India Aluminum Smelting Market Size, Share, Trends, and Forecast by Product Type, Smelting Process, Smelting Capacity, End User, and Region, 2025-2033

India Aluminum Smelting Market Size and Share:

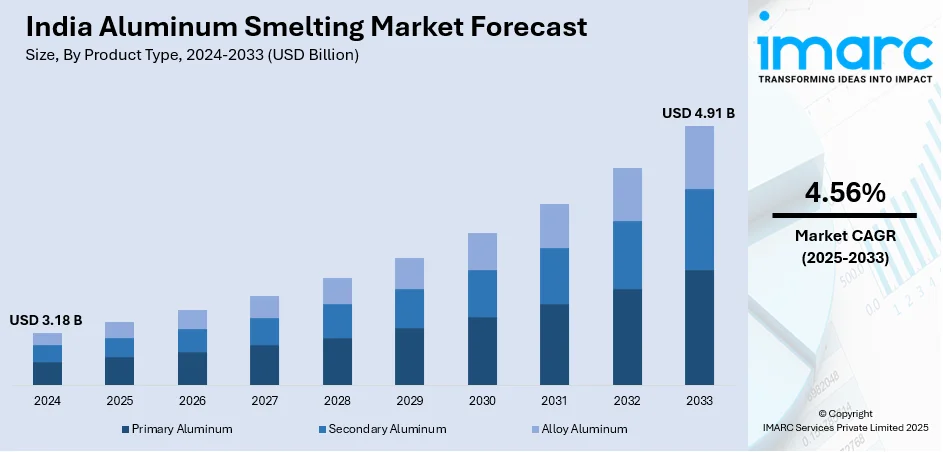

The India aluminum smelting market size reached USD 3.18 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.91 Billion by 2033, exhibiting a growth rate (CAGR) of 4.56% during 2025-2033. The market is expanding due to the rising industrial demand, infrastructure growth, and government initiatives promoting domestic production and sustainability. Additionally, increasing investments in energy-efficient smelting, renewable energy integration, and recycling technologies are shaping the industry, reducing import dependency and supporting India’s economic and environmental goals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.18 Billion |

| Market Forecast in 2033 | USD 4.91 Billion |

| Market Growth Rate (2025-2033) | 4.56% |

India Aluminum Smelting Market Trends:

Adoption of Energy-Efficient and Low-Carbon Smelting Technologies

The India aluminum smelting market is increasingly adopting energy-efficient and low-carbon technologies to tackle rising power costs and sustainability challenges. Aluminum smelting is an energy-intensive process, prompting producers to modernize operations by integrating advanced electrolytic cells, automated process controls, and heat recovery systems to improve efficiency and lower emissions. Moreover, government initiatives like the Perform, Achieve, and Trade (PAT) scheme encourage industries to adopt low-energy solutions, while investments in renewable energy-powered smelting plants are supporting sustainability goals. For instance, as of July 2024, 1,333 designated consumers across 13 sectors have been assigned energy conservation targets, which has further boosted the demand for energy-efficient solutions. The push for green aluminum production, utilizing solar, wind, and hydropower, is gaining momentum, aligning with India’s net-zero commitments. Additionally, AI-driven process optimizations are enabling manufacturers to track real-time energy consumption and enhance operational efficiency. With growing regulatory pressures for carbon neutrality and the need to remain cost-competitive in the global market, the adoption of energy-efficient aluminum smelting technologies is expected to drive significant improvements in production, sustainability, and resource optimization across the industry.

To get more information on this market, Request Sample

Expansion of Domestic Smelting Capacity to Meet Growing Demand

India is witnessing rapid expansion in domestic aluminum smelting capacity, driven by the rising demand from automotive, construction, infrastructure, and power transmission sectors. With aluminum being a crucial raw material for these industries, India is facilitating production and refining operations to reduce reliance on imported aluminum. Moreover, companies are investing in new smelting facilities to strengthen India’s self-sufficiency in aluminum production. For instance, in April 2024, Vedanta announced the successful commissioning of a 1.5 million tonnes per annum (MTPA) expansion at its alumina refinery in Lanjigarh, Odisha, which increased its refining capacity to 3.5 MTPA. Additionally, the rise of electric vehicles (EVs) is accelerating the need for lightweight aluminum components, further driving smelting capacity expansion. The government’s focus on reducing aluminum imports has led to policy measures supporting domestic raw material processing and incentives for aluminum producers. Furthermore, with increased industrial investments, infrastructure projects, and a shift toward indigenous production, India’s aluminum smelting industry is set for steady growth, ensuring greater supply chain resilience and economic self-reliance while catering to the country’s evolving industrial and manufacturing needs.

India Aluminum Smelting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, smelting process, smelting capacity, and end user.

Product Type Insights:

- Primary Aluminum

- Secondary Aluminum

- Alloy Aluminum

The report has provided a detailed breakup and analysis of the market based on the product type. This includes primary aluminum, secondary aluminum, and alloy aluminum.

Smelting Process Insights:

- Electrolytic Reduction

- Aluminothermic Reduction

A detailed breakup and analysis of the market based on the smelting process have also been provided in the report. This includes electrolytic reduction and aluminothermic reduction.

Smelting Capacity Insights:

- Small-Scale (50,000 MTPA)

- Medium-Scale (50,000-150,000 MTPA)

- Large-Scale (>150,000 MTPA)

The report has provided a detailed breakup and analysis of the market based on the smelting capacity. This includes small-scale (50,000 MTPA), medium-scale (50,000-150,000 MTPA), and large-scale (>150,000 MTPA).

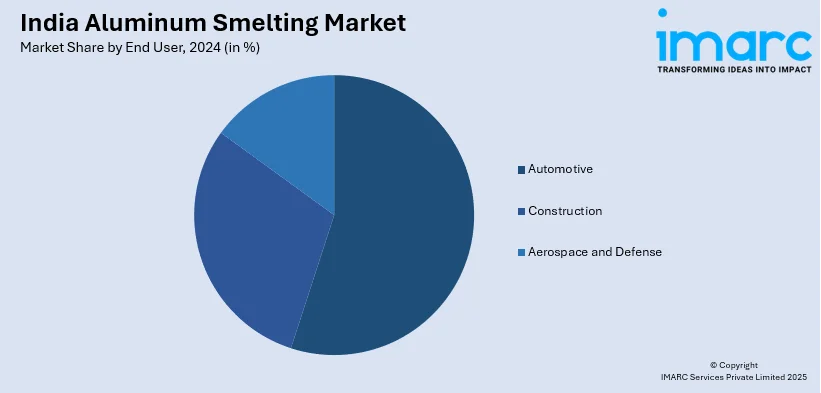

End User Insights:

- Automotive

- Construction

- Aerospace and Defense

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, construction, and aerospace and defense.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aluminum Smelting Market News:

- In February 2025, Hindalco Industries announced an MoU with the Madhya Pradesh government for an investment of ₹15,000 crore over two years to expand its aluminum smelting operations. The company aims to strengthen its local presence, boost economic growth, and develop new mining projects.

India Aluminum Smelting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Primary Aluminum, Secondary Aluminum, Alloy Aluminum |

| Smelting Processes Covered | Electrolytic Reduction, Aluminothermic Reduction |

| Smelting Capacities Covered | Small-Scale (50,000 MTPA), Medium-Scale (50,000-150,000 MTPA), Large-Scale (>150,000 MTPA) |

| End Users Covered | Automotive, Construction, Aerospace and Defense |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India aluminum smelting market performed so far and how will it perform in the coming years?

- What is the breakup of the India aluminum smelting market on the basis of product type?

- What is the breakup of the India aluminum smelting market on the basis of smelting process?

- What is the breakup of the India aluminum smelting market on the basis of smelting capacity?

- What is the breakup of the India aluminum smelting market on the basis of end user?

- What is the breakup of the India aluminum smelting market on the basis of region?

- What are the various stages in the value chain of the India aluminum smelting market?

- What are the key driving factors and challenges in the India aluminum smelting market?

- What is the structure of the India aluminum smelting market and who are the key players?

- What is the degree of competition in the India aluminum smelting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aluminum smelting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aluminum smelting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aluminum smelting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)