India Algorithmic Trading Market Size, Share, Trends and Forecast by Component, Deployment, Trading Types, Trader, and Region, 2025-2033

India Algorithmic Trading Market Overview:

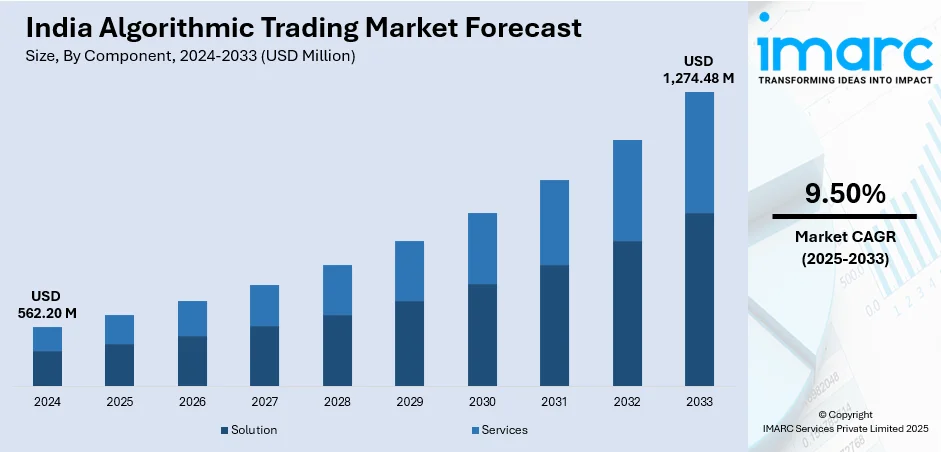

The India algorithmic trading market size reached USD 562.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,274.48 Million by 2033, exhibiting a growth rate (CAGR) of 9.50% during 2025-2033. The Indian algorithmic trading industry is expanding driven by the increasing usage of AI, machine learning, and cloud computing. Moreover, government support, higher automation, and the need for high-speed trade execution are fueling market growth. Also, institutional investors and brokerage houses are adopting sophisticated algorithms for improved efficiency and risk management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 562.20 Million |

| Market Forecast in 2033 | USD 1,274.48 Million |

| Market Growth Rate (2025-2033) | 9.50% |

India Algorithmic Trading Market Trends:

Growing Demand for High-Frequency Trading

The need for high-frequency trading (HFT) is growing in India as market players look for quicker execution, reduced latency, and greater efficiency. Moreover, traders are using algorithmic techniques to take advantage of market movements in milliseconds with the fast pace of technological development. The presence of AI-based trading platforms is also fueling adoption, enabling investors to automate strategies with minimal human intervention. A key development supporting this trend is the recognition of QuantPower as India’s Best Trading Platform in May 2024. By integrating AI-powered solutions such as Algo Bots, Backtesting, and Strategy Builder, the platform enhances decision-making and optimizes trade execution. This landmark is a pointer to the increasing role of advanced tools in determining India's algorithmic trading space. Regulatory shifts and infrastructure developments are also contributing towards speeding up the adoption of HFT. Along with this, improvements in co-location services, direct market access (DMA), and lowered transaction costs are enhancing the viability of automated trading. Further, growing market liquidity and competitive brokerage packages are incentivizing institutional and retail investors to adopt algorithmic trading strategies. As technology continues to gain a foothold in India, the use of high-frequency trading is also seen to increase further.

To get more information on this market, Request Sample

Increasing Adoption of AI and ML in Trading

The use of artificial intelligence (AI) and machine learning (ML) in algorithmic trading is increasing in India. These technologies help traders analyze large volumes of financial data, identify patterns, and make quick trading decisions. AI-driven algorithms improve accuracy and reduce manual intervention, leading to efficient trade execution. Many trading firms and institutional investors are integrating AI to develop advanced trading strategies that adapt to market changes in real-time. Financial institutions are focusing on predictive analytics to enhance risk management and optimize trade execution. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) are implementing regulations to ensure ethical AI usage in financial markets. Additionally, brokerage firms are launching AI-based trading platforms to provide better insights to retail traders. Companies are investing in AI-powered trading bots to automate processes and increase profitability. The growing need for data-driven decision-making is driving innovation in algorithmic trading strategies. With increasing smartphone penetration and internet access, more traders are using AI-powered tools for market analysis. As technology advances, AI-driven algorithmic trading is expected to become more sophisticated, making Indian financial markets more efficient and competitive on a global scale.

India Algorithmic Trading Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment, trading types, and trader.

Component Insights:

- Solution

- Platforms

- Software Tools

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (platforms and software tools) and services (professional services and managed services).

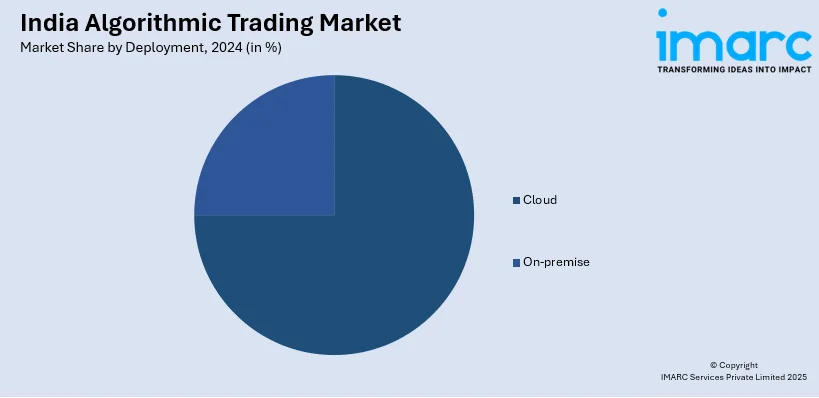

Deployment Insights:

- Cloud

- On-premise

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes cloud and on-premise.

Trading Types Insights:

- Foreign Exchange (FOREX)

- Stock Markets

- Exchange-Traded Fund (ETF)

- Bonds

- Cryptocurrencies

- Others

A detailed breakup and analysis of the market based on the trading types have also been provided in the report. This includes foreign exchange (FOREX), stock markets, exchange-traded fund (ETF), bonds, cryptocurrencies, and others.

Trader Insights:

- Institutional Investors

- Long-Term Traders

- Short-Term Traders

- Retail Investors

A detailed breakup and analysis of the market based on the trader have also been provided in the report. This includes institutional investors, long-term traders, short-term traders, and retail investors.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Algorithmic Trading Market News:

- January 2025: ION was certified as an algorithmic trading vendor on BSE, offering seamless access to Fidessa’s advanced algorithms. This milestone enhances trading efficiency, with algorithmic trading now driving over 55% of all trades in India, significantly boosting market automation, reducing costs, and improving performance.

- December 2024: SEBI proposed regulations for retail investors to access algorithmic trading, addressing speed and volume thresholds. This move aims to level the playing field with institutional traders, enhancing market efficiency and encouraging broader retail participation, boosting India’s algorithmic trading landscape.

India Algorithmic Trading Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Covered |

|

| Deployment Covered | Cloud, On-premise |

| Trading Types Covered | Foreign Exchange (FOREX), Stock Markets, Exchange-Traded Fund (ETF), Bonds, Cryptocurrencies, Others |

| Trader Covered | Institutional Investors, Long-Term Traders, Short-Term Traders, Retail Investors |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India algorithmic trading market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India algorithmic trading market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India algorithmic trading industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The algorithmic trading market in India was valued at USD 562.20 Million in 2024.

The India algorithmic trading market is projected to exhibit a CAGR of 9.50% during 2025-2033, reaching a value of USD 1,274.48 Million by 2033.

The market is driven by the growing emphasis on automation in financial services, demand for faster trade execution, and the rise of technology-enabled investing. Increasing use of mathematical models, improved access to market data, and interest from institutional traders are encouraging adoption. Advanced strategies enable participants to manage large volumes efficiently with minimal manual intervention.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)