs) and the development of autonomous driving technologies and advanced driver-assistance systems (ADAS) are stimulating demand for reliable and high-performance solutions for their packaging. New packaging options such as the flip-chip and 3D packages are becoming widespread, as well, for improved thermal management, durability, and electrical performance required for automotive use cases. Furthermore, the initiatives taken by the Indian government in the form of the adoption of EVs with initiatives such as FAME-II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) generate business opportunities for automotive electronics. As a result, this trend is expected to remain magnified as automotive manufacturers and electronics providers partner up to deliver technologically advanced packaging, meeting the demanding automotive requirements including safety, efficiency, and sustainability.

India Advanced Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Flip-Chip Ball Grid Array

- Flip Chip CSP

- Wafer Level CSP

- 5D/3D

- Fan Out WLP

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes flip-chip ball grid array, flip chip CSP, wafer level CSP, 5D/3D, fan out WLP, and others.

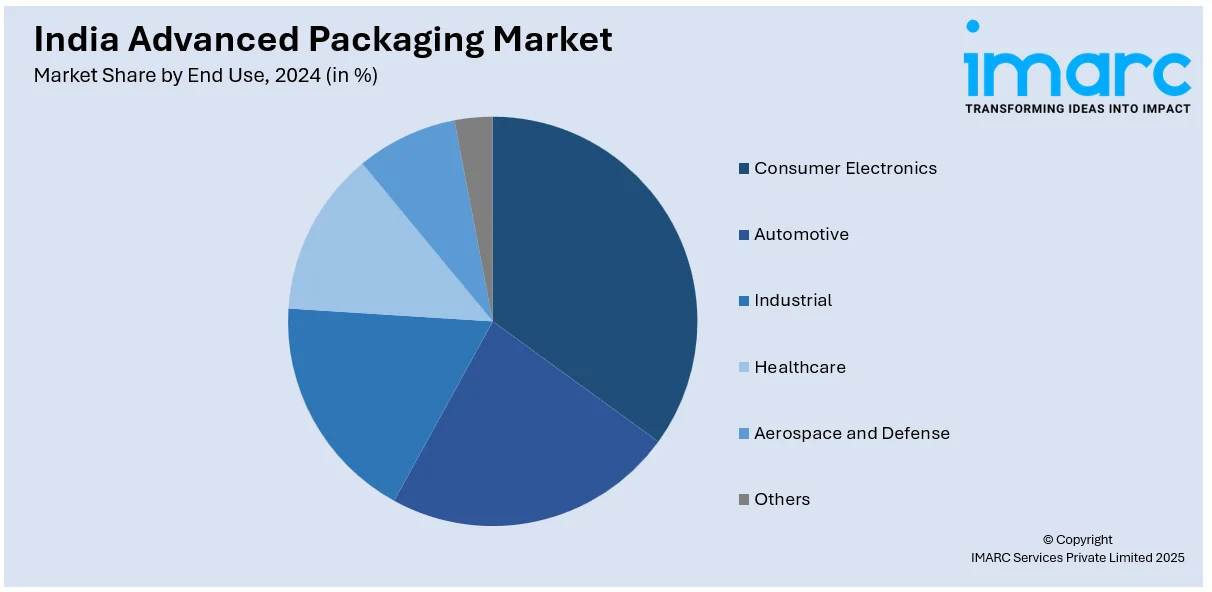

End Use Insights:

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes consumer electronics, automotive, industrial, healthcare, aerospace and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Advanced Packaging Market News:

- September 25, 2024: Henkel Adhesive Technologies, a global leader in industrial adhesives and electronics packaging, is gearing up to support India's burgeoning semiconductor ecosystem. Henkel provides adhesive solutions crucial for semiconductor packaging, including die-attach pastes/films, encapsulation materials, and underfills.

- July 30, 2024: CSIR launched a NATIONAL MISSION ON SUSTAINABLE PACKAGING through CSIR-NIIST with an aim to create startup packages that need to be biodegradable and eco-friendly packaging in India. The initiative involves eight CSIR laboratories and several industry partners to produce biodegradables, advance recycling processes, and develop a biodegradability testing center. By focusing on the replacement of multi-layer plastics and the replacement of PET bottles, the project aims to move India's packaging industry towards a net-zero future.

India Advanced Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flip-Chip Ball Grid Array, Flip Chip CSP, Wafer Level CSP, 5D/3D, Fan Out WLP, Others |

| End Uses Covered | Consumer Electronics, Automotive, Industrial, Healthcare, Aerospace and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India advanced packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India advanced packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India advanced packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The advanced packaging market in India was valued at USD 1.74 Billion in 2024.

The India advanced packaging market is projected to exhibit a CAGR of 10.26% during 2025-2033, reaching a value of USD 4.50 Billion by 2033.

As consumer electronics, automotive electronics, and telecommunication industries are rapidly evolving, the need for compact, energy-efficient, and high-speed semiconductor packaging solutions is rising. Government initiatives are further encouraging domestic chip manufacturing, fueling the growth of advanced packaging technologies. Additionally, the proliferation of 5G is driving innovations in chip design, leading the industry towards more sophisticated packaging formats.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)