India Aloe Vera Gel Market Size, Share, Trends and Forecast by Nature, Distribution Channel, End Use Industry and Region, 2025-2033

India Aloe Vera Gel Market Overview:

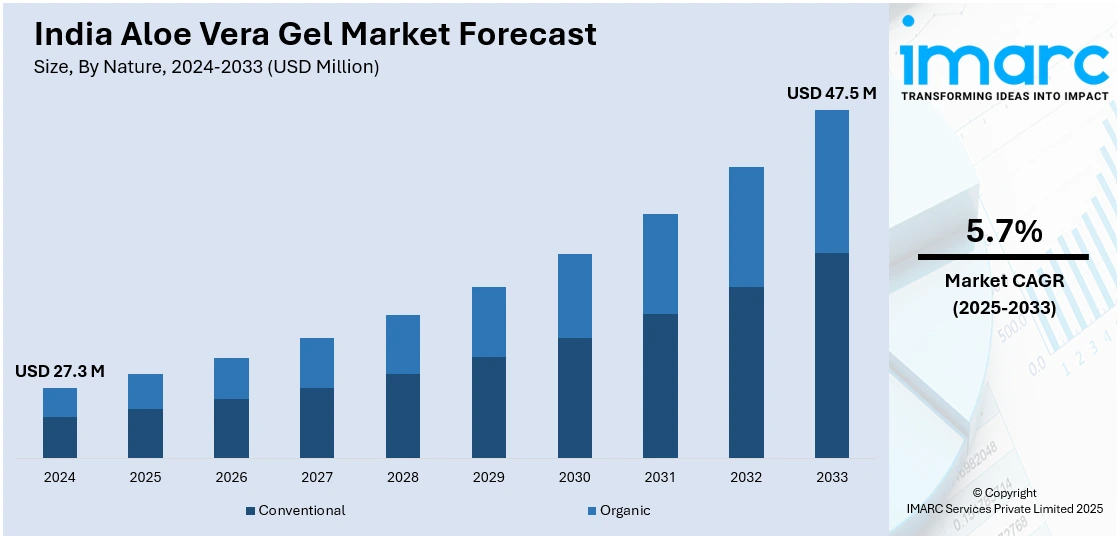

The India aloe vera gel market size reached USD 27.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 47.5 Million by 2033, exhibiting a growth rate (CAGR) of 5.7% during 2025-2033. Rising demand for natural skincare, government support for aloe vera cultivation, growing awareness of Ayurveda, expansion of herbal cosmetic brands, preference for chemical-free products, innovations in aloe vera formulations, and substantial application in pharmaceuticals and food industries, are driving India's aloe vera market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27.3 Million |

| Market Forecast in 2033 | USD 47.5 Million |

| Market Growth Rate 2025-2033 | 5.7% |

India Aloe Vera Gel Market Trends:

Rising Consumer Preference for Natural and Herbal Products

Over the past few years, there has been a well-defined trend of Indian consumers moving toward natural and herbal products based on rising awareness of health and well-being. Aloe vera, which has traditionally been known for its medicinal and cosmetic values, is now a sought-after ingredient for many products. This can be seen from the escalating demand for herbal cosmetics and personal care products that use aloe vera gel. The Indian market for aloe vera gel has witnessed an upsurge trend. This development is overwhelmingly contributed by the rapid adoption of aloe vera gel in cosmetics due to its anti-inflammatory, acne-fighting, and antioxidant features. Consumers are significantly demanding healthy lifestyles and are opting for natural ingredient-based cosmetics. In India, this trend toward natural products has been further enhanced by the rich heritage of Ayurveda and herbal medicines. The incorporation of aloe vera gel into personal care routines in everyday life goes in line with traditional practices and, hence, is more acceptable and appealing to consumers. The widespread availability of aloe vera gel in cosmetic brand stores, pharmacies, and online websites has also made it available to more people, thus propelling the market.

To get more information on this market, Request Sample

Government Initiatives and Support for Aloe Vera Cultivation

The Indian government has identified the potential of aloe vera cultivation as a tool for promoting sustainable agriculture and expanding income for farmers. Under different schemes and programs, attempts have been made to incentivize the boosting and processing of aloe vera and, in turn, reinforce the value chain and guarantee raw material availability for the gel industry. As per the "Agricultural Statistics at a Glance 2021" report published by the Directorate of Economics and Statistics, Department of Agriculture and Farmers Welfare, concerted efforts have been made to encourage the cultivation of medicinal plants, such as aloe vera. The aim behind this effort has been to diversify agricultural operations and give farmers alternative income streams. Khadi and Village Industries Commission (KVIC) has also been instrumental in the development of aloe vera-based industries. With common project profiles and guidelines for the manufacture of aloe vera gel, KVIC has enabled small-scale industries, hence inflating rural employment and economic development. These initiatives by the government have not only increased the production capacity of aloe vera but also provided quality control and standardization in the processing plants. These efforts have boosted confidence among consumers about the effectiveness and safety of aloe vera gel products and hence affected market dynamics in a positive way.

India Aloe Vera Gel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on nature, distribution channel, and end-use industry.

Nature Insights:

- Conventional

- Organic

The report has provided a detailed breakup and analysis of the market based on the nature. This includes conventional and organic.

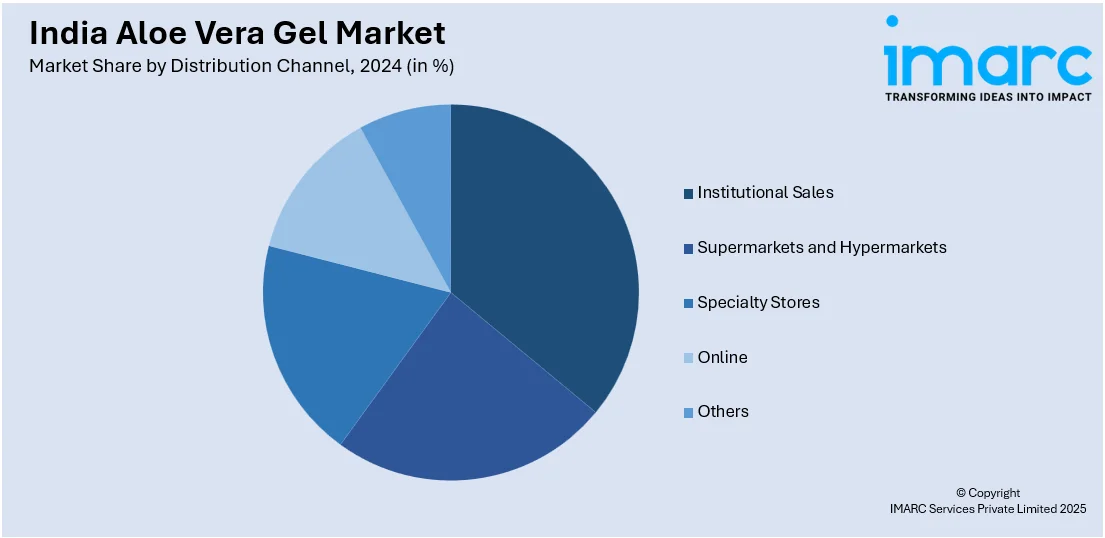

Distribution Channel Insights:

- Institutional Sales

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes institutional sales, supermarkets and hypermarkets, specialty stores, online, and others.

End Use Industry Insights:

- Cosmetic and Personal Care Industry

- Food and Beverages Industry

- Pharmaceutical Industry

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes cosmetic and personal care industry, food and beverages industry, and pharmaceutical industry.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aloe Vera Gel Market News:

- February 2025: The National Institute of Ayurveda (NIA) unveiled a new line of plant-based cosmetic products under the Ministry of Ayush. The products range from foot care cream to aloe vera gel, lip balm, and herbal soaps of various types, all based on plant extracts to provide effective skincare. This move is consolidating the India aloe vera gel market by supporting natural alternatives, consumer awareness, and product development through Ayurveda.

- January 2025: Dabur India Ltd. launched its 100% Pure Aloe Vera Gel with hyaluronic acid. This product is the fusion of nature and science that caters to the changing skin care needs of consumers. With such innovative launches, Dabur is meeting the growing demand for natural and efficient skin care solutions, thus supporting the rise of the aloe vera gel market in India.

India Aloe Vera Gel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Conventional, Organic |

| Distribution Channels Covered | Institutional Sales, Supermarkets and Hypermarkets, Specialty Stores, Online, Others |

| End Use Industries Covered | Cosmetic and Personal Care Industry, Food and Beverages Industry, Pharmaceutical Industry |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aloe vera gel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aloe vera gel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aloe vera gel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India aloe vera gel market was valued at USD 27.30 Million in 2024.

The India aloe vera gel market is projected to exhibit a CAGR of 5.70% during 2025-2033, reaching a value of USD 47.50 Million by 2033.

The India aloe vera gel market is driven by growing consumer preference for natural skincare, boosted by awareness about aloe’s soothing and anti-aging properties. Rising adoption in dermatology and home beauty routines, combined with expanded distribution via e-commerce and modern retail, further supports the segment’s rapid growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)