India AI in Fintech Market Size, Share, Trends and Forecast by Type, Deployment Model, Application, and Region, 2025-2033

India AI in Fintech Market Overview:

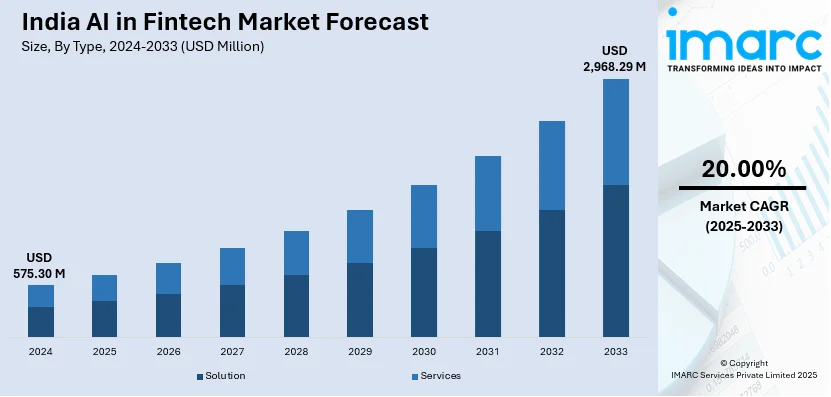

The India AI in fintech market size reached USD 575.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,968.29 Million by 2033, exhibiting a growth rate (CAGR) of 20.00% during 2025-2033. India's AI-driven fintech market is expanding rapidly, driven by advancements in credit management, fraud prevention, and digital payment security. Moreover, AI integration enhances financial accessibility, automates risk assessment, and strengthens transaction security, fostering innovation across banking, lending, and payment solutions in the evolving digital financial ecosystem.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 575.30 Million |

| Market Forecast in 2033 | USD 2,968.29 Million |

| Market Growth Rate (2025-2033) | 20.00% |

India AI in Fintech Market Trends:

AI-Driven Credit Management Growth

Artificial intelligence is revolutionizing credit management in India's fintech industry by increasing financial awareness, maximizing rewards, and improving credit utilization. In addition, the growing adoption of AI-based solutions is assisting customers in making better financial choices, enhancing credit health, and lowering defaults. Furthermore, fintech companies are using AI to gain real-time insights, automate spending analysis, and make tailor-made suggestions as digital banking continues to grow at a rapid pace. For example, in January 2025, Indian fintech firm CheQ launched Wisor, the country’s first AI-powered credit card expert. Wisor simplifies credit management by analyzing spending patterns, optimizing rewards, and offering customized insights. This innovation is solidifying AI adoption in fintech by enhancing credit management efficiency and user accessibility. AI adoption in credit management is increasing transparency and trust in India's financial market. Besides this, AI-based credit solutions are becoming the need of the hour for financial planning, with consumers relying more on digital tools. The use of predictive analytics with automation is also assisting banks as well as fintech players to provide improved models of risk assessment. Concurrently, the fintech sector will see surprising leaps in credit management, enhancing credit usage and access to finance nationwide with constant evolution in AI.

To get more information on this market, Request Sample

Advanced Fraud Prevention in Payments

The growth in online transactions has raised the need for advanced fraud prevention and security technologies in India's fintech sector. AI is helping to detect suspicious behavior, prevent risks, and enhance digital payment security. Along with this, financial institutions are adopting AI-fueled tools to reinforce transaction monitoring and prevention of fraud as they increasingly worry about threats from cyber-attacks. For example, in August 2024, NPST introduced seven AI-powered digital payment solutions at Global Fintech Fest. These innovations focus on fraud prevention, transaction security, and risk intelligence. Through the use of AI, NPST is assisting banks and payment aggregators in enhancing compliance, efficiency, and scalability in fraud prevention and digital payment processing. The use of AI in preventing fraud is enhancing the security and reliability of transactions. AI programs scan enormous amounts of transactional data in real time, identifying anomalies and preventing suspected fraud attempts. This pre-emptive measure lowers financial losses while enhancing consumer confidence in digital payments. As the technology of AI improves, banking and financial institutions will keep upgrading with advanced fraud detection mechanisms to provide smooth and safe digital payments. The increased adoption of AI-based security systems will propel India's fintech space into its next wave of digital payment transformation.

India AI in Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, deployment model, and application.

Type Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solution and services.

Deployment Model Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes cloud-based and n-premises.

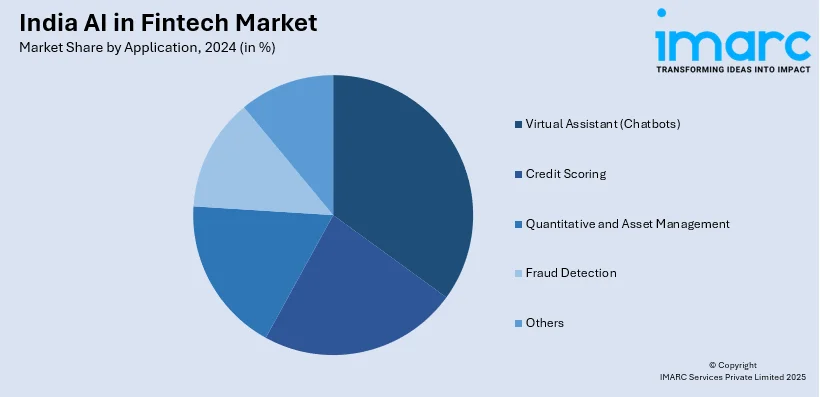

Application Insights:

- Virtual Assistant (Chatbots)

- Credit Scoring

- Quantitative and Asset Management

- Fraud Detection

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes virtual assistant (chatbots), credit scoring, quantitative and asset management, fraud detection, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India AI in Fintech Market News:

- March 2025: SBI announced a specialized project finance unit for AI, fintech, and e-commerce industries. This initiative, backed by expert hires and external consultants, enhances funding accessibility for emerging tech sectors. It strengthens fintech innovation, accelerates AI-driven financial solutions, and boosts economic growth in India.

- March 2025: Operant AI launched in India, introducing real-time cybersecurity for AI-driven fintech applications. Its advanced threat detection and auto-redaction capabilities enhance data security, regulatory compliance, and fraud prevention. This development strengthens fintech infrastructure, enabling safer AI adoption and accelerating secure digital financial transactions across India.

India AI in Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solution, Services |

| Deployment Models Covered | Cloud-based, On-premises |

| Applications Covered | Virtual Assistant (Chatbots), Credit Scoring, Quantitative and Asset Management, Fraud Detection, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India AI in fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India AI in fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India AI in fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India AI in fintech market size reached USD 575.30 Million in 2024.

The India AI in fintech market is expected to reach USD 2,968.29 Million by 2033, exhibiting a robust CAGR of 20.00% during 2025-2033.

The India AI in fintech market growth is driven by increasing adoption of AI technologies for fraud detection, risk management, personalized banking, growing digital payments ecosystem, and supportive government policies fostering fintech innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)