India Agricultural Fumigants Market Size, Share, Trends, and Forecast by Type, Form, Crop Type, Application, Pest Control Method, and Region, 2025-2033

India Agricultural Fumigants Market Overview:

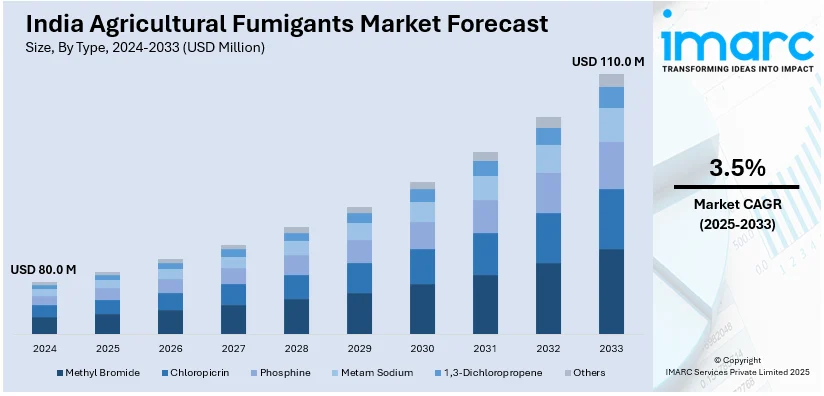

The India agricultural fumigants market size reached USD 80.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 110.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. The market is expanding due to the rising demand for pest control in stored grains and commercial farming. Growth is further driven by increasing food security concerns, modern storage facilities, and adoption of advanced fumigation techniques to minimize post-harvest losses and ensure crop quality.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.0 Million |

| Market Forecast in 2033 | USD 110.0 Million |

| Market Growth Rate (2025-2033) | 3.5% |

India Agricultural Fumigants Market Trends:

Rising Adoption of Phosphine-Based Fumigants

The Indian agricultural fumigants market is undergoing a burgeoning inclination towards phosphine-based fumigation owing to their exceptional efficacy in stored grain pest control and a comparatively reduced environmental influence. Magnesium and alumininum phosphide that belongs to phosphine fumigants category have started replacing methyl bromide, which is slowly being phased out because of its the environmental hazards. Stringent regulations set by the government of India to reduce pesticide residues in issued exports further stimulate the adoption of phosphine-based solutions for exports, giving it an edge over other available solutions to meet the international trade standards. Additionally, phosphine is preferred for its deep penetration capabilities, enabling effective pest control without leaving harmful residues. The expansion of warehouse storage capacities and increasing focus on minimizing post-harvest losses are driving demand for efficient fumigation methods. For instance, as per industry reports, around 74 Million Tons of post-harvest loss is recorded in India annually, which is 22% of the total foodgrain output. Market players are investing in advanced formulations such as controlled-release phosphine, improving safety and efficiency. These innovations support the growing need for sustainable and residue-free fumigation solutions in India’s rapidly evolving agricultural sector.

To get more information on this market, Request Sample

Increasing Utilization of Integrated Pest Management (IPM) in Grain Storage

The adoption of Integrated Pest Management (IPM) strategies in India's agricultural fumigants market is rising as stakeholders prioritize sustainable pest control methods. IPM combines chemical fumigation with non-chemical approaches such as hermetic storage, aeration, and biological control, reducing over-reliance on chemical treatments. This shift is driven by increasing awareness of the adverse impacts of extensive pesticide utilization on both the environment and human health. For instance, as per UN Environment Programme, in March 2024, India, Laos, Ecuador, Kenya, Vietnam, Philippines, and Uruguay joined forces introduce a USD 379 Million initiative to mitigate pollution caused by pesticides utilization in agriculture. Around 11,000 individuals die yearly due to the toxicity of pesticides. Moreover, large-scale food storage facilities, warehouses, and government procurement agencies are implementing IPM to enhance food security while ensuring compliance with safety regulations. Advanced monitoring technologies, such as electronic sensors for pest detection, are improving fumigation efficiency by enabling precise application based on infestation levels. The emphasis on safe storage practices, along with policy support for sustainable pest control, is accelerating IPM adoption. As a result, fumigant manufacturers are developing targeted solutions that align with IPM principles, ensuring both efficacy and regulatory compliance.

India Agricultural Fumigants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on Type, Form, Crop Type, Application, Pest Control Method.

Type Insights:

- Methyl Bromide

- Chloropicrin

- Phosphine

- Metam Sodium

- 1,3-Dichloropropene

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes methyl bromide, chloropicrin, phosphine, metam sodium, 1,3-dichloropropene, and others.

Form Insights:

- Solid

- Liquid

- Gas

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes solid, liquid, and gas.

Crop Type Insights:

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes cereals and grains, oilseeds and pulses, fruits and vegetables, and others.

Application Insights:

.webp)

- Soil

- Warehouse

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes soil and warehouse.

Pest Control Method Insights:

- Tarpaulin Fumigation

- Non-Tarp Fumigation by Injection

- Structural Fumigation

- Vacuum Chamber Fumigation

- Others

A detailed breakup and analysis of the market based on the pest control method have also been provided in the report. This includes tarpaulin fumigation, non-tarp fumigation by injection, structural fumigation, vacuum chamber fumigation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Agricultural Fumigants Market News:

- In July 2024, Coromandel International Limited, an India-based agri-solutions firm, announced the launch of Paramfos Plus, its new magnesium-fortified fertilizer (complex grade). This product is incorporated with sulfur (13%), nitrogen (16%), magnesium (0.6%), and phosphorus (20%).

India Agricultural Fumigants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Methyl Bromide, Chloropicrin, Phosphine, Metam Sodium, 1,3-Dichloropropene, Others |

| Forms Covered | Solid, Liquid, Gas |

| Crop Types Covered | Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others |

| Application Covered | Soil, Warehouse |

| Pest Control Methods Covered | Tarpaulin Fumigation, Non-Tarp Fumigation by Injection, Structural Fumigation, Vacuum Chamber Fumigation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India agricultural fumigants market performed so far and how will it perform in the coming years?

- What is the breakup of the India agricultural fumigants market on the basis of type?

- What is the breakup of the India agricultural fumigants market on the basis of form?

- What is the breakup of the India agricultural fumigants market on the basis of crop type?

- What is the breakup of the India agricultural fumigants market on the basis of application?

- What is the breakup of the India agricultural fumigants market on the basis of pest control method?

- What is the breakup of the India agricultural fumigants market on the basis of region?

- What are the various stages in the value chain of the India agricultural fumigants market?

- What are the key driving factors and challenges in the India agricultural fumigants market?

- What is the structure of the India agricultural fumigants market and who are the key players?

- What is the degree of competition in the India agricultural fumigants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India agricultural fumigants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India agricultural fumigants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India agricultural fumigants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)