India Aluminium Market Size, Share, Trends and Forecast by Product Type, Processing Method, Alloy Type, and Region, 2025-2033

India Aluminium Market Size and Share:

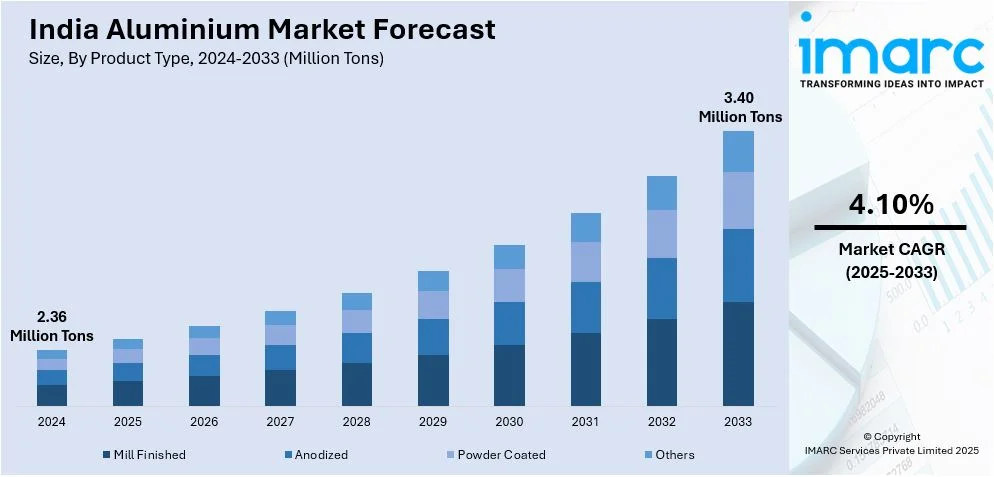

The India aluminium market size reached 2.36 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 3.40 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The rising demand from construction, automotive, and electrical sectors, supported by favorable government initiatives and sustainability trends are expanding the India aluminium market share. In addition to this, the increasing production capacities, and advancements in recycling technologies are also supporting the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 2.36 Million Tons |

| Market Forecast in 2033 | 3.40 Million Tons |

| Market Growth Rate 2025-2033 | 4.10% |

India Aluminium Market Trends:

Growing Demand from the Automotive and Transportation Sector

The growing use in the automotive and transport sector is driving India aluminium market growth. Aluminium's strength-to-weight ratio and lightweight properties, as well as its resistance to corrosion, make it a suitable material for car production. With India's shift towards electric vehicles (EVs), the demand for aluminium parts in battery casing, body structure, and chassis is growing, which aids vehicle efficiency and mileage. According to an industry report, approximately 2 Million EVs were delivered in 2024, underscoring the country's transition to environmentally friendly transportation. Government programs have reduced the cost and increased consumer access to EVs, such as the FAME II scheme, which offers subsidies of up to INR 10,000 per kWh. This shift towards electric mobility is having a profound impact on the Indian aluminum market. Apart from this, railways and aerospace industries are also integrating aluminium to enhance fuel efficiency and durability. Moreover, the growing exports of aluminium auto components from India indicate a robust market expansion. As the industry transitions toward sustainable solutions, aluminium's role in modern transportation will continue to expand, driving market growth over the coming years.

To get more information on this market, Request Sample

Expansion of Domestic Aluminium Production and Recycling Initiatives

India's aluminium industry is growing at a fast pace owing to rising domestic production capacity and a growing emphasis on recycling programs. Large aluminium manufacturers are adding capacity to their plants to meet growing demand from industries like construction, packaging, and electronics. Government encouragement in the form of programs such as "Make in India," and production-linked incentives (PLI) schemes further boosts the industry. For instance, the Press Information Bureau stated on March 25, 2025, that the Production Linked Incentive (PLI) Scheme for the Automobile and Auto Component Industry was authorized by the Indian government on September 23, 2021, with an INR 25,938 Crore (about USD 3,037 Million) budgeted allocation. India's capacity to produce cutting-edge automotive technologies, such as electric cars and their parts, is to be improved by the program. The PLI-Auto Scheme has drawn substantial investments as of March 2025. Additionally, the emphasis on sustainability has led to increased investment in aluminium recycling plants, reducing dependence on imports and enhancing resource efficiency. The rise of secondary aluminium production, which requires significantly less energy than primary production, aligns with India's commitment to reducing carbon emissions, which in turn is positively impacting India aluminium market outlook. With aluminium demand surging in infrastructure development and industrial applications, efficient recycling practices ensure a steady supply of raw materials while minimizing environmental impact. These advancements are shaping the future of India's aluminium market, making it more self-reliant and sustainable.

India Aluminium Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, processing method, and alloy type.

Product Type Insights:

- Mill Finished

- Anodized

- Powder Coated

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mill finished, anodized, powder coated, and others.

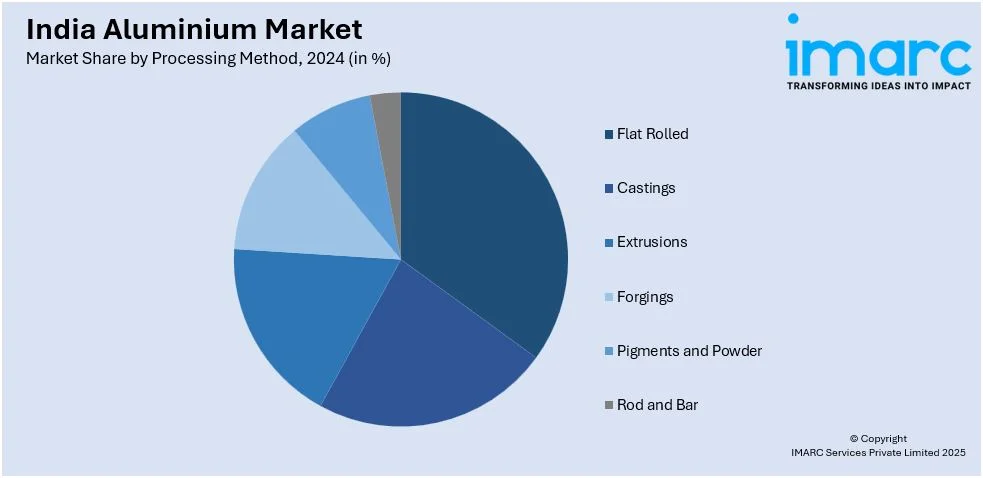

Processing Method Insights:

- Flat Rolled

- Castings

- Extrusions

- Forgings

- Pigments and Powder

- Rod and Bar

A detailed breakup and analysis of the market based on the processing method have also been provided in the report. This includes flat rolled, castings, extrusions, forgings, pigments and powder, and rod and bar.

Alloy Type Insights:

- Automotive and Transportation

- Aerospace and Defense

- Marine

- Building and Construction

- Others

A detailed breakup and analysis of the market based on the alloy type have also been provided in the report. This includes automotive and transportation, aerospace and defense, marine, building and construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aluminium Market News:

- On February 24, 2025, Hindalco Industries announced plans to invest INR 15,000 Crore (approximately USD 1.81 Billion) in Madhya Pradesh to expand its aluminium smelting capacity at existing and new sites. The announcement was made during the Madhya Pradesh Global Investors Summit 2025 in Bhopal, following the signing of a Memorandum of Understanding with the state government. Hindalco's Managing Director, Satish Pai, stated that the investment would be made over the next two years and includes the opening of a large mine called Banda.

- On April 4, 2024, Vedanta Aluminium announced the successful commissioning of a 1.5 Million Tonnes per annum (MTPA) expansion at its alumina refinery in Lanjigarh, Odisha, increasing the facility's production capacity from 2 MTPA to 3.5 MTPA. This development is part of the company's ongoing efforts to achieve 100% vertical integration and support its goal of reaching 3 MTPA of aluminium production capacity.

India Aluminium Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mill Finished, Anodized, Powder Coated, Others |

| Processing Methods Covered | Flat Rolled, Castings, Extrusions, Forgings, Pigments and Powder, Rod and Bar |

| Alloy Types Covered | Automotive and Transportation, Aerospace and Defense, Marine, Building and Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aluminium market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aluminium market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aluminium industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aluminium market in India size reached 2.36 Million Tons in 2024.

The India aluminium market is projected to exhibit a (CAGR) of 4.10% during 2025-2033, reaching a volume of 3.40 Million Tons by 2033.

The market is underpinned by growth in infrastructure, urbanization, and rising demand from the automotive, construction, and packaging industries. The industrial attractiveness of aluminium due to its light weight, corrosion resistance, and recyclability adds to its appeal. Government schemes such as Make in India and rising interest in electric vehicles (EVs) are also supporting domestic aluminium output and downstream value addition capacity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)