India Aluminum Chloride Market Size, Share, Trends and Forecast by Grade, Application, End Use, and Region, 2025-2033

India Aluminum Chloride Market Overview:

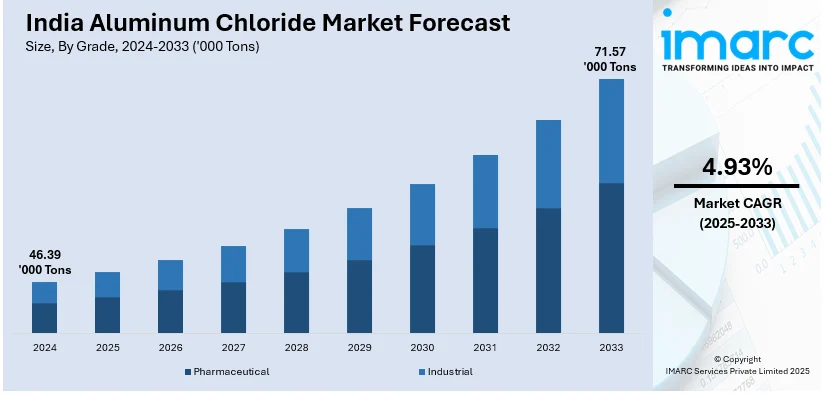

The India aluminum chloride market size reached 46.39 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 71.57 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 4.93% during 2025-2033. The market is driven by rising demand from water treatment, pharmaceuticals, and cosmetics industries. Government initiatives for clean water, urbanization, and stricter environmental regulations augment India aluminum chloride market share. Additionally, growth in personal care products and pharmaceutical applications further propels market expansion, despite challenges like raw material price volatility and regulatory constraints.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 46.39 Thousand Tons |

| Market Forecast in 2033 | 71.57 Thousand Tons |

| Market Growth Rate 2025-2033 | 4.93% |

India Aluminum Chloride Market Trends:

Rising Demand from the Water Treatment Industry

The increasing demand from the water treatment sector is majorly driving the India aluminum chloride market growth. Groundwater pollution impacted over two million individuals in India in 2024 with the major pollutants being groundwater sources contaminated by heavy metals and arsenic. The bulk of pollution comes from the agricultural industry and the release of industrial wastewater, leading to a migration from rural areas to urban centers. With rapid urbanization and tightening environmental regulations, municipalities and industries are adopting advanced water purification technologies. Aluminum chloride is widely used as a coagulant agent in wastewater treatment to remove impurities, which is key to maintaining clean water access. Additionally, government initiatives and the smart cities project promote sustainable water management practices, which in turn drive up the demand. In addition, the increasing treatment of industrial wastewater in sectors such as textiles, chemicals, and pharmaceuticals are driving the growth of the industrial wastewater treatment market. Manufacturers are increasingly focused on improving production efficiency to meet the higher demand in addition to looking for cost-effective alternatives. However, the fluctuations in raw material prices and competition with other coagulants, such as polyaluminum chloride (PAC), pose a challenge. Despite these challenges, the water treatment industry remains a key end-use sector, contributing significantly to the aluminum chloride market in India.

To get more information on this market, Request Sample

Growth in Pharmaceutical and Cosmetic Applications

The pharmaceutical and cosmetic industries are emerging as major consumers of aluminum chloride in India, contributing to market growth. Aluminum chloride is a key ingredient in antiperspirants, astringents, and topical medications due to its antimicrobial and sweat-reducing properties. The expanding personal care industry, driven by rising disposable incomes and increasing hygiene awareness, is fueling demand. In pharmaceuticals, it is used in formulations for treating hyperhidrosis (excessive sweating) and as a catalyst in drug synthesis. The growing prevalence of skin-related disorders and the rise of generic drug manufacturing is further creating a positive India aluminum chloride market outlook. A research report released by IMARC Group indicates that the pharmaceutical market in India was valued at USD 61.36 billion in 2024. It is projected to grow to USD 174.31 billion by 2033, reflecting a compound annual growth rate (CAGR) of 11.32% from 2025 to 2033. Companies are investing in research to develop high-purity aluminum chloride for specialized applications. However, regulatory scrutiny on chemical safety and the shift toward natural alternatives in cosmetics could restrain growth. Nevertheless, the pharmaceutical and cosmetic sectors are expected to remain key growth drivers for the aluminum chloride market in India.

India Aluminum Chloride Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on grade, application, and end use.

Grade Insights:

- Pharmaceutical

- Industrial

The report has provided a detailed breakup and analysis of the market based on the grade. This includes pharmaceutical and industrial.

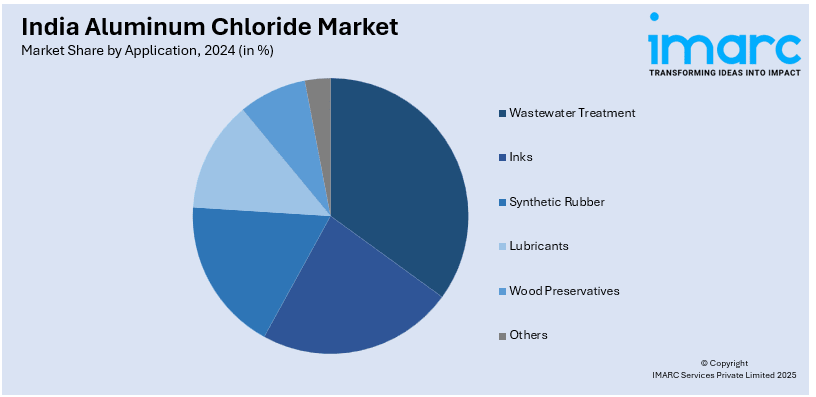

Application Insights:

- Wastewater Treatment

- Inks

- Synthetic Rubber

- Lubricants

- Wood Preservatives

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes wastewater treatment, inks, synthetic rubber, lubricants, wood preservatives, and others.

End Use Insights:

- Chemicals

- Pharmaceuticals

- Agrochemicals

- Metal Production

- Pulp and Paper

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes chemicals, pharmaceuticals, agrochemicals, metal production, pulp and paper, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aluminum Chloride Market News:

- October 18, 2024: DCM Shriram Ltd. commenced a 300 TPD flexi-fuel flaker at its plant in Jhagadia, Gujarat which is expected to enhance operational efficiency and sustainability. The expanded capacity of the plant helps the company to meet growth in exports of products including aluminum chloride. This strategic move further substantiates DCM Shriram Ltd's position in the Indian aluminum chloride market and is aligned with its overall growth plan across diverse sectors.

India Aluminum Chloride Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Pharmaceutical, Industrial |

| Applications Covered | Wastewater Treatment, Inks, Synthetic Rubber, Lubricants, Wood Preservatives, Others |

| End Uses Covered | Chemicals, Pharmaceuticals, Agrochemicals, Metal Production, Pulp and Paper, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aluminum chloride market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aluminum chloride market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aluminum chloride industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aluminum chloride market in India reached a volume of 46.39 Thousand Tons in 2024.

The India aluminum chloride market is projected to exhibit a CAGR of 4.93% during 2025-2033, reaching a volume of 71.57 Thousand Tons by 2033.

Growing demand from water treatment, pharmaceuticals, and cosmetics, supported by government clean water initiatives, urbanization, and stricter environmental norms, is pushing market growth. Applications in personal care products and pharmaceuticals continue to expand use, despite raw material price swings and competition from alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)