India Air Freshener Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

India Air Freshener Market Summary:

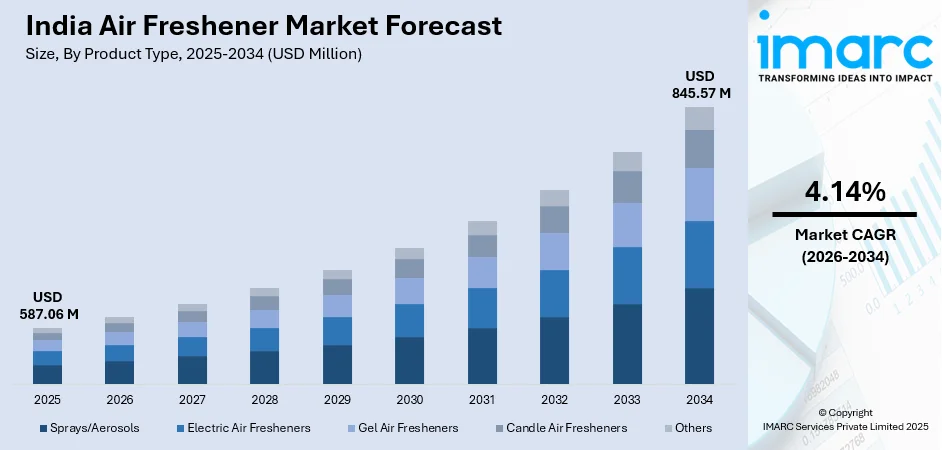

The India air freshener market size was valued at USD 587.06 Million in 2025 and is projected to reach USD 845.57 Million by 2034, growing at a compound annual growth rate of 4.14% from 2026-2034.

The air freshener market in India is witnessing steady growth on the back of increasing urbanization, improving disposable incomes, and growing awareness among consumers about indoor air quality and hygiene. The Indian consumer is increasingly looking for products that would add a new dimension to their stay at home, offices, and in vehicles. The evolving lifestyle preferences coupled with expanding organized retail networks and greater proliferation of e-commerce platforms improve product access across urban and semi-urban areas.

Key Takeaways and Insights:

- By Product Type: Sprays/aerosols dominates the market with a share of 39% in 2025, driven by their instant odor-eliminating properties, wide variety of fragrances, portability, affordability, and versatility for use across multiple settings including bathrooms, kitchens, and living spaces.

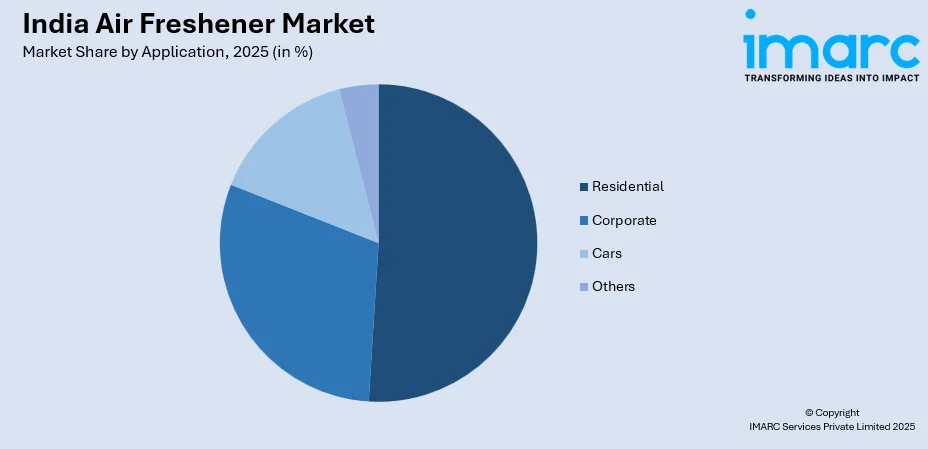

- By Application: Residential leads the market with a share of 51% in 2025, attributed to heightened consumer focus on home comfort, wellness, and creating inviting living spaces amid changing lifestyle patterns and increased time spent indoors.

- By Distribution Channel: Supermarkets and hypermarkets dominate the market with a share of 32% in 2025, owing to wide product assortments, competitive pricing, promotional offers, and the convenience of one-stop shopping experiences for household care products.

- By Region: North India leads the market with a share of 29% share in 2025, supported by high population density, significant urbanization rates, rising affluence in metropolitan areas, and strong retail infrastructure development.

- Key Players: The India air freshener market exhibits a moderately consolidated competitive landscape with established domestic manufacturers and multinational consumer goods corporations competing through product innovation, diverse fragrance portfolios, strategic pricing, and extensive distribution networks to capture evolving consumer preferences.

To get more information on this market Request Sample

The India air freshener market is evolving as consumers focus more on indoor air quality and pleasant fragrances. In October 2025, Godrej Consumer Products expanded its Godrej aer automatic freshener range and launched a festive campaign to position air care as both a daily essential and a celebration staple for Indian homes. Rising middle-class aspirations, exposure to global lifestyle trends, and awareness of the psychological benefits of scents are influencing consumer choices. Manufacturers are responding with diverse formats including sprays, gels, electric diffusers, and candles to cater to different preferences and occasions. Additionally, demand for natural, organic, and eco-friendly products is growing, reflecting health and sustainability priorities, while the expansion of modern retail and e-commerce is increasing access in tier-two and tier-three cities, extending the market beyond metropolitan areas.

India Air Freshener Market Trends:

Rising Demand for Natural and Eco-Friendly Formulations

Indian consumers are increasingly turning to natural and eco-friendly air fresheners as awareness of health and environmental impacts grows. In January 2024, student innovator Rajiv Sharma developed a biodegradable, sensor-activated air freshener from temple flower waste, recycling over 1,500 kg of flowers and eliminating plastics and harmful chemicals. Concerns over synthetic chemicals in conventional products, linked to allergies and respiratory issues, are boosting demand for plant-based and essential oil-infused alternatives. Manufacturers are responding with biodegradable materials, non-toxic ingredients, and sustainable packaging, especially in metropolitan cities where wellness and eco-conscious choices strongly influence purchasing decisions.

Technological Advancements and Smart Air Fresheners

Technology is reshaping the Indian air freshener market, with increasing adoption of smart and connected devices. According to reports, Dabur expanded its Odonil range with the Odonil Exotic Room Spray, a water-based format offering nature-inspired fragrances like Sensual Dahlia and Sakura, reflecting consumer demand for longer-lasting, user-friendly alternatives to traditional aerosols. Modern air fresheners now feature motion detection, automated fragrance release, app connectivity, and programmable schedules, allowing users to control scent intensity and timing. Integration with smart home systems and IoT capabilities is driving demand among urban consumers seeking convenience, personalization, and seamless experiences in their connected lifestyles.

Premiumization and Customized Fragrance Experiences

The Indian air freshener market is shifting toward premium and customized solutions as consumers seek enhanced sensory experiences. Urban buyers increasingly prefer programmable air fresheners, mood‑enhancing diffusers, and curated essential oil blends for specific rooms or occasions. In 2024, Rentokil Initial Hygiene India introduced its Signature Scent ambient scenting solution, offering customizable fragrance intensity and sustainable, aerosol-free formulations for businesses and premium spaces. This trend highlights growing focus on wellness, comfort, and sensory refinement, with manufacturers expanding portfolios of layered, long-lasting fragrances in aesthetically designed packaging that complements modern interiors.

Market Outlook 2026-2034:

The market for air fresheners in India is set for further development during the forecast period. This can be attributed to the favorable demographic conditions in the country. With the advancement of urbanization and the increase in the nuclear family trend in the coming period, the demand for air fresheners in the Indian market shall increase. Moreover, the development of organized retailing and online shopping shall further increase the accessibility of air fresheners in the Indian market. Innovation in the product development of air fresheners shall also play an important role in the development of the market. The market generated a revenue of USD 587.06 Million in 2025 and is projected to reach a revenue of USD 845.57 Million by 2034, growing at a compound annual growth rate of 4.14% from 2026-2034.

India Air Freshener Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Sprays/Aerosols |

39% |

|

Application |

Residential |

51% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

32% |

|

Region |

North India |

29% |

Product Type Insights:

- Sprays/Aerosols

- Electric Air Fresheners

- Gel Air Fresheners

- Candle Air Fresheners

- Others

The sprays/aerosols dominate with a market share of 39% of the total India air freshener market in 2025.

Spray and aerosol air fresheners continue to dominate the Indian market due to their quick effectiveness, convenience, and wide retail availability. At the 6th India Aerosols Expo 2025 in Mumbai, top FMCG and home-care brands showcased innovations in these formats, highlighting their ongoing relevance in homes and commercial spaces. They offer instant odor elimination and a variety of fragrances, from floral and fruity to woody and fresh, catering to personal preferences and seasonal moods.

Affordability and portability are significant reasons for the wide adoption of spray air fresheners across different consumer segments and income groups. These products do not require installation or electricity; this convenient usage flexibility makes these products appealing to consumers who seek simple and affordable air care solutions. Manufacturers keep innovating in this segment by offering water-based formulations, long-lasting variants, and refillable options that address the evolving consumer need for value and sustainability while offering the instant effectiveness that defines the product category.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Corporate

- Cars

- Others

The residential leads with a share of 51% of the total India air freshener market in 2025.

The residential segment holds the leading market share in the Indian air fresheners market as consumers are focusing on creating favorable indoor spaces. Growing knowledge about indoor air quality, as well as consumer aspirations to have favorably conducive living spaces, are leading to increased spending on air care products in the domestic segment. The rising number of nuclear families, apartments, and shrinking spaces are creating concern among consumers to control unpleasant odors and improve ambient fragrance in residential spaces.

Indian consumers use air fresheners in different sectors of their residential premises such as living rooms, bedrooms, bathrooms, and kitchens in order to remove different odor issues. The increasing trend of home entertaining and creating favorable impacts on guests will support the adoption of air fresheners in residential spaces. Moreover, consumers spend most of their time at home, and this has amplified their concerns about creating comfortable and desirable home spaces.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Pharmacies

- Others

The supermarkets and hypermarkets dominate with a market share of 32% of the total India air freshener market in 2025.

Supermarkets and hypermarkets are the primary retail channels for air fresheners in India, offering extensive product assortments, competitive pricing, and convenient one-stop shopping. More Retail, backed by Amazon, plans to expand by around 150 new stores nationwide between the start of the next financial year and March 2026, aiming to strengthen neighborhood retail and provide a wider range of FMCG and home-care products. These modern formats allow consumers to compare brands and prices in one visit while enabling manufacturers to use visual merchandising, promotions, and in-store sampling to boost awareness and trial.

In fact, the expansion of supermarket and hypermarket chains across the cities of India is continuously improving access to air fresheners among urban and suburban consumers. These retail formats usually stock a wide array of air fresheners, from the economy to premium price categories, to match various consumer preferences and budget considerations. Furthermore, frequent promotional offers, bundled deals, and loyalty program benefits available through organized retail channels encourage value-conscious Indian consumers to make repeat purchases and explore different brands.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 29% share of the total India air freshener market in 2025.

North India continues to be the foremost regional market for air fresheners. The factor favoring North India being a prominent market for air fresheners is the high population density along with a considerable rate of urbanization and the presence of major cities like the National Capital Region. The factor favoring the growth of the home and personal products market in North India is a relatively higher disposable income of the population in the National Capital Region. Seasonal factors like harsh weather conditions in summer fuel the demand for air fresheners.

The growth in office spaces, commercial centers, and hotels in the cities in North India translates to high consumer demand for commercial air care services in addition to residential services. In cultures where home hospitality is valued and there is an emphasis on maintaining a respectable domestic environment as part of one’s social standing in the community, the strong market standing for the industry in the North Indian region in the country’s air fresheners industry is supported.

Market Dynamics:

Growth Drivers:

Why is the India Air Freshener Market Growing?

Rising Urbanization and Changing Lifestyle Patterns

India is experiencing rapid urbanization, with millions moving to cities for better employment and living standards. Built-up areas in major cities have more than doubled from 2,136 sq km in 1995 to 4,308 sq km in 2025, reflecting intense rural-to-urban migration. This shift concentrates populations in apartments and smaller dwellings, increasing awareness of indoor air quality and odor management. Urban consumers, influenced by global lifestyle trends, increasingly view air fresheners as essential household products. The rise of nuclear families and changing household structures also drives demand for personalized fragrances and air care solutions across metropolitan and tier-two cities.

Increasing Disposable Incomes and Aspiration for Better Living

Economic growth and rising employment across sectors have boosted household incomes, allowing consumers to spend more on lifestyle and home care products. In FY25, Indian households notably increased spending on consumer durables and FMCG, driven by higher per capita and disposable incomes and a trend toward upgrading homes with appliances and lifestyle goods. Consumers are increasingly willing to invest in products that enhance comfort and well-being, including air fresheners. Young professionals and dual-income households, in particular, prioritize convenience and ambiance, fueling demand for premium products with superior formulations, longer-lasting fragrances, and innovative delivery mechanisms.

Expansion of Retail Infrastructure and E-commerce Channels

The rapid growth of organized retail, including supermarkets, hypermarkets, and specialty stores, has greatly enhanced air freshener accessibility in Indian cities. Carrefour plans to re-enter India in 2025 through a franchise partnership with Apparel Group, introducing supermarkets and compact hypermarkets that will expand organized retail options for FMCG and home-care products. Modern retail enables product discovery, brand comparison, and promotional engagement, while e-commerce platforms transform how consumers evaluate and purchase products. Online channels offer convenience, competitive pricing, reviews, and diverse brands. Influencer marketing, social media, and targeted digital ads further boost visibility, with subscription-based refill models gaining popularity among urban buyers seeking hassle-free, consistent availability.

Market Restraints:

What Challenges the India Air Freshener Market is Facing?

Health and Environmental Concerns Regarding Synthetic Ingredients

Growing consumer awareness about potential health effects associated with synthetic chemicals used in conventional air fresheners presents a challenge for traditional product formulations. Concerns regarding respiratory sensitivities, allergic reactions, and indoor air pollution from volatile organic compounds influence purchasing decisions among health-conscious consumers. This scrutiny requires manufacturers to invest in reformulation efforts, transparent ingredient communication, and development of natural alternatives that address these concerns while maintaining product effectiveness.

Price Sensitivity and Competition from Unorganized Sector

The Indian consumer market remains highly price-sensitive, particularly in semi-urban and rural areas where air fresheners compete with traditional odor management methods and lower-priced alternatives from unorganized manufacturers. The presence of numerous local and regional producers offering economical products creates pricing pressure on established brands seeking to maintain market share while investing in quality and innovation. Balancing affordability with product quality and brand positioning requires careful strategic consideration from market participants.

Limited Awareness in Rural and Semi-Urban Markets

Despite overall market growth, air freshener adoption remains concentrated in urban and metropolitan areas, with limited penetration in rural and smaller town markets. Lower awareness about branded air freshener products, preference for traditional alternatives, and distribution challenges constrain market expansion beyond established urban centers. Additionally, cultural factors and varying perceptions about the necessity of air freshening products influence adoption rates across diverse demographic segments and geographic regions.

Competitive Landscape:

The India air freshener market features a moderately consolidated competitive landscape with established domestic manufacturers and multinational consumer goods corporations vying for market leadership. Key players compete through diverse product portfolios spanning multiple format types, fragrance varieties, and price segments to address heterogeneous consumer preferences. Innovation in product formulations, delivery technologies, and packaging designs serves as a primary differentiator among leading competitors. Strategic distribution partnerships, retail presence optimization, and digital marketing initiatives enable market participants to enhance brand visibility and consumer engagement. The competitive environment is further shaped by new product launches, brand extensions, and promotional activities that seek to capture consumer attention and drive trial purchases. Established players leverage their distribution networks and brand equity while emerging competitors focus on niche segments including natural formulations and premium offerings.

Recent Developments:

- In September 2025, Godrej Consumer Products Ltd (GCPL) expanded its air care range with the launch of Godrej aer Plug, touted as India’s most affordable electric room freshener. Priced at ₹149, it offers up to 60 days of continuous fragrance, catering to consumers moving from sprays to electric diffusers.

India Air Freshener Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays/Aerosols, Electric Air Fresheners, Gel Air Fresheners, Candle Air Fresheners, Others |

| Applications Covered | Residential, Corporate, Cars, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Pharmacies, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India air freshener market size was valued at USD 587.06 Million in 2025.

The India air freshener market is expected to grow at a compound annual growth rate of 4.14% from 2026-2034 to reach USD 845.57 Million by 2034.

Sprays/aerosols dominated the India air freshener market with a share of 39%, driven by their instant odor-eliminating properties, wide variety of fragrances, affordability, portability, and versatility for use across multiple household and commercial settings.

Key factors driving the India air freshener market include rising urbanization and changing lifestyle patterns, increasing disposable incomes and consumer aspiration for better living standards, growing awareness about indoor air quality and hygiene, expansion of organized retail and e-commerce channels, and rising demand for natural and eco-friendly fragrance solutions.

Major challenges include health and environmental concerns regarding synthetic chemical ingredients in conventional formulations, price sensitivity among consumers particularly in semi-urban and rural areas, competition from unorganized sector manufacturers, limited product awareness and penetration beyond metropolitan markets, and the need to balance affordability with product innovation and quality improvements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)