India Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

India Air Freight Market Overview:

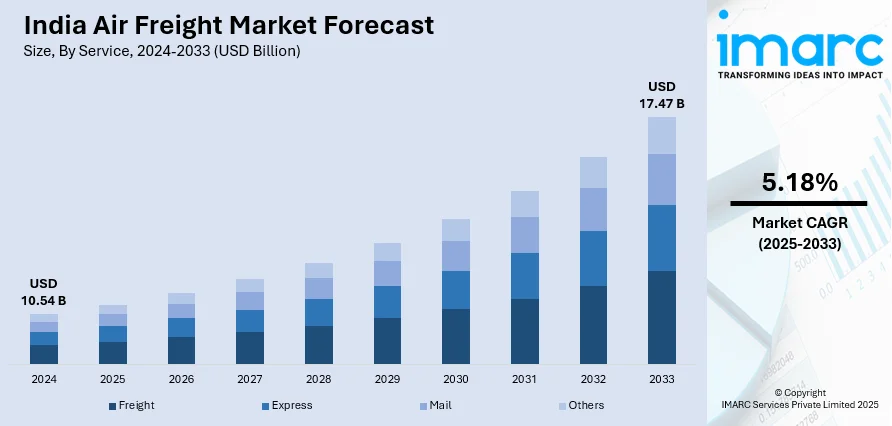

The India air freight market size reached USD 10.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.47 Billion by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. The market is driven by the accelerating demand for express logistics solutions from e-commerce platforms and expanding trade in pharmaceuticals and perishables. Infrastructure developments, dedicated cargo terminals, and policy reforms are strengthening India’s air freight capabilities. Additionally, increasing investments in digitalization, cold chain logistics, and regional connectivity are ensuring operational efficiency, further augmenting the India air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.54 Billion |

| Market Forecast in 2033 | USD 17.47 Billion |

| Market Growth Rate 2025-2033 | 5.18% |

India Air Freight Market Trends:

Strengthening Pharmaceutical and Perishable Goods Supply Chains

India’s prominence as a global pharmaceutical manufacturing hub significantly contributes to the demand for specialized air freight services. With rising exports of active pharmaceutical ingredients (APIs), vaccines, and finished drugs, reliable cold chain and temperature-sensitive logistics have become imperative. The COVID-19 pandemic underscored the need for resilient and responsive air cargo networks, accelerating investments in pharmaceutical handling capabilities at key airports such as Mumbai, Hyderabad, and Delhi. Additionally, India’s agricultural and perishable food exports—including seafood, exotic fruits, and vegetables—depend heavily on air freight for maintaining freshness during long-distance transportation. Airlines and cargo operators are expanding specialized services, including temperature-controlled containers and express clearance processes, to meet this demand. Support from the government’s ‘National Logistics Policy’ and dedicated freight corridors is further bolstering cold chain logistics development. On April 25, 2025, Air India was awarded the Good Distribution Practices (GDP) certification for its cargo business, making it the first and only Indian carrier, and one of the few in Asia, to achieve this global standard. In the financial year 2024-25, Air India transported over 4,000 tonnes of pharmaceuticals globally, reinforcing its capacity to handle time- and temperature-sensitive shipments. The GDP certification covers major domestic stations including Delhi, Mumbai, and Chennai, and international hubs like New York, London, and Frankfurt. These advancements are positioning air freight operators as indispensable partners for India’s pharmaceutical and perishable goods sectors, ensuring that exports maintain quality standards and reach global markets efficiently. These factors are supporting sustained India air freight market growth by strengthening the critical logistics backbone required for the economy.

To get more information of this market, Request Sample

Infrastructure Development and Policy Reforms Supporting Air Cargo

India’s government has prioritized logistics infrastructure development, particularly in aviation, to enhance the efficiency of air freight operations. Initiatives such as the UDAN (Ude Desh ka Aam Nagrik) scheme for regional connectivity and dedicated air cargo terminals at major airports are improving cargo capacity and accessibility. Several greenfield airport projects are underway, aimed at increasing both passenger and cargo handling capabilities across regions underserved by current logistics networks. Indian air cargo traffic is expected to grow from 3.7 million tons in 2024 to 5-5.8 million tons by 2029, with a 6-9% annual growth. The market saw a 19% growth in international cargo and a 6-8% rise in domestic cargo in 2024. Additionally, 90% of India’s air cargo is handled at six airports: Delhi, Mumbai, Bengaluru, Chennai, Hyderabad, and Kolkata. Additionally, digitization initiatives under the ‘Digital India’ campaign are simplifying customs procedures, reducing paperwork, and improving tracking visibility across supply chains. Policy measures such as concessional GST rates for air freight services and the promotion of public-private partnerships are encouraging private sector investment in cargo infrastructure. Logistics parks, multimodal hubs, and bonded warehouse zones near airports are further enhancing operational efficiency. These combined developments provide the operational backbone necessary for scaling domestic and international air cargo operations, ensuring that India remains competitive in global trade flows and logistics innovation.

India Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

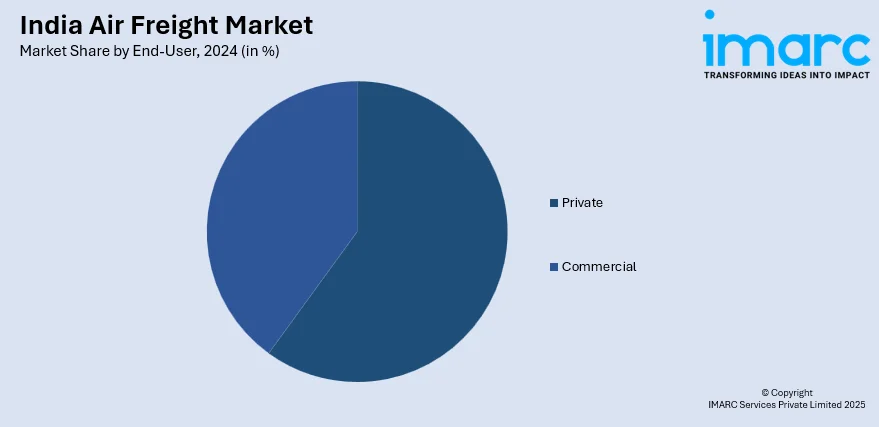

End-User Insights:

- Private

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes private and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all major regional markets. This includes North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Air Freight Market News:

- On March 9, 2025, Dubai-based cargo operator SolitAir announced an investment of USD 25 million in India's air cargo market for its first year of operations. The company launched freighter services to Bengaluru in January 2025 and plans to expand its network to 50 cities within the Global South. This investment could increase in the coming years as SolitAir targets key Indian gateways such as Delhi, Mumbai, and Bengaluru, to cater to the growing demand for express logistics services, particularly in the e-commerce and pharmaceutical sectors.

- On May 21, 2025, Air India successfully delivered its first airport-to-door international cargo shipment, transporting six tons of life-saving pharmaceuticals from Delhi to Brussels. The temperature-sensitive shipment, requiring a controlled environment between 15-25°C, was completed within 36 hours, with the goods being transferred to a cooled Road Feeder Service truck in Paris. This achievement highlights Air India's expanding global reach and its new focus on providing high-quality airport-to-door services, supported by its GDP certification for pharmaceutical logistics.

India Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the India air freight market on the basis of service?

- What is the breakup of the India air freight market on the basis of destination?

- What is the breakup of the India air freight market on the basis of end-user?

- What is the breakup of the India air freight market on the basis of region?

- What are the various stages in the value chain of the India air freight market?

- What are the key driving factors and challenges in the India air freight market?

- What is the structure of the India air freight market and who are the key players?

- What is the degree of competition in the India air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)