India Air Cargo Market Size, Share, Trends, and Forecast by Type, Service, Destination, End User, and Region, 2025-2033

India Air Cargo Market Size and Share:

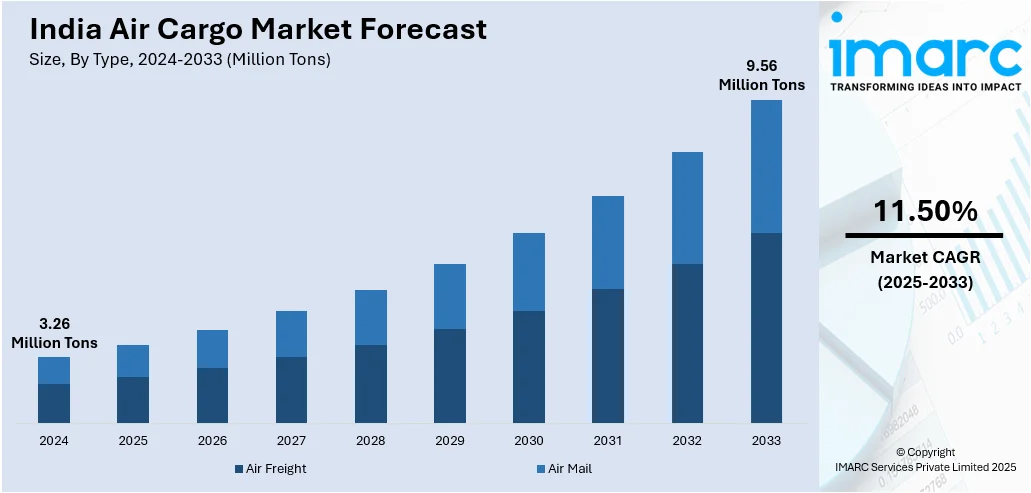

The India air cargo market size reached 3.26 Million Tons in 2024. The market is expected to reach 9.56 Million Tons by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market growth is attributed to the rapid expansion of e-commerce driven by increasing digital adoption and consumer preference for quick delivery services, robust infrastructure development including dedicated cargo terminals and multimodal logistics parks, and comprehensive government policy support through initiatives like the National Air Cargo Policy aimed at positioning India as a global transshipment hub.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of type, the market has been divided into air freight and air mail.

- On the basis of service, the market has been divided into express and regular.

- On the basis of destination, the market has been divided into domestic and international.

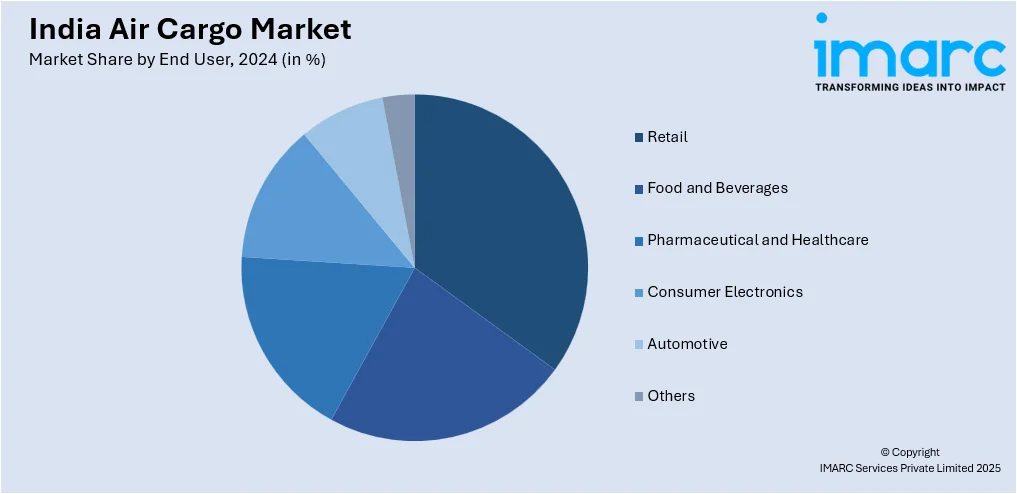

- On the basis of end user, the market has been divided into retail, food and beverages, pharmaceutical and healthcare, consumer electronics, automotive, and others.

Market Size and Forecast:

- 2024 Market Size: 3.26 Million Tons

- 2033 Projected Market Size: 9.56 Million Tons

- CAGR (2025-2033): 11.50%

India Air Cargo Market Trends:

Expansion of E-Commerce Driving Air Cargo Demand

India's air cargo industry is witnessing notable growth, mainly propelled by the amplified expansion of the e-commerce sector, according to the India air cargo market statistics. For instance, as per industry reports, e-commerce sector in India is anticipated to grow to USD 550 Billion by the year 2035, with online shoppers in tier 2 and 3 cities increasing to 56% in FY2024 and anticipated to further increase to 64% by the financial year 2030. Major online retail platforms are increasing reliance on air freight for faster delivery across the country. Rising internet penetration, digital payment adoption, and consumer preference for quick logistics solutions are fueling the demand for express air cargo services. Additionally, the development of dedicated air cargo networks by major e-commerce firms, along with increased investment in air freight infrastructure, is strengthening the sector. Regulatory initiatives, such as relaxed foreign direct investment (FDI) policies in aviation and improved airport cargo handling capacity further support growth. Express logistics providers are adopting advanced technologies like AI-driven route optimization and automation in warehousing to enhance efficiency. As competition intensifies, airlines and cargo service providers are expanding dedicated freighter fleets, leveraging airport modernization projects, and enhancing cold-chain logistics for perishable goods transportation.

To get more information on this market, Request Sample

Infrastructure Development and Policy Support Boosting Market Growth

Infrastructure expansion and government policy support are key factors driving India’s air cargo market. The National Air Cargo Policy aims to increase air cargo handling capacity and position India as a global transshipment hub. Investments in dedicated air cargo terminals, free trade zones, and multimodal logistics parks are strengthening the supply chain network, positively impacting the air cargo industry in India. For instance, as per industry reports, air cargo sector in India is expected to receive a heavy investment of USD 4.99 Billion over the next 4 years. Besides this, by the year 2026, the government plans to allocate USD 1.83 Billion for airport infrastructure development and enhancement of aviation navigation services. Moreover, the implementation of DigiYatra and digital cargo tracking systems is enhancing operational efficiency and reducing turnaround times. Additionally, airport privatization and modernization efforts are augmenting the India air cargo market share by increasing cargo handling capabilities, particularly in major hubs such as Delhi, Mumbai, and Bengaluru. The government's push for indigenous aircraft manufacturing and leasing incentives under Atmanirbhar Bharat is further contributing to long-term market stability. The rise of regional connectivity under the UDAN scheme is also facilitating air freight expansion in Tier-2 and Tier-3 cities. These developments are improving logistics efficiency and supporting the increasing demand for domestic and international air cargo transportation.

Trade Route Disruptions and Digital Innovation

The Indian air cargo market outlook is experiencing unprecedented transformation due to global maritime disruptions and advanced technology adoption across the logistics ecosystem. The ongoing Red Sea crisis has severely impacted traditional shipping routes, compelling international traders and freight forwarders to shift substantial cargo volumes from sea to air transportation to maintain critical supply chain continuity. This crisis-driven modal shift is generating significant new business opportunities for the India air cargo market analysis sector, particularly benefiting express cargo services and time-sensitive shipments that cannot afford maritime delays. Regional trade agreements including the Regional Comprehensive Economic Partnership (RCEP), India-ASEAN Free Trade Agreement, and bilateral trade pacts with countries like Australia and UAE are fundamentally reconfiguring cargo flow patterns and destination preferences. These agreements are establishing preferential trade corridors that favor air cargo transportation for high-value, low-weight commodities, positioning India as a strategic transshipment hub for intra-Asian and global trade networks, contributing to the Indian air cargo industry. The Indian air cargo industry is simultaneously undergoing technological transformation through widespread implementation of IoT-enabled cold chain tracking systems that provide real-time monitoring capabilities for temperature, humidity, location, and handling conditions throughout the entire logistics chain. These advanced tracking solutions are particularly crucial for pharmaceutical, biotechnology, and perishable food shipments, enabling precise environmental control and regulatory compliance documentation. Additionally, the air cargo industry in India is witnessing accelerated adoption of sustainable aviation fuel (SAF) in cargo operations as operators prioritize environmental compliance, carbon footprint reduction, and alignment with global sustainability mandates. As per the India air cargo market analysis, airlines are investing in SAF infrastructure and partnerships with biofuel producers to meet increasingly stringent environmental regulations while maintaining operational efficiency and cost competitiveness.

Growth, Opportunities, and Challenges in the India Air Cargo Market:

- Growth Drivers of the India Air Cargo Market: The rapid expansion of e-commerce and increasing demand for express delivery services are propelling substantial market growth across urban and rural areas. Government infrastructure investments including dedicated cargo terminals and modernization of major airports are enhancing operational capacity and efficiency. Rising pharmaceutical exports and temperature-sensitive goods transportation requirements are driving demand for specialized cargo services in the India air cargo market share landscape.

- Opportunities in the India Air Cargo Market: The growing adoption of China Plus One manufacturing strategies presents significant opportunities for increased cargo volumes as companies relocate production facilities to India. Development of regional air connectivity through UDAN scheme offers expansion potential for cargo services in tier-2 and tier-3 cities. Strategic partnerships with global logistics providers and e-commerce platforms can enhance market reach and service capabilities in the India air cargo market statistics framework.

- Challenges in the India Air Cargo Market: Limited dedicated freighter aircraft capacity with only 18 freighters in 2024 creates operational bottlenecks and dependency on passenger aircraft belly space for cargo transportation. Inadequate cold chain infrastructure and skilled workforce shortages pose challenges for handling pharmaceutical and perishable goods efficiently. High operational costs including aviation turbine fuel prices and airport charges constrain profitability margins for cargo operators.

India Air Cargo Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, service, destination, and end user.

Type Insights:

- Air Freight

- Air Mail

The report has provided a detailed breakup and analysis of the market based on the type. This includes air freight and air mail.

Service Insights:

- Express

- Regular

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes express and regular.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

End User Insights:

- Retail

- Food and Beverages

- Pharmaceutical and Healthcare

- Consumer Electronics

- Automotive

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes retail, food and beverages, pharmaceutical and healthcare, consumer electronics, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Air Cargo Market News:

- In August 2025, Jeena & Company, one of India's largest logistics firms, partnered with Salesforce to enhance its operations through AI-powered solutions, marking a significant step in India's air cargo sector. By deploying Salesforce’s Sales Cloud and Customer 360 platform, Jeena & Company aims to improve sales visibility, streamline logistics workflows, and foster deeper customer engagement.

- In March 2025, Adani Defence and Aerospace announced plans to enter India's growing air cargo market by launching passenger-to-freighter (P2F) conversion operations. With only 20-25 freighters currently serving India’s expanding logistics sector, the move aims to address the increasing demand for dedicated freighter aircraft and reduce reliance on foreign operators.

- In January 2025, Air India expanded its partnership with SATS Ltd and Worldwide Flight Services (WFS) by awarding 14 new cargo and ground handling contracts across multiple global regions, including North America, the UK, Europe, and Asia. The new stations, covering major airports like Chicago, Washington Dulles, London Heathrow, and Frankfurt, reflect Air India's commitment to streamlining logistics and improving service levels, contributing to the airline's ongoing transformation.

- In January 2025, Andhra Pradesh Trade Promotion Corporation (APTPC) announced that it is set to manage the cargo operations at Vizag airport where international air cargo operations are anticipated to initiate soon.

- In August 2024, Air India Group announced plans of upgrading its cargo services across its 4 airlines, suggestively resulting in the development of a separate body with dedicated freighters. This tactical more targets to capitalize on India's augmenting air cargo industry. The company also revealed plans to design an extensive software for managing commercial ecosystem, revenue, and requests for cargo.

- In February 2024, air cargo India announced that they will collaborate with CTL-BHP to create a comprehensive experience for the logistics and transport industry, co-locating both exhibitions at the Jio World Convention Centre in Mumbai. This strategic partnership aims to highlight multimodal logistics solutions and address India’s growing trade volumes, especially in sectors like perishables, pharma, and project forwarding.

India Air Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air Freight, Air Mail |

| Services Covered | Express, Regular |

| Destinations Covered | Domestic, International |

| End Users Covered | Retail, Food and Beverages, Pharmaceutical and Healthcare, Consumer Electronics, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India air cargo market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India air cargo market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India air cargo industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India air cargo market size reached 3.26 Million Tons in 2024.

The India air cargo market is projected to exhibit a CAGR of 11.50% during 2025-2033, reaching a volume of 9.56 Million Tons by 2033.

The India air cargo market is driven by growing e-commerce demand, rapid industrial expansion, and increased international trade. Rising need for time-sensitive deliveries and improved airport infrastructure also support market growth. Additionally, government initiatives promoting exports and logistics digitization further enhance the sector’s efficiency and competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)